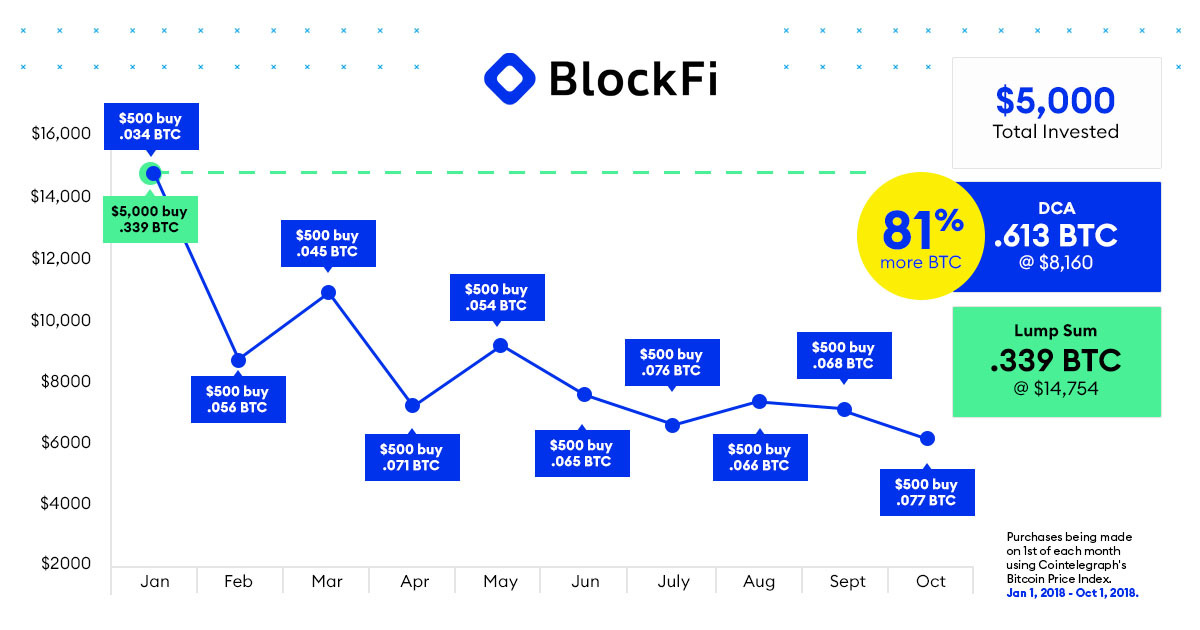

3/ DCA is an ongoing, longer-term strategy. Let’s say you have $5,000 to buy BTC. You could drop $5,000 upfront. Or you could use DCA and spread that $5,000 out with small, equal purchases of BTC on a regular schedule. Here’s an example of what that could look like.

4/ So, why would you use DCA as an investment strategy? Here’s a few reasons:

1. Minimize the impact of price volatility

2. Remove the temptation to time the market ( FOMO)

FOMO)

3. Simplify your life

4. Build wealth over time

5. Avoid emotional investing

6. Invest for the long-term

1. Minimize the impact of price volatility

2. Remove the temptation to time the market (

FOMO)

FOMO)3. Simplify your life

4. Build wealth over time

5. Avoid emotional investing

6. Invest for the long-term

5/ Plus, in any year, the majority of Bitcoin gains are produced about 10 days of the year. So in the words of @fundstrat, consider: “Are u that good at trading?” https://bit.ly/2D3p2vM

6/ Okay. You’re probably now thinking, “But, what’s the bottom line?” Let’s take a closer look using a hypothetical scenario in which you jump aboard the Bitcoin train on February 3 of 2018 as BTC’s price is around $9,227.80 USD.

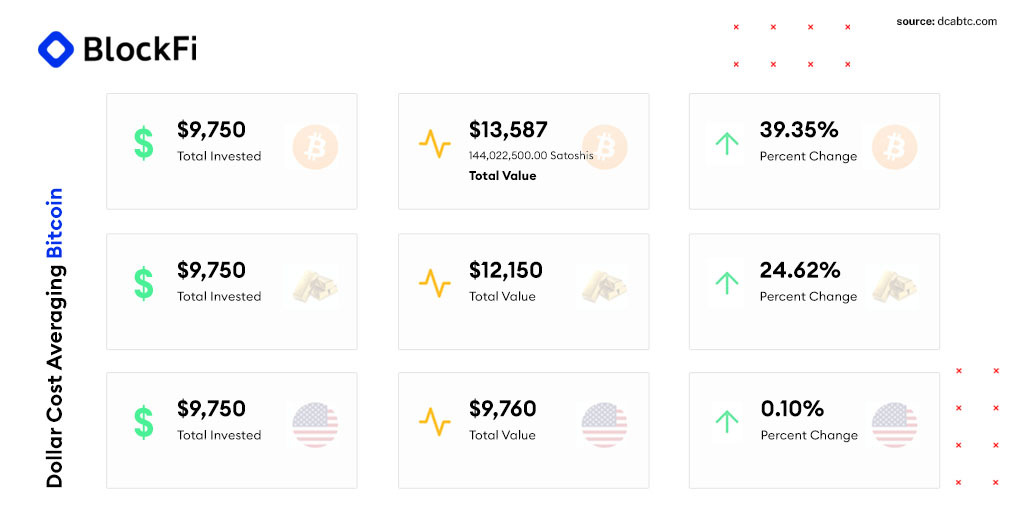

7/ Scenario 1: You buy a little over 1 BTC with $9,750 USD on February 3 of 2018. Assuming your BTC remains untouched, with the price of BTC at about $10,629 USD on July 26 of 2020, you would be up +15.18% — not bad.

8/ Scenario 2: You take $9,750 and decide to invest $75 a week in BTC. With the price of BTC at about $10,629 USD on July 26 of 2020, you would be up +39.35%. And your cost basis would be roughly $5,249 USD vs. $9,227.80 USD if you purchased everything on February 3 of 2018.

9/ And that’s not all. Here’s how Bitcoin stacks up compared to other investment tools if you used DCA and purchased $75 of each asset every week starting on February 3 of 2018.

10/ And just for fun, let’s look at what your portfolio would look like as of July 26, 2020 if you bought $1 of BTC every day for 5 years, 4 years, 3 years, 2 years, and 1 year.

11/ TL;DR: Slow and steady—more often than not—wins the race. We’re not saying to not buy the dip, but DCA can be handy especially if you’re weary about risk. You can also up your DCA game by using analysis tools to inform your strategy. DYOR and choose what’s right for you.

12/ Disclaimer: The past performance of any investment or financial instrument is not a guide to future performance. No Content or information stated above constitutes, or should be construed as, investment, tax, legal, financial or any other advice. See: https://blockfi.com/terms/ .

Read on Twitter

Read on Twitter