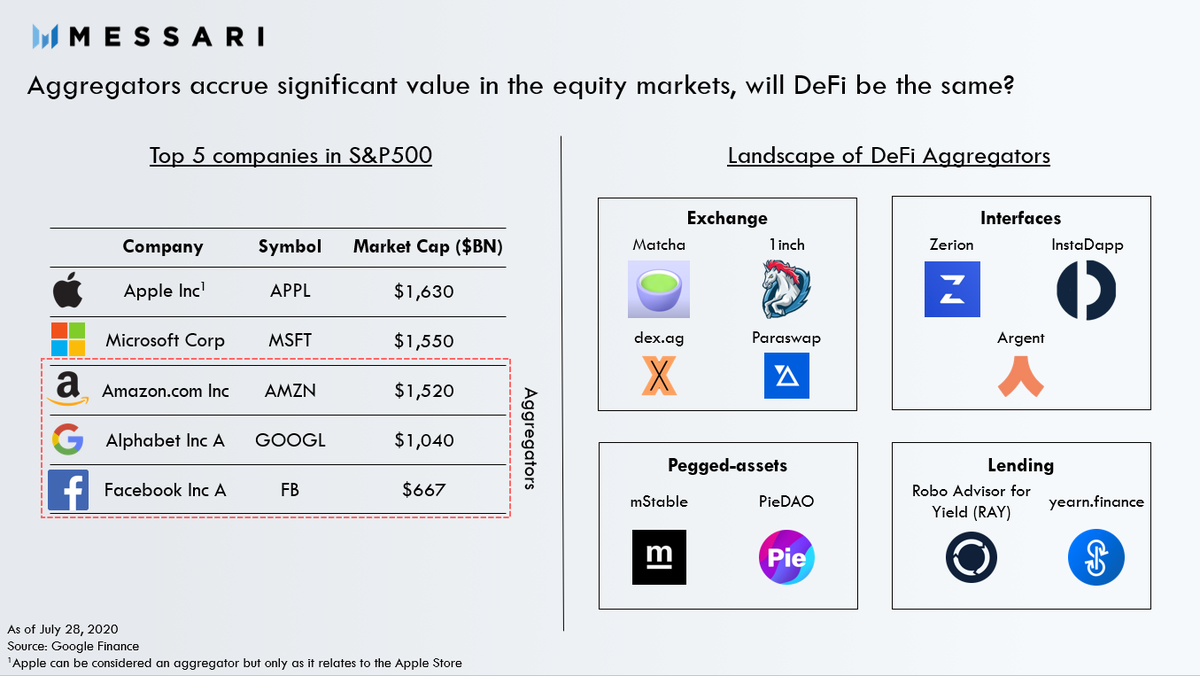

The 21st century is dominated by aggregators.

Aggregators have captured trillions of dollars in value from their role intermediating our lives.

DeFi is now seeing early attempts at aggregation, but will its aggregators capture the same value?

@Ryanwatkins_ and I took a look

Aggregators have captured trillions of dollars in value from their role intermediating our lives.

DeFi is now seeing early attempts at aggregation, but will its aggregators capture the same value?

@Ryanwatkins_ and I took a look

In order to be considered an “aggregator” as the term is typically used, there are 3 requirements

1. Direct relationship with users?

2. Zero-marginal cost for serving additional users? https://stratechery.com/2017/defining-aggregators/

https://stratechery.com/2017/defining-aggregators/

1. Direct relationship with users?

2. Zero-marginal cost for serving additional users?

https://stratechery.com/2017/defining-aggregators/

https://stratechery.com/2017/defining-aggregators/

Demand-driven Multi-sided Networks with Decreasing Acquisition Costs?

This means that new users make the platform more attractive for suppliers to join which then make it more valuable which draws more users.

This means that new users make the platform more attractive for suppliers to join which then make it more valuable which draws more users.

This virtuous cycle decreases the cost of acquiring customers since they are increasingly incentivized to join as more users/suppliers come on

However, in DeFi suppliers (underlying lending/exchange protocols) are open source making them available to all aggregators

And the marginal user of the aggregator doesn’t make it any more valuable

So DeFi aggregators aren’t technically even aggregators

And the marginal user of the aggregator doesn’t make it any more valuable

So DeFi aggregators aren’t technically even aggregators

Since these are open source and they don’t own the underlying data, switching costs are effectively zero

So unlike FAANG, rent extraction becomes much more difficult

So unlike FAANG, rent extraction becomes much more difficult

Any attempt at capturing more value than users are willing to give means providing a worse service for users and will lead to a quick exodus. https://twitter.com/RyanWatkins_/status/1287125882667229184?s=20

That being said - this doesn’t mean value capture is impossible

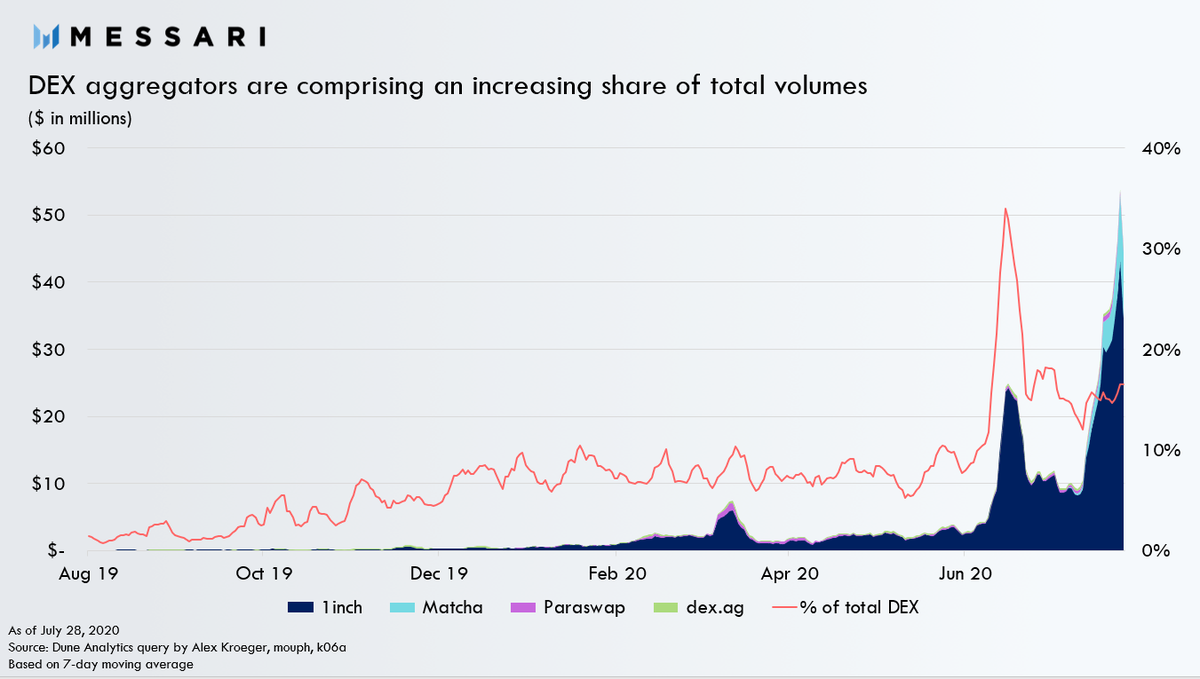

We’re beginning to see an increase in the value flowing through aggregators

This will only increase going forward

We’re beginning to see an increase in the value flowing through aggregators

This will only increase going forward

So to capture this increasing flow of value DeFi aggregators need to do a few things

Create an interface so good that not even @twobitidiot on his guitar will make you want to leave https://twitter.com/reeeatine/status/1274891609427992576?s=20

Create an interface so good that not even @twobitidiot on his guitar will make you want to leave https://twitter.com/reeeatine/status/1274891609427992576?s=20

As @cburniske says - remain minimally extractive so users don’t flee to the nearest competitor https://www.placeholder.vc/blog/2019/10/6/protocols-as-minimally-extractive-coordinators

Lastly - bridge the gap between the various sub-verticals creating a capital pool for all defi needs https://messari.io/article/value-capture-in-the-age-of-defi-aggregation

Read on Twitter

Read on Twitter