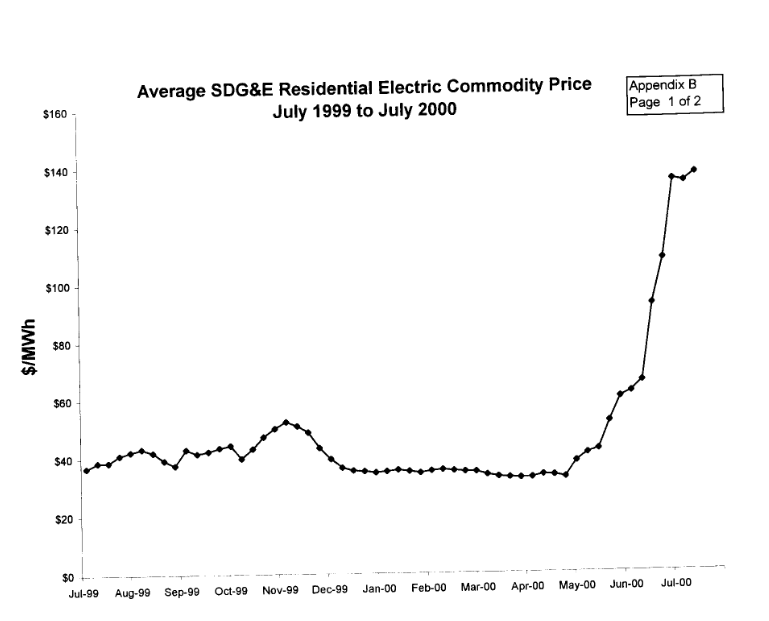

Sunday marks 20 years since the start of California Energy Crisis FERC proceedings. On August 2, 2000, San Diego Gas & Electric (SDG&E) asked FERC to cap all bids into the CAISO and Power Exchange (PX) markets at $250.

A recap of what happened in 2000-01 and the aftermath:

A recap of what happened in 2000-01 and the aftermath:

SDG&E’s complaint kicked off 20 years of proceedings at FERC and fed cts. SDG&E’s filing focused on the market structure, characterized by a day-ahead mkt operated by the PX and a real-time mkt run by the ISO. This separation was unique among the new ISOs. https://elibrary.ferc.gov/idmws/file_list.asp?document_id=2077236

SDG&E: “The design and structure of the markets…are fundamentally flawed and inherently incapable of producing workable competition…The only way that FERC can rein in prices in bid-based markets…is to limit what sellers can bid.”

Market manipulation is mentioned in passing, and certainly was not anyone's focus in August 2000 – “The new markets and rules are unfamiliar and unproven, and may well produce even more opportunities for ‘gaming’ the system, leading to generally higher prices.”

SDG&E’s residential ratepayers were the first in the nation to see wholesale costs immediately passed to retail bills.

Fun fact – the first entry in this epic FERC docket is a handwritten note from someone in Campo, CA complaining that rates have gone up – “I’m told that your Commission actually sets rates. Is this true?” https://elibrary.ferc.gov/idmws/file_list.asp?document_id=2090677

Anyway, SDG&E’s proposal in FERC Docket EL00-95 was controversial, to say the least. Meanwhile, prices dipped in the fall but shot back up in the winter.

In January 2001, with PG&E and SCE’s credit ratings deteriorating (PG&E declared bankruptcy in April 2001), California ordered its Dept of Water Resources to purchase energy on behalf of the IOUs. This too was controversial and led to more litigation.

In general, proceedings at FERC pitted buyers and the state who wanted FERC to intervene against sellers who kinda liked high prices. You wanted a market, you got a market! The “gaming” activities of Enron and essentially every other market participant had not yet come to light.

Enron filed for bankruptcy in late 2001. Those proceedings revealed the infamous December 2000 memo describing various trading strategies with names like Fatboy, Deathstar, and Get Shorty. You can read the memo here - https://elibrary.ferc.gov/idmws/common/OpenNat.asp?fileID=12749465

The release of the memo garnered national media attention - https://www.nytimes.com/2002/05/07/business/enron-forced-up-california-prices-documents-show.html, but by then FERC had already started an investigation into whether Enron or its affiliates had manipulated the markets - https://elibrary.ferc.gov/idmws/file_list.asp?document_id=2245497

In March 2003, FERC staff released its report: “While Staff found significant market manipulation, this does not alter FERC’s original conclusion… that significant supply shortfalls and a fatally flawed market design were the root causes” of the crisis.

https://elibrary.ferc.gov/idmws/file_list.asp?document_id=4087257

https://elibrary.ferc.gov/idmws/file_list.asp?document_id=4087257

In June 2003, FERC launched two intersecting sets of investigations into sellers’ manipulative conduct - https://elibrary.ferc.gov/idmws/file_list.asp?document_id=4114291 (the Show Cause proceeding) and partnerships with Enron – https://elibrary.ferc.gov/idmws/file_list.asp?document_id=4114288

Meanwhile, the state and its two major utilities (PG&E and SCE) were in the midst of trying to get refunds from sellers at FERC and in state and federal courts, based on numerous FPA, antitrust, and other claims.

Most sellers settled – As of Oct. 2017, 57 parties settled with the state (and PG&E+SCE). That includes major traders and generators, as well as numerous muni utilities (I wish I had the total dollar value of the settlements - anyone?).

(From 2011-2013 I was represented sellers in litigation at FERC. Yes, that’s 10-12 years after any of the relevant events. The 9th Circuit upheld FERC’s decision in 2016, finally bringing that stage of the proceedings to a close.)

What caused high prices? FERC summarized in 2007: “flawed market rules; inadequate addition of generating facilities in the preceding years; a drop in available hydropower due to drought conditions; a rupture of a major pipeline supplying natural gas into California…

"strong growth in the economy and in electricity demand; unusually high temperatures; an increase in unplanned outages of extremely old generating facilities; and market manipulation.” https://elibrary.ferc.gov/idmws/common/opennat.asp?fileID=11313181

The crisis made a lot of lawyers and consultants a lot of money.

It also led to numerous federal court decisions – Some significant FERC precedent came out of these crisis cases. A recap:

It also led to numerous federal court decisions – Some significant FERC precedent came out of these crisis cases. A recap:

Morgan Stanley v Snohomish – SCOTUS – clarifies the Mobile-Sierra presumption – “FERC may abrogate a valid contract only if it harms the public interest.” http://supreme.justia.com/cases/federal/us/554/527/

OneOK v. Learjet – SCOTUS – The Natural Gas Act does not preempt state antitrust law because those laws do not aim or target matters that are under FERC’s exclusive jurisdiction. https://casetext.com/case/oneok-inc-v-learjet-inc

CAISO v. FERC – DC Cir – FERC doesn't have authority to order ISO to remove board members bc FERC’s authority is “limited to those methods or ways of doing things on the part of the utility that directly affect the rate or are closely related to the rate.” http://caselaw.findlaw.com/us-dc-circuit/1344700.html

Lockyer v FERC – DC Cir – Rejects CA’s facial challenge to market-based rates but holds FERC cannot dismiss sellers’ failure to comply w transaction reporting requirements as “as mere punctilio” and FERC may order remedies for failure to file reports - https://casetext.com/case/california-ex-rel-lockyer-v-ferc

CPUC v. FERC – 9th Cir – FERC has authority under s. 309 to order remedies for tariff violations that occurred prior to the s. 206 refund effective date. This case is more interesting for its thorough summary of 4 years of proceedings - https://casetext.com/case/public-utilities-comn-of-state-v-ferc

More 9th Circuit cases:

245 F.3d 1110 (2001)

267 F.3d 1042 (2001)

307 F.3d 794 (2002)

341 F.3d 906 (2003)

375 F.3d 831 (2004)

379 F.3d 641 (2004)

383 F.3d 1006 (2004)

384 F.3d 756 (2004)

422 F.3d 908 (2005)

464 F.3d 861 (2006)

499 F.3d 1016 (2007)

507 F.3d 1222 (2007)

245 F.3d 1110 (2001)

267 F.3d 1042 (2001)

307 F.3d 794 (2002)

341 F.3d 906 (2003)

375 F.3d 831 (2004)

379 F.3d 641 (2004)

383 F.3d 1006 (2004)

384 F.3d 756 (2004)

422 F.3d 908 (2005)

464 F.3d 861 (2006)

499 F.3d 1016 (2007)

507 F.3d 1222 (2007)

More 9th Circuit cases (cont):

693 F.3d 828 (2012)

809 F.3d 491 (2015)

836 F.3d 1155 (2016)

And the Federal Circuit!

838 F.3d 1341 (2016)

What did I miss?

693 F.3d 828 (2012)

809 F.3d 491 (2015)

836 F.3d 1155 (2016)

And the Federal Circuit!

838 F.3d 1341 (2016)

What did I miss?

Important addition - The Energy Crisis gave us Governor Schwarzenegger! https://twitter.com/venerable_bede/status/1288880860838662146

Yes - another important addition. It's a shame that "Enron" is still an argument against expanding CAISO. https://twitter.com/benserrurier/status/1288883991236337664

Another good addition - it was an ENERGY crisis, not merely an electricity crisis https://twitter.com/TysonSlocum/status/1288903224725065730

Read on Twitter

Read on Twitter