THREAD

Crown Castle $CCI responds to Elliott and says actually, fiber is a great business worth investing in, potentially an even better business than towers, and definitely better than dividends.

Crown Castle $CCI responds to Elliott and says actually, fiber is a great business worth investing in, potentially an even better business than towers, and definitely better than dividends.

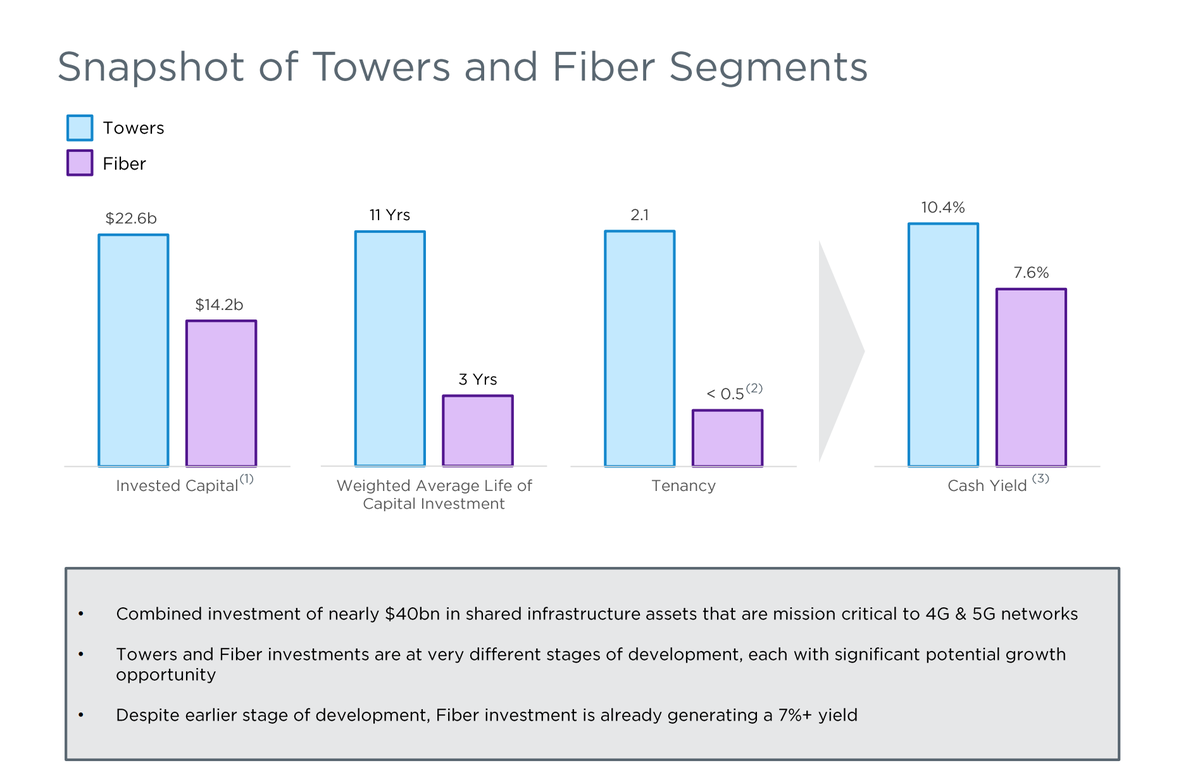

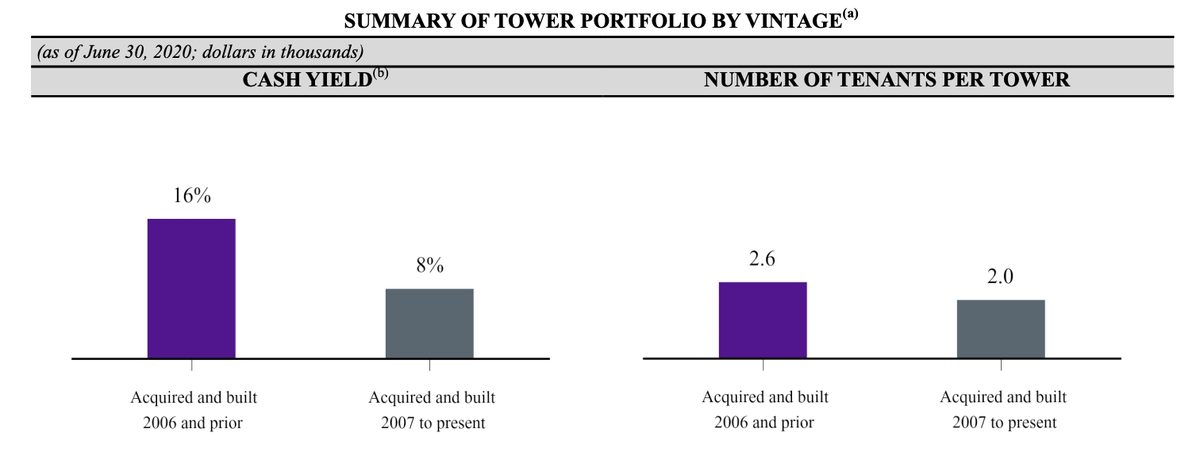

Fiber is already generating a 7%+ yield despite it being extremely early, compares to towers at mid-10%

Which is important because Crown's tower portfolio has an average of two tenants.

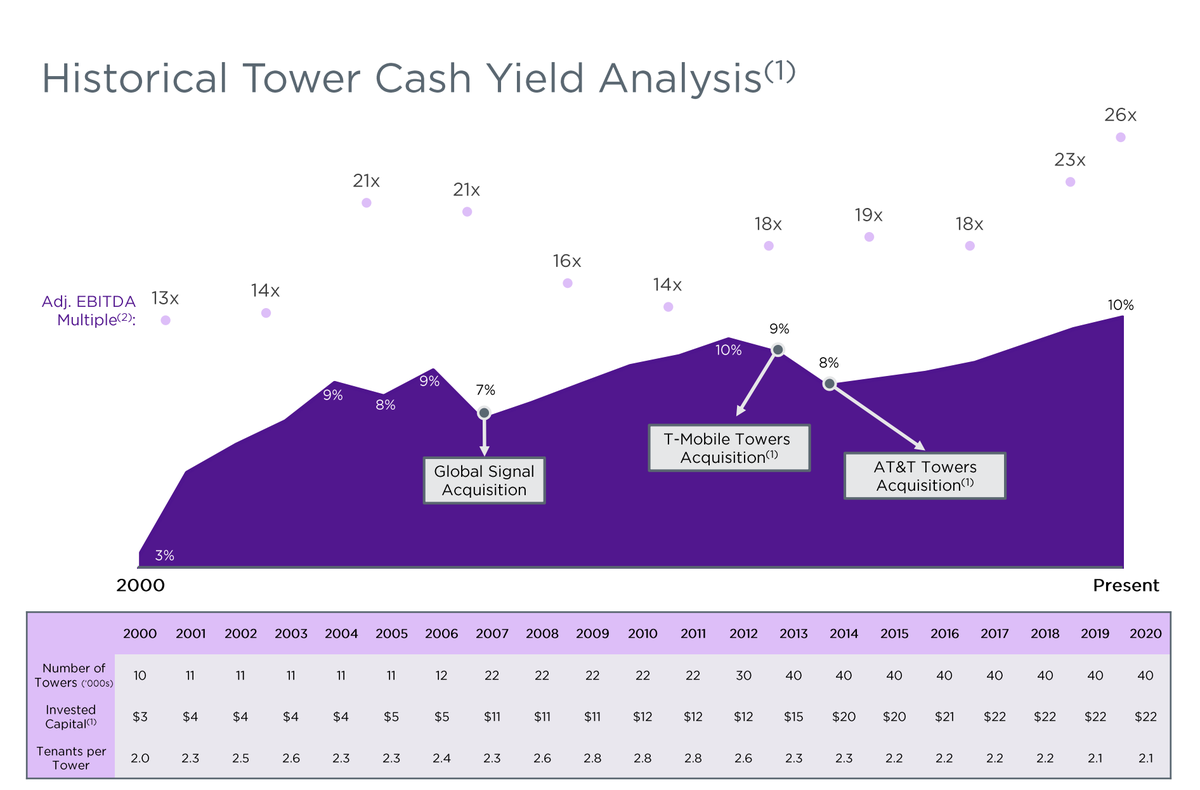

Also, look at that MULTIPLE EXPANSION!

Also, look at that MULTIPLE EXPANSION!

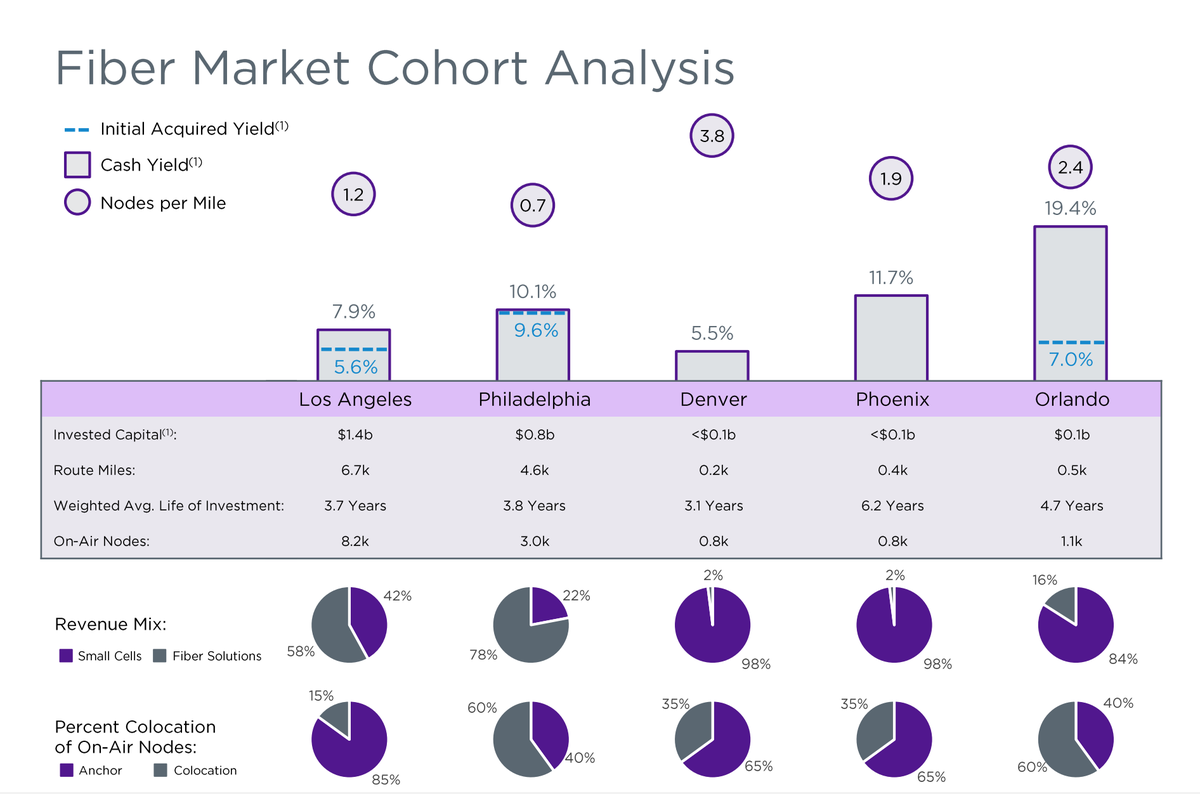

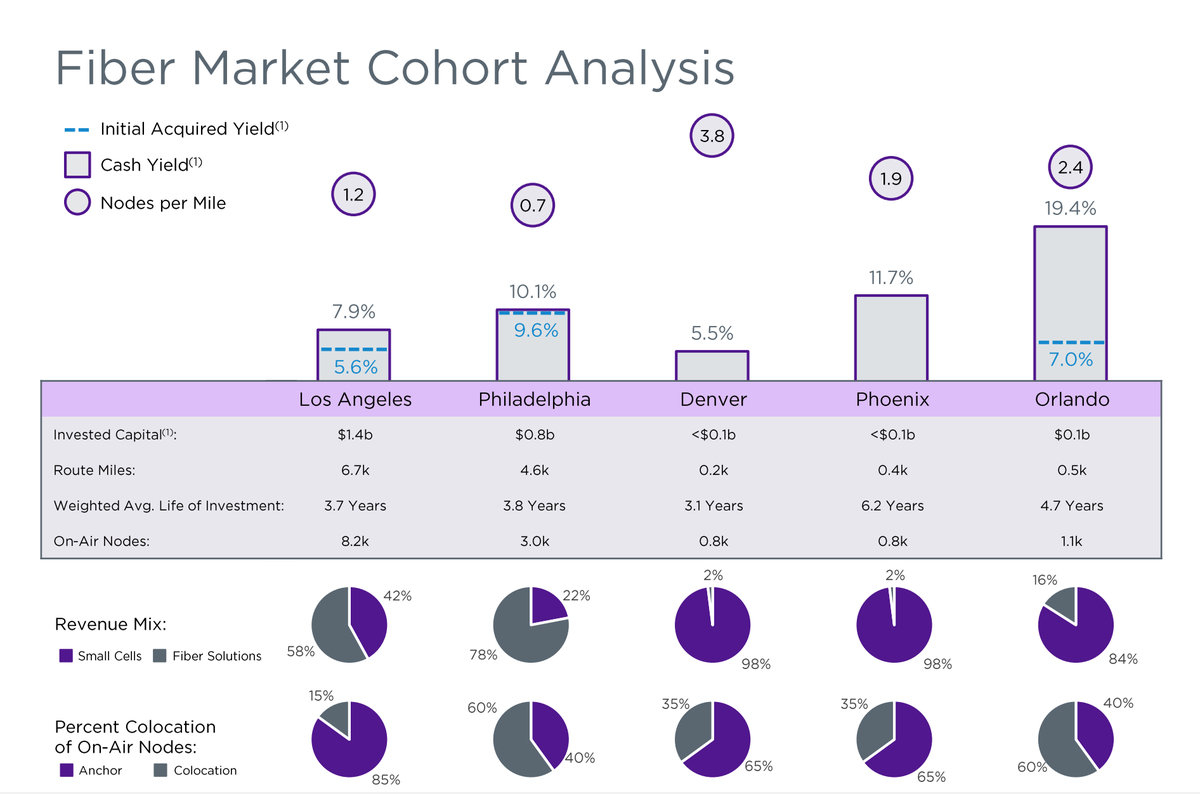

In some areas where Crown has bought fiber, there's still a large piece of Enterprise business, where the EBITDA currently is.

But in other cities, yields are already higher than tower yields, like Orlando at 19%!

But in other cities, yields are already higher than tower yields, like Orlando at 19%!

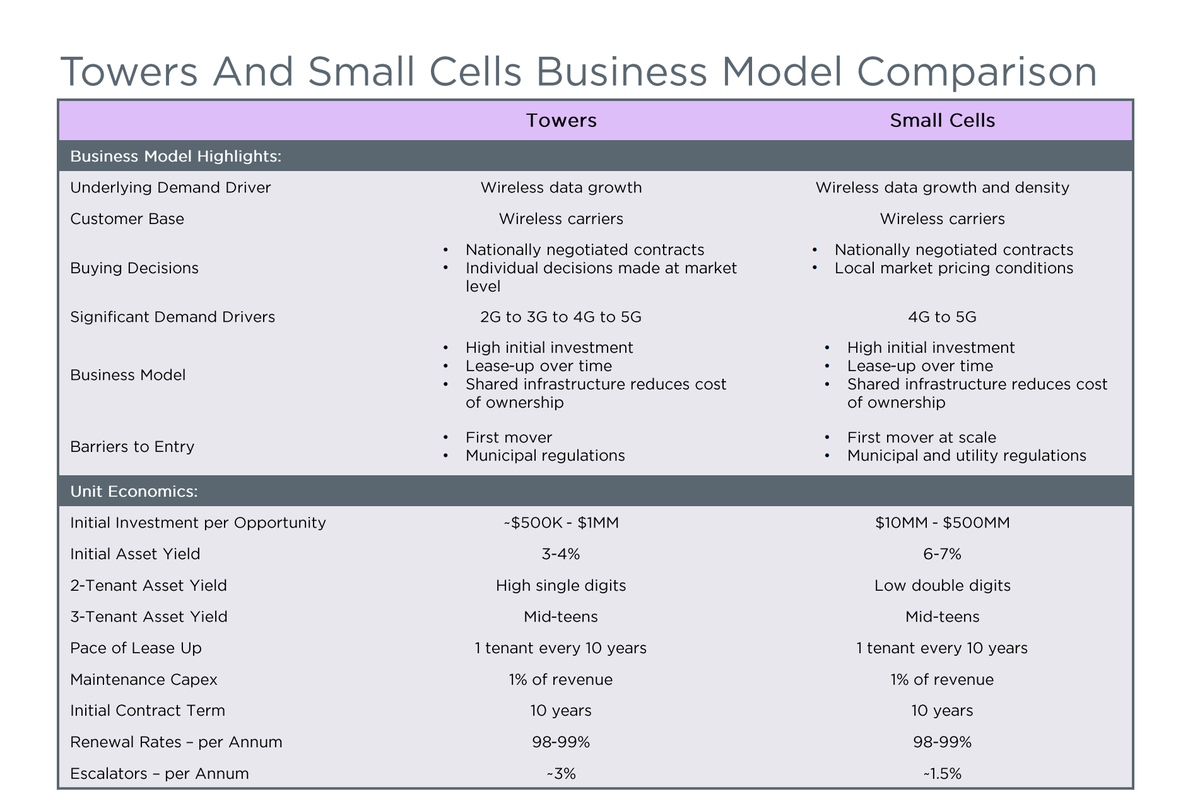

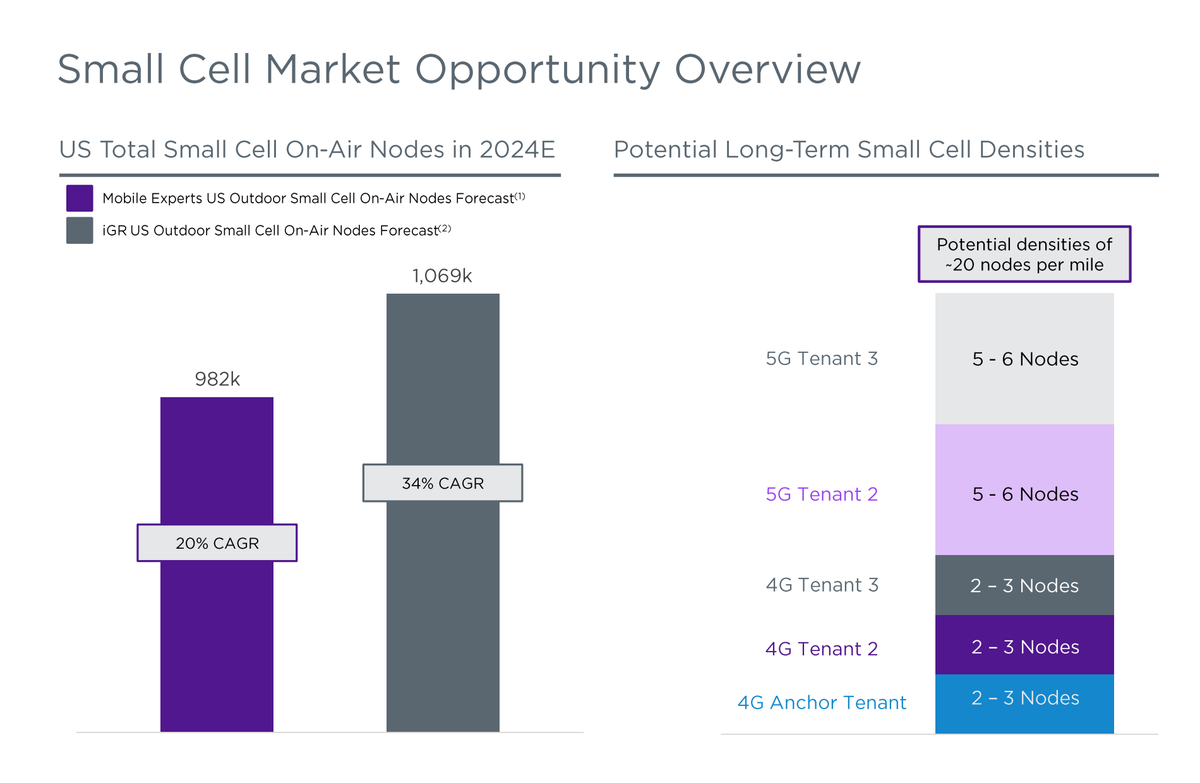

The CAGR for small cells is large and either way, that's a much higher CAGR than annual new tower builds, for sure

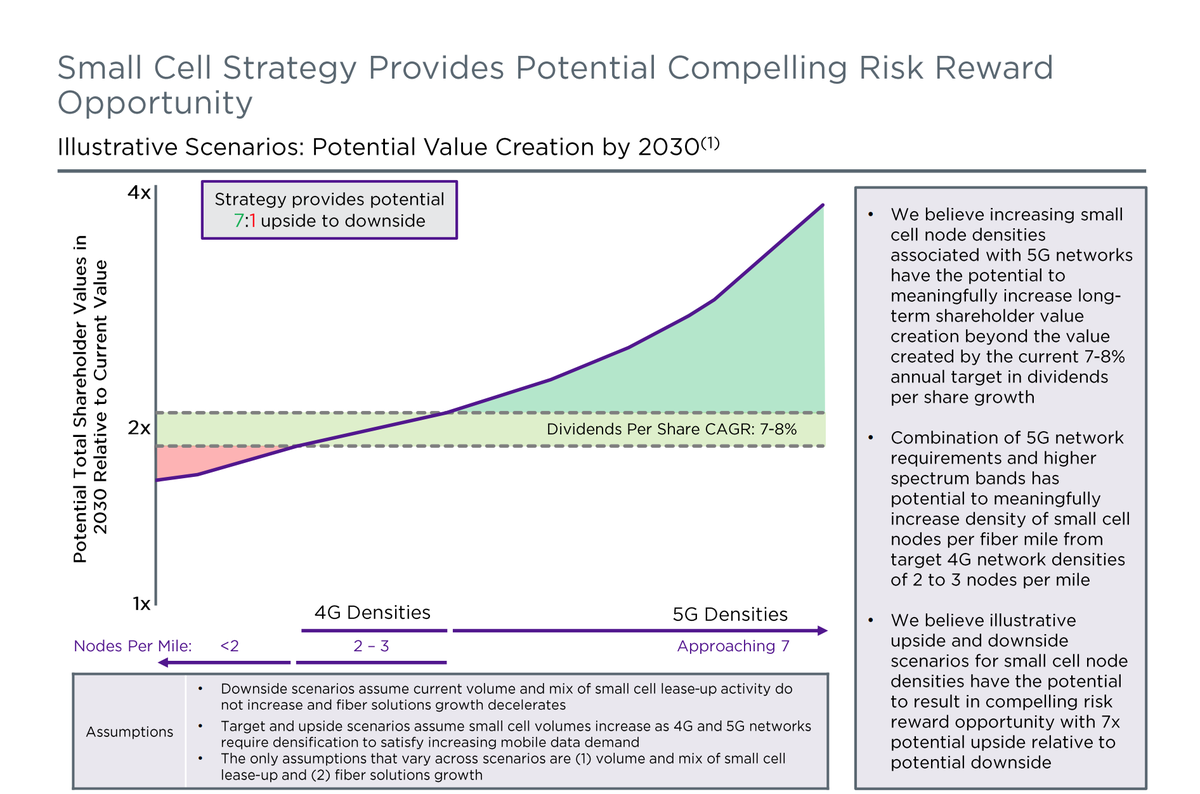

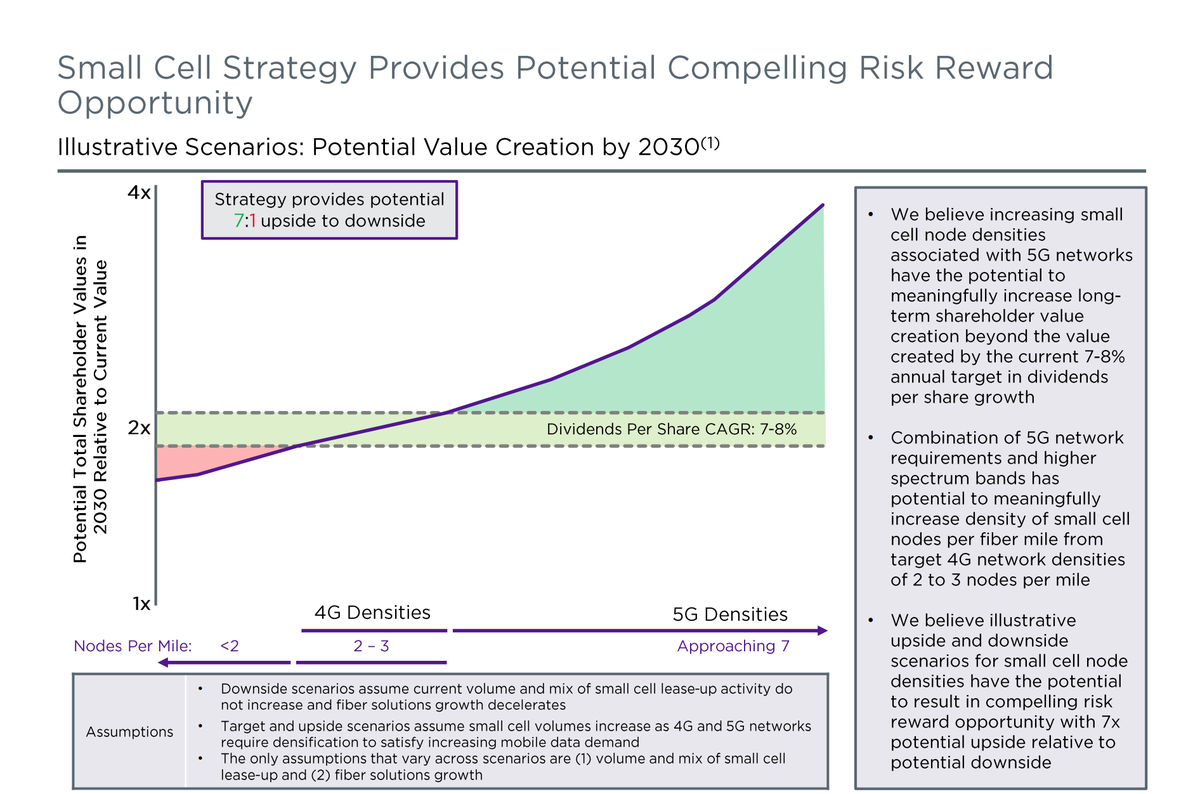

Here is the chart that Elliott, $AMT and $SBAC all do not want to be accurate!

Fiber > dividends in telco, what a concept!

Fiber > dividends in telco, what a concept!

$CCI is getting an 8% yield on towers acquired and built from 2007 on, which compares to a 7% yield they are currently getting in the extremely early days of fiber.

On call: says towers yields started out at 3% and went to 9% after 6 years.

We are so early in small cell deployment and already getting 7% yields on fiber!!

We are so early in small cell deployment and already getting 7% yields on fiber!!

"What is known by investors today that towers is a great business was not always a widely held view."

"If at any point we had stopped investing in assets, we'd have missed out on significant value creation."

"If at any point we had stopped investing in assets, we'd have missed out on significant value creation."

LA: 70% invested capital on buying fiber; yield increase from small cells

Denver: majority from anchor small cell customers; but 5.5% low for typical anchor builds

Orlando: Initial small cell system; what fully leased up market looks like; want up to 20% for all markets

Denver: majority from anchor small cell customers; but 5.5% low for typical anchor builds

Orlando: Initial small cell system; what fully leased up market looks like; want up to 20% for all markets

They'll be updating the above markets going forward - picked them because they are so different (buying fiber, building for anchor customers, Orlando was the first small cell market 10 years ago)

Only major change in the assumptions to increase value are node densities increasing (more small cells per fiber mile).

Thinks densities could be significantly higher than today of 2-3 for 4G and 7 projected - think could be 20 per mile for 5G!!

Thinks densities could be significantly higher than today of 2-3 for 4G and 7 projected - think could be 20 per mile for 5G!!

Carriers: "thoughtful" about expenses, co-located with others on towers because it was less expensive than owning themselves.

But also, "we're not gonna do it all" won't build fiber everywhere, won't build where they can't get multiple tenants.

So about those $VZ builds...

But also, "we're not gonna do it all" won't build fiber everywhere, won't build where they can't get multiple tenants.

So about those $VZ builds...

$CCI: For 4G -> 5G, carriers will add 5G equipment to existing towers. But on the densification side, will need to use small cells.

This is why I like the $CCI strategy: once you layer on the 5G coverage layer on towers, the money will be spent on densifying on dense metro fiber

This is why I like the $CCI strategy: once you layer on the 5G coverage layer on towers, the money will be spent on densifying on dense metro fiber

Another one on the $VZ self-perform question: $CCI sees other small cell builders going outside Top 30 markets, they may choose to but really focused on Top 30.

$VZ building fiber in over 60 markets.

So will it be successful? Time will tell...

$VZ building fiber in over 60 markets.

So will it be successful? Time will tell...

"There is not a solution to meet growing customer network demand on macro towers...this will be done on small cells."

Cost savings for deploying small cells on $CCI infrastructure vs. their own is 50%

Read on Twitter

Read on Twitter