1/n

Last week we also released a report on updated projections of India's electricity demand out to 2025, in the light of the COVID shock.

In this thread, I provide a summary; links to the pdf and free results data come at the end as your carrot for getting through!

Last week we also released a report on updated projections of India's electricity demand out to 2025, in the light of the COVID shock.

In this thread, I provide a summary; links to the pdf and free results data come at the end as your carrot for getting through!

2/n

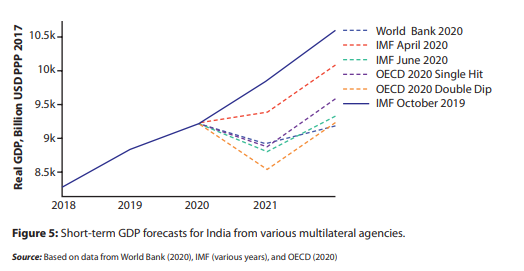

There is now no doubt that India's GDP will contract in 2020. International agency forecasts sit around -3 to -7% . Domestic agencies and banks around -5 to even -9%.

. Domestic agencies and banks around -5 to even -9%.

This would be close to if not the worst economic shock in India's post independence history.

There is now no doubt that India's GDP will contract in 2020. International agency forecasts sit around -3 to -7%

. Domestic agencies and banks around -5 to even -9%.

. Domestic agencies and banks around -5 to even -9%. This would be close to if not the worst economic shock in India's post independence history.

3/n

There is a lot of evidence that recessionary shocks can have a persistent downward impact on post-shock growth, through several channels:

- debt

- wealth destruction

- lower investment and innovation

- human capital erosion.

There is a lot of evidence that recessionary shocks can have a persistent downward impact on post-shock growth, through several channels:

- debt

- wealth destruction

- lower investment and innovation

- human capital erosion.

4/n

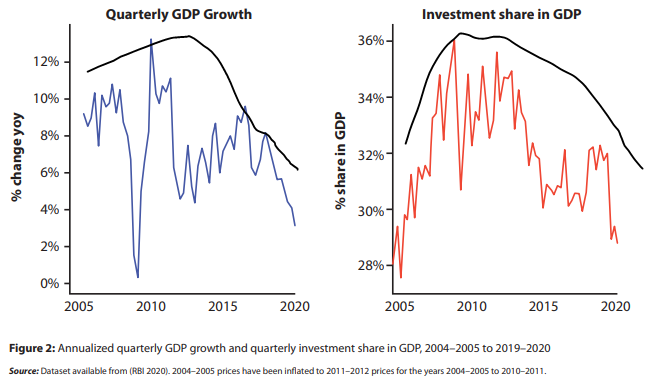

Indeed, we can draw on India's recent past to illustrate this.

India's GDP growth rate, and investment rate, never really recovered after the shocks of the Global Financial Crisis, 'perfect storm' of 2011-13, and so on.

Indeed, we can draw on India's recent past to illustrate this.

India's GDP growth rate, and investment rate, never really recovered after the shocks of the Global Financial Crisis, 'perfect storm' of 2011-13, and so on.

5/n

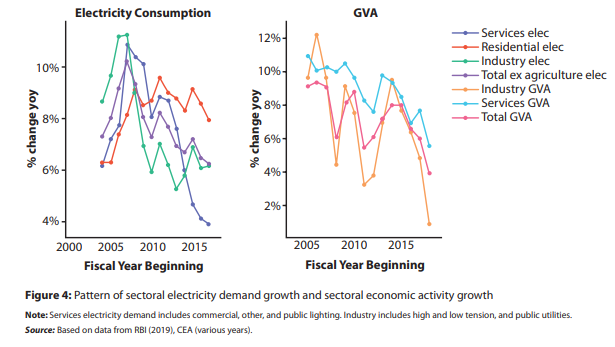

As a consequence, India's electricity demand growth rate has also followed a similar bell-shaped pattern .

.

The consequences are well known: large build up of non-performing assets, NPAs, and over capacity.

As a consequence, India's electricity demand growth rate has also followed a similar bell-shaped pattern

.

.The consequences are well known: large build up of non-performing assets, NPAs, and over capacity.

6/n

The recent history of the electricity sector is also a good illustration of one of the mechanisms of shock perpetuation, schematically:

shock -> lower demand -> financial sector stress -> lower investment -> lower productivity growth -> lower GDP growth.

The recent history of the electricity sector is also a good illustration of one of the mechanisms of shock perpetuation, schematically:

shock -> lower demand -> financial sector stress -> lower investment -> lower productivity growth -> lower GDP growth.

7/n

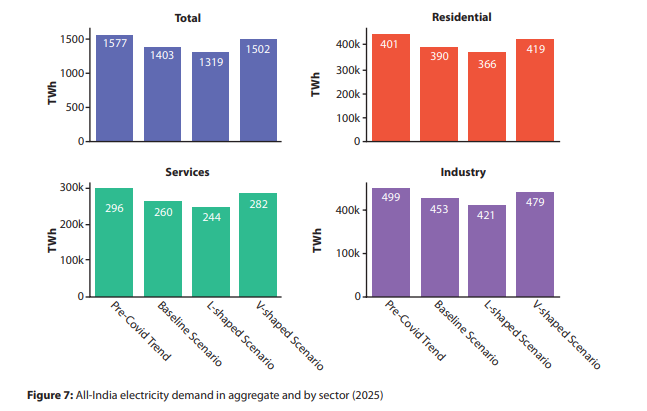

So our baseline, we argue, must be that the massive COVID-19 shock, despite best efforts to mitigate it, leads to a persistent downward revision in India's GDP potential growth rate.

As a consequence, we project lower electricity demand, relative to the pre-COVID baseline.

So our baseline, we argue, must be that the massive COVID-19 shock, despite best efforts to mitigate it, leads to a persistent downward revision in India's GDP potential growth rate.

As a consequence, we project lower electricity demand, relative to the pre-COVID baseline.

8/n

Relative to the pre-COVID baseline, we project that demand could be 75-258 TWh lower, or 6-17%, by 2025 .

This is a substantial downward revision, equivalent to roughly 11-39 GW of coal-fired generating capacity.

Relative to the pre-COVID baseline, we project that demand could be 75-258 TWh lower, or 6-17%, by 2025 .

This is a substantial downward revision, equivalent to roughly 11-39 GW of coal-fired generating capacity.

9/n

The consequences could be significant:

- persistent DISCOM stress

- persistent overcapacity

- lower investment in new capacity

- an event stronger case for retirements of old plant and optimal resource planning

- missing GW based targets, but exceeding on generation shares.

The consequences could be significant:

- persistent DISCOM stress

- persistent overcapacity

- lower investment in new capacity

- an event stronger case for retirements of old plant and optimal resource planning

- missing GW based targets, but exceeding on generation shares.

10/n

We made these scenarios with a lot of humility: there's a huge amount of uncertainty, and we have deliberately chosen a wide range of contrasting scenarios.

Our purpose was to make the case that we need to entertain and study the possibility of a sustained demand hit.

We made these scenarios with a lot of humility: there's a huge amount of uncertainty, and we have deliberately chosen a wide range of contrasting scenarios.

Our purpose was to make the case that we need to entertain and study the possibility of a sustained demand hit.

11/n

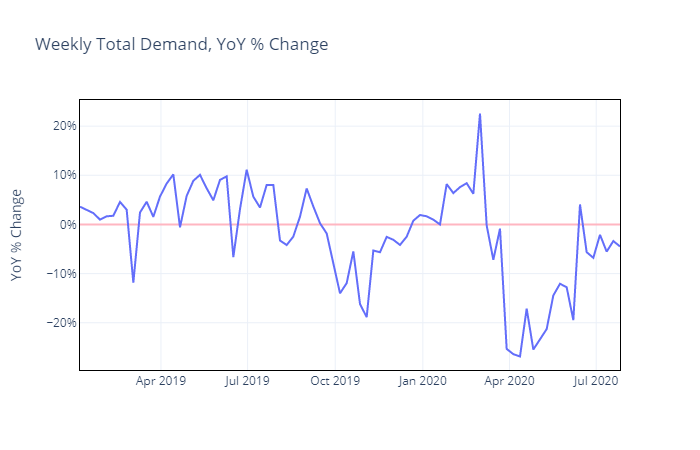

This is also why we put the dataset out in the public domain, for people to draw their own conclusions. I also have to address the apparent recent rebound in demand.

Because of daily noise this should be looked at on at least weekly time scales

This is also why we put the dataset out in the public domain, for people to draw their own conclusions. I also have to address the apparent recent rebound in demand.

Because of daily noise this should be looked at on at least weekly time scales

12/n

I think the initial rebound was driven by the sudden exit from lockdown: consumers satisfied essential consumption and producers produced to rebuild inventories.

Recent weeks suggest we've settled back to a pattern in which demand is 4-5% below the same period last year.

I think the initial rebound was driven by the sudden exit from lockdown: consumers satisfied essential consumption and producers produced to rebuild inventories.

Recent weeks suggest we've settled back to a pattern in which demand is 4-5% below the same period last year.

13/n

BUT: 4-5% below last year's level is 9-12% below the counterfactual of continued growth in 2020. Investments are made on future expectations. Our report's conclusion is simple: future demand expectations probably need to be brought down as a result of this tragic shock.

BUT: 4-5% below last year's level is 9-12% below the counterfactual of continued growth in 2020. Investments are made on future expectations. Our report's conclusion is simple: future demand expectations probably need to be brought down as a result of this tragic shock.

Read on Twitter

Read on Twitter