We didn't learn a whole lot about the Fed's forward guidance strategy aside from the fact that it will be related to the conclusion of the Fed's framework review. If the Fed needs some suggestions for how to proceed with state-contingent forward guidance

https://medium.com/@skanda_97974/the-fed-still-needs-to-do-its-part-six-ways-to-improve-the-evans-rule-to-recover-jobs-and-wages-1a27c9806647 https://twitter.com/IrvingSwisher/status/1288533637118464002

https://medium.com/@skanda_97974/the-fed-still-needs-to-do-its-part-six-ways-to-improve-the-evans-rule-to-recover-jobs-and-wages-1a27c9806647 https://twitter.com/IrvingSwisher/status/1288533637118464002

For those wondering, yes, these suggestions overlap with @employamerica's proposed #FloorGLI framework in that the goal is to achieve a baseline rate of employment and wage growth: https://medium.com/@skanda_97974/floor-it-fixing-the-feds-framework-with-paychecks-not-prices-78171423e9c1

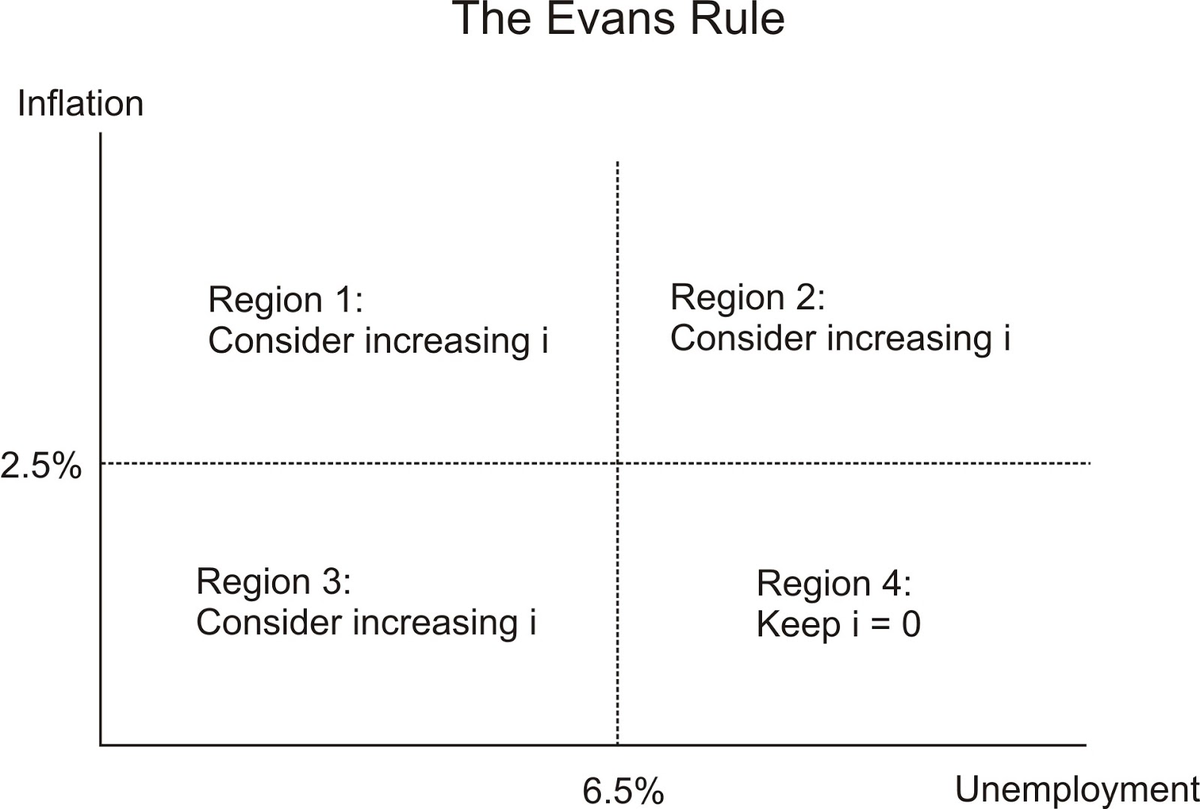

The Evans Rule had a number of flaws from which Sudiksha Joshi and I hope the Fed learns the right lessons...

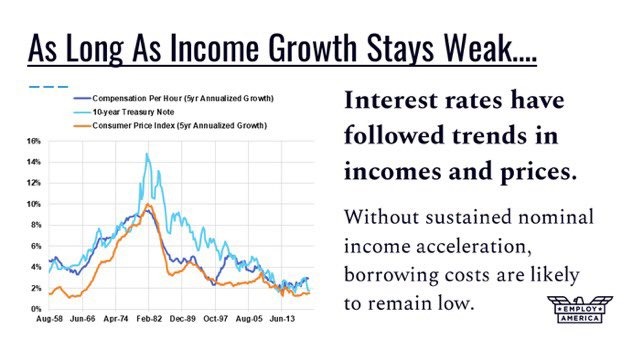

To start with, the Fed really should look beyond consumer price inflation if they want to escape the asymmetric costs posed by the zero lower bound...

To start with, the Fed really should look beyond consumer price inflation if they want to escape the asymmetric costs posed by the zero lower bound...

@darioperkins recently released a nice piece on the incoherence of economists' understanding of what guides inflation. This really shouldn't be a surprise if you're aware of how the inflation sausage is actually made.... https://blogs.tslombard.com/road-to-inflation

As the BLS tries to capture quality-adjustments within price indices, the methodology evolves. But the components of headline/core inflation measures do not follow a single consistent methodology, nor does each component's methodology remain fixed through time....

The result is almost necessarily incoherent. About the most we can say about consumer price inflation is that over long time periods, it bears a loose correlation with nominal income growth (which makes sense since b/c nominal spending growth is necessarily correlated).

Unlike consumer price inflation, nominal wage growth actually does follow some meaningfully predictable patterns. @ernietedeschi and @ModeledBehavior have both documented the sensitivity of wage growth to the prime-age employment rate https://twitter.com/ernietedeschi/status/1123221483403214848

We can say with some certainty that nominal wage growth is sensitive to some mix of labor utilization and the growth rate in economic activity. Price inflation OTOH is methodologically messy, slow to respond to economic dynamics, and not really the true objective of accommodation

To speak in terms of 'striving for more inflation' is to confuse the byproduct with the objective. Shifting the focus to wage growth can help clean up some of the Fed's communication nightmares.

Which gets us to our second recommendation: opt for a floor, not a ceiling.

The Evans Rule took a defensive approach to forward guidance but if the Fed wants to sustainably escape the trap of low nominal income growth and inflation, it ought to set an affirmative goal

The Evans Rule took a defensive approach to forward guidance but if the Fed wants to sustainably escape the trap of low nominal income growth and inflation, it ought to set an affirmative goal

Contrary to what FOMC hawks in 2012 were worried about, an inflation ceiling on its own did not lead to overshooting. And after 8 years of missing the Fed's self-adopted target, the systematic policy bias for below-target inflation is increasingly glaring.

Philly Fed president Patrick Harker is already moving in our proposed direction by suggesting the Fed not raise rates at least until inflation is back to the 2% target. The problem with this specific approach is in how easily it can be misinterpreted (byproduct vs objective)

Our third proposed improvement: make the labor utilization threshold a necessary "level target" but not an individually sufficient condition for ending forward guidance. To see why, I'd start with this timely @dandolfa post http://andolfatto.blogspot.com/2012/12/the-hawkish-nature-of-evans-rule.html

One of the flaws with the Evans Rule that ultimately led to its premature conclusion was that unemployment rate crossing the 6.5% threshold alone meant the end of state-based forward guidance, even though inflation remained below target and wage growth stayed sluggish

Our solution is to make Regions 2 and 3 of @dandolfa's diagram more like Region 4. This was probably not politically feasible within the FOMC when the Evans Rule was first debated but it seems more feasible now given the evolution of the committee over the last 8 years

For the longest time, Fed officials have thought about labor utilization in terms of its alleged relevance to price inflation and wage growth. The Phillips Curve was supposed to imply that relatively high labor utilization would translate into faster inflation....

The latter years of this expansion give strong reason for skepticism. Historically low unemployment did not result in above-target inflation. The Phillips Curve is not a good rationale for retaining a labor utilization threshold, but there is a much better rationale: context.

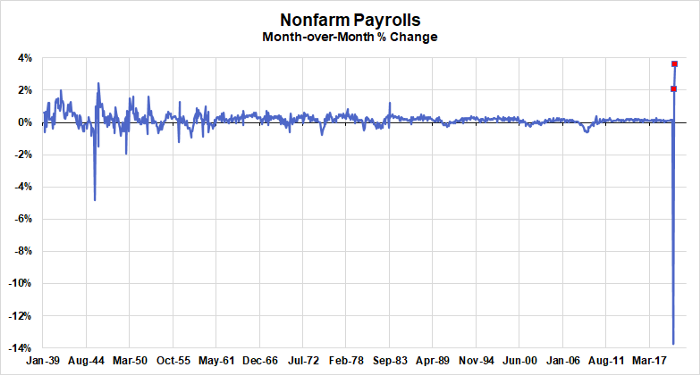

To see the value of using a labor utilization threshold, it helps to consider just how volatile the economic data has been over the past few months. Percentage change of any economic variable (employment, wages, output, prices) can easily mislead right now...see nonfarm payrolls

@Neil_Irwin's piece from back in May captured this point well: "In normal times, percentage change is a helpful guide to what’s happening in the economy. But these are not normal times." https://www.nytimes.com/2020/05/19/upshot/virus-economic-data-upended.html

For this reason alone, the rationale for retaining some form of a "level target" seems compelling, and a necessary labor utilization threshold would be an intuitive way of doing so. I would recommend this @DavidBeckworth thread for the full reasoning here: https://twitter.com/DavidBeckworth/status/1265753757683499008

Making both labor utilization and wage growth necessary conditions for ending forward guidance might seem too aggressive. What if inflation accelerates before labor utilization is close to the threshold? The result would be some inflation overshoot but that's a risk worth taking

The Fed says it is committed to symmetric inflation outcomes; given its systematic downside misses, it should be equally lenient to upside surprises and trying to accommodate as much progress in terms of labor utilization and wage growth as it reasonably can.

Read on Twitter

Read on Twitter