Here is a prediction --

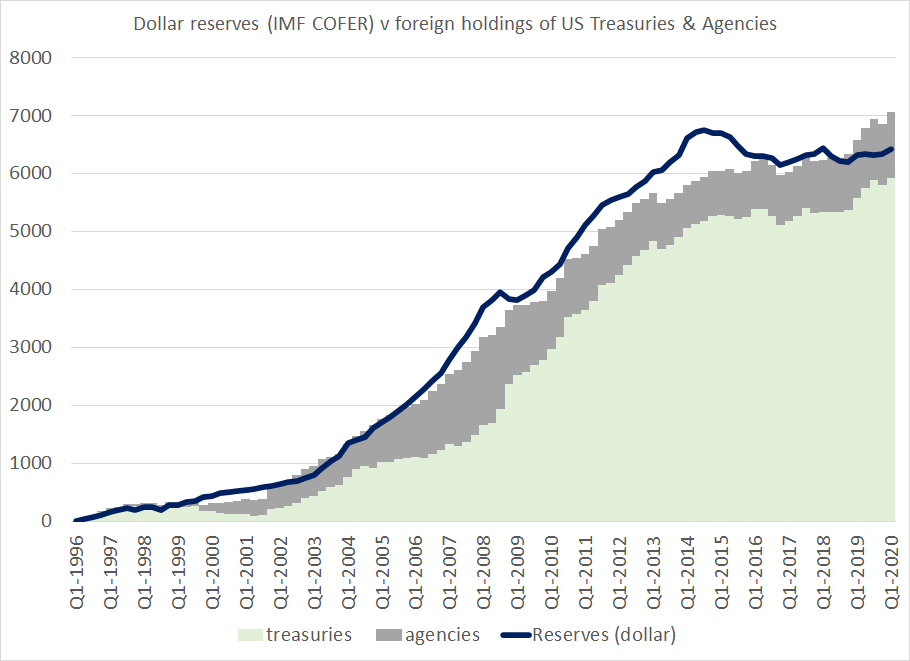

Despite all the talk about the demise of the dollar as a reserve currency (including by GS of all places ... ), when the IMF's data on dollar reserve holdings at the end of q3 is released, the world will hold more dollar reserves than it does now

1/n

Despite all the talk about the demise of the dollar as a reserve currency (including by GS of all places ... ), when the IMF's data on dollar reserve holdings at the end of q3 is released, the world will hold more dollar reserves than it does now

1/n

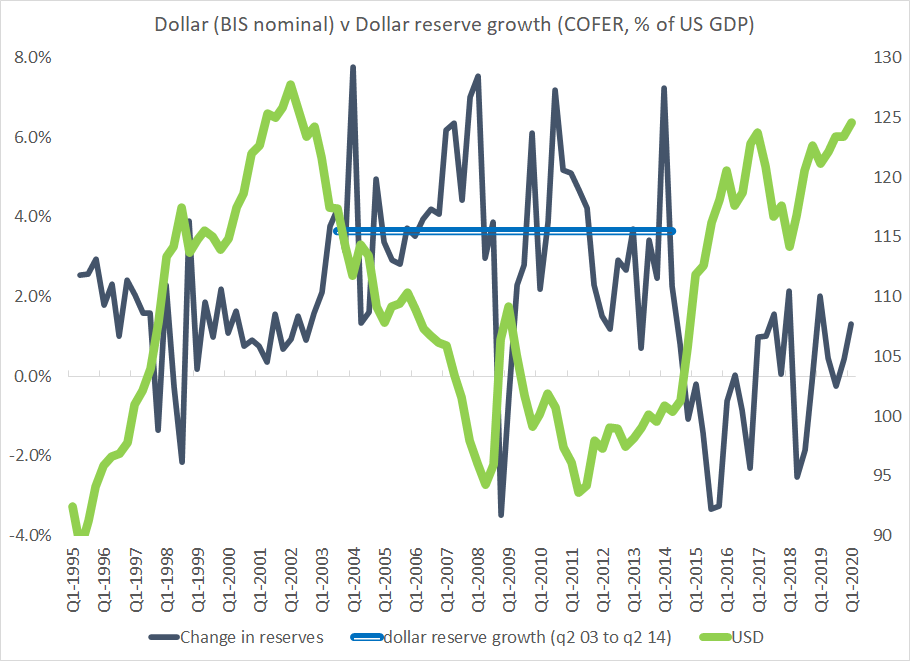

Talk about the demise of the dollar as a reserve currency tends to be correlated with falls in the dollar against the major advanced economy currencies, which generally float.

And a weaker dollar is correlated with higher intervention by emerging market economies ...

2/n

And a weaker dollar is correlated with higher intervention by emerging market economies ...

2/n

Call it the Setser rule (ha!) -- dollar reserve growth goes up when the dollar goes down.

(inflows into Treasuries also tend to be correlated with dollar weakness for precisely this reason ... something that should get more attention in high level int finance than it does)

(inflows into Treasuries also tend to be correlated with dollar weakness for precisely this reason ... something that should get more attention in high level int finance than it does)

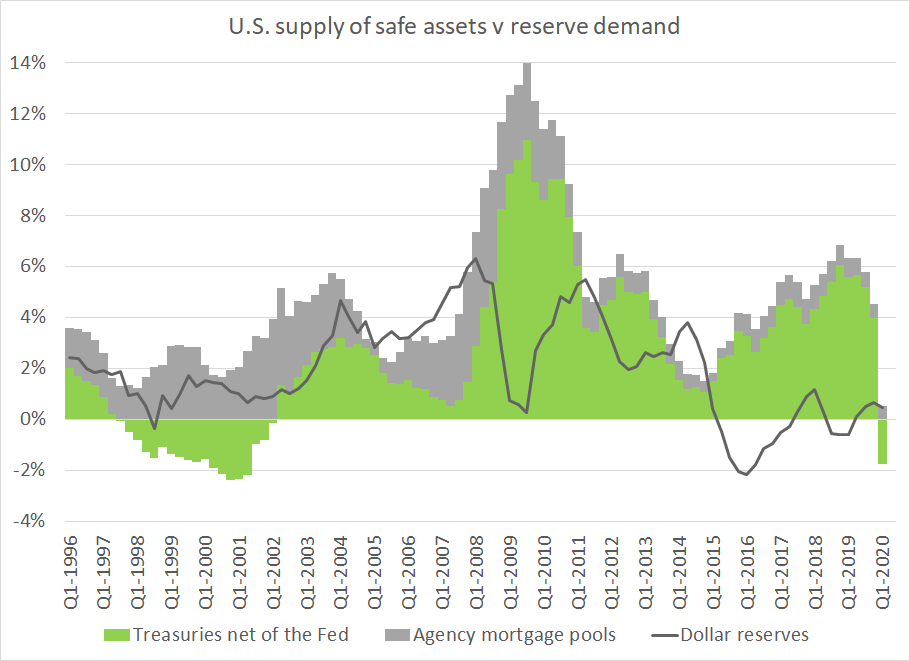

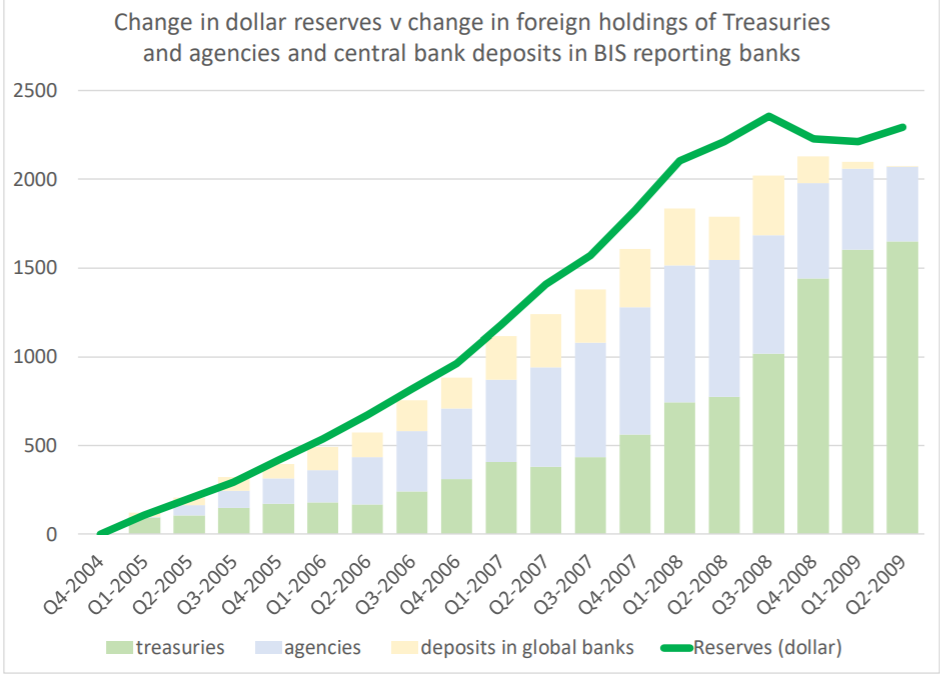

And here is something for proponents of the strong view of the banking glut argument as the only cause of the global financial crisis to ponder ...

in the years before the global crisis, Treasury supply growth lagged the increase in dollar reserves

4/n

in the years before the global crisis, Treasury supply growth lagged the increase in dollar reserves

4/n

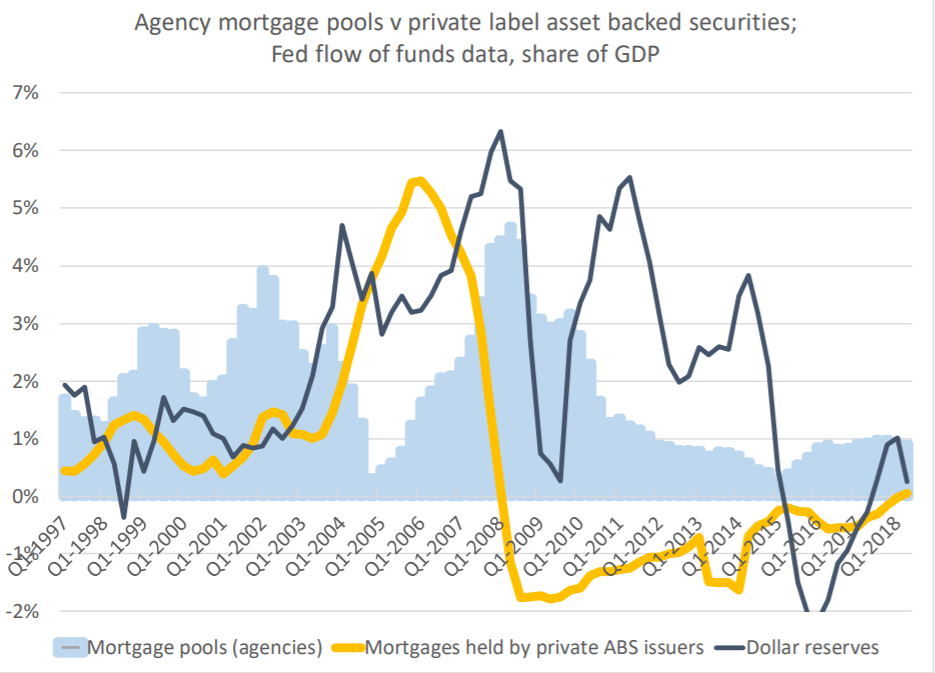

So an unusually large share of dollar reserves were at the time being intermediated through the U.S. agencies (Freddie and Fannie and the like) and the global banking system ...

5/n

5/n

The run up in official (reserve manager) dollar deposits in the global banks during this period is visible in the BIS data on deposits, and would be even more visible if swap funding was transparently reported.

in other words, reserve managers were fueling the banking glut

6/6

in other words, reserve managers were fueling the banking glut

6/6

p.s. a full explanation of my views can be found by following the link to my Iceland conference paper here

http://www.centerforfinancialstability.org/iceland.php

http://www.centerforfinancialstability.org/iceland.php

Read on Twitter

Read on Twitter