Big Tech valuations - a Thread

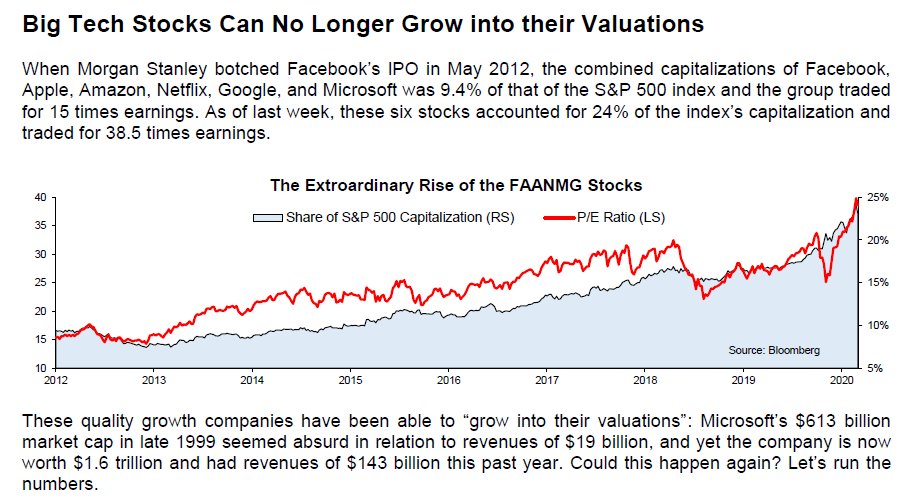

Microsoft’s $613 billion market cap in late 1999 seemed absurd in relation to revenues of $19 bn, and yet the company is now worth $1.6 trillion and had revenues of $143 billion this past year. Could this happen again? Let’s run the numbers.

1/4

Microsoft’s $613 billion market cap in late 1999 seemed absurd in relation to revenues of $19 bn, and yet the company is now worth $1.6 trillion and had revenues of $143 billion this past year. Could this happen again? Let’s run the numbers.

1/4

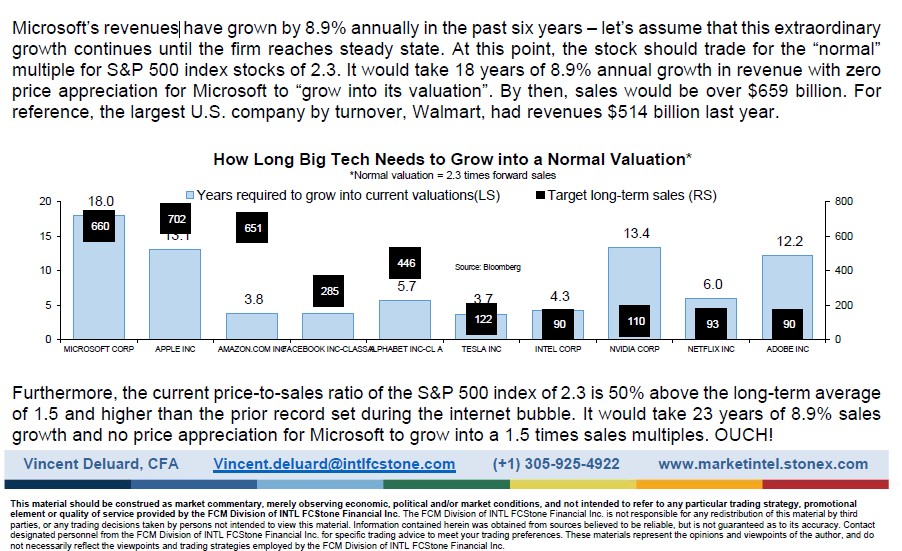

Microsoft’s revenues have grown by 8.9% in the past 6 years – let’s assume that this continues until the stock trades for the “normal” multiple for S&P 500 index stocks of 2.3. It would take 18 years with zero price appreciation for Microsoft to “grow into its valuation”

2/4

2/4

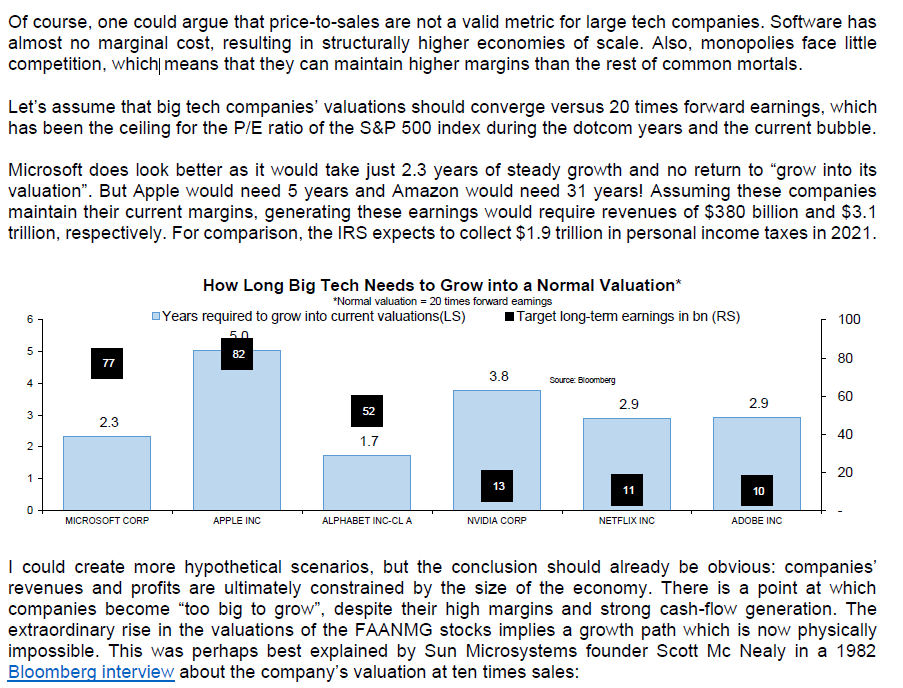

Price-to-sales may not be a valid metric for large tech companies. Software has almost no marginal cost, resulting in higher economies of scale. Also, monopolies face little competition, which means that they can maintain higher margins than the rest of the index

3/4

3/4

Read on Twitter

Read on Twitter