If you've finished your lunch and have an hour to spare before today's FOMC meeting, some suggestions for how the Fed should approach its forward guidance strategy: https://medium.com/@skanda_97974/the-fed-still-needs-to-do-its-part-six-ways-to-improve-the-evans-rule-to-recover-jobs-and-wages-1a27c9806647

I think the starting point for how the Fed should proceed with forward guidance starts with the Evans Rule. My co-author Sudiksha Joshi and I tried to first put some context around what the Evans Rule actually meant for the economy from 2012-14: https://medium.com/@skanda_97974/the-success-of-the-evans-rule-and-the-case-for-state-based-quantitative-forward-guidance-738e19ad6201

The Fed is obviously not an all-powerful institution. Fiscal policy is the more direct mechanism for providing affirmative support; the Fed is more constrained. But it doesn't mean the Fed is powerless either. Forward guidance is how the Fed can commit to "doing no harm"

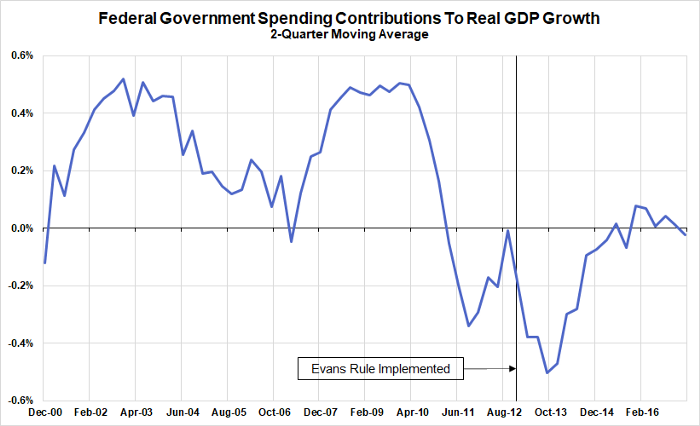

While there were some deep flaws with the Evans Rule (to be discussed later), I think it's important to understand that in 2012, fiscal policy wasn't just failing to support the economy, but actively hurting the economy in a manner that was historically unusual.

That alone was going to weigh on aggregate demand by siphoning away income that would flow towards businesses and households. On top of that, households were still working through the balance sheet overhang of the housing bust. The propensity to save was much higher post-crisis

Despite tightening fiscal policy and a retrenching household sector, the economy managed to stay afloat.

The Fed's commitment to support the economy for as long as the unemployment rate was >6.5% and inflation projections were below 2.5% was an underrated part of that process

The Fed's commitment to support the economy for as long as the unemployment rate was >6.5% and inflation projections were below 2.5% was an underrated part of that process

To see why, I think it helps to first understand what forward guidance is and can do.

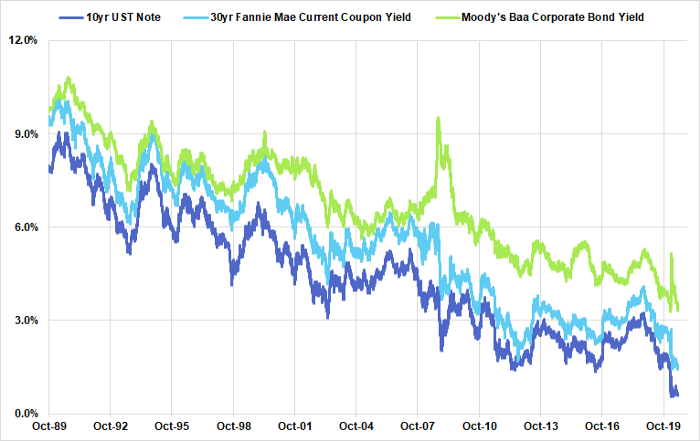

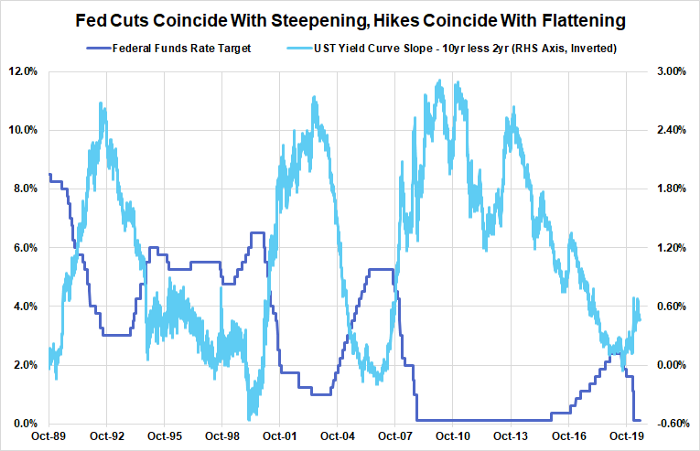

While the Fed directly targets a short-term interest rate (the overnight fed funds rate), it is long-term interest rates that actually have a meaningful effect on the propensity to spend/invest

While the Fed directly targets a short-term interest rate (the overnight fed funds rate), it is long-term interest rates that actually have a meaningful effect on the propensity to spend/invest

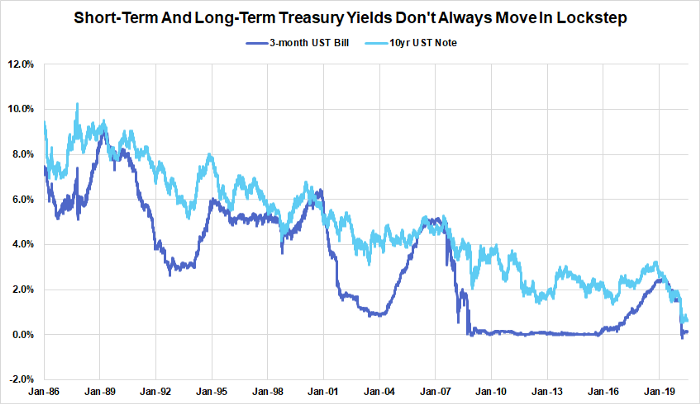

It is to the extent that short-term interest rates actually influence long-term interest rates that the Fed is mostly effective in how it influences the economy. But not all short-term interest rate changes are equally influential...

If the Fed signals that interest rate changes are to be reversed at a later date (e.g. "back to neutral"), then market expectations reflected in long-term interest rates less likely to be influenced by the change in short-term interest rates.

We often see a similar effect when the yield curve inverts while the Fed keeps hiking. The hikes increase the probability that growth will slow down and market participants justifiably suspect that the interest rate hikes are unsustainable and must be reversed to avoid recession.

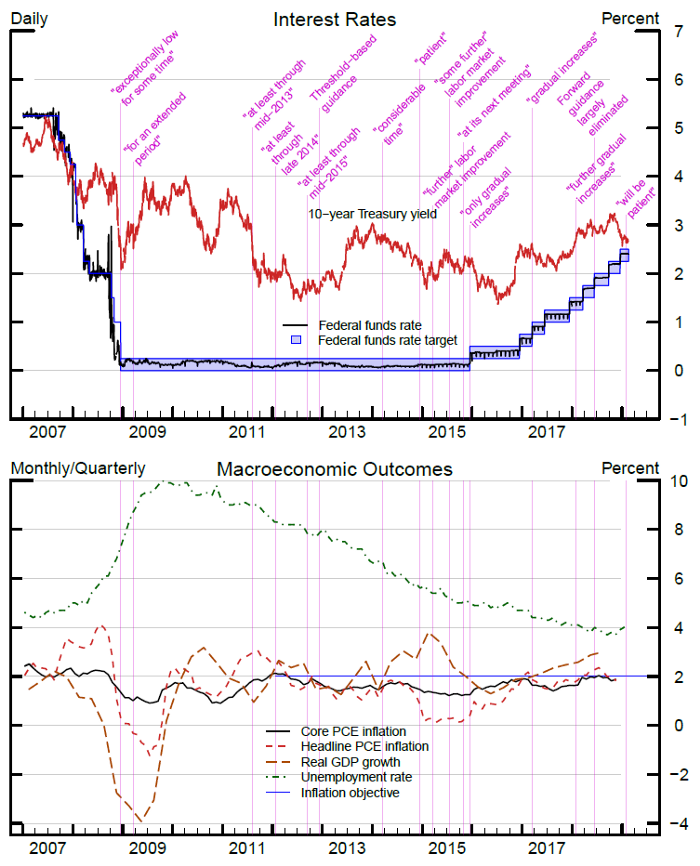

But prior to the implementation of the Evans Rule in December 2012, the Fed's forward guidance policy was a bit of a mess and contributed to the sluggish recovery.

In the spring of 2009, the FOMC stated that interest rates would stay low "for an extended period of time." Surely it would be clear to markets that in an economy still hemorrhaging jobs, rate hikes would not be considered...

Yet markets nevertheless grew excited (probably as a result of the nascent asset and commodity price recovery) about the prospect of the Fed exiting its accommodative policies. "For an extended period" was not actually having much effect on market expectations...

Surely the Fed would strengthen its guidance....After all, throughout 2009, the Fed staff's forecasts showed that rate hikes would not be justified for a long time due to elevated unemployment: https://twitter.com/sam_a_bell/status/1160258144683069440

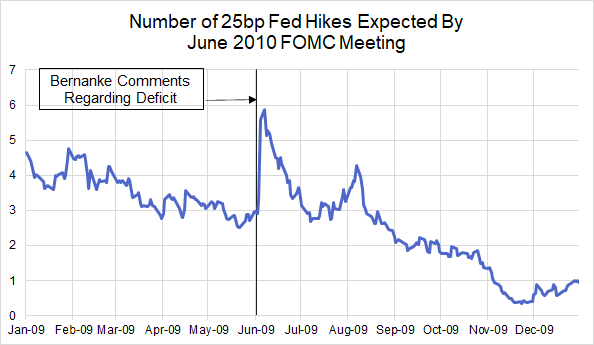

Wrong! Amidst mkt hype about when the Fed might exit, Bernanke instead talked up the need for Congress to control the deficit. Weird to be so concerned about inflation and optimistic about the recovery in the midst of historic job losses... https://www.ft.com/content/e8aa33c6-504c-11de-9530-00144feabdc0

For those who don't believe in the power of Fedspeak, check the market reaction following his comments. Market expectations for rate hikes over the subsequent 12 months soared following his comments.

Spoiler: The Fed didn't hike at all over this period.

Spoiler: The Fed didn't hike at all over this period.

In a way, this little experience itself shows both the power of the Fed's words but also how zero interest rate policy can be ineffective if it is not actually leading to lower long-term interest rates (and worse if Fedspeak is actively spurring higher long-term borrowing costs)

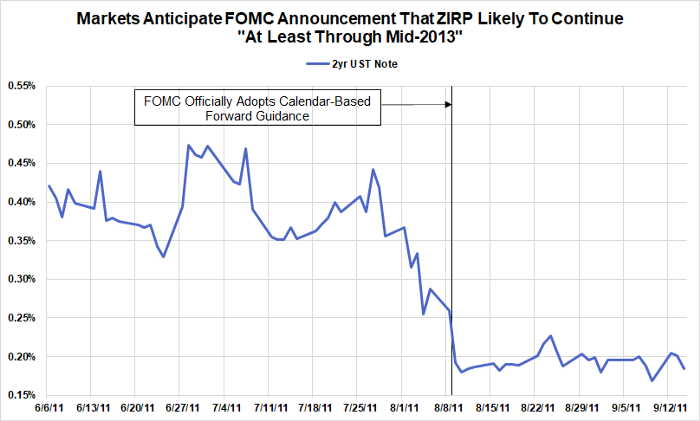

Fast forward two years later and the economy is back on the brink of recession (debt ceiling, household overrange, eurozone crisis). This time the Fed knows it needs to support the economy and so it makes a clear commitment to keep interest rates low for the next two years

Clearly superior to a vague commitment to keep interest rates low "for an extended period" but what's the objective the Fed was trying to achieve with these words? Especially when markets already knew the economy was in trouble.

It's possible that when the Fed said they would keep rates low at least through mid-2013, it thought a lower unemployment declines were achievable. But it also could have just been seen as nothing more than a modest offset to the headwinds that were emerging.

Which brings us to the Evans Rule, which is the first time the Fed used clear quantitative forward guidance that was state-contingent. If the economic state weakened, the Fed's timeline for staying at zero interest rates would necessarily be extended.

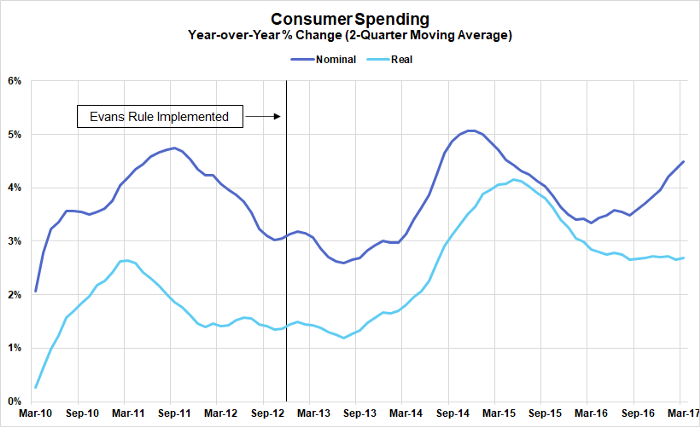

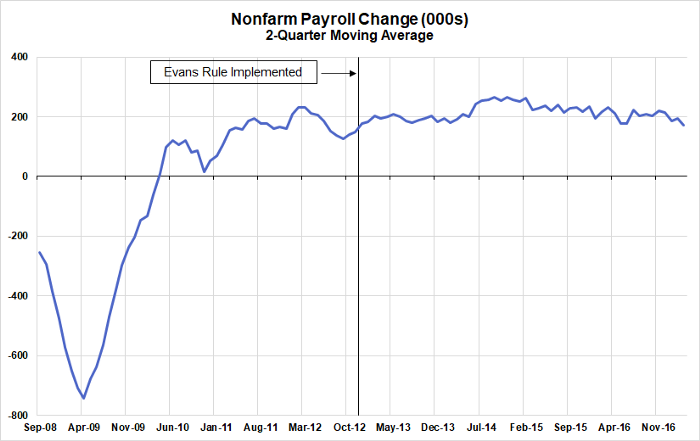

For all of the flaws with how the Fed specified and calibrated the Evans Rule, the results were rather impressive under the circumstances. Job growth stayed steady despite the external headwinds to aggregate demand.

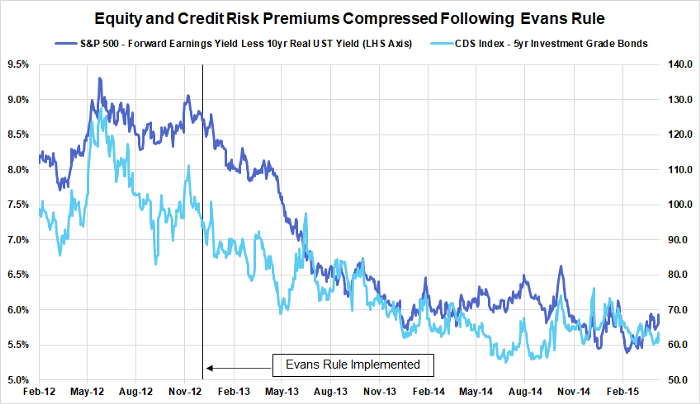

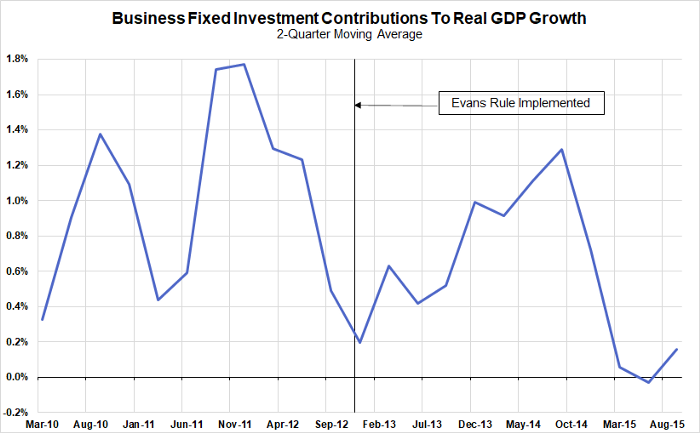

A big (though not comprehensive) part of this story was that the Fed's guidance helped to compress corporate credit and equity risk premiums, which largely coincided with a rebound in business fixed investment.

Businesses typically don't try to spend more than they earn unless they are confident that aggregate demand will ultimately stay afloat. With fiscal policy is tightening and households deleveraging, the US economy was not far away from setting off Keynes' paradox of thrift.

While this is surely a suboptimal way to structure a recovery (fiscal policy should be contributing, not detracting from this process), I think it does go to show the extent to which the Fed can still support the economy even from its constrained position.

It's 5 minutes to FOMC. Let's see if how much Powell tips his hand on what forward guidance will look like. Part 2 on how to improve the Evans Rule and state-based forward guidance to follow...

Read on Twitter

Read on Twitter