At $1,500, $TSLA valuation is mind-boggling cheap. Nothing against Bernstein - I used to work there, and I have highest respect for Toni S. But he’s using auto mfrs as his proxy, and TSLA should be valued more like $AAPL than BMW - ironic since TS is the #1 rated analyst on AAPL.

Like $AAPL, $TSLA has forever changed the auto industry with disruptive tech driven by centralized software (like iOS). It’s a single brand. It’s products are sold direct to consumers over the internet and at its stores. Like NOK, RIMM, and Motorola, its competitors are dying.

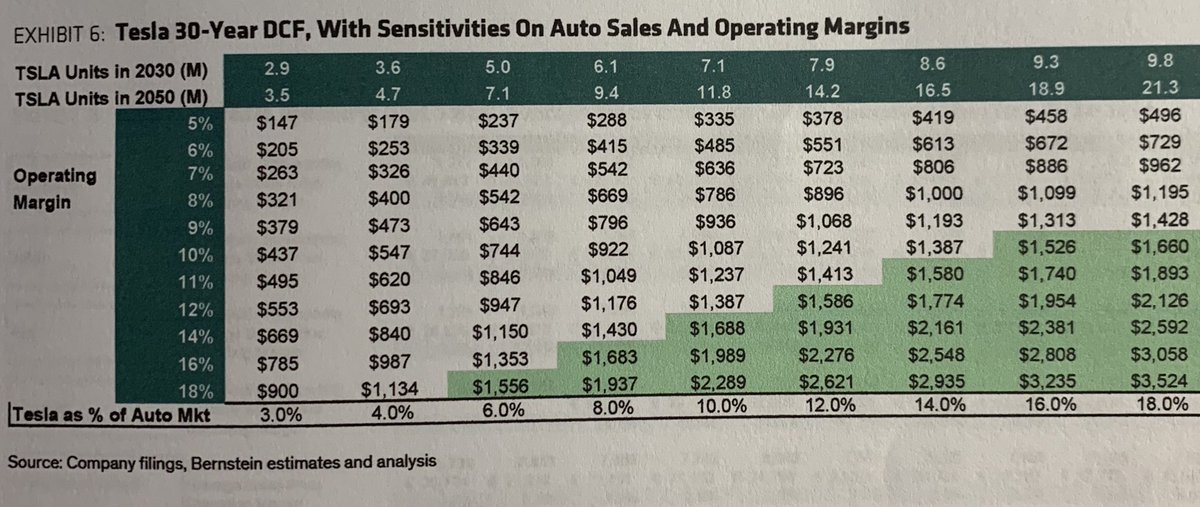

The key to TS argument: By 2030, TSLA will earn 8-10% operating margins - low by a factor of 2x. By 2030, assuming EV adoption 50%, and TSLA keeps its 17% EV share, TSLA will sell 6.8M cars vs 500K in 2020. OpEx will be ~2x today. That translates to Oper Margins of 19% in 2030.

Read on Twitter

Read on Twitter