Stephen Williamson @1954swilliamson raises important questions about the BoC’s quantitative easing policy. If the goal is the goal is to flatten the yield curve, then why the massive purchases of T-bills? (tweet 1/n) https://newmonetarism.blogspot.com/2020/07/does-bank-of-canada-really-want-to-be.html

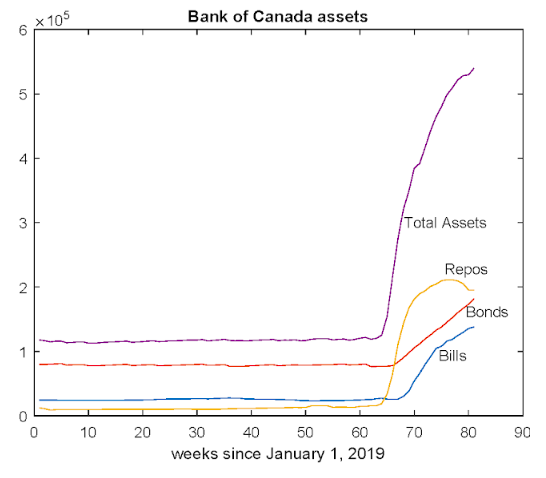

Of course, BoC is purchasing government bonds too. Massively so. By end of year, I think the Bank will end up holding about two-thirds of the new debt issued by Ottawa.

Since the Bank’s purchases of bonds are classed as held to maturity, they enter the Bank’s balance sheet at book value. But the risk is there.

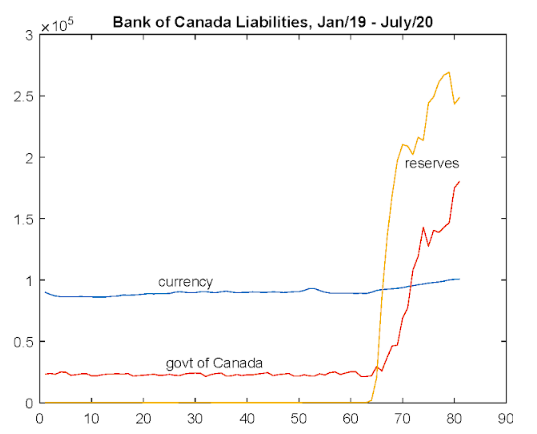

Williamson: “if interest rates go up … the Bank will have quite low interest earnings on an asset portfolio that is being financed by maybe … 50% reserves (at the policy rate). So that would put a dent in the transfer the Bank makes to the federal government.”

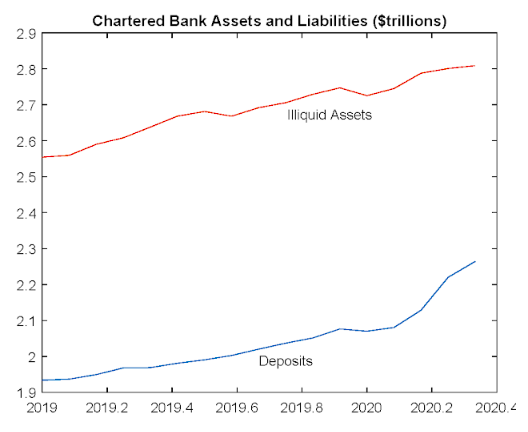

Meanwhile, on the supply side, chartered banks are turning the liquidity BoC is providing … into deposits? It’s not clear what macroeconomic objective that serves.

With all that issuance, the government’s own deposits with the Bank are swelling. For the time being at least, most of the proceeds of the bond and bill sales are just sitting in cash at the Bank of Canada.

Based on all this, you have to think what the Bank is now doing has very little to do with macroeconomic policy. It’s about providing liquidity to Ottawa, while shifting the risks of that strategy onto the Bank’s balance sheet.

In short, it seems to me that Canadian-style QE is mainly about making sure Bill Morneau can sleep at night. (end)

Read on Twitter

Read on Twitter