1/  India is at the forefront of global fintech innovation because our approach to building 'public digital infrastructure' is unique (and pretty cool)

India is at the forefront of global fintech innovation because our approach to building 'public digital infrastructure' is unique (and pretty cool)

A thread on India Stack & where Account Aggregators fit in, from @snjyjn's presentation at the @Sahamati AA Hackathon

A thread on India Stack & where Account Aggregators fit in, from @snjyjn's presentation at the @Sahamati AA Hackathon

India is at the forefront of global fintech innovation because our approach to building 'public digital infrastructure' is unique (and pretty cool)

India is at the forefront of global fintech innovation because our approach to building 'public digital infrastructure' is unique (and pretty cool) A thread on India Stack & where Account Aggregators fit in, from @snjyjn's presentation at the @Sahamati AA Hackathon

A thread on India Stack & where Account Aggregators fit in, from @snjyjn's presentation at the @Sahamati AA Hackathon

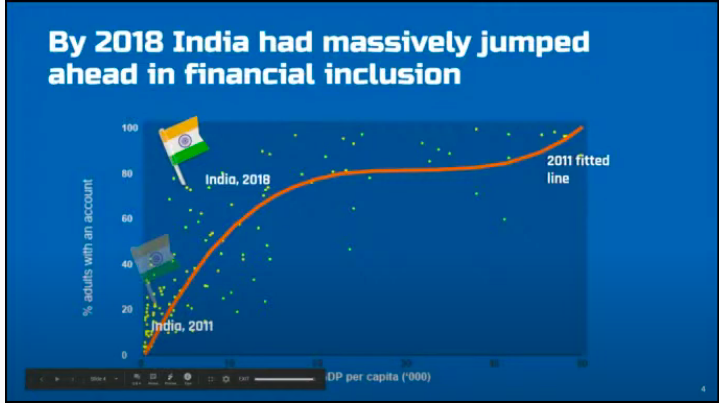

2/ Back in 2008, only 17% of Indians had bank accounts, which placed us fairly close to the trend line in comparison to other countries with similar GDP per capita

3/ However by 2018 we were well ahead of where our GDP per capita ‘should’ have placed us on the financial inclusion curve.

Most countries would have taken 46 years to make that journey but we did it in 6 years. How?

Most countries would have taken 46 years to make that journey but we did it in 6 years. How?

4/ The acceleration was due to 3 factors:

1. Public initiatives (eg: the Pradhan Mantri Jan Dhan Yojna which sought to expand access to affordable financial services)

2. A proactive Central Bank

3. India Stack

...all enabled by widespread smartphone usage & cheaper data

1. Public initiatives (eg: the Pradhan Mantri Jan Dhan Yojna which sought to expand access to affordable financial services)

2. A proactive Central Bank

3. India Stack

...all enabled by widespread smartphone usage & cheaper data

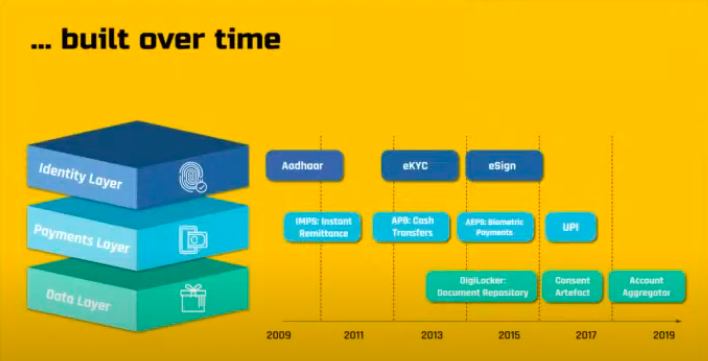

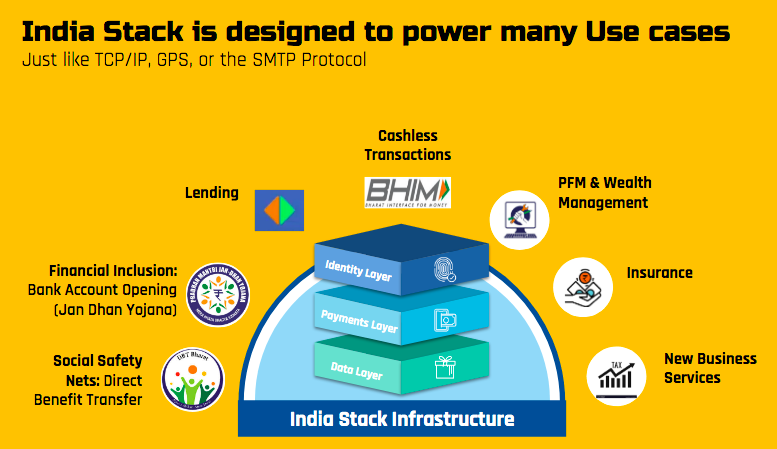

5/ So what is India Stack?

India Stack is a set of open source tools which enable digital services that are ‘presence-less, paperless, cashless’ and based around user consent.

The 'Stack' is made up of:

- an identity layer

- a payments layer

- a data empowerment layer

India Stack is a set of open source tools which enable digital services that are ‘presence-less, paperless, cashless’ and based around user consent.

The 'Stack' is made up of:

- an identity layer

- a payments layer

- a data empowerment layer

6/ The project has been steadily built out over the past decade, and today this set of utilities (APIs) forms a key part of the connective tissue that glues together much of our fintech infrastructure.

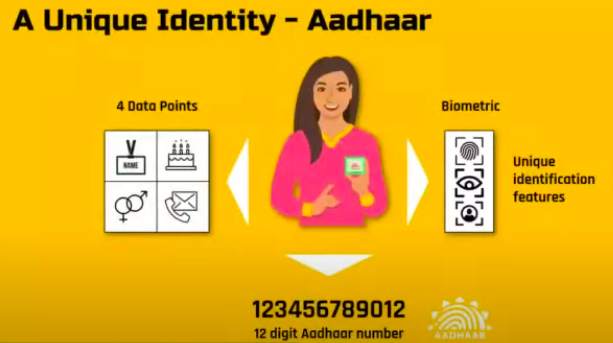

7/ It began with the launch of Aadhaar in 2010 which sought to give every Indian a unique digital identity - a springboard for digital authentication & financial access

Today close to 98% of the population has been covered by Aadhaar with 647m Aadhaar-enabled bank accounts

Today close to 98% of the population has been covered by Aadhaar with 647m Aadhaar-enabled bank accounts

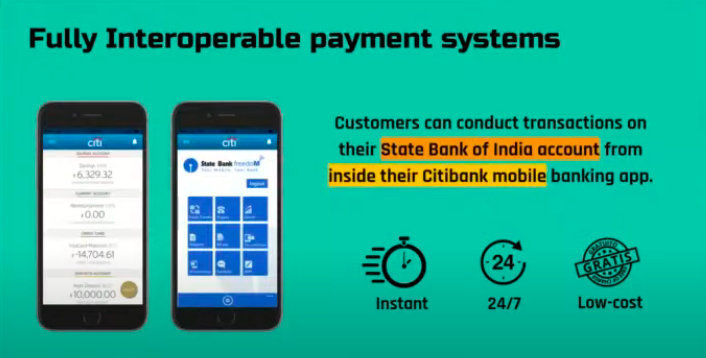

8/ The next big milestone was Unified Payments Interface (UPI) which is a fully interoperable payment system that lets you transfer money between different bank accounts through a mobile platform using a Virtual Payment Address.

There was now a common rail for payments in India.

There was now a common rail for payments in India.

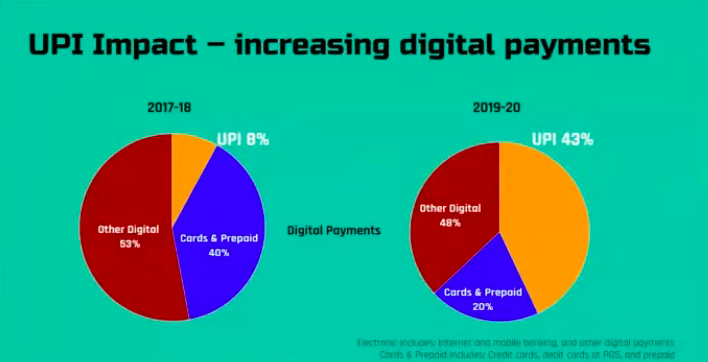

9/ The almost 'magical' ease of making a UPI transaction has resulted in UPI now overtaking every other mode of digital payment in India, with the number of monthly transactions now crossing one billion

10/ So to recap, the 'identity' layer enabled individuals to provide digital, biometric authentication, & access 'paperless' systems like e-KYC, e-Sign & DigiLocker (official document storage)

The 'payments' layer (UPI, AEPS, APB) is ushering a transition to a cashless economy

The 'payments' layer (UPI, AEPS, APB) is ushering a transition to a cashless economy

11/ How does this affect your life?

Well, you probably use these tools more often that you realise

Making a payment from PhonePe to PayTM

Using DigiLocker to verify your identity at the airport

Using e-KYC to remotely open a bank account

Yup, all enabled by India Stack

Well, you probably use these tools more often that you realise

Making a payment from PhonePe to PayTM

Using DigiLocker to verify your identity at the airport

Using e-KYC to remotely open a bank account

Yup, all enabled by India Stack

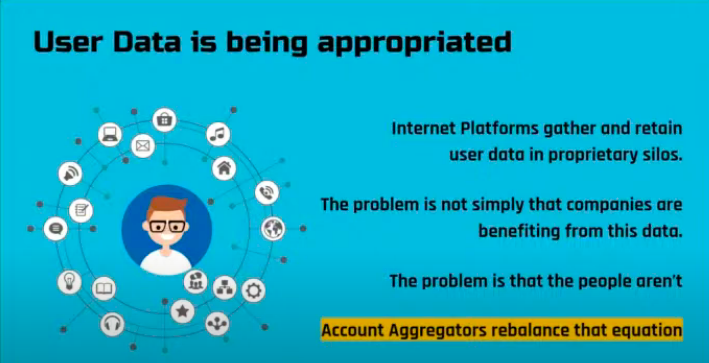

12/ As we increase the number of digital touchpoints in our lives, we generate data that has so far been owned and exploited by everyone other than us, without our consent.

Now, the 'data empowerment' layer aims to address this using the Account Aggregator framework.

Now, the 'data empowerment' layer aims to address this using the Account Aggregator framework.

13/ "The problem is not that companies are using this data but that people aren't able to use their own data for their own benefit."

Account Aggregators allow individuals to dictate the terms under which another entity can use their (financial) data.

Account Aggregators allow individuals to dictate the terms under which another entity can use their (financial) data.

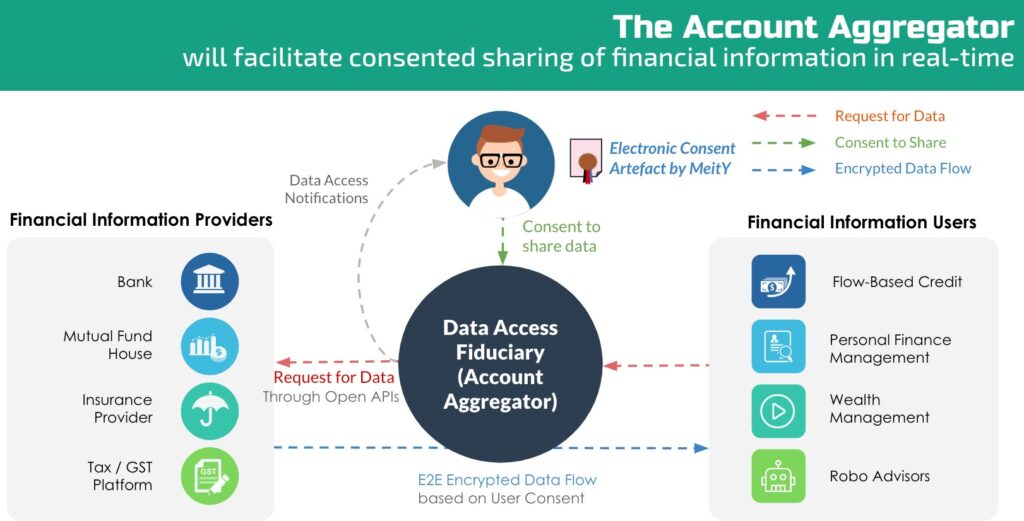

14/ An AA functions as a 'data-blind' intermediary i.e. a 'consent manager' tasked with facilitating the flow of consented information from the providers of user data (eg: banks, mutual funds) to the entities that want to use this data (eg: lenders, wealth management apps)

15/ Eg: with a few clicks on an AA mobile app, a business owner can give her bank the go-ahead to securely share her a/c balance with a prospective lender, who can then make a decision on whether to grant her a loan on the back of that information, practically in real time.

16/ The use of an AA makes the process of sharing data faster, cheaper and more secure, not to mention electronic and standardised.

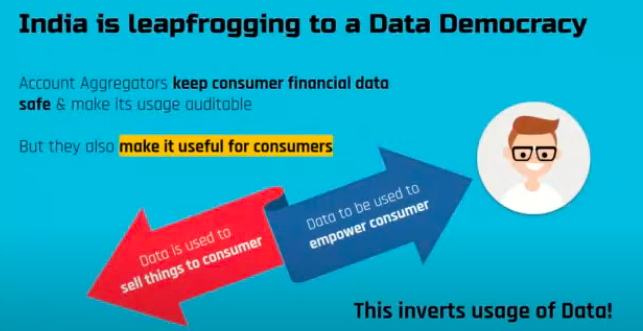

The hope is that this framework will usher in a 'data democracy' in India, with the control and ownership of data restored to individual users.

The hope is that this framework will usher in a 'data democracy' in India, with the control and ownership of data restored to individual users.

17/ All together, India Stack is levelling the playing field for digital India, providing these "digital public goods" that can power use cases across the financial services spectrum.

The AA framework is the next step to widening the net for financial inclusion in India.

The AA framework is the next step to widening the net for financial inclusion in India.

For more information -

Link to the session video:

To learn more about the AA ecosystem:

https://sahamati.org.in/

To learn more about India Stack:

https://www.indiastack.org/

https://ispirt.in/our-industry/indiastack/

Link to the session video:

To learn more about the AA ecosystem:

https://sahamati.org.in/

To learn more about India Stack:

https://www.indiastack.org/

https://ispirt.in/our-industry/indiastack/

Read on Twitter

Read on Twitter