#LAURUS LABS

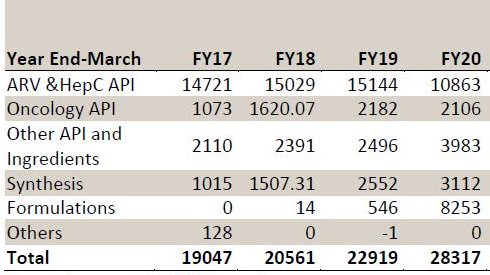

-A HYDERABAD based pharma co. having presence in 4 VERTICALS - API’S, GENERIC–FDF(fixed dosage formulations), Synthesis and Ingredients.

- founded by Dr. Satyanarayana Chava (CEO) around 2007

- R&D spend 5.7% of Rev.

-750+ scientists and 50+ PHDs

-A HYDERABAD based pharma co. having presence in 4 VERTICALS - API’S, GENERIC–FDF(fixed dosage formulations), Synthesis and Ingredients.

- founded by Dr. Satyanarayana Chava (CEO) around 2007

- R&D spend 5.7% of Rev.

-750+ scientists and 50+ PHDs

-Carries out its operations through 6 plants – all USFDA approved except UNIT-5 (CDMO) which is a dedicated Hormone and Steroid facility for ASPEN PHARMA.

- Total capacity 3615 KL, 751 reactors and 5 billion tablet capacity

-65% is export revenue and 35% is domestic revenue

- Total capacity 3615 KL, 751 reactors and 5 billion tablet capacity

-65% is export revenue and 35% is domestic revenue

- UNIT1 & 3 contibutes 80% of topline.

- Unit-2 is sole US formulations facility wid capacity of 5 bn tabs/capsules per yr also undergoing expansion which will be operational by Sept’20.

-Unit-6 is for captive API consumption

- Unit-2 is sole US formulations facility wid capacity of 5 bn tabs/capsules per yr also undergoing expansion which will be operational by Sept’20.

-Unit-6 is for captive API consumption

-Co. had aggressively expanded its capacities in d past & low utilization along with higher Raw material prices affected its profitability in FY18-19.

-With inc. orders n optimal utilization of its FDF facility, bckwrd integr. of their key API’S Co hs been able to get bk on track

-With inc. orders n optimal utilization of its FDF facility, bckwrd integr. of their key API’S Co hs been able to get bk on track

1.Generic –FDF (29%OF FY20 Rev. from 2% OF FY19)

-development and manufacture of oral solid formulations.

-expected to be a key growth driver going ahead.

We can further divide FDF business under two heads:

i.Tender Driven ii.Non Tender

-development and manufacture of oral solid formulations.

-expected to be a key growth driver going ahead.

We can further divide FDF business under two heads:

i.Tender Driven ii.Non Tender

i.Tender Driven- In 2019 Co. rcvd d tender frm Global Fund fr Supply of HIV drug TLD for 3.5yrs.

TLD- Is a combo of tenofovir (TDF 300mg), lamivudine (3TC 300mg) and dolutegravir (DTG 50 mg).

-TLD Rev potential~$150mn(1125cr) from TLD tenders during FY20-22

TLD- Is a combo of tenofovir (TDF 300mg), lamivudine (3TC 300mg) and dolutegravir (DTG 50 mg).

-TLD Rev potential~$150mn(1125cr) from TLD tenders during FY20-22

-After WHO changed its guidelines for 1st Line Regimen for HIV from TLE(Efavirenz) to TLD, Demand for TLD is expected to inc.

-Apart frm TLD it also produces TLE400/600 (Efavirenz) which was earlier 1st line regimen for HIV & now is most preferred after TLD.

-Apart frm TLD it also produces TLE400/600 (Efavirenz) which was earlier 1st line regimen for HIV & now is most preferred after TLD.

-It hs recently rcvd USFDA App.under PEPFAR for TLE 400 (Tenofovir/ Lamivudine/ Efavirenz - 300/300/400mg) & TLE 600 tabs.

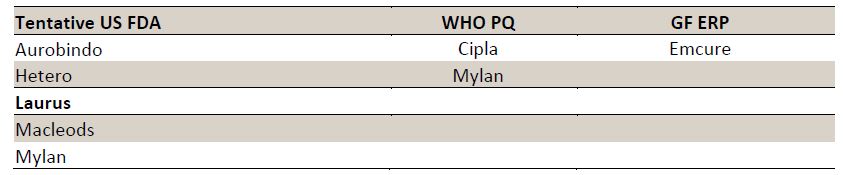

-Apart frm Laurus, only 2 players- Mylan 7 Macleods currently hv tentative USFDA app./WHO PQ fr d same.

-It mfgs all 4 imp. mol for ARV's.(DTG,3TC,EFV,TDF)

-Apart frm Laurus, only 2 players- Mylan 7 Macleods currently hv tentative USFDA app./WHO PQ fr d same.

-It mfgs all 4 imp. mol for ARV's.(DTG,3TC,EFV,TDF)

-TLE400/600-can contribute 135cr/210cr widout participation in global tenders.

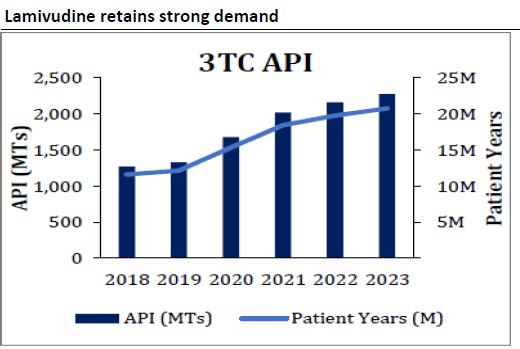

-There is price pressure in this seg. But patient base is inc therefore high vol. r expected.

-Laurus can compete in prices & maintain margins bcoz of its backward integration of key API’S

-There is price pressure in this seg. But patient base is inc therefore high vol. r expected.

-Laurus can compete in prices & maintain margins bcoz of its backward integration of key API’S

ii) NON TENDER–Contributes 20% of its total FDF buss.,which is split equally betwn d US & Europe.

-Metformin-Co. hs 4% mkt share in Metformin

-Pegabalin- high teen mkt share

-Launched Hydroxychloroquine in US (Mar 2020)

-Also looking to mfg REMDESIVIR & FAVIPIRAVIR.

-Metformin-Co. hs 4% mkt share in Metformin

-Pegabalin- high teen mkt share

-Launched Hydroxychloroquine in US (Mar 2020)

-Also looking to mfg REMDESIVIR & FAVIPIRAVIR.

Overall outlook fr FDF buss. luks gud & acc to mgt they r working at PEAK capacity utilization wid a healthy order book & target to double FDF capacity by FY2022 speaks a lot.

2.GENERIC API’S-57% of Rev.

-60+Commercialized API’S in d area of ARV, ONCOLOGY, Anti-Diabetic,hepC etc

2.GENERIC API’S-57% of Rev.

-60+Commercialized API’S in d area of ARV, ONCOLOGY, Anti-Diabetic,hepC etc

-API buss comprises d development, mfg & sale of APIs and adv intermediates.

-FY20 saw a 28% decline in revenues from API due to lower off-take of Efavirenz(EFV) and FTC APIs.

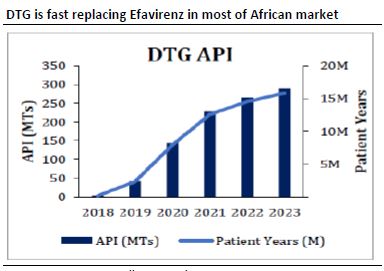

-Dolutegravir(DTG) in TLD is fast replacing Efavirenz in most of African market

-FY20 saw a 28% decline in revenues from API due to lower off-take of Efavirenz(EFV) and FTC APIs.

-Dolutegravir(DTG) in TLD is fast replacing Efavirenz in most of African market

-Growth will be driven by Lamivudine(3TC) and Dolutegravir(DTG)

-They also completed filing of 2nd line ARV API of Lopinavir and Ritonavir

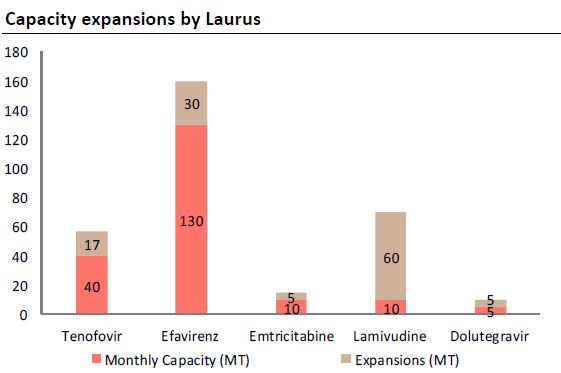

-Co. is undergoing expansion in all Main APIs

-They also completed filing of 2nd line ARV API of Lopinavir and Ritonavir

-Co. is undergoing expansion in all Main APIs

NON ARV API’S-Has significant mkt share in Gemcitabine.

-Carboplatin is another important oncology molecule.

-Onco APIs Rev. Rs 210cr in FY20.

-Total Non ARV Rev Rs.320cr in FY20 (+54%YOY).

Good growth is expected in API seg. as co. has healthy order book.

-Carboplatin is another important oncology molecule.

-Onco APIs Rev. Rs 210cr in FY20.

-Total Non ARV Rev Rs.320cr in FY20 (+54%YOY).

Good growth is expected in API seg. as co. has healthy order book.

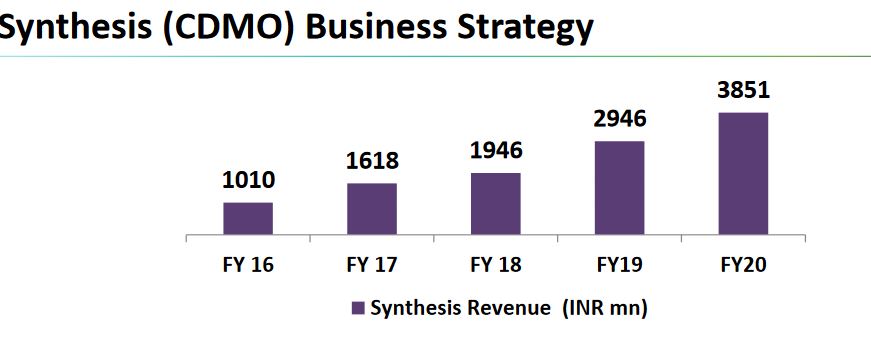

3.SYNTHESIS (CDMO) BUSINESS(14% of Rev.)

-includes contract development and mfg services for global pharmaceutical co’s.

-contributed Rs.385cr for FY20 vs Rs.294cr (+30%)

-This buss. Can be profitability driver going ahead as it generates better EBITDA margins

-Grown 4x in 5yrs

-includes contract development and mfg services for global pharmaceutical co’s.

-contributed Rs.385cr for FY20 vs Rs.294cr (+30%)

-This buss. Can be profitability driver going ahead as it generates better EBITDA margins

-Grown 4x in 5yrs

-Unit 5(125KL) is dedicated facility for ASPEN for mfg of hormonal and steroid inter.

-Out of 30-40 Active projects 1 is intermediate COMMERCIALIZED & 2 r in PHASE-3

-Added a dedicated block at UNIT-4 for C2PHARMA for contract mfg of HIGH value APIs.

-Out of 30-40 Active projects 1 is intermediate COMMERCIALIZED & 2 r in PHASE-3

-Added a dedicated block at UNIT-4 for C2PHARMA for contract mfg of HIGH value APIs.

-Recently they got validation for DIGOXIN API for C2Pharma.

CAPEX- after undergoing capex in last few yrs mgt is still going ahead with Rs.300cr capex for FY21 for expanding capacities in formulations & debottlenecking of existing formulation facilities .

CAPEX- after undergoing capex in last few yrs mgt is still going ahead with Rs.300cr capex for FY21 for expanding capacities in formulations & debottlenecking of existing formulation facilities .

-Long-term plan to expand API capacity from current 4mn liter to 5mn liter reactor capacity

-Doubling of FDF Capacity

NOTE:In last 7 yrs it has already inc its fixed assets by 3.5x from 499cr to 1726crs

-Doubling of FDF Capacity

NOTE:In last 7 yrs it has already inc its fixed assets by 3.5x from 499cr to 1726crs

Risks-1.Lumpiness of Synthesis Buss.

2.Efavirenz (ARV) offtake might take a hit due to change in WHO guidelines.

3.Pricing pressure in ARV tender Buss.

4.Raw mat sourcing from China at 50%, though it is coming down but still can effect in short term.

2.Efavirenz (ARV) offtake might take a hit due to change in WHO guidelines.

3.Pricing pressure in ARV tender Buss.

4.Raw mat sourcing from China at 50%, though it is coming down but still can effect in short term.

5. Promoter Pledge @31.56% has come down from 45.22% but Individual Promoter Level Pledge still at 45%.

Could not share any financial info otherwise thread wud hv bcome more longer.Tried to make it as short as poss.

In case of any mistake in d info do correct me.

#LAURUS

Could not share any financial info otherwise thread wud hv bcome more longer.Tried to make it as short as poss.

In case of any mistake in d info do correct me.

#LAURUS

Update:

Promoters released pledge on 25lac shares.

Pledged shares wrt total share cap now stands at 7.32% only.

#lauruslabs

Promoters released pledge on 25lac shares.

Pledged shares wrt total share cap now stands at 7.32% only.

#lauruslabs

@threadreaderapp unroll

Read on Twitter

Read on Twitter