Thread on $XPEL

10 year return: +16,755.2% - 66.9% CAGR

5 year return: +350.7% - 35.1% CAGR

A bit of history about XPEL:

XPEL was founded in 1997 as a software company

In 2007, they started selling paint protection film (PPF)

1/n

10 year return: +16,755.2% - 66.9% CAGR

5 year return: +350.7% - 35.1% CAGR

A bit of history about XPEL:

XPEL was founded in 1997 as a software company

In 2007, they started selling paint protection film (PPF)

1/n

In 2011, the company introduced ULTIMATE, the first PPF with self-healing properties

In 2016, XPEL introduced automotive window film with its Prime brand

In 2018, XPEL launched its first product outside of the automotive industry, a residential and ...

2/n

In 2016, XPEL introduced automotive window film with its Prime brand

In 2018, XPEL launched its first product outside of the automotive industry, a residential and ...

2/n

commercial film with its Vision brand

In 2019, they introduced Fusion, a ceramic coating product complementary to its PPF offering

3/n

In 2019, they introduced Fusion, a ceramic coating product complementary to its PPF offering

3/n

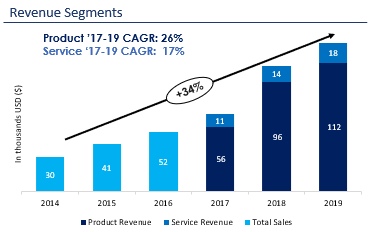

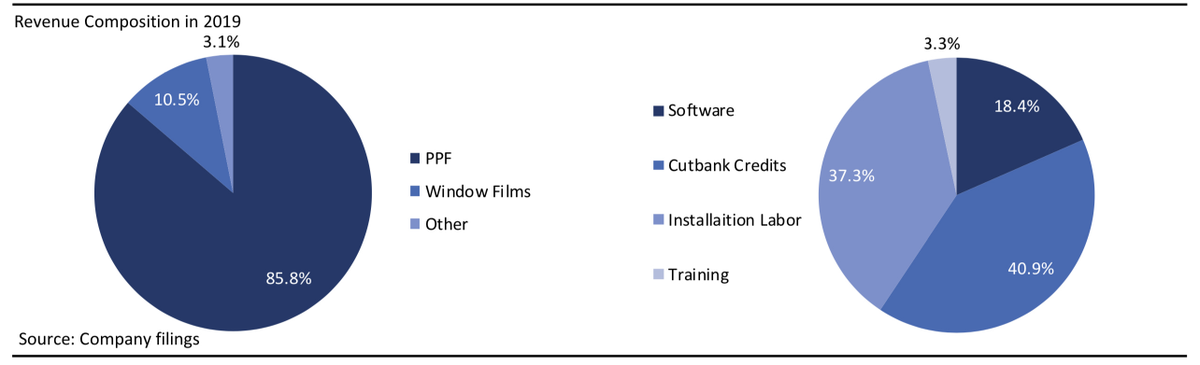

In 2019, about 80% of XPEL product revenue came from PPF, and about 60% of service revenue came from the DAP software and Cutbank credits

4/n

4/n

DAP software

A significant portion of XPEL success comes from the DAP software.

Installers choose XPEL because the DAP software helps them become more efficient, reduce film waste and get a discount on XPEL PPF.

This creates a moat for XPEL.

5/n

A significant portion of XPEL success comes from the DAP software.

Installers choose XPEL because the DAP software helps them become more efficient, reduce film waste and get a discount on XPEL PPF.

This creates a moat for XPEL.

5/n

DAP has a database of over 80 thousand patterns, and it's unmatched compared to the competition. DAP is useful to get a precise PPF installation, which is more difficult than a vinyl wrap installation because PPF loses its properties if stretched

6/n

6/n

During an interview, an independent installer in Montreal told me that he prefers using the software because it lets him pre-cut the film a bit bigger than the actual size so that he can wrap the edges of the car for a full-protection and a truly invisible installation

7/n

7/n

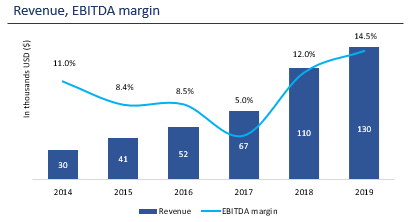

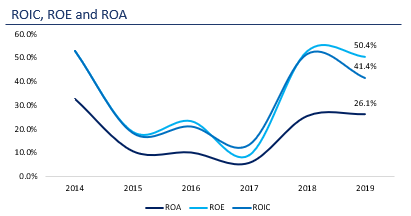

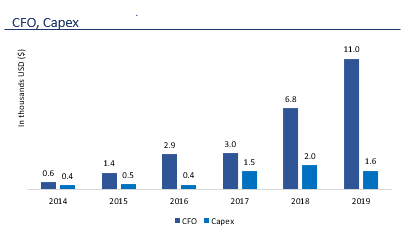

Because of its capital-light structure, XPEL has high returns.

Low capital investment requirements and a clean balance sheet enables XPEL to make strategic acquisitions

8/n

Low capital investment requirements and a clean balance sheet enables XPEL to make strategic acquisitions

8/n

Opportunity:

1- The PPF has a lot of room to grow.

The penetration rate of PPF is in the single digits. In some areas, we can see a higher penetration rate because of road and weather conditions. A small number of car dealerships offer PPF solutions and the ones ...

10/n

1- The PPF has a lot of room to grow.

The penetration rate of PPF is in the single digits. In some areas, we can see a higher penetration rate because of road and weather conditions. A small number of car dealerships offer PPF solutions and the ones ...

10/n

that do offer usually outsource to independent installers. I contacted almost all luxury/higher-end car dealerships in the Montreal area and none of them install the product themselves.

11/n

11/n

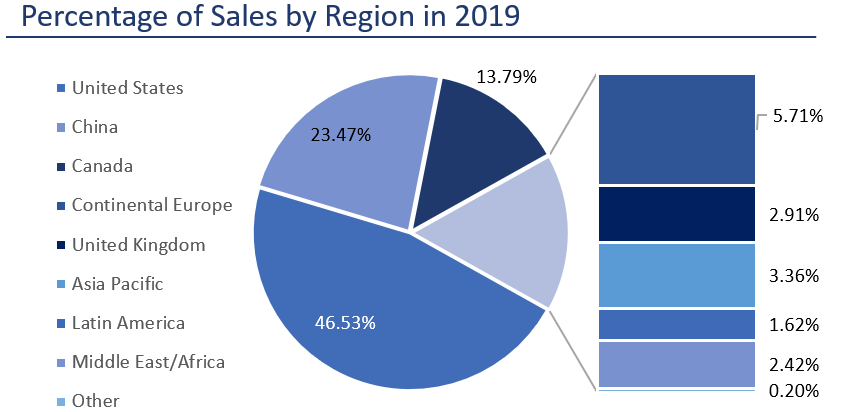

2- International Expansion

The company has been expanding internationally in the past few years. It has a lot of opportunities because PPF adoption is very low outside the US and Canada.

12/n

The company has been expanding internationally in the past few years. It has a lot of opportunities because PPF adoption is very low outside the US and Canada.

12/n

3- Cross-selling and up-selling

With product offerings in the automotive industry and the architectural glass film segment, the company has the ability to cross-sell and up-sell its product offerings.

13/n

With product offerings in the automotive industry and the architectural glass film segment, the company has the ability to cross-sell and up-sell its product offerings.

13/n

Team Penske

XPEL recently announced a multi-year partnership with Team Penske. This partnership will help XPEL increase brand awareness, brand recognition and market penetration.

14/n

XPEL recently announced a multi-year partnership with Team Penske. This partnership will help XPEL increase brand awareness, brand recognition and market penetration.

14/n

Risk:

1- Automotive industry is cyclical in nature. Mitigation: Majority of the company’s revenue is derived from high-end vehicles, car enthusiasts or the purchase of vehicles for commercial purposes which are less cyclical than lower-end cars

15/n

1- Automotive industry is cyclical in nature. Mitigation: Majority of the company’s revenue is derived from high-end vehicles, car enthusiasts or the purchase of vehicles for commercial purposes which are less cyclical than lower-end cars

15/n

2- Sole distributor in China. Mitigation: XPEL brand recognition and product demand is strong, and it should not be difficult for the company to find a new distributor partner or to establish itself in China

16/n

16/n

3- Supplier Concentration - Approximately 80% of XPEL’s 2019 inventory was from a single supplier. Mitigation: XPEL has qualified alternative suppliers to prevent any disruption to its current supply chain and its anticipated growth

17/n

17/n

XPEL CEO and BOD own about 40% of the company

Here is an excellent interview with Ryan Pape, XPEL's CEO, if you want to learn more about the story of the company and the CEO.

Article: https://www.bizjournals.com/sanantonio/news/2020/03/11/executive-profile-ryan-pape-put-skin-in-the-game.html

Podcast: https://pca.st/episode/35171b7c-ba6b-4735-9d6d-542ee223de18

18/18

Here is an excellent interview with Ryan Pape, XPEL's CEO, if you want to learn more about the story of the company and the CEO.

Article: https://www.bizjournals.com/sanantonio/news/2020/03/11/executive-profile-ryan-pape-put-skin-in-the-game.html

Podcast: https://pca.st/episode/35171b7c-ba6b-4735-9d6d-542ee223de18

18/18

Read on Twitter

Read on Twitter