Amazon is taking a bigger & bigger cut of the revenue earned by the small businesses that depend on its site. Amazon is pocketing 30% of their sales — up from 19% just 5 years ago.

We have a new report! Here are a few findings. 1/ https://ilsr.org/amazons_tollbooth/

We have a new report! Here are a few findings. 1/ https://ilsr.org/amazons_tollbooth/

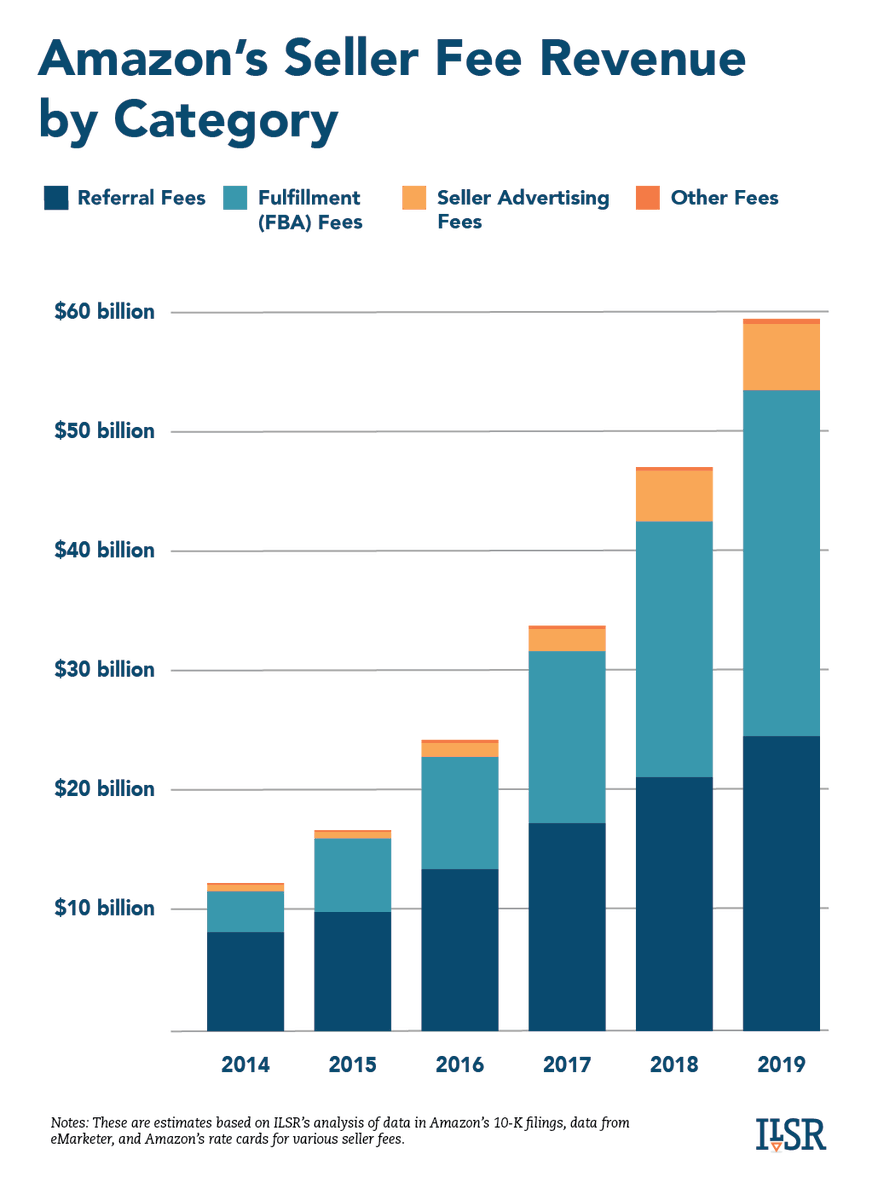

First there were the referral fees – 15% off the top.

And then Amazon said: if you want to qualify for Prime and keep generating sales, you should sign up for FBA, our warehousing & shipping services. That’s another set of fees, which keep rising. 2/

And then Amazon said: if you want to qualify for Prime and keep generating sales, you should sign up for FBA, our warehousing & shipping services. That’s another set of fees, which keep rising. 2/

Then Amazon decided to build a big advertising business. It turned over more of its search pages to sponsored ads.

It said to sellers: If you still want your products on the first page, that will be another set of fees. And, oh, those fees will rise too. 3/

It said to sellers: If you still want your products on the first page, that will be another set of fees. And, oh, those fees will rise too. 3/

Last year Amazon’s revenue from seller fees was nearly $60 billion — almost double what it earned from AWS, its massive, sprawling cloud computing division. 4/

AWS is widely said to be Amazon’s cash cow, True enough.

But its other cash cow are the many small businesses that have little choice but to depend on Amazon if they want to reach the online market.

Amazon rules their lives — and it effectively taxes their trade.

5/

But its other cash cow are the many small businesses that have little choice but to depend on Amazon if they want to reach the online market.

Amazon rules their lives — and it effectively taxes their trade.

5/

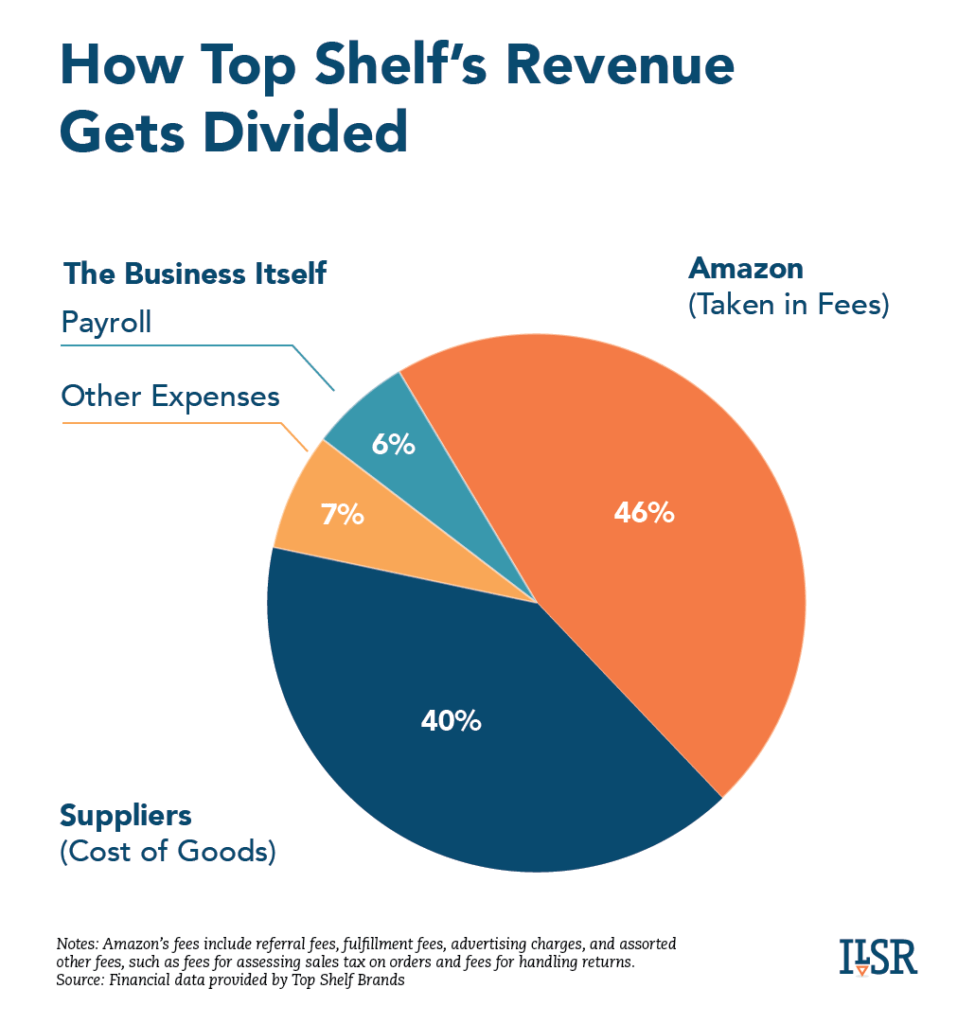

Doug Mrdeza built a 50-person business, named by Inc magazine as one of America's fastest growing companies.

But Amazon’s growing fees doomed this online retailer.

Take a look at this graph. 46% for Amazon. 13% for Doug and his employees. How does that add up?

But Amazon’s growing fees doomed this online retailer.

Take a look at this graph. 46% for Amazon. 13% for Doug and his employees. How does that add up?

We found that Amazon’s aim isn’t only to extract and appropriate the revenue of sellers.

It’s also leveraging its power over sellers to expand its dominance, including by moving into new industries. 6/

It’s also leveraging its power over sellers to expand its dominance, including by moving into new industries. 6/

By compelling sellers to use its fulfillment service, it’s built a big logistics business. Amazon is delivering 1/2 of the orders on its site & a growing share of those of other sites. It's overtaken USPS in the e-commerce parcel market & will surpass UPS & FedEx by 2022. 7/

You ask: Maybe sellers are signing up for Amazon fulfillment because it’s very competitive?

Not really. Its warehousing costs are 50-200% above average.

“On a dollars and cents side, it’s not that competitive,” a shipping expert told us. 8/

Not really. Its warehousing costs are 50-200% above average.

“On a dollars and cents side, it’s not that competitive,” a shipping expert told us. 8/

You ask: If Amazon gets all this revenue from sellers, why would it squeeze them to death?

The answer we found is grim: There’s an endless stream of people working bad jobs or with failing stores who are willing to try making it on Amazon. Most crash & burn within 3 years. 9/

The answer we found is grim: There’s an endless stream of people working bad jobs or with failing stores who are willing to try making it on Amazon. Most crash & burn within 3 years. 9/

Bottom line: Amazon’s monopoly strategy is multidimensional. By integrating across business lines — marketplace, retail, private label, logistics, etc. — Amazon gains multiple points of leverage, which it exploits with finesse. 10/

This is why the solution to Amazon’s power must be twofold: Separate its business lines into stand-alone companies. And impose public utility-like standards of fair dealing and non-discrimination on its platform. 11/11

Read more! https://ilsr.org/amazons_tollbooth/

Read more! https://ilsr.org/amazons_tollbooth/

Read on Twitter

Read on Twitter