Many food & bev brands are growing inefficiently.

Either they stay online only too long, or start retail first.

Here's the new strategy we used over the past 4 years at Kettle & Fire, one of the fastest growing CPG brands.

Either they stay online only too long, or start retail first.

Here's the new strategy we used over the past 4 years at Kettle & Fire, one of the fastest growing CPG brands.

1/ First, note that >90% of food sales still happen in grocery stores. Yet incumbents still own most of the shelf space.

Prior to eCom, new brands had to start in farmers markets & specialty stores. Now, online-first brands can get into nationwide grocery distribution quicker.

Prior to eCom, new brands had to start in farmers markets & specialty stores. Now, online-first brands can get into nationwide grocery distribution quicker.

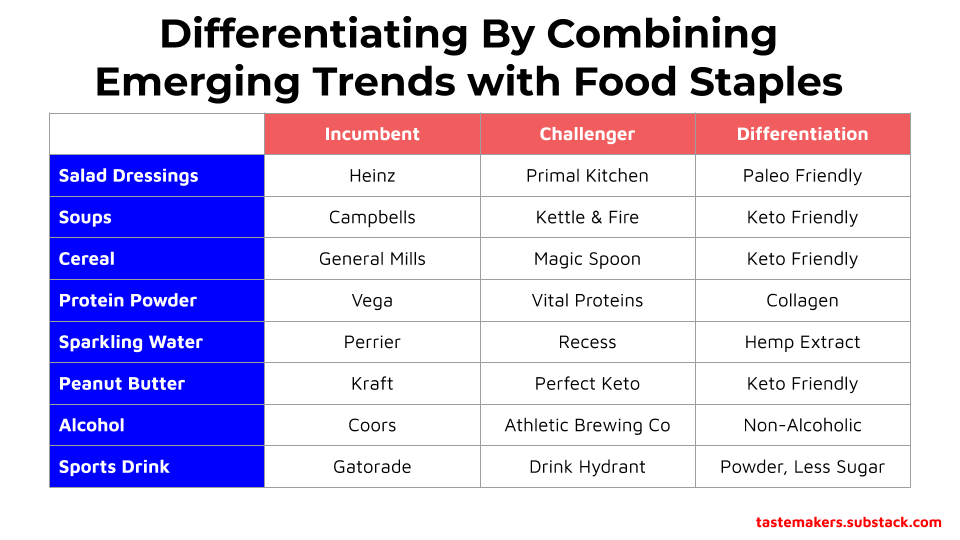

2a/ Diet trends come and go. But the food staples remain constant.

By combining new trends with food staples, it provides an opportunity to differentiate against the incumbents by going niche.

This also enables a 'premium positioning' as a 'better-for-you' alternative.

By combining new trends with food staples, it provides an opportunity to differentiate against the incumbents by going niche.

This also enables a 'premium positioning' as a 'better-for-you' alternative.

2b/ Once a product opportunity is identified, the thesis can be validated without even having a product to sell.

@jwmares goes over how Kettle & Fire did it: https://justinmares.substack.com/p/the-next-brand-episode-6

Also this tweetstorm by @mrsharma goes into this method: https://twitter.com/mrsharma/status/1219448741603827713

@jwmares goes over how Kettle & Fire did it: https://justinmares.substack.com/p/the-next-brand-episode-6

Also this tweetstorm by @mrsharma goes into this method: https://twitter.com/mrsharma/status/1219448741603827713

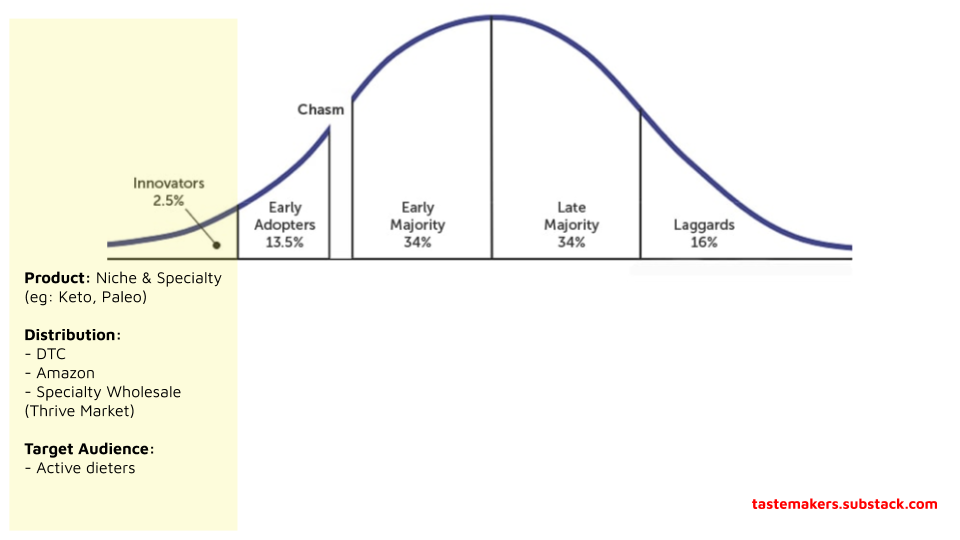

3/ Once the 1st product is ready, brands that start online will have 4 key benefits over retail-first brands:

- Ability to target niche consumers

- Attributable marketing spend

- Customer feedback

- Shorter cash conversion cycles (see @jayvasdigital https://twitter.com/jayvasdigital/status/1283735493595758595)

- Ability to target niche consumers

- Attributable marketing spend

- Customer feedback

- Shorter cash conversion cycles (see @jayvasdigital https://twitter.com/jayvasdigital/status/1283735493595758595)

4a/ As online-first brands saturates their online market, they should consider expanding into retail grocery stores. There are 5 main categories here:

a) Specialty (Erewhon Market)

b) Natural (Wholefoods)

c) Conventional (Krogers)

d) Mass (Walmart)

e) Club (Costco)

a) Specialty (Erewhon Market)

b) Natural (Wholefoods)

c) Conventional (Krogers)

d) Mass (Walmart)

e) Club (Costco)

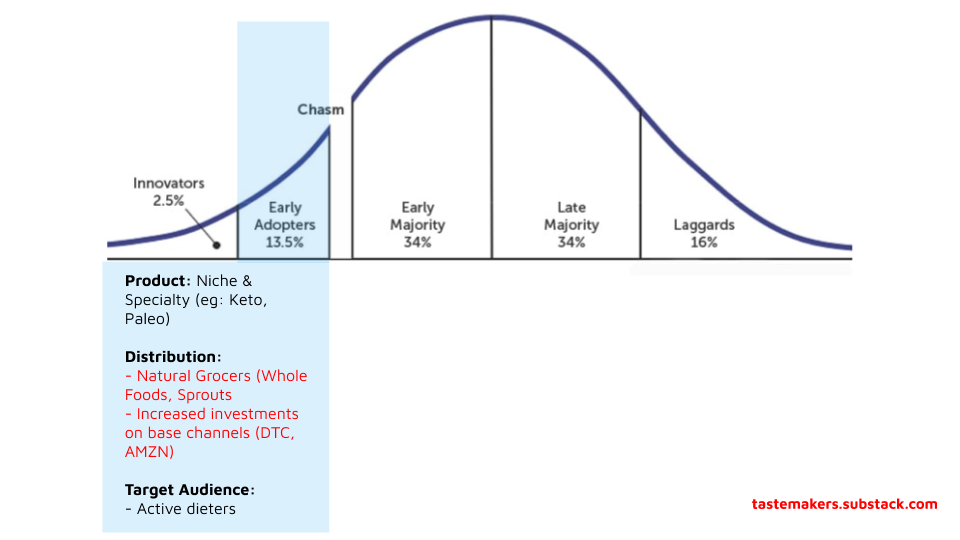

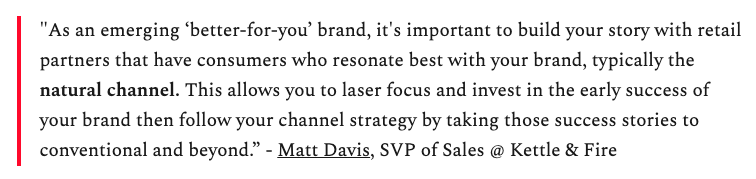

4b/ Of these, Natural Grocers is a good starting point as they're more experimental with new & trendy products.

Retail buyers only care about: 1) hitting sales velocity targets, 2) the wholesale margins.

This is where online-first brands can build a compelling sales story.

Retail buyers only care about: 1) hitting sales velocity targets, 2) the wholesale margins.

This is where online-first brands can build a compelling sales story.

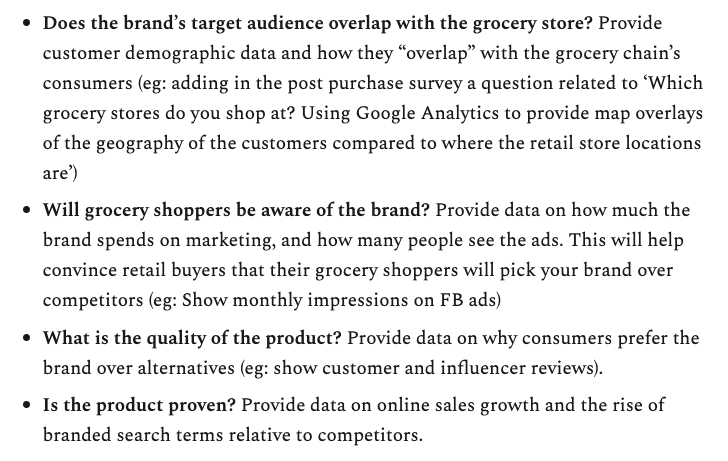

4c/ The screenshot below shows examples of how an online-first brand can use their data to craft a compelling sales story.

What normally took retail-first brands 3-5 years to build a compelling growth story, can now be achieved in 1-2 years from online-first brands.

What normally took retail-first brands 3-5 years to build a compelling growth story, can now be achieved in 1-2 years from online-first brands.

5a/ If sales are strong within the Natural grocers, brands can leverage that data to get into more mainstream conventional grocers.

But since the brand started with a niche product, there's a ceiling to how much the brand grows. And there's risk of the niche trend becoming a fad

But since the brand started with a niche product, there's a ceiling to how much the brand grows. And there's risk of the niche trend becoming a fad

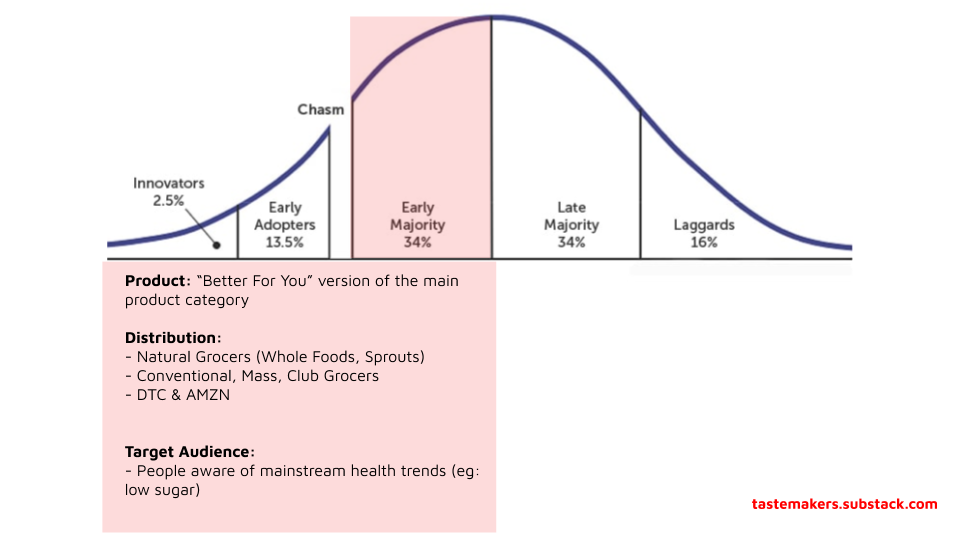

5b/ So unless the niche is growing at a rapid rate (eg: Vital Proteins <> Collagen), many brands at this stage will shift their growth strategy towards product expansion.

Fortunately, by now, the brand has relationships with retail buyers and also a premium positioning.

Fortunately, by now, the brand has relationships with retail buyers and also a premium positioning.

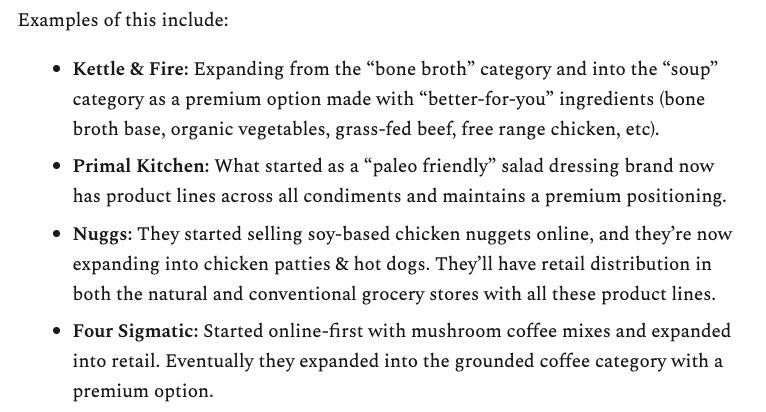

5c/ This makes it much easier for the brand to finally expand into mainstream and broader health trends (eg: low sugar, organic ingredients, etc).

By doing so, the brand can compete directly with incumbents as a PREMIUM alternative to the staple food category.

Examples:

By doing so, the brand can compete directly with incumbents as a PREMIUM alternative to the staple food category.

Examples:

SUMMARY: Brands can compete against incumbents by going niche and with an online go-to-market strategy.

From there, they can springboard into retail using the online data, and eventually expand into the mainstream category as a 'premium' alternative.

From there, they can springboard into retail using the online data, and eventually expand into the mainstream category as a 'premium' alternative.

For the full post, subscribe at my free newsletter: https://tastemakers.substack.com/p/food-and-bev-a-new-approach

I post sporadically and only when I have something valuable to share. Most of the content will be focused on insights related to growing a CPG business, and sourced directly from operators.

I post sporadically and only when I have something valuable to share. Most of the content will be focused on insights related to growing a CPG business, and sourced directly from operators.

Read on Twitter

Read on Twitter