There's more to this gold rally than inflation fear.

A thread. https://www.bloomberg.com/news/articles/2020-07-28/why-there-s-more-to-gold-s-rally-than-inflation-fears-quicktake

A thread. https://www.bloomberg.com/news/articles/2020-07-28/why-there-s-more-to-gold-s-rally-than-inflation-fears-quicktake

That's led some to say that this is all over-blown worry about hyperinflation on QE -- but there's more to it than that.

Yes, gold is an inflation hedge over very long periods. Research has shown that gold purchases the same amount of bread as it did in the age of Babylon. https://www.spdrgoldshares.com/media/GLD/file/research_study_22.pdf

But inflation's impact on day-to-day gold prices is mostly directed via real rates, not the absolute level of inflation.

Real rates have tracked gold prices very closely over time.

Real rates have tracked gold prices very closely over time.

Ok, so all we need to predict future gold prices is an estimation of real rates?

Not quite.

Not quite.

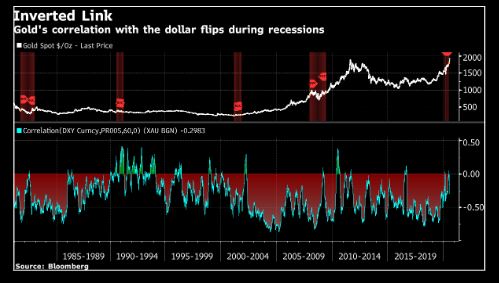

The impact of real rates on gold is mainly felt via the influence on the dollar -- and as any keen gold watcher know, gold is the anti-dollar.

...except when it's not.

In times of acute stress -- say, the early phases of the coronavirus crisis -- gold's relationship to the dollar flips and BOTH become havens.

In times of acute stress -- say, the early phases of the coronavirus crisis -- gold's relationship to the dollar flips and BOTH become havens.

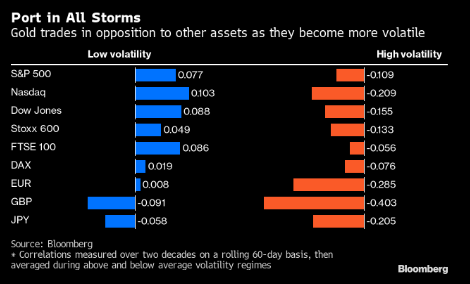

Here's my favourite chart of the last year. It shows that when stress in almost any asset increases, the inverse correlation to gold rises.

That makes gold an insurance against generalised risk.

That makes gold an insurance against generalised risk.

But, then there's one more thing to remember:

Gold can become a Veblen good, which means that as its price goes up, it can become even more desired. When gold rallies, it excites commentators and investors -- so more is written about it, which can lead to more money flowing in.

Gold can become a Veblen good, which means that as its price goes up, it can become even more desired. When gold rallies, it excites commentators and investors -- so more is written about it, which can lead to more money flowing in.

At those times, rallies become self-perpetuating.

It gets caught in a mania. Like bitcoin in 2017.

And I think we're currently in one of those times.

For more, read Charles MacKay's classic, Extraordinary Popular Delusions and the Madness of Crowds.

http://www.gutenberg.org/files/24518/24518-h/24518-h.htm

It gets caught in a mania. Like bitcoin in 2017.

And I think we're currently in one of those times.

For more, read Charles MacKay's classic, Extraordinary Popular Delusions and the Madness of Crowds.

http://www.gutenberg.org/files/24518/24518-h/24518-h.htm

Read on Twitter

Read on Twitter