Are you good at identifying trends?

Do you feel like you can accurately forecast which way the economy is going?

If the answer is yes.

A Sector Rotation strategy might be for you.

What is it?

Let me show you…

- A THREAD -

Do you feel like you can accurately forecast which way the economy is going?

If the answer is yes.

A Sector Rotation strategy might be for you.

What is it?

Let me show you…

- A THREAD -

Sector Rotation is a top-down approach.

This means that you study the broad macroeconomic factors first.

Before narrowing down to individual stocks.

If you’re good with trends…

This could make you a lot of money.

This means that you study the broad macroeconomic factors first.

Before narrowing down to individual stocks.

If you’re good with trends…

This could make you a lot of money.

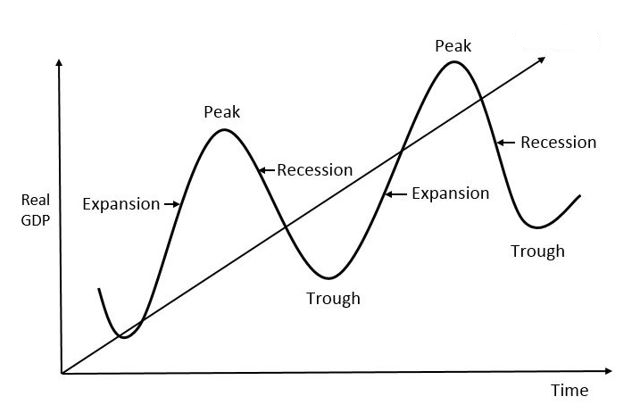

The economy goes through 4 main business cycles.

- Expansions

- Peaks

- Recessions

- Troughs

And it rotates through these cycles constantly.

- Expansions

- Peaks

- Recessions

- Troughs

And it rotates through these cycles constantly.

The Sector Rotation strategy is based upon the idea that certain sectors outperform others during each phase of the business cycle.

The main focus is the current phase of the business cycle.

As well as the direction it’s headed in.

The main focus is the current phase of the business cycle.

As well as the direction it’s headed in.

Have you ever noticed how some sectors do better after a recession?

Or how some are booming during a peak?

This strategy will help you capture those capital gains.

Or how some are booming during a peak?

This strategy will help you capture those capital gains.

For example….

During the last stages of a recession (early bull market)

- Bank stocks may start to rally

- Followed by consumer growth stocks

- Then consumer cyclical stocks (entertainment, housing, automotive and retail)

During the last stages of a recession (early bull market)

- Bank stocks may start to rally

- Followed by consumer growth stocks

- Then consumer cyclical stocks (entertainment, housing, automotive and retail)

During the expansion phase (mid to late bull market)

- Industrials

- Energy

- Materials

- Telecom

All start to rally and gain momentum.

- Industrials

- Energy

- Materials

- Telecom

All start to rally and gain momentum.

Finally once we get to the market top (peak) we see defensive stocks start to rally…

These are stocks with low betas, who are not as heavily impacted by economic cycles.

Sectors like:

- Healthcare

- Consumer staples

- Utilities

These are stocks with low betas, who are not as heavily impacted by economic cycles.

Sectors like:

- Healthcare

- Consumer staples

- Utilities

The Sector Rotation strategy places a higher importance on the industry, rather than individual stock selection.

It’s all about market timing.

But be careful!

There are some disadvantages to this strategy as well…

It’s all about market timing.

But be careful!

There are some disadvantages to this strategy as well…

- Turnover is high meaning trading costs may be inflated

- Good individual stocks may be overlooked

- It increases the volatility of your portfolio so make sure you understand your own risk tolerance

- Good individual stocks may be overlooked

- It increases the volatility of your portfolio so make sure you understand your own risk tolerance

With that being said, if you pride yourself on understanding the economic cycle….

And have a good idea of which direction it’s headed.

Then this just might be the strategy for you.

And have a good idea of which direction it’s headed.

Then this just might be the strategy for you.

To end it off…

Which phase of the economic cycle do you think we’re in now and why?

I’d love to hear your answers below

Which phase of the economic cycle do you think we’re in now and why?

I’d love to hear your answers below

Read on Twitter

Read on Twitter