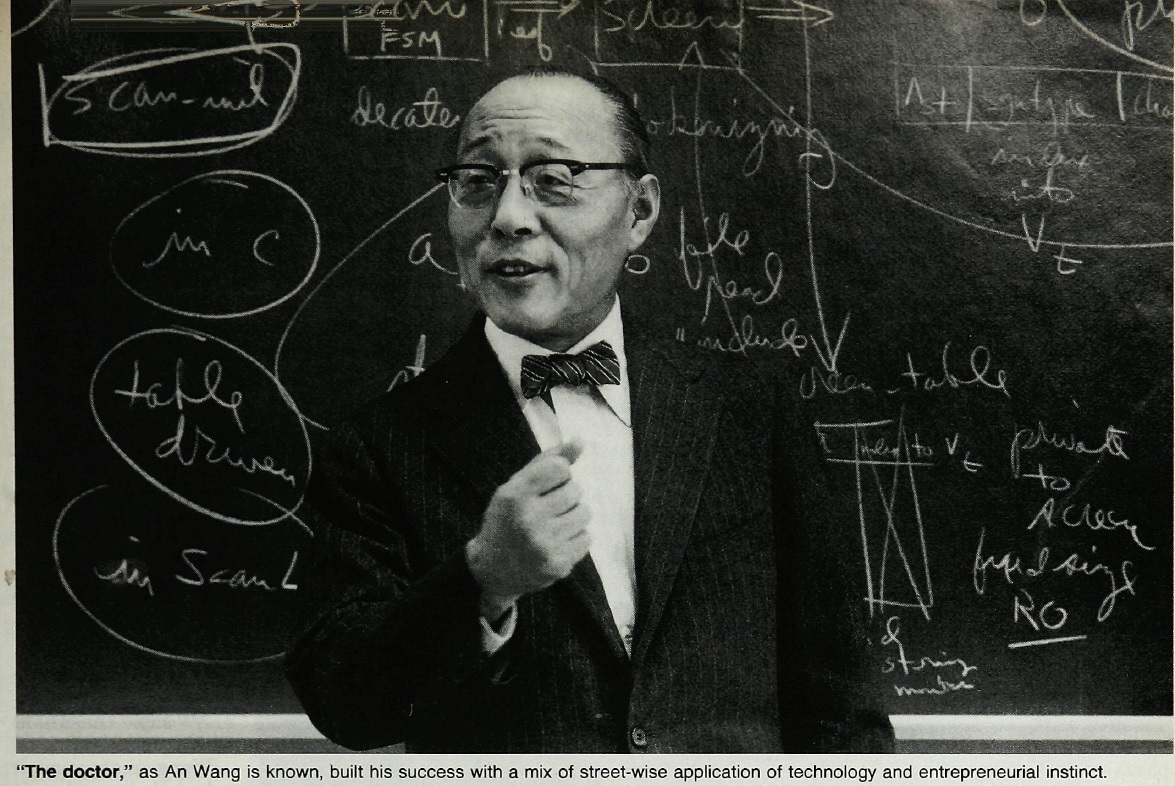

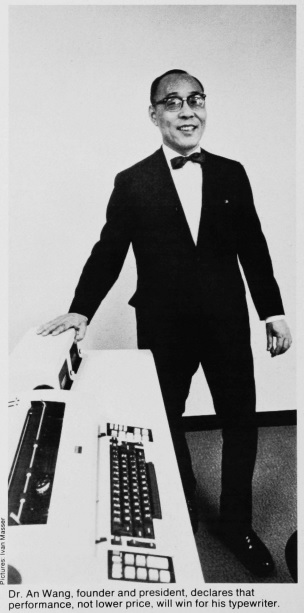

The Rise and Fall of "The Doctor" An Wang.

The forgotten story of an immigrant who came to the US with nothing and rose to the top of the tech world, going toe to toe with IBM. He spent his last years battling cancer, firing his son as CEO, and watching his life's work crumble.

The forgotten story of an immigrant who came to the US with nothing and rose to the top of the tech world, going toe to toe with IBM. He spent his last years battling cancer, firing his son as CEO, and watching his life's work crumble.

Born in Shanghai in 1920, he entered Chiao Tung University at age 16. One year later, Japan invaded and Wang lost both parents and a sister in the fighting.

After graduation he built radios for government troops in China's interior.

After graduation he built radios for government troops in China's interior.

In 1945 he jumped at the opportunity to travel to the US for technical studies. He enrolled at Harvard and earned his PhD in applied physics.

When the communists gained control of China, he decided not to return.

When the communists gained control of China, he decided not to return.

"I knew myself well enough to know that I could not survive under a totalitarian communist system. I had long been independent and I wanted to continue to make my own decisions about life."

He worked at the Harvard Computation Laboratory under computer pioneer Howard Aiken.

Aiken asked him to develop a way to record and access magnetically stored information without mechanical motion.

Aiken asked him to develop a way to record and access magnetically stored information without mechanical motion.

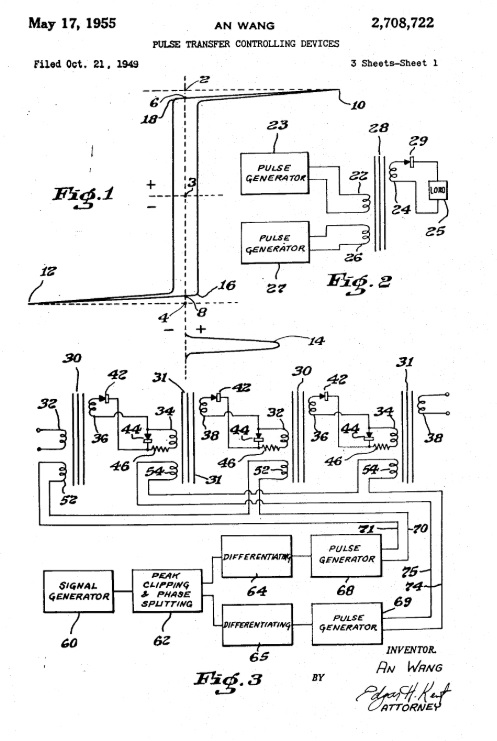

Wang found an elegant solution, the write-after-read cycle, and became part of inventing the magnetic memory core.

Due to Harvard's policy at the time, Wang could patent and own his invention, the pulse transfer controlling device.

https://patents.google.com/patent/US2708722

Due to Harvard's policy at the time, Wang could patent and own his invention, the pulse transfer controlling device.

https://patents.google.com/patent/US2708722

“Like everybody else, I had been preoccupied with preserving the magnetic flux, I lost sight of the objective. I realized it did not matter that I destroyed the information while reading it. With the information from reading the memory, I could simply rewrite the data afterward.”

"No matter how complicated a problem is, it usually can be reduced to a simple, comprehensible form which is often the best solution."

In 1951 he left Harvard to set up his own business. With $600 in savings he rented a room above a Boston garage. Cash settlement of his Harvard pension gave him a year of runway.

He contacted anyone who might need memory cores and slowly built orders.

He contacted anyone who might need memory cores and slowly built orders.

He also did some consulting work for IBM and granted them an option to buy a license for his pending patent.

IBM incorporated the memory core in its new line-up of computers and when Wang's patent was issued in 1955, they opened negotiations.

IBM incorporated the memory core in its new line-up of computers and when Wang's patent was issued in 1955, they opened negotiations.

IBM rejected Wang's price of $2.5m. IBM tried attacking the validity of the patent. Then they pulled a trump card: another inventor called Frederick Viehe had filed a patent that IBM claimed would lead to an interference.

Wang accepted $400k cash and a contingent payment of $100k

Wang accepted $400k cash and a contingent payment of $100k

But he never received the $100,000 as an interference between the patents was declared. IBM bought Viehe's patent too - reportedly for a million. Wang could no longer appeal the interference decision and walked away with a lifelong grudge against IBM.

"Timing and bluff played an important role in our negotiations, and they were affected at the eleventh hour by an event totally unanticipated by me or my lawyers, and which to this day I remain convinced was instigated by IBM."

"Later events suggested that IBM knew more about Mr. Viehe's patent application than they were telling at the time."

He was also surprised by IBM's slow pace and became convinced that faster, more nimble firms could compete against the corporate giants.

He was also surprised by IBM's slow pace and became convinced that faster, more nimble firms could compete against the corporate giants.

To support further growth, he sold 25% of the company for $50,000 to Warner and Swasey, one of his customers. He almost immediately regretted the deal. He hated losing any control of his company.

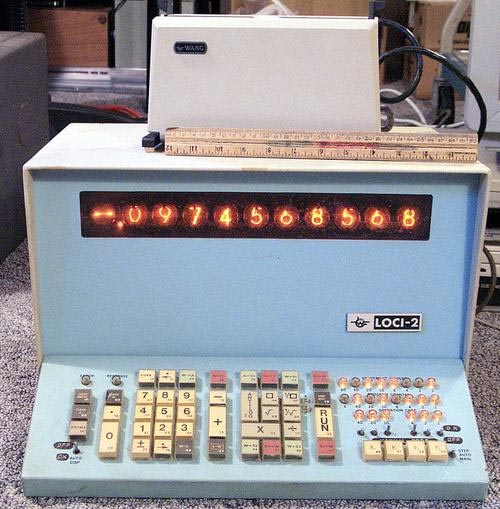

Wang's first breakout product was he LOCI (logarithmic calculating instrument), a scientific desktop calculator released in 1964

The machines could perform logarithms with a single keystroke and were sold widely to laboratories, R&D departments, even NASA for the Apollo mission

The machines could perform logarithms with a single keystroke and were sold widely to laboratories, R&D departments, even NASA for the Apollo mission

A later calculator, the Wang 300, became legendary on Wall Street when it was used to reveal an error in Salomon Brothers' bond trading tables which had been used for 30 years.

Wang Laboratories went public in the 1960's bull market and its stock jumped from $12 to $37 on the first day of trading.

As an interesting aside, Wang stock was recorded at cost on Warner and Swasey's balance sheet and turned into a hidden asset. In the 1970's, William Agee of Bendix would acquire Warner and Swasey and pay for the deal by selling the Wang stock the company owned.

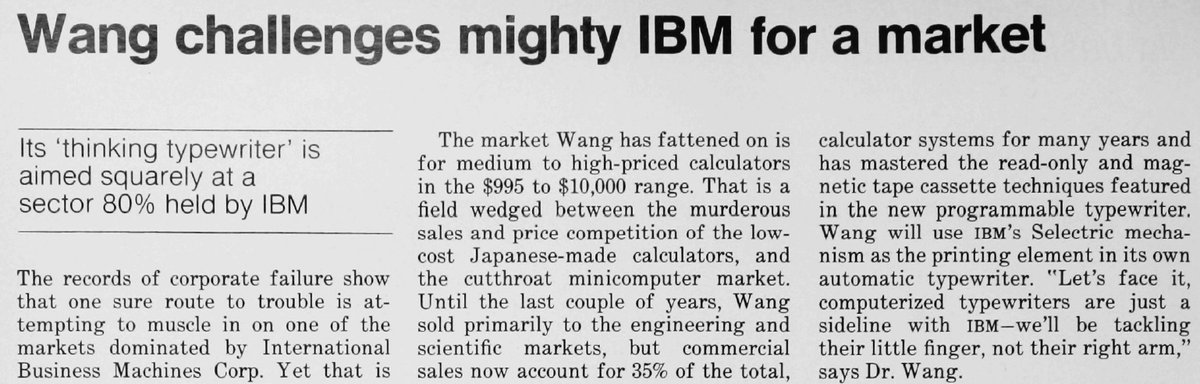

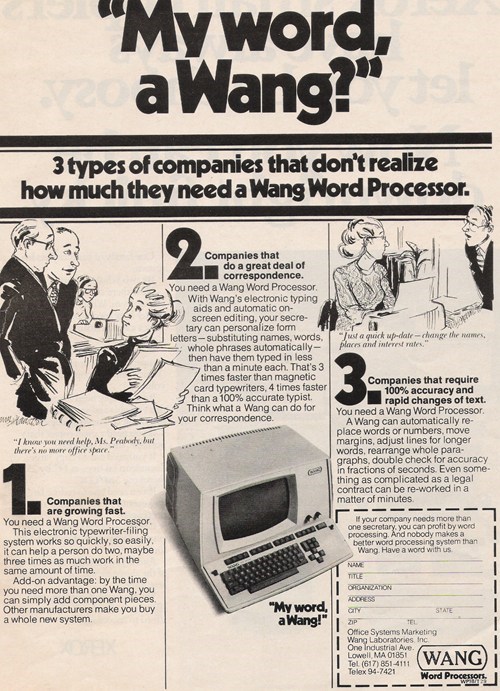

Calculators became highly competitive, prices dropped. Wang already had a new market in his sights: word processing.

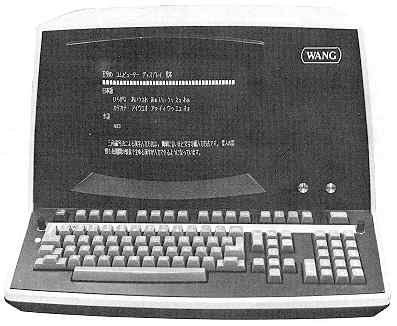

This system allowed a secretary to type up a letter on a terminal which stored the data on a tape cassette for printing and was more efficient than typewriter.

This system allowed a secretary to type up a letter on a terminal which stored the data on a tape cassette for printing and was more efficient than typewriter.

This time he was going up against IBM with an 80% market share. But Wang was confident that this time the he would prevail: "computerized typewriters are just a sideline with IBM - we'll be tackling their little finger, not their right arm."

"With their large base of rental equipment, IBM will be reluctant to make any major improvements in their equipment very quickly," says Wang. "My guess is that we'll be able to get four or five percentage points of market share before they react."

In 1976, he introduced a more advanced word processing terminal with a screen, a commercial novelty. The product became a blockbuster and Wang rose to be the largest supplier of screen-based word processors.

80% of the largest 2,000 US companies owned Wang equipment

80% of the largest 2,000 US companies owned Wang equipment

Wang Laboratories became the "Word Processing Company"

Wang also put his 26 year old son Frederick in charge of the new department. He was grooming Fred to be his successor, a decision that would come to haunt him.

Wang also put his 26 year old son Frederick in charge of the new department. He was grooming Fred to be his successor, a decision that would come to haunt him.

Six years before Apple's famous '1984' ad, Wang ran his own controversial Super Bowl ad: it was "David. vs. Goliath," Wang vs. IBM

"Nobody is hungrier than Wang!"

Brand recognition among managers jumped from 4% to 80%.

"Nobody is hungrier than Wang!"

Brand recognition among managers jumped from 4% to 80%.

In 1985, he ran another Super bowl ad aimed at IBM whose CEO was seen swatting away smaller competitors.

"Wang: we're gunning for IBM"

Even for the 80's that was a bit outrageous.

"Wang: we're gunning for IBM"

Even for the 80's that was a bit outrageous.

Wang entered the 80's by breaking construction on Wang Towers, a massive $60 million new headquarter outside Boston.

After a life of modesty and rejecting splendor, he started to accept the blessings of wealth, including a corporate jet and office with fireplace and jacuzzi.

After a life of modesty and rejecting splendor, he started to accept the blessings of wealth, including a corporate jet and office with fireplace and jacuzzi.

Wang's stock peaked at $43 in 1983 and he was estimated to be worth more than $2 billion. One of the richest Americans. On paper at least.

He was still obsessed with IBM and kept a chart with the growth of both firms. In the 1990's, he believed, his firm would overtake them.

He was still obsessed with IBM and kept a chart with the growth of both firms. In the 1990's, he believed, his firm would overtake them.

The 1980's however would not be kind to Wang. Now in his 60's, he wanted to step away from day to day management.

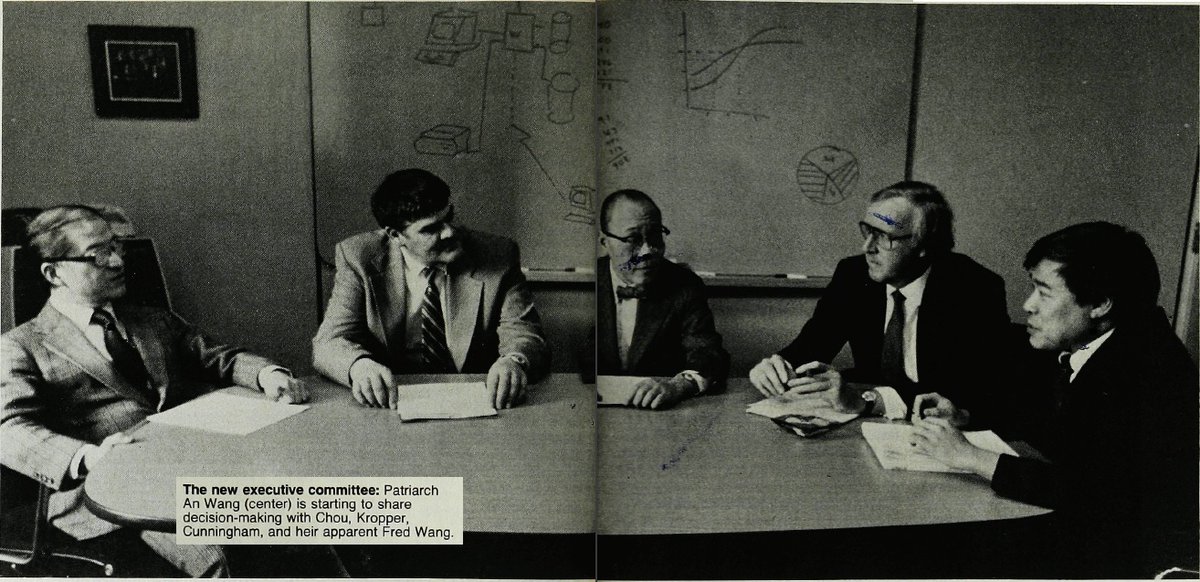

First, he tried to have an executive committee run the business. When that didn't work, he appointed company veteran John Cunningham as CEO.

First, he tried to have an executive committee run the business. When that didn't work, he appointed company veteran John Cunningham as CEO.

Meanwhile, his son Fred was heading the R&D effort. Wang had missed the market's transition to the PC. Suddenly, the company was under siege in office electronics.

Fred realized this and announced a line-up of 14 new products. But most of them were vaporware.

Fred realized this and announced a line-up of 14 new products. But most of them were vaporware.

"Progress is not a straight line, the future is not a mere projection of trends in the present. Rather, it is revolutionary. It overturns the conventional wisdom of the present, which often conceals or ignores the clues to the future."

Dr. An Wang.

Dr. An Wang.

Wang's core product lines in word processors and minicomputers were entering terminal decline. Meanwhile, Wang had long resisted building systems compatible with IBM. This became a problem because IBM was dominant in PCs.

This time, the Doctor had missed the revolution.

This time, the Doctor had missed the revolution.

In 1985, sales dropped from $2.8bn to $2.3bn and the company lost $54mm. Cunningham resigned. Wang picked his son Fred to succeed him.

"All other things being equal, my children should be more highly motivated than a professional manager because of their substantial ownership."

"All other things being equal, my children should be more highly motivated than a professional manager because of their substantial ownership."

But incentives aren't everything and Wang was alone with his confidence in his son.

"He is my son. He can do it," he told skeptical board members and employees.

"He is my son. He can do it," he told skeptical board members and employees.

In addition to the leadership transition and being out of step with the technological paradigm shift, Wang Laboratories had another weakness: its balance sheet.

Wang was careful to retain control and had dual share classes that gave him more voting power.

Wang was careful to retain control and had dual share classes that gave him more voting power.

But the businesses needed a lot of capital to grow and in order to avoid further dilution, Wang had issued hundreds of millions in debt. This became problematic when earnings started to swing wildly.

In 1989, Wang underwent cancer surgery. The company announced a $424 million loss. His son was in over his head.

Back from the hospital, Wang fired his son who accepted the decision stoically.

"It was a very difficult decision. I am sorry," Wang told him.

Back from the hospital, Wang fired his son who accepted the decision stoically.

"It was a very difficult decision. I am sorry," Wang told him.

Instead of watching his company crush IBM, Wang spent the last months of his life in a battle to save his business.

He would pass away from cancer in 1990. Wang Laboratories filed for bankruptcy in 1992.

He would pass away from cancer in 1990. Wang Laboratories filed for bankruptcy in 1992.

This is an example of what Jim Collins called "genius with a thousand helpers" in 'Good to Great'

"The geniuses seldom build great management teams, for the simple reason that they don't need one, and often don't want one. When the genius leaves, the helpers are often lost."

"The geniuses seldom build great management teams, for the simple reason that they don't need one, and often don't want one. When the genius leaves, the helpers are often lost."

Sadly, his desire for control and family leadership was ill-suited for a company that needed to be completely rejuvenated.

Despite his Icarus-like fall, it is worth remembering how much he achieved. Nobody thought he would reach the pinnacle of business in the first place.

Despite his Icarus-like fall, it is worth remembering how much he achieved. Nobody thought he would reach the pinnacle of business in the first place.

When he left Harvard, his friends worried his Chinese name would be an obstacle to success and advised him to stay in academia.

"I founded Wang Laboratories... to show that Chinese could excel at things other than running laundries and restaurants."

He sure did.

"I founded Wang Laboratories... to show that Chinese could excel at things other than running laundries and restaurants."

He sure did.

And a little anecdote about finding opportunity: the $60mm HQ building was auctioned off in bankruptcy.

The auctioneer wanted to start bids at $3mm but "the silence was deafening"

So instead he started at $100,000. The final bid was only $525,000. Sold.

The auctioneer wanted to start bids at $3mm but "the silence was deafening"

So instead he started at $100,000. The final bid was only $525,000. Sold.

The buyer was an accountant fronting for a group of real estate brokers. Working with the city and state, the partnership renovated the buildings - and sold them for $100 million in 1998 to real estate private equity.

Dr. An Wang:

"You have to risk failure to succeed. The important thing is not to make one single mistake that will jeopardize the future."

"Success is more a function of consistent common sense than it is of genius."

"You have to risk failure to succeed. The important thing is not to make one single mistake that will jeopardize the future."

"Success is more a function of consistent common sense than it is of genius."

"Markets change, tastes change, so the companies and the individuals who choose to compete in those markets must change."

Read on Twitter

Read on Twitter