The USD is not at risk of losing reserve status.

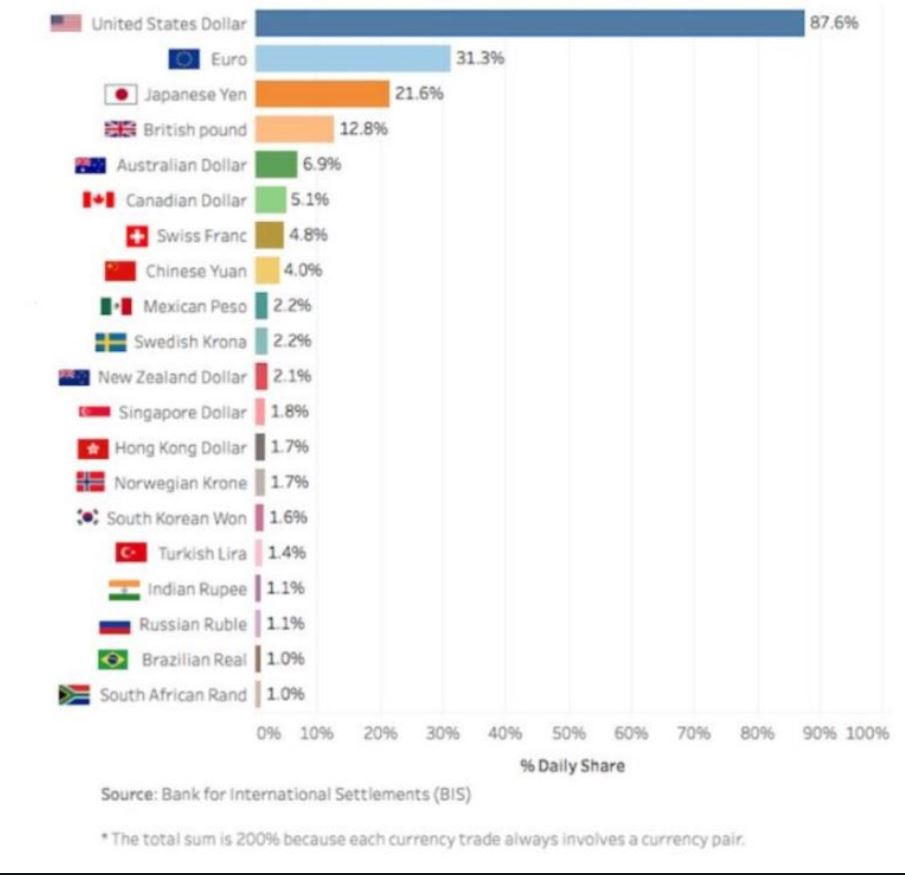

1) No contender. Use of other currencies is much weaker.

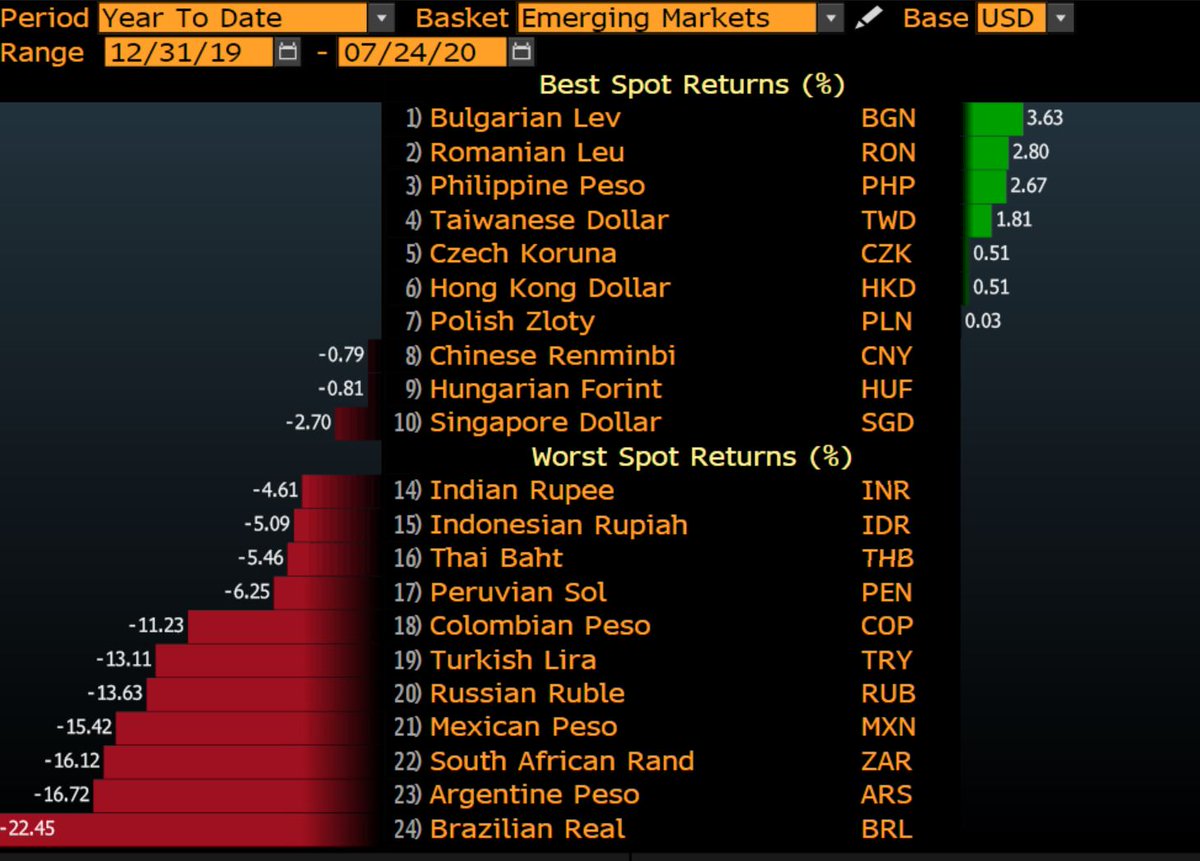

2) The US Dollar is UP vs most emerging currencies.

3) There is no Gold-backed currency out there

Gold is money. Fiat money is credit.

Thread:

1) No contender. Use of other currencies is much weaker.

2) The US Dollar is UP vs most emerging currencies.

3) There is no Gold-backed currency out there

Gold is money. Fiat money is credit.

Thread:

1) No contender: Global use of the USD is highest and rising since 2008. Euro has a redenomination risk. Feel free to substitute the USD.

2) The US Dollar is up vs most emerging market currencies.

Other central banks are destroying purchasing power much faster and worse than the Fed.

Other central banks are destroying purchasing power much faster and worse than the Fed.

3) No, China cannot kill the US dollar as a reserve currency and the Yuan, like all other fiat currencies, is not gold-backed

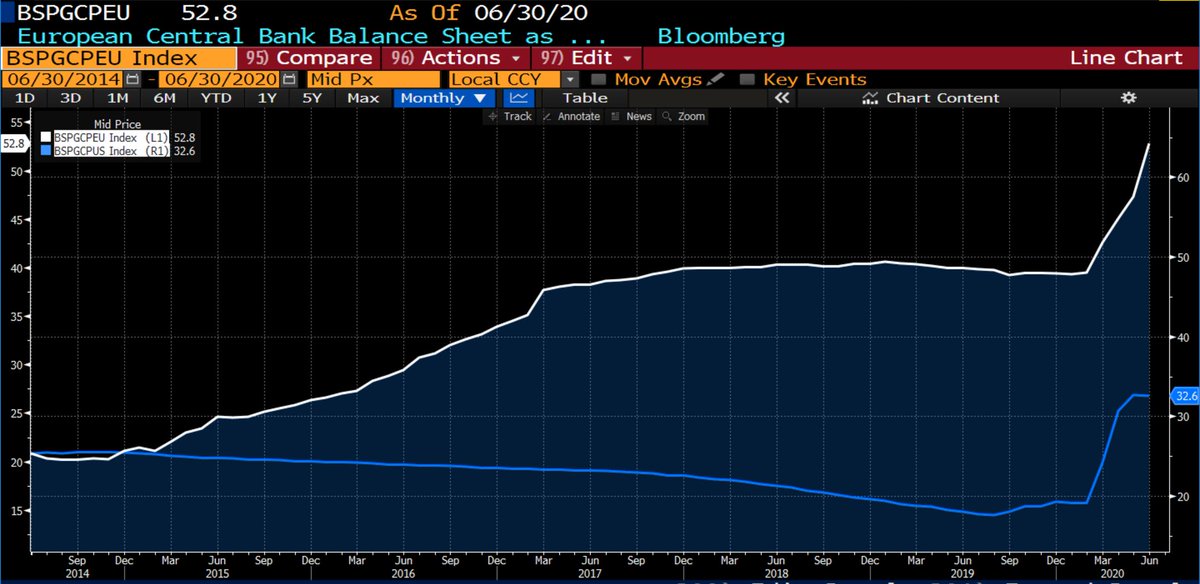

4) Yes, the Fed monetary policy is insane. ECB and BOJ is even crazier. You want Euro exposure with re-denomination risk and €2 trillion excess liquidity in the middle of a crisis, be my guest.

ECB Balance sheet and excess liquidity

ECB Balance sheet and excess liquidity

5) The DXY Index is weak? Relative to what?

Sure the dollar is weak these days on mirage expectations of a rapid eurozone and global recovery. Those hopes fade. And soon

Sure the dollar is weak these days on mirage expectations of a rapid eurozone and global recovery. Those hopes fade. And soon

6) The US Dollar will likely remain reserve currency relative to other fiat currencies because ALL OTHERS implement crazier monetary policies without the global demand of USD.

Hence, buy Gold. Not euros or even weaker currencies.

Hence, buy Gold. Not euros or even weaker currencies.

7) Monetary policy is not a game of who wins, but who loses first.

The USD will keep its reserve status because all other fiat currencies fall into the trap of aggressive printing policies without real global demand USD has. Once the mirage of recovery fades, bye-bye carry trade

The USD will keep its reserve status because all other fiat currencies fall into the trap of aggressive printing policies without real global demand USD has. Once the mirage of recovery fades, bye-bye carry trade

8) You think USD will lose reserve status because US will implement MMT? Guess what. Likelihood of MMT-style printing is higher in Eurozone-China where political and economic leadership are already inclined to pursue it.

And without the $ global demand

And without the $ global demand

9) All the above tell you one thing and one thing only. Forget investment banks' carry trade stimulus mirages.

Buy Gold and Silver, maybe some crypto. Monetary insanity will get crazier as recovery hopes vanish, particularly in Europe. End thread

Buy Gold and Silver, maybe some crypto. Monetary insanity will get crazier as recovery hopes vanish, particularly in Europe. End thread

Read on Twitter

Read on Twitter