1/ I call this thread "How to fake a profit in one easy step".

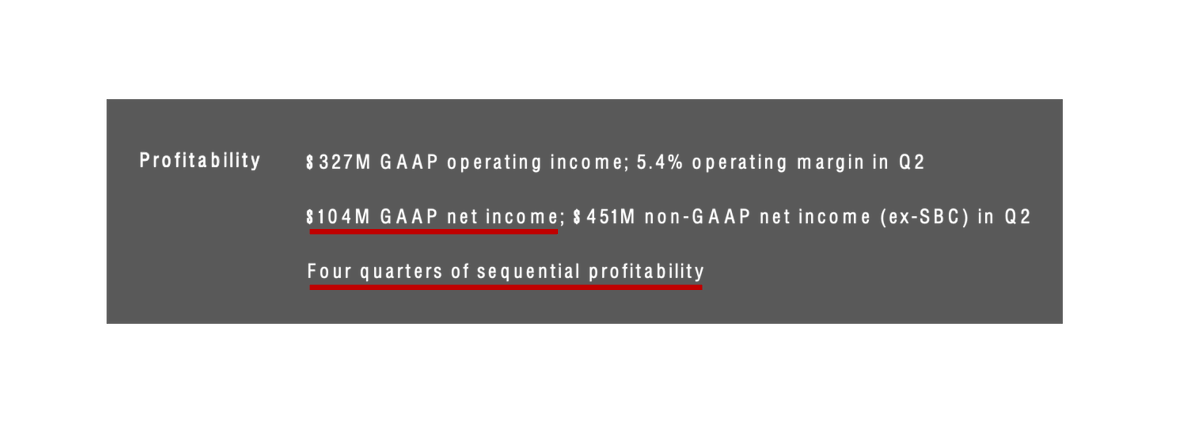

To much fanfare and acclaim, especially from the cheerleaders at @CNBC, Tesla claimed $104MM GAAP net income and four straight quarters of profitability, setting themselves up (presumably) for S&P inclusion. $TSLAQ

To much fanfare and acclaim, especially from the cheerleaders at @CNBC, Tesla claimed $104MM GAAP net income and four straight quarters of profitability, setting themselves up (presumably) for S&P inclusion. $TSLAQ

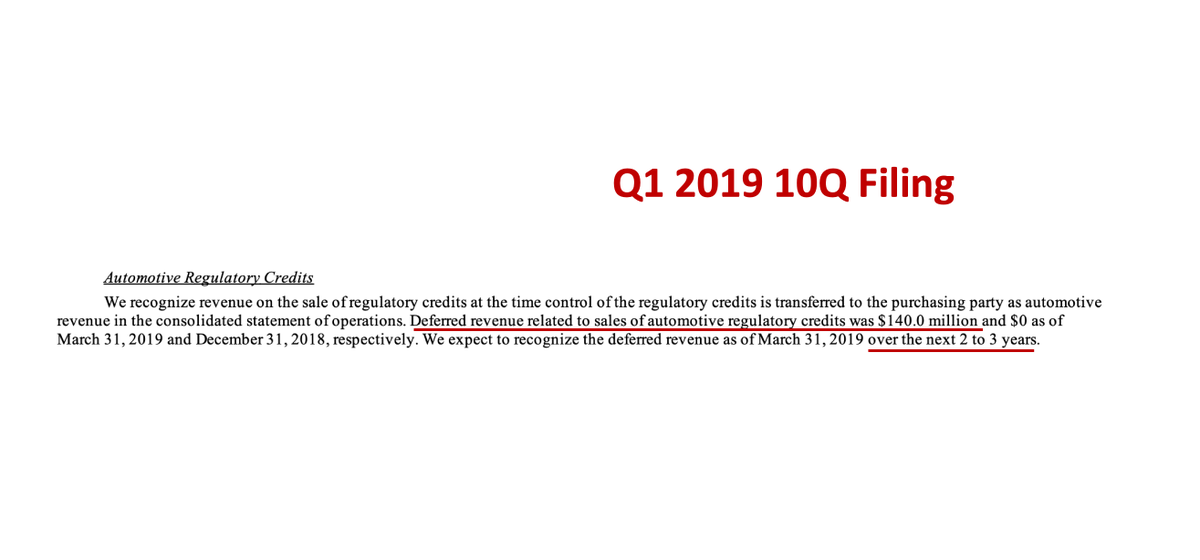

2/ In the first quarter of 2019 (i.e. six quarters ago), Tesla and Fiat Chrysler struck a deal on regulatory credits. In the 2019 10Q filing, there appeared this note. $140 million of deferred revenue to be recognized "over the next 2 to 3 years". $TSLAQ

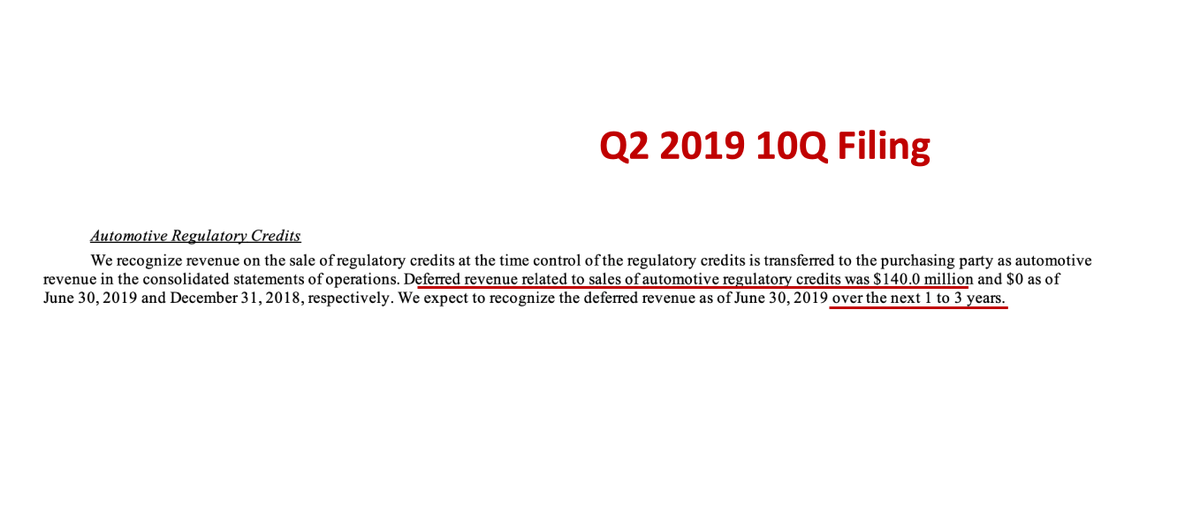

3/ In the second quarter of 2019, Tesla recognized none of this revenue, but the guidance language was changed to "over the next 1 to 3 years". $TSLAQ

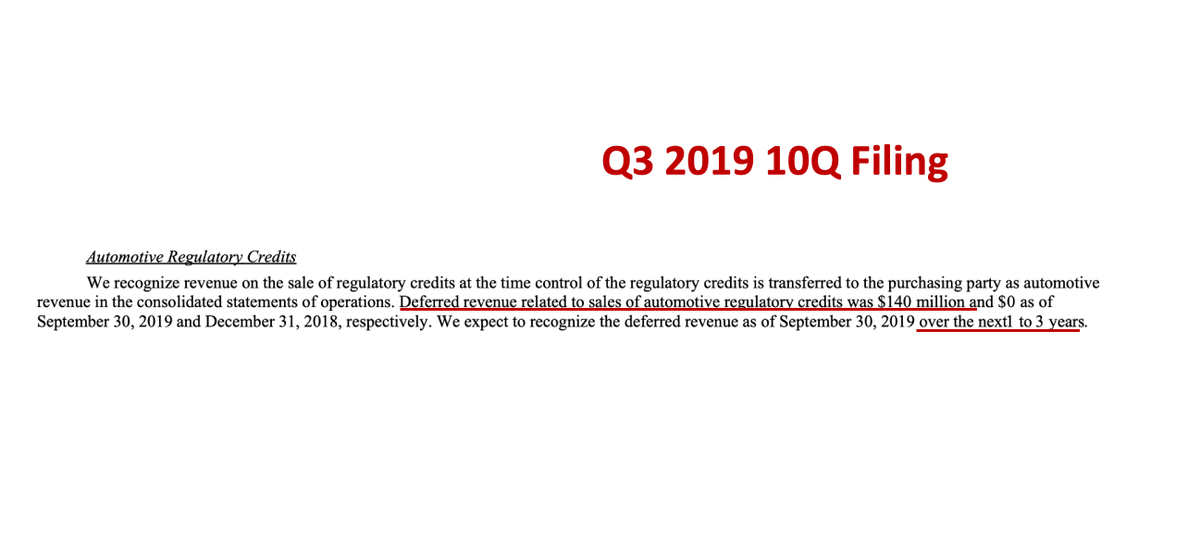

4/ In the third quarter of 2019, Tesla recognized none of this revenue, and the guidance language once again stated "over the next 1 to 3 years". $TSLAQ

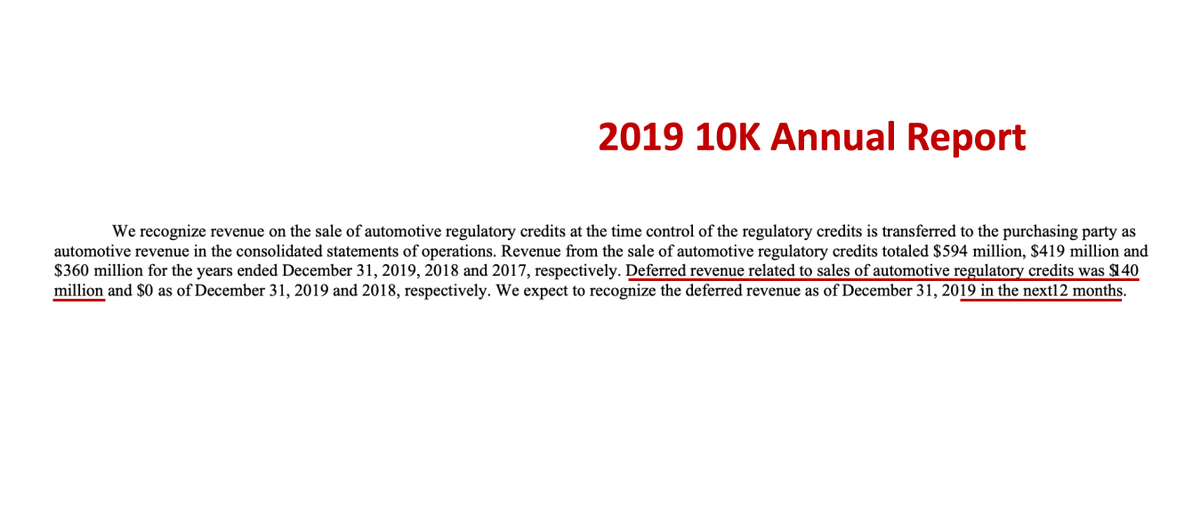

5/ In the annual report for 2019, we learned that Tesla recognized none of this revenue, and the guidance language was changed to "in the next 12 months". $TSLAQ

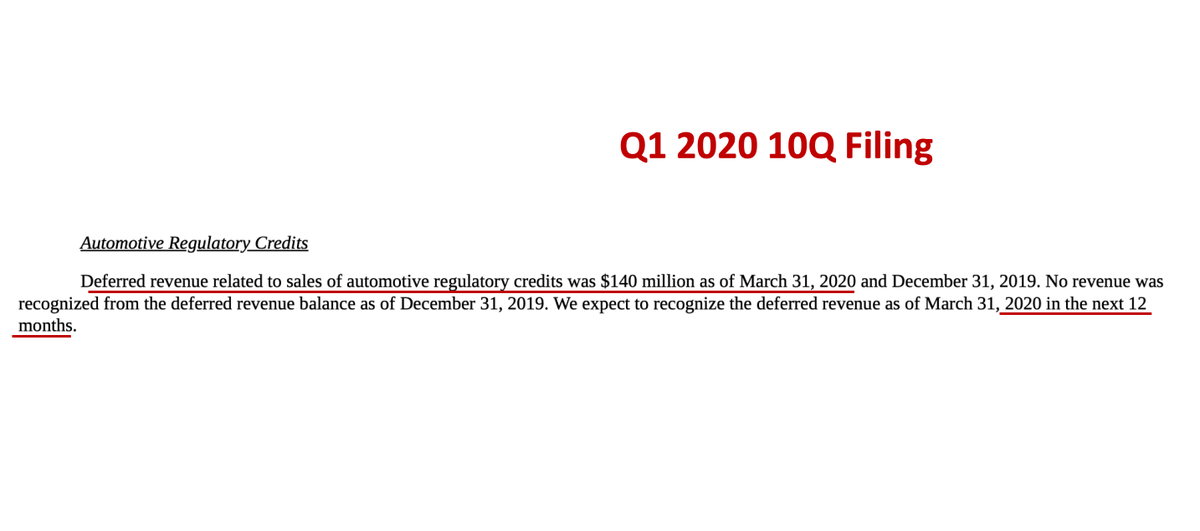

6/ In the first quarter of 2020, Tesla recognized none of this revenue, and the guidance language once again stated "in the next 12 months". $TSLAQ

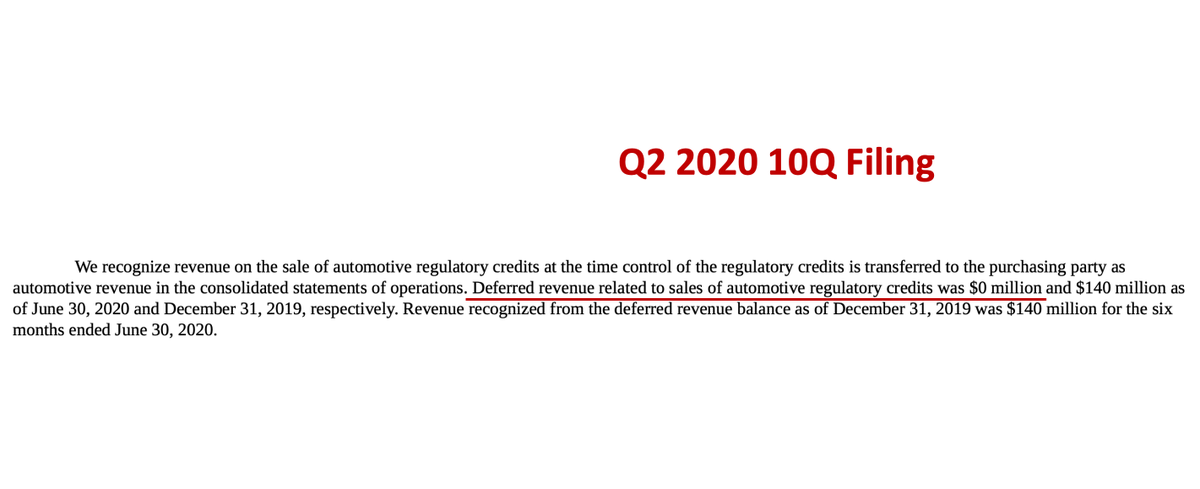

7/ In the most recent quarter, suddenly and all at once, Tesla recognized THE FULL $140 MILLION. This revenue is widely believed to be pure margin. In other words, this one decision accounts for ~132% of Tesla's claimed profits for the quarter. $TSLAQ

8/ And that, ladies and gentlemen, is how you fake a profit to trick the S&P 500 into including your stock in their index. $TSLAQ

Read on Twitter

Read on Twitter