My latest post with Sanjeev Gupta ( @CGDev) " #COVID19 and Seizing the Opportunity for Reforming #Tax Expenditures in Africa" is available

https://www.cepweb.org/covid-19-and-seizing-the-opportunity-for-reforming-tax-expenditures-in-africa/

A thread with the main takeaways follows

1/n

https://www.cepweb.org/covid-19-and-seizing-the-opportunity-for-reforming-tax-expenditures-in-africa/

A thread with the main takeaways follows

1/n

The resources needed for financing the #SDGs are estimated at USD 2.5 – 3 trillion per year. Low-income countries will need, on average, additional resources amounting to 15.4% of GDP to finance the SDGs by 2030

https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2019/01/18/Fiscal-Policy-and-Development-Human-Social-and-Physical-Investments-for-the-SDGs-46444

2/n

https://www.imf.org/en/Publications/Staff-Discussion-Notes/Issues/2019/01/18/Fiscal-Policy-and-Development-Human-Social-and-Physical-Investments-for-the-SDGs-46444

2/n

Yet, the #COVID19 pandemic made mobilization of resources for financing the #SGDs almost impossible. Eg, the collapse in economic activity will make consumption taxes plummet even more than during the global financial crisis. #Tax compliance will significantly suffer as well

3/n

3/n

External flows'll also shrink. Global #FDI will fall by 30% in 2020...even more in developing countries. Remittances'll drop by 20%, sharpest in recent history. During first 2 months of #COVID19, >USD 100 billion flew out of emerging markets, >3 times than during 2008 crisis

4/n

4/n

#COVID19 has made it imperative for developing countries to reform their #tax systems. Reforming tax expenditures will generate additional revenues, improve the perception about fairness of tax systems and enhance budget transparency

5/n

5/n

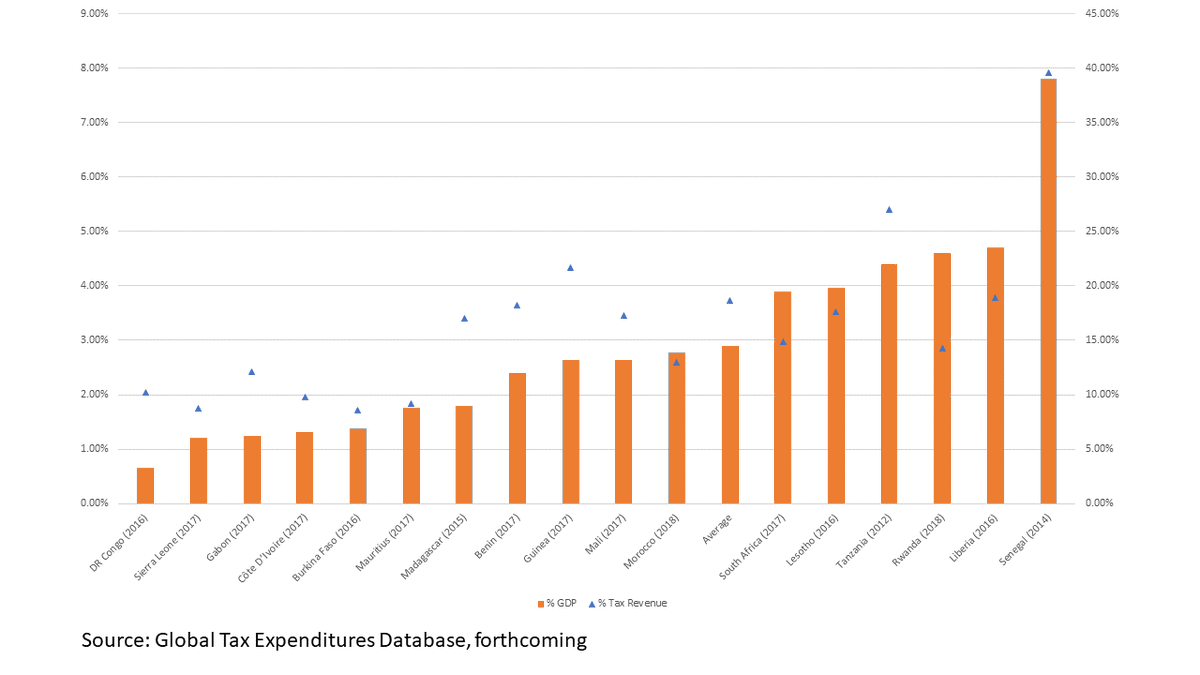

Average share of #tax expenditure accounts for 2.9% of GDP in Africa, 1% less than in LATAM. Yet, the lack of transparency is striking, and underreporting is very likely to be an issue…64% of African countries didn't publish a tax expenditure report during the 2000-19 period

6/n

6/n

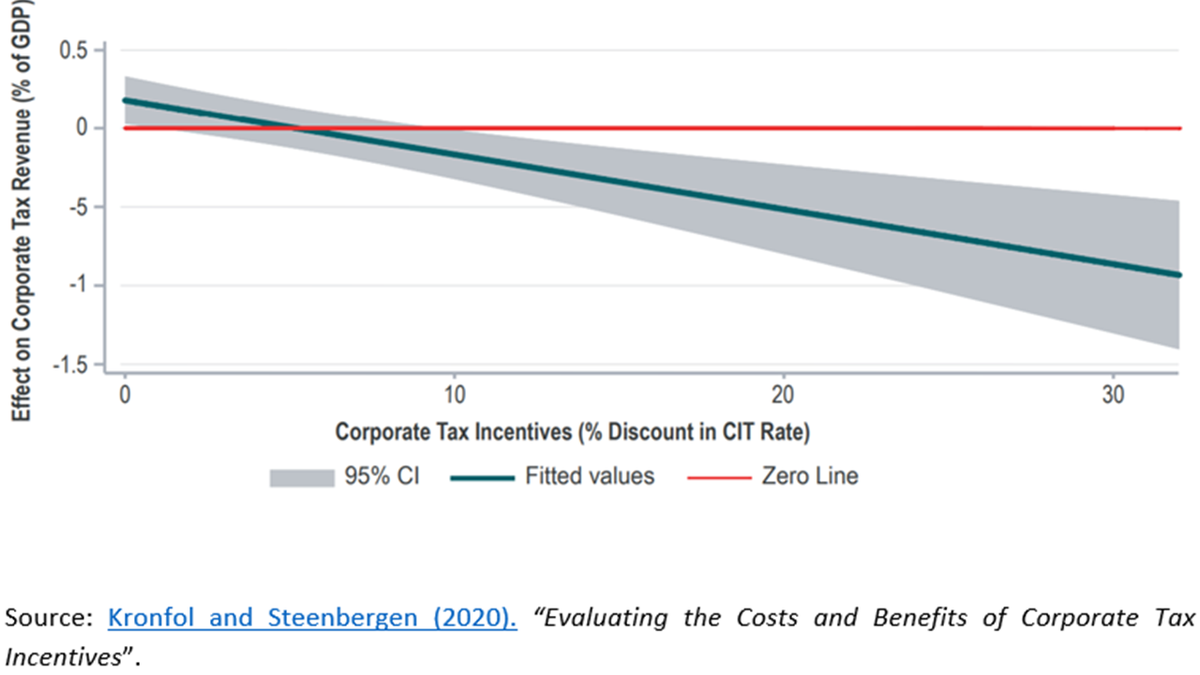

Besides their fiscal cost, #tax expenditures are often ineffective and can result in net revenue losses. Eg, tax incentives for #investment, have proven highly ineffective and there is a strong, negative relationship between their generosity and CIT revenues

7/n

7/n

Developing countries are urged to start assessing #tax expenditures during the next annual budget discussions to lower their annual cost by at least 1% of GDP. This would be a milestone since, in the past decade, tax-to-GDP increased only by <1% of GDP, on average

8/n

8/n

#COVID19 provides an opportunity to rationalize the use of #tax expenditures. Widespread support can increase since additional resources are needed for health services and to mitigate the impact of the pandemic...even more since these provisions often benefit the better-off

9/9

9/9

Read on Twitter

Read on Twitter