New paper with @JCMecon and @Courtemanche_CJ published in Journal of Risk & Uncertainty.

We find that #ecig taxes adult ecig use and

adult ecig use and  adult cigarette use. Cigarette taxes have symmetrical effects. Large unintended effects!

adult cigarette use. Cigarette taxes have symmetrical effects. Large unintended effects!

Paper: https://link.springer.com/article/10.1007/s11166-020-09330-9

#EconTwitter 1/12

We find that #ecig taxes

adult ecig use and

adult ecig use and  adult cigarette use. Cigarette taxes have symmetrical effects. Large unintended effects!

adult cigarette use. Cigarette taxes have symmetrical effects. Large unintended effects!Paper: https://link.springer.com/article/10.1007/s11166-020-09330-9

#EconTwitter 1/12

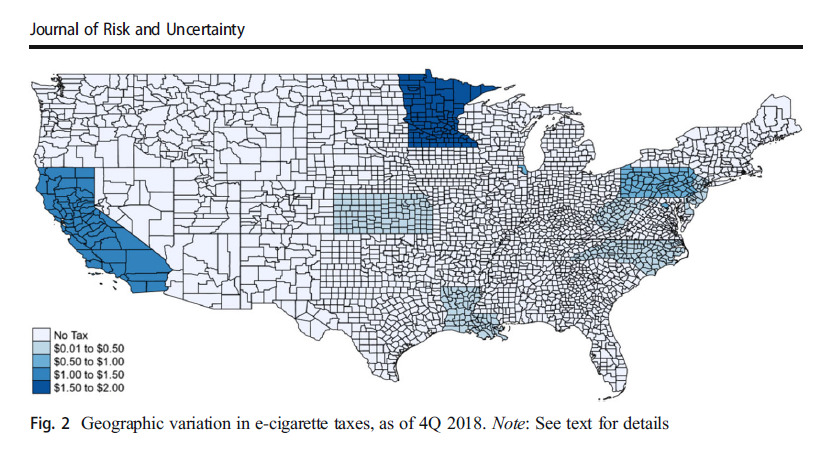

E-cig taxes were adopted in ten states and two large counties between 2011 to 2018, with the taxes ranging from $0.05 per ml to $1.82 per fluid ml by the end of 2018. Cigarette taxes meanwhile increased in 21 states and five counties over the same time period.

2/12

2/12

We study the effect of these tax changes using #brfss and #nhis data for over 4 million adults.

3/12

3/12

In a Census research data center, we estimate diff-in-diff-like regression models, controlling for demographics, other policies, county fixed effects, and time fixed effects.

4/12

4/12

A $1.00 increase in the cigarette tax reduces adult daily smoking by 5.3%. A $1.00 increase in the e-cigarette tax (per fluid ml) reduces the probability of adult daily vaping by 14.2%.

5/12

5/12

Increasing the tax on one product increases usage of the other. #substitution. A $1.00 increase in the cigarette tax increases daily vaping by 14.2% and a $1.00 increase in the e-cigarette tax increases daily smoking by 5.3%.

6/12

6/12

We find evidence that most of the own- and cross-tax responsiveness is driven by younger adults under 40 years of age.

7/12

7/12

The House of Representatives has passed a bill to implement a national e-cigarette tax of $1.65 per fluid ml, exceeding the tax per pack of cigarettes of $1.01.

If this becomes law, we estimate it will cause 2.5 million extra adult daily smokers.

https://www.congress.gov/bill/116th-congress/house-bill/2339

8/12

If this becomes law, we estimate it will cause 2.5 million extra adult daily smokers.

https://www.congress.gov/bill/116th-congress/house-bill/2339

8/12

This study supports the conclusion from many other studies that regulating e-cigarettes has large unintended effects of raising cigarette use in youth, adults, and pregnant women.

https://bit.ly/2XrIQzb .

https://twitter.com/JCMecon/status/1226874665705959425

9/12

https://bit.ly/2XrIQzb .

https://twitter.com/JCMecon/status/1226874665705959425

9/12

Since #ecigs are thoughts by most researchers to be substantially safer products than cigarettes, this is particularly concerning. #HarmReduction

10/12

10/12

Check out other great e-cigarette articles that will be included in this Journal of Risk & Uncertainty e-cigarette special issue, including by @Mikenber, @WKipViscusi, @danieldench1, and others.

https://www.springer.com/journal/11166

11/12

https://www.springer.com/journal/11166

11/12

Read on Twitter

Read on Twitter