Did you know that your bank account is your first source of CO2 emissions?

Thread/

Thread/

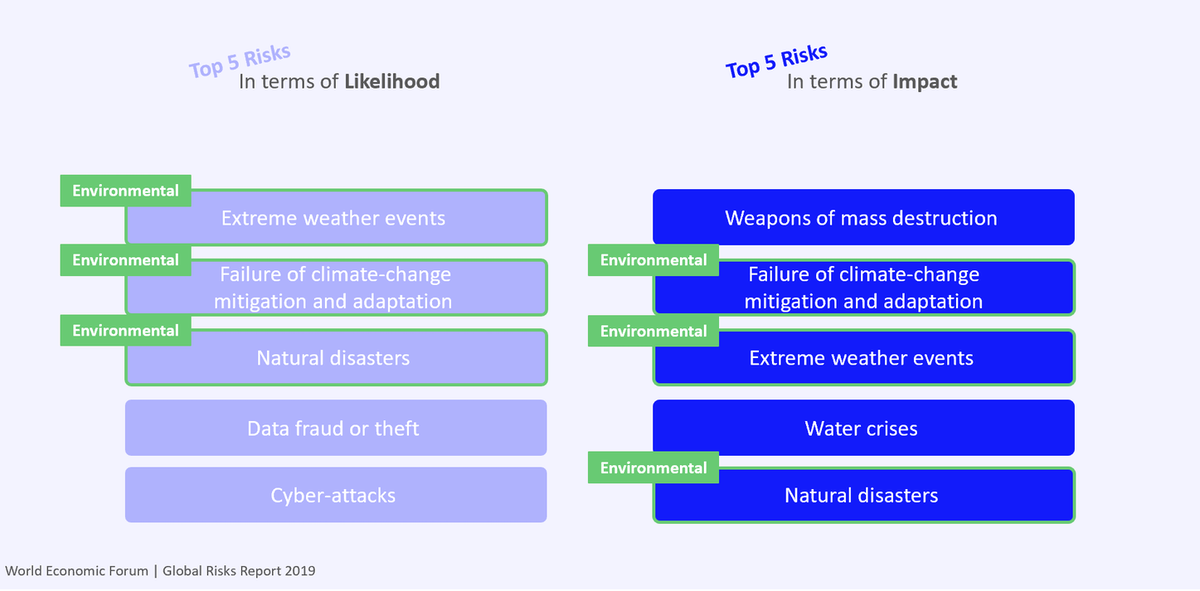

0/ The World Economic Forum’s 2019 Global Risks Report mentioned that environmental risks accounted for three of the top five global risks by likelihood and by impact.

Global awareness is rising as we’ve never seen before.

It’s time to act!

Global awareness is rising as we’ve never seen before.

It’s time to act!

1/ Commitment to SDGs keep increasing

The SDG vision calls for a deep transformation in which corporations must not only participate but lead.

Any company (of any size) can find its starting point, understand/share its impact, set goals, and track improvement

It’s time to act!

The SDG vision calls for a deep transformation in which corporations must not only participate but lead.

Any company (of any size) can find its starting point, understand/share its impact, set goals, and track improvement

It’s time to act!

2/ Sustainable Finance emerges

Pressed by this surging megatrend, the financial sector left its passivity to embrace the concept of sustainable finance in a more active and comprehensive way.

Pressed by this surging megatrend, the financial sector left its passivity to embrace the concept of sustainable finance in a more active and comprehensive way.

3/ Look around you, things are evolving

- Sustainability risks are already having concrete financial Impact

- Asset managers increase and broaden their ESG product offer

- Banks are shifting their portfolios

- Sustainability risks are already having concrete financial Impact

- Asset managers increase and broaden their ESG product offer

- Banks are shifting their portfolios

4/ Look around you, things are evolving (bis)

- Stock exchanges are creating green segments

- ESG rating agencies being acquired by credit rating ones

- Stock exchanges are creating green segments

- ESG rating agencies being acquired by credit rating ones

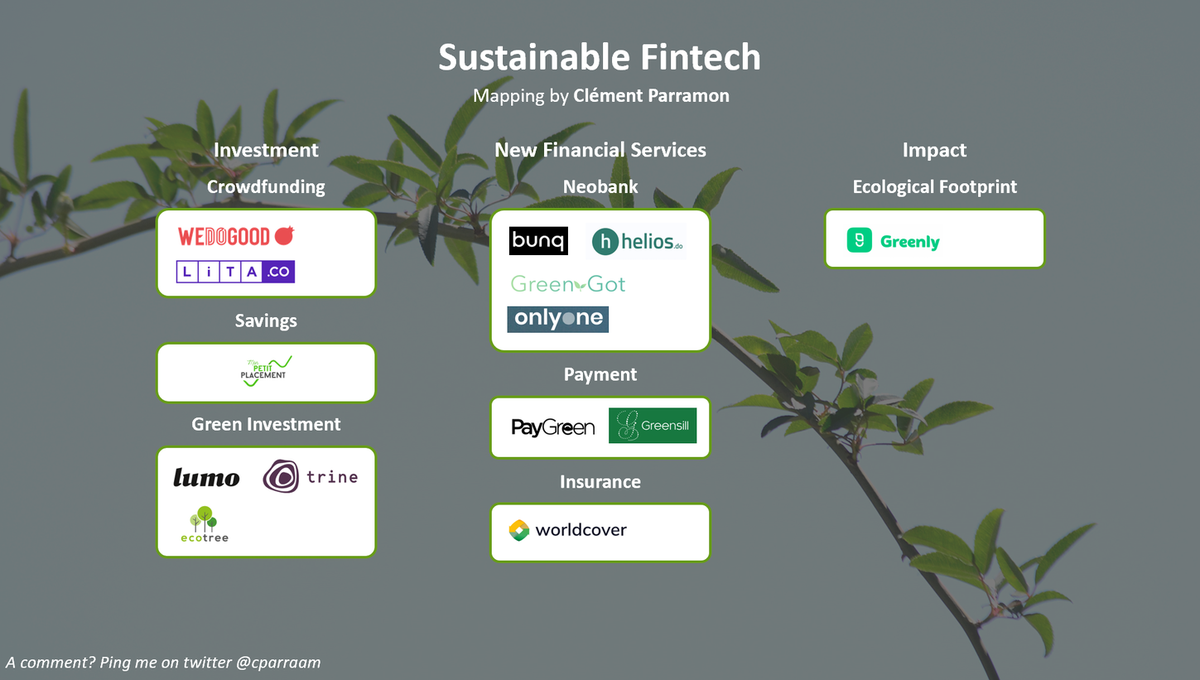

5/ Entrepreneurs are building a better world

During my research, I have identified a few startups actively working for sustainable finance. Here is my first draft! Feel free to help me on that one :)

During my research, I have identified a few startups actively working for sustainable finance. Here is my first draft! Feel free to help me on that one :)

If you enjoyed it, please do share :)

I also write a weekly newsletter about Fintech which you may like.

Have a nice week you all https://parram.substack.com/

https://parram.substack.com/

I also write a weekly newsletter about Fintech which you may like.

Have a nice week you all

https://parram.substack.com/

https://parram.substack.com/

Read on Twitter

Read on Twitter