All-time highs for #gold – a thread

Gold hit a new all-time high this morning, posting $1944.71/oz during late Asian trading and is currently near that level.

There has been a LOT of coverage of the all-time-high on social media – who knew there were so many #gold experts?

Gold hit a new all-time high this morning, posting $1944.71/oz during late Asian trading and is currently near that level.

There has been a LOT of coverage of the all-time-high on social media – who knew there were so many #gold experts?

It’s great timing as far as we are concerned, as it means that #gold is getting a lot of attention ahead of the launch of our Q2-2020 / H1-2020 #GoldDemandTrends release, which will come out on Thursday.

What can we say about #gold at the moment? Obviously I am not going to front run the release of GDT, but we can repeat themes we’ve been making for some time.

For those concerned about the all-time high in #gold, look at a previous significant high, $850/oz from 1980.

When gold approached this level in 2007 many wondered about its significance. But gold went on to trade to a high more than double the prior ATH. ( #NotAForecast)

When gold approached this level in 2007 many wondered about its significance. But gold went on to trade to a high more than double the prior ATH. ( #NotAForecast)

With US real interest rates heading lower, the most important financial market signal is supporting #gold at this point.

A weak US dollar has also helped gold over the past two months.

A weak US dollar has also helped gold over the past two months.

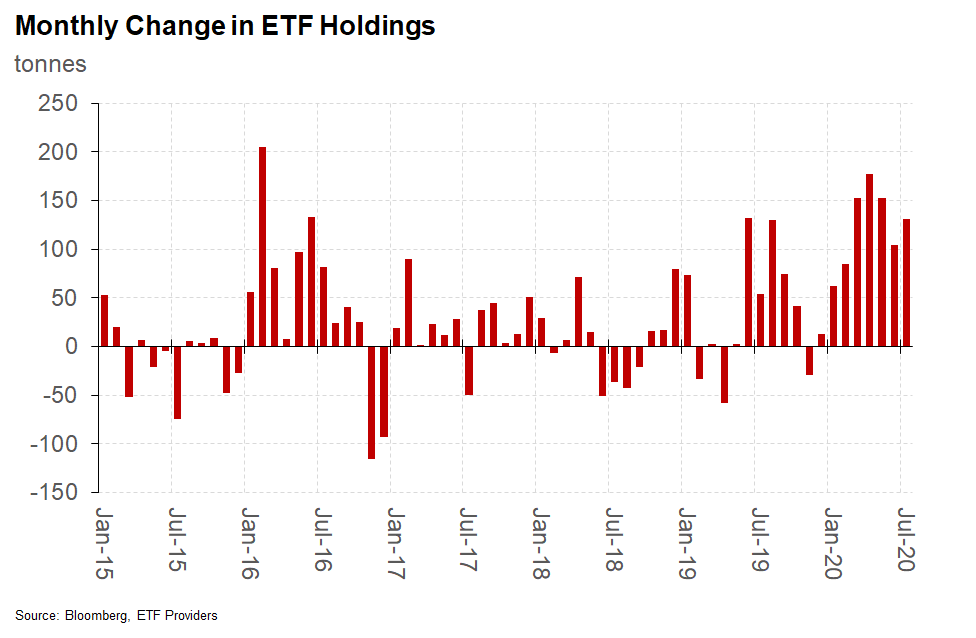

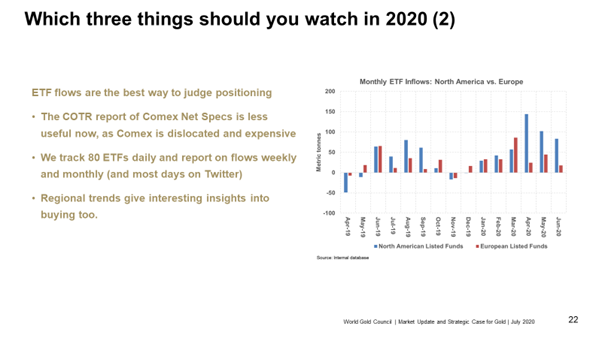

Investor #gold buying, most evident via inflows into physically-backed ETFs, continues at a strong and steady rate.

But consumer demand is undoubtedly weak as economies are affected by coronavirus and the associated lock-downs.

Q1-20 jewellery demand was the weakest we've seen on record, for example.

Q1-20 jewellery demand was the weakest we've seen on record, for example.

And some technical indicators suggest that #gold has come a long way, quickly, which should give short-term traders qualms about the prospect for further gains.

We don’t forecast the gold price, something that is often a frustration for me (but at other times, like now, is a bit of a relief).

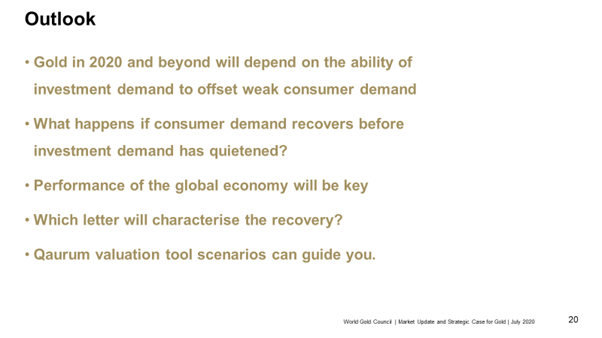

But we do have a tool that helps you understand the performance of gold.

But we do have a tool that helps you understand the performance of gold.

We make the case that #gold should be in your portfolios as a source of returns, diversification and liquidity, and events of the past twelve months have again demonstrated why this is the case.

https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2020

https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2020

So for all the gold bulls out there, enjoy your time in the sun and I wish you best of luck in trading.

For everyone else, #gold has shown why it is a mainstream asset and that you should spend time understanding the arguments about why you should own some.

For everyone else, #gold has shown why it is a mainstream asset and that you should spend time understanding the arguments about why you should own some.

What should you look at for the rest of 2020?

I was asked recently by @JGCCrawley for the three most important things to watch in #gold for the balance of the year. I have hundreds of spreadsheets and market data feeds, but these three are key (at least for now).

I was asked recently by @JGCCrawley for the three most important things to watch in #gold for the balance of the year. I have hundreds of spreadsheets and market data feeds, but these three are key (at least for now).

Visit #goldhub and our #blog to stay in touch with our current thinking on gold.

And do watch out for #GoldDemandTrends on Thursday!

And do watch out for #GoldDemandTrends on Thursday!

@threadreaderapp please unroll

Read on Twitter

Read on Twitter