1/ Notes from @ericvishria episode at @InvestLikeBest

I have started listening and reading the transcript of the episodes at the same time.

It helps me keep focus while reading, and also highlight important sections for me to look back later.

So here goes my notes...

I have started listening and reading the transcript of the episodes at the same time.

It helps me keep focus while reading, and also highlight important sections for me to look back later.

So here goes my notes...

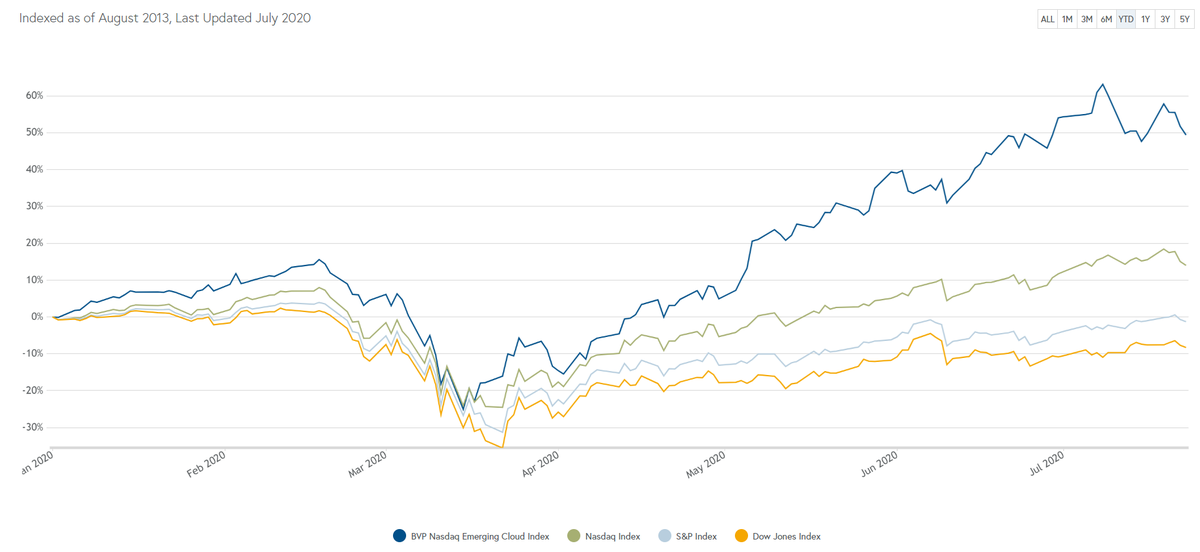

2/ YTD of BVP Emerging Cloud Index is an astounding ~+50%!

Interestingly, the whole index is above "the rule of 40".

Although I think after adjusting for SBC, FCF is nowhere close to 7-8%.

Interestingly, the whole index is above "the rule of 40".

Although I think after adjusting for SBC, FCF is nowhere close to 7-8%.

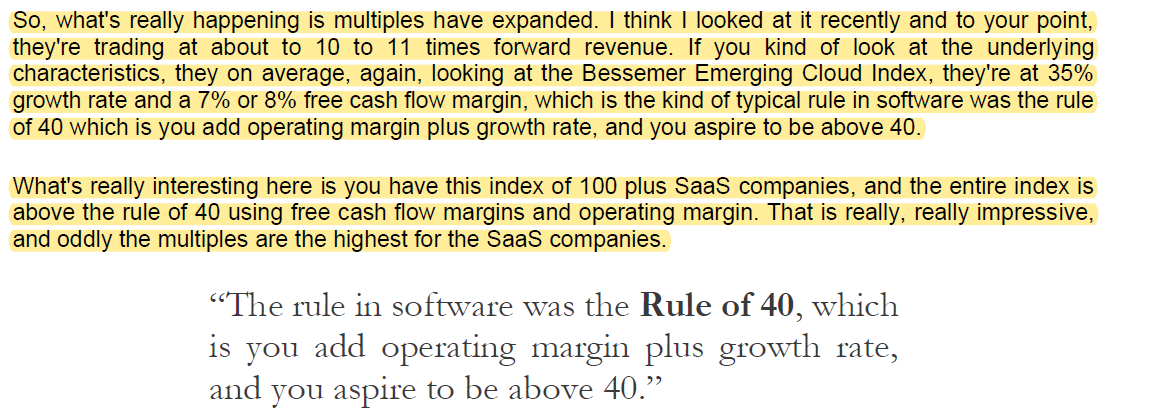

3/ $NKE's goal of reaching 30% DTC was pulled forward by three years.

Digital is not a sideshow anymore; it is an existential question.

Digital is not a sideshow anymore; it is an existential question.

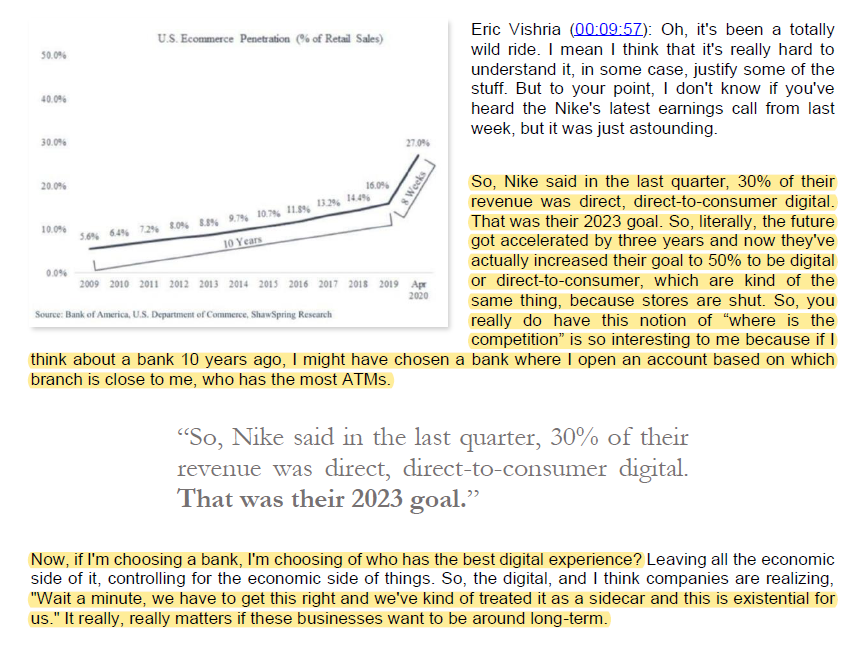

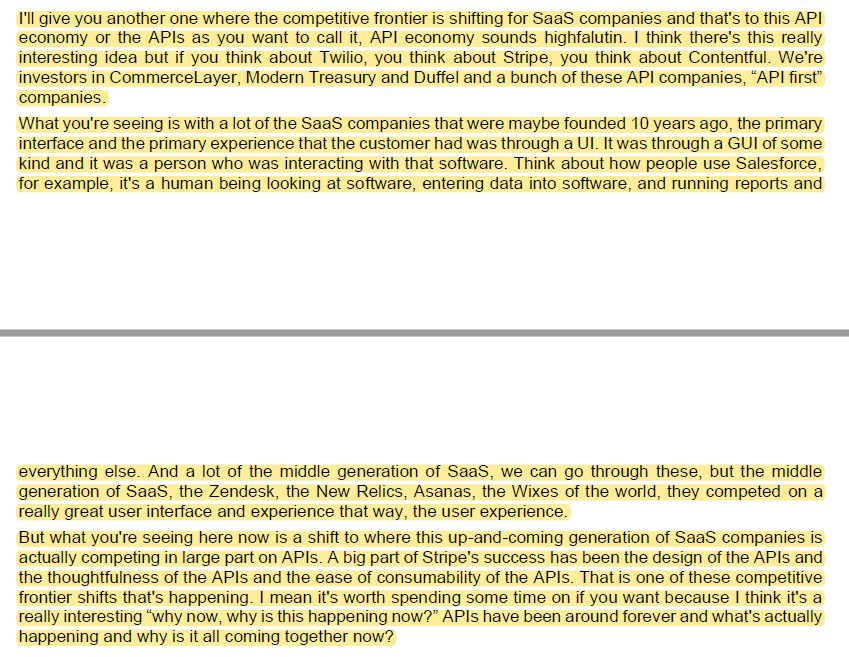

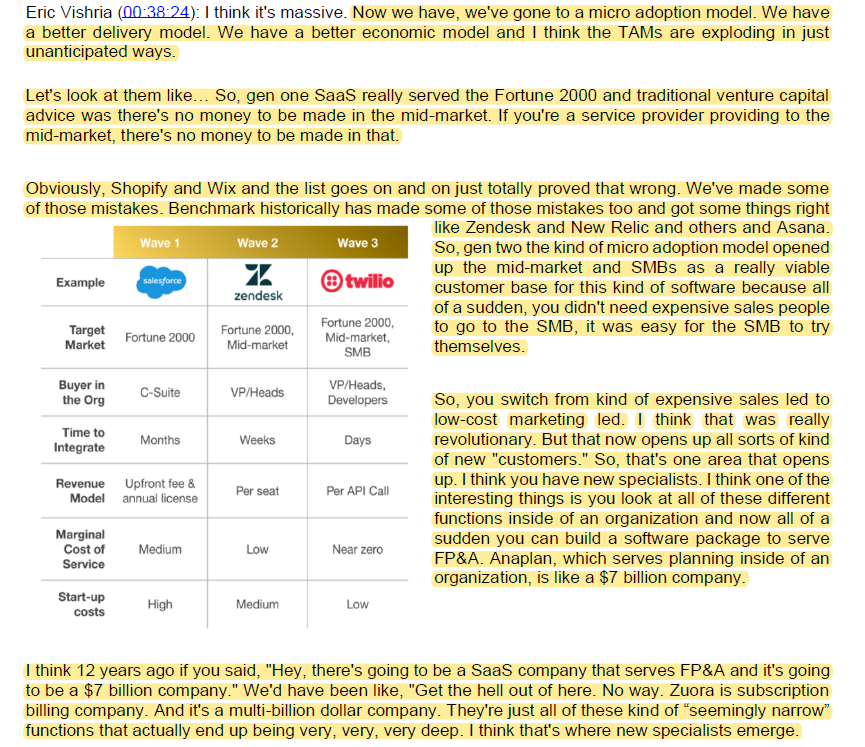

5/ API first SaaS companies have a different pricing model than the first gen SaaS companies.

$CRM $NOW $TWLO

$CRM $NOW $TWLO

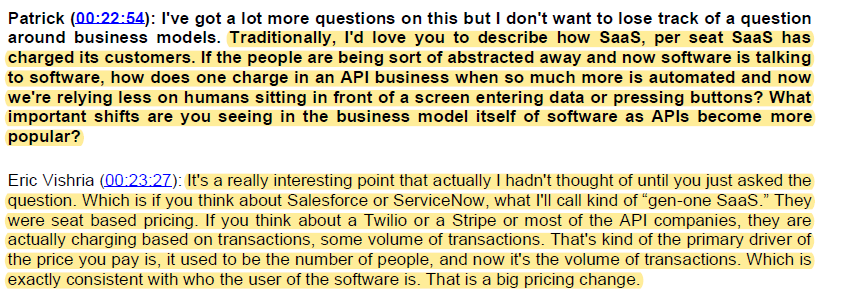

6/ Image I: What is Generation I SaaS companies?

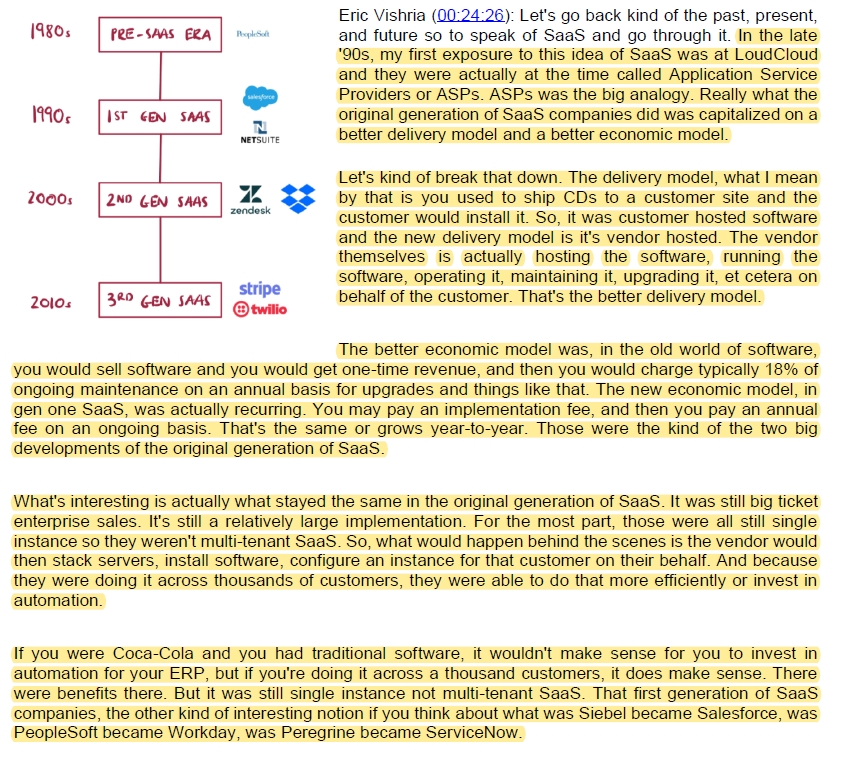

Image II: Gen I SaaS companies (continued)

Image III: What is Generation II SaaS companies?

Image IV: Gen II SaaS companies (continued)

Image II: Gen I SaaS companies (continued)

Image III: What is Generation II SaaS companies?

Image IV: Gen II SaaS companies (continued)

8/ Cloud and SaaS penetration of total IT is currently 15-20% and can eventually be 60% or even higher.

9/ Better delivery model+better economic model+TAM expansion = Cambrian explosion of SaaS companies

$ZEN

$ZEN

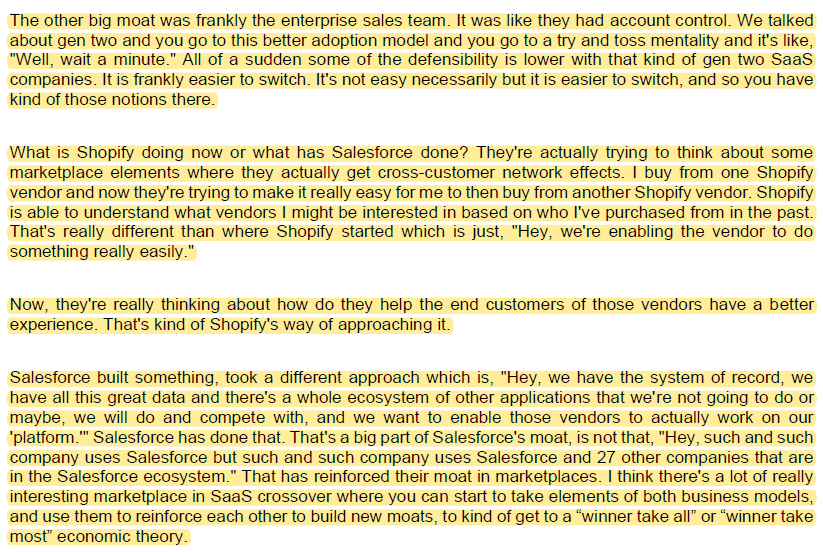

10/ SaaS and marketplace crossover. Both SaaS and marketplaces can pick interesting and complementary things from each other. $SHOP is a good example.

11/ The initial stage at a startup is more about the product, but as things scale, it quickly becomes more about having the right people.

12/ SaaS companies can utilize cross-customer perspectives more to enhance the value proposition for all customers.

13/ Episode link: http://investorfieldguide.com/eric-vishria-the-past-present-and-future-of-saas-software/

You can also explore all my threads here: https://originalandborrowedideas.home.blog/2020/03/19/all-my-twitter-threads/

You can also explore all my threads here: https://originalandborrowedideas.home.blog/2020/03/19/all-my-twitter-threads/

Read on Twitter

Read on Twitter