Anyone up for more $IDEX chart analysis? What better to do on weekends to prep for new week, right?

Obv just my opinion, make your own decisions.

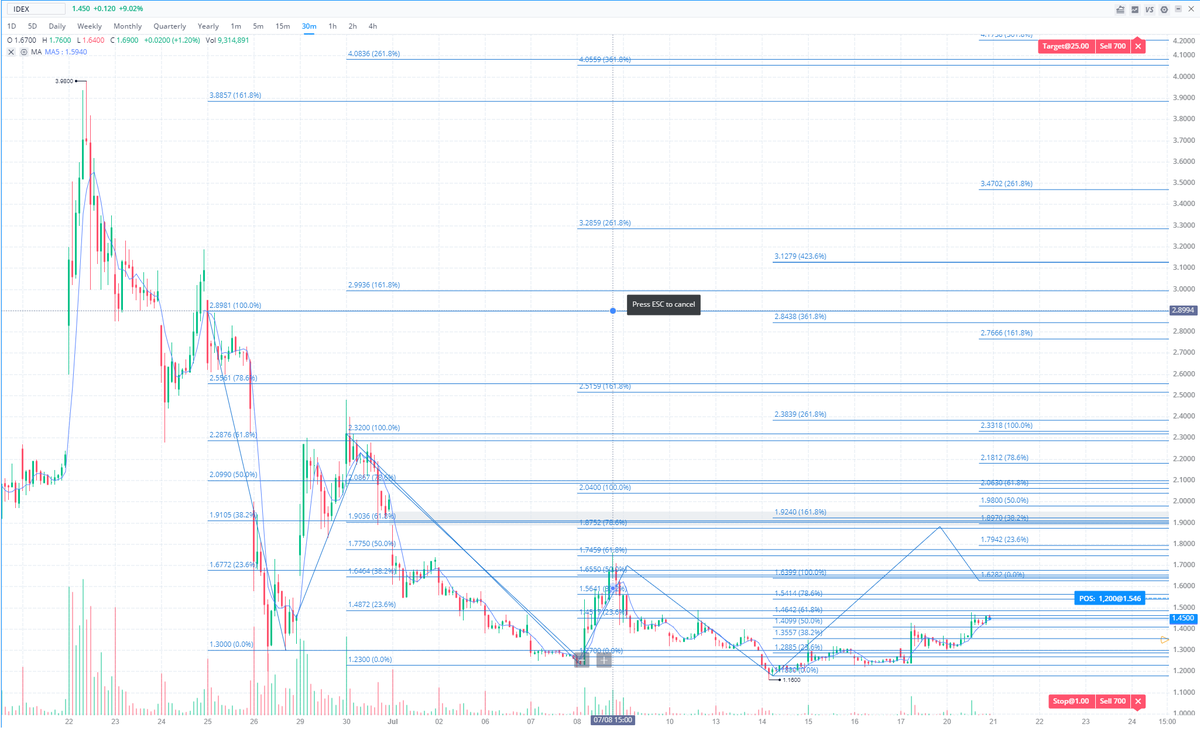

Chart has me super bullish, almost lookes like multiple cup/handles been set up past few weeks to lead to 8/4 & 8/11 catalysts.

Obv just my opinion, make your own decisions.

Chart has me super bullish, almost lookes like multiple cup/handles been set up past few weeks to lead to 8/4 & 8/11 catalysts.

$IDEX has demonstrated the following trends on the charts since 7/1.

- Possible cup/handles being formed

- Established floor @ $1.30

- Triple bottom @ $1.20 on 6/26, 7/7, & 7/14

- Gap @ 1.90-1.97 to possibly fill, 4 fibonaccis intersecting the gap.

- Possible cup/handles being formed

- Established floor @ $1.30

- Triple bottom @ $1.20 on 6/26, 7/7, & 7/14

- Gap @ 1.90-1.97 to possibly fill, 4 fibonaccis intersecting the gap.

For this post, I will be posting my ESTIMATES for chart growth the next 2.5-3 weeks based on the chart trends listed above, as well as catalysts that can make these moves happen.

Blue line is estimate based on all this info. I expect you to come to your own conclusions here.

Blue line is estimate based on all this info. I expect you to come to your own conclusions here.

Attached are the following: 15m/30m/1h charts & 4 day old chart w/ fibonaccis. Please have these open as we will be using them for reference from hereon out.

Once more, keep in mind these are estimates based on the information and chart analysis I've done the past few weeks.

Once more, keep in mind these are estimates based on the information and chart analysis I've done the past few weeks.

I'll touch on the floors and triple bottom, as they're shortest in this post.

1.30 supp

We briefly lost 1.30 support from 7/7-7/8, gaining it back until losing it again from 7/14-7/17. Has fought since 7/17 to maintain 1.30, closing Fri AH at it after a brief fight on 7/24.

1.30 supp

We briefly lost 1.30 support from 7/7-7/8, gaining it back until losing it again from 7/14-7/17. Has fought since 7/17 to maintain 1.30, closing Fri AH at it after a brief fight on 7/24.

Draw a horizontal line @ 1.20 and you'll see a triple bottom established in the same time frame as the 1.30 support is being fought over. All that barcoding.

$IDEX not only won this battle, but during many red market days to boot.

Both trip bottom & new support = bullish IMO

$IDEX not only won this battle, but during many red market days to boot.

Both trip bottom & new support = bullish IMO

Before further chart analysis, this is a good point to talk catalysts.

"CAN SLIM is based on the seven common characteristics found in his study of the greatest stock market winners of the last 45 years."

"CAN SLIM is based on the seven common characteristics found in his study of the greatest stock market winners of the last 45 years."

C = Current Earnings Growth A = Annual Earnings Growth N = New Products, New Services, New Management, New Price Highs S = Supply & Demand L = Leader or Laggard I = Institutional Sponsorship M = Market

$IDEX have any of these coming?

$IDEX have any of these coming?

Lets see.

Current Earnings Growth? Check

Annual Earnings Growth? Estimates place Q2 above all 2019, so, check.

New products/services? Check (Treeletrik, MEG)

New Price High? You tell me after reading this thread; but this a check for me.

Current Earnings Growth? Check

Annual Earnings Growth? Estimates place Q2 above all 2019, so, check.

New products/services? Check (Treeletrik, MEG)

New Price High? You tell me after reading this thread; but this a check for me.

S&D? Lots of supply, with China and Cali forcing demand.

Leader or Laggard? Def laggard, but undeserved IMO. Unless other dealerships have the EV numbers that $IDEX does, they will become laggards while $IDEX leads the EV market trend.

Institutional Sponsorship? Easy check.

Leader or Laggard? Def laggard, but undeserved IMO. Unless other dealerships have the EV numbers that $IDEX does, they will become laggards while $IDEX leads the EV market trend.

Institutional Sponsorship? Easy check.

Finally, market? We can't determine this until we're there. What I can say though, is if market overall is bullish in August, then it further emphasizes prior CAN SLIM bullet points.

So, lots of catalysts that fit CAN SLIM. Just 2-3 of these is bullish, but fitting most of them?

So, lots of catalysts that fit CAN SLIM. Just 2-3 of these is bullish, but fitting most of them?

Yeah, WOW. Super bullish, but lets continue trend analysis.

Now, onto the cup/handles, fibonaccis for price movement estimates, the 1.90-1.97 gap, and finally how the gap relates to the fibonaccis and cup trends. This is where its going to get long, so fair warning.

Now, onto the cup/handles, fibonaccis for price movement estimates, the 1.90-1.97 gap, and finally how the gap relates to the fibonaccis and cup trends. This is where its going to get long, so fair warning.

Cups first, as well as speculation as to how/if catalysts can drive these estimates.

Check the 15/30m for July. On 7/8 you see a run to test the 1.65 resistance. This fails, resulting in a dip until 7/14 forming a potential cup.

My hunch is that Mon-Wed will test 1.65 again.

Check the 15/30m for July. On 7/8 you see a run to test the 1.65 resistance. This fails, resulting in a dip until 7/14 forming a potential cup.

My hunch is that Mon-Wed will test 1.65 again.

After testing 1.65, it drop and form the cup's handle and potential bull flag.

Know why 1.65 been such a hard resistance? Look at charts, 1.90 is next resistance which also happens to be inside the 1.90-1.97 gap.

See all the fibs that intersect that gap?

Know why 1.65 been such a hard resistance? Look at charts, 1.90 is next resistance which also happens to be inside the 1.90-1.97 gap.

See all the fibs that intersect that gap?

Based on this, I see 1.65 resistance breaking before Thursday. Once 1.65 breaks, this fights for 1.90 until our 8/4 catalyst. Barcoding @ 1.80-1.90 on 7/31 & 8/3 until the catalyst causes it to spike.

Now look at the second cup that formed from 6/30-7/7.

Now look at the second cup that formed from 6/30-7/7.

That cup was formed when testing 2.30 resistance failed.

The 8/4 catalyst has potential to drive the SP up to testing 2.30 again.

It will fail 2.30 again due to lots of sell action, and will likely fall through 1.90 again so it can confirm 1.65 floor again

The 8/4 catalyst has potential to drive the SP up to testing 2.30 again.

It will fail 2.30 again due to lots of sell action, and will likely fall through 1.90 again so it can confirm 1.65 floor again

Once the floor has been confirmed it will likely bull flag back up to 1.90-2.00 range. In fact, we could even see a bull flag push all the way to the 2.30 resistance again.

Bulls can easily win the 2.30 fight this time, with the 8/11 catalyst coming up.

Bulls can easily win the 2.30 fight this time, with the 8/11 catalyst coming up.

The 8/11 catalyst is where things have potential to get juicy.

Take a look at that cup that started on 6/25.

Here's where pure speculation takes place, so keep that in mind before reading further.

Cup on 6/25 could def fill on 8/11 if ER/PR is good enough. Breaks $3 likely.

Take a look at that cup that started on 6/25.

Here's where pure speculation takes place, so keep that in mind before reading further.

Cup on 6/25 could def fill on 8/11 if ER/PR is good enough. Breaks $3 likely.

But, notice the other bull flag/handle I put on the 3.20 cup?

ER+PR isn't until AH on 8/11. Hype+big volume could easily fill the 3.20 cup until ER/PR happens where a bullflag could potential form as the market collectively decides if $IDEX is actually worth something.

ER+PR isn't until AH on 8/11. Hype+big volume could easily fill the 3.20 cup until ER/PR happens where a bullflag could potential form as the market collectively decides if $IDEX is actually worth something.

Obviously, it can be bad and plummet.

But.

If PR+ER is amazing enough, I can see this skyrocketing. If a cup forms @ 3.20, that isn't too far off from prior 52w high on 3.98.

If PR/ER is somehow good enough to break 52w high, then I see $5+ happening before correction.

But.

If PR+ER is amazing enough, I can see this skyrocketing. If a cup forms @ 3.20, that isn't too far off from prior 52w high on 3.98.

If PR/ER is somehow good enough to break 52w high, then I see $5+ happening before correction.

Once again, this is speculation.

But you can see how the fibonaccis and catalysts both make sense of the cup/handles and bull flags forming.

So these corrections I'm speculating on, while optimistic, are definitely very possible.

It's ultimately up to $IDEX at this point.

But you can see how the fibonaccis and catalysts both make sense of the cup/handles and bull flags forming.

So these corrections I'm speculating on, while optimistic, are definitely very possible.

It's ultimately up to $IDEX at this point.

You've likely seen me demonstrate just how much more purveyors make than manufacturers.

We will see the truth on 8/11, and just take a look at other DD into their partners, the tons of institutional investments, big name investors, and the math behind the deals we know about.

We will see the truth on 8/11, and just take a look at other DD into their partners, the tons of institutional investments, big name investors, and the math behind the deals we know about.

I believe this is why $IDEX has been quiet. The famous drop wasn't all Hindenburg's fault you know, shareholders collectively losing faith in mass numbers dumping their shares is what caused that dip.

Most investors did no research, only investing because a guy on Twit said so.

Most investors did no research, only investing because a guy on Twit said so.

So the result is most shareholders panicking due to sheer ignorance. THAT is what caused the famous dip.

Ppl like Hindenburg cannot be successful with a company that most investors are confident in. Hindenburg CANNOT succeed without panic sellers.

Ppl like Hindenburg cannot be successful with a company that most investors are confident in. Hindenburg CANNOT succeed without panic sellers.

Problem with $IDEX, their shareholders were mostly people like us.

It is easy to instill panic in someone with little experience, and people only in $IDEX because of Twitter making up the bulk of your shareholders?

Super super easy short/distort.

This is why $IDEX is quiet

It is easy to instill panic in someone with little experience, and people only in $IDEX because of Twitter making up the bulk of your shareholders?

Super super easy short/distort.

This is why $IDEX is quiet

The best way to regain confidence? Stop fighting and wait for numbers to do the talking. Rather than release tons of small deals to be short/distorted, they will likely release all of those deals at the same time on 8/11.

One big number looks better to dozens of small ones.

One big number looks better to dozens of small ones.

$IDEX showing numbers and possibly announcing potential for more orders/profits will instill so much investor confidence that a short and distort would become bankroll suicide.

This is why I think $IDEX has been silent and barcoding. Big investors definitely consolidating.

This is why I think $IDEX has been silent and barcoding. Big investors definitely consolidating.

Just look at the myriad of big investors and institutional investors.

5 companies with over 1M invested. BlackRock has 8.2 MILLION invested. Why is BlackRock so important? They have over 90 BILLION invested in ESG stocks, pledging 1 TRILLION by 2030.

5 companies with over 1M invested. BlackRock has 8.2 MILLION invested. Why is BlackRock so important? They have over 90 BILLION invested in ESG stocks, pledging 1 TRILLION by 2030.

BlackRock AND Goldman Sachs involved; two of the biggest hedge funds in the world have faith in $IDEX.

Vanguard, Charles Schwab, and Fidelity have faith in $IDEX.

The only thing $IDEX needs is retail investors like you and me to have the same faith.

Vanguard, Charles Schwab, and Fidelity have faith in $IDEX.

The only thing $IDEX needs is retail investors like you and me to have the same faith.

As you can see, there's a wealth of information here that shows quite a few opportunities. If you study it and come up with a plan before the action, you can set yourself up for some good trades.

As a result, I'm pretty much done posting about $IDEX.

As a result, I'm pretty much done posting about $IDEX.

There's really no need. I believe the graph has shown us plenty information about how the next 2 weeks will play out.

If I see pertinent news/info about $IDEX, I'll tweet it.

But other than that, I have no need to post about $IDEX anymore with all this chart analysis.

If I see pertinent news/info about $IDEX, I'll tweet it.

But other than that, I have no need to post about $IDEX anymore with all this chart analysis.

As you can see, I'm pretty bullish on $IDEX. I do not see this being a penny stock 2021.

My faith in $IDEX is everything but irrational. This post, and all my others will show just how much analysis and studying I've done on them.

Do not FOMO this.

My faith in $IDEX is everything but irrational. This post, and all my others will show just how much analysis and studying I've done on them.

Do not FOMO this.

I hope some of you found this information useful. My hope is that it will allow people to not only make more informed decisions, but to successfully set their own SL and PTs.

Hope this helped, and thanks for reading. Warned you it'd be long! :p

Hope this helped, and thanks for reading. Warned you it'd be long! :p

Just remember.

I've given you chart analysis, unbiased information, and have encouraged you to do your own work and come to your own conclusions.

Absolutely no hype here, just potential and realistic estimates.

I've given you chart analysis, unbiased information, and have encouraged you to do your own work and come to your own conclusions.

Absolutely no hype here, just potential and realistic estimates.

Read on Twitter

Read on Twitter