90% of my savings were in equity, debt was never attractive! Last few months have taught me the imp of diversification!

Gold - through SGBs was my move on diversifying! Holder since Jan'20 - so far so good!

A on talk given by @PositiveGamma on Investing in Gold!

on talk given by @PositiveGamma on Investing in Gold!

(1/16)

Gold - through SGBs was my move on diversifying! Holder since Jan'20 - so far so good!

A

on talk given by @PositiveGamma on Investing in Gold!

on talk given by @PositiveGamma on Investing in Gold! (1/16)

Link to the here -

MMTC PAMP is where Krishna worked before Setu and he was also responsible for launching Digi Gold at PayTM!

1) Why Gold?

1.1 Diversification - Volatility & Returns not tied to market conditions - diff. from financial assets.

(2/16)

MMTC PAMP is where Krishna worked before Setu and he was also responsible for launching Digi Gold at PayTM!

1) Why Gold?

1.1 Diversification - Volatility & Returns not tied to market conditions - diff. from financial assets.

(2/16)

1.2 Safe Haven - High value asset, easy to transport! Large value - limited space. Liquid and easy to convert to cash across the world.

1.3 Hedge against inflation and currency depreciation! (Depreciation of Rupee is a major factor behind Gold returns in India)

(3/16)

1.3 Hedge against inflation and currency depreciation! (Depreciation of Rupee is a major factor behind Gold returns in India)

(3/16)

1.4 Upside in Tail Risk - Confidence in currencies & financial systems is low, gold can see upside in scenarios like this!

1.5 Upside on Demand/Supply - Constant Demand - Supply is stable!

2) Gold - Indian Context - Better returns compared to other asset classes...

(4/16)

1.5 Upside on Demand/Supply - Constant Demand - Supply is stable!

2) Gold - Indian Context - Better returns compared to other asset classes...

(4/16)

... specially in the last 2-3 years. Gold has done well both in low inflation & high inflation returns. So both real (ex. inflation) & nominal returns have been good!

3) How much to Allocate?

3.1 Diversification/Inflation Hedge - 10-20%

3.2 Tail Risk/Safe Haven - 5-20%

(5/16)

3) How much to Allocate?

3.1 Diversification/Inflation Hedge - 10-20%

3.2 Tail Risk/Safe Haven - 5-20%

(5/16)

4) There has been a rethink on investment in Gold over last year or so - due to Price performance and people looking for reasons of continue performance! Pandemic - Demand for stimulus and easing of rates - currency trust goes down - faith in Gold increases!

(6/16)

(6/16)

5) How is Gold in India Priced?

How are the prices of gold calculated that we see in newspapers, news channels etc.

If long gold in US$ form in London - instead of 41% increase is only 31%, because Rupee has depreciated substantially compared to the $. (3rd Tweet)

(7/16)

How are the prices of gold calculated that we see in newspapers, news channels etc.

If long gold in US$ form in London - instead of 41% increase is only 31%, because Rupee has depreciated substantially compared to the $. (3rd Tweet)

(7/16)

7) Gold Investment Options in India

7.1 Jewellery

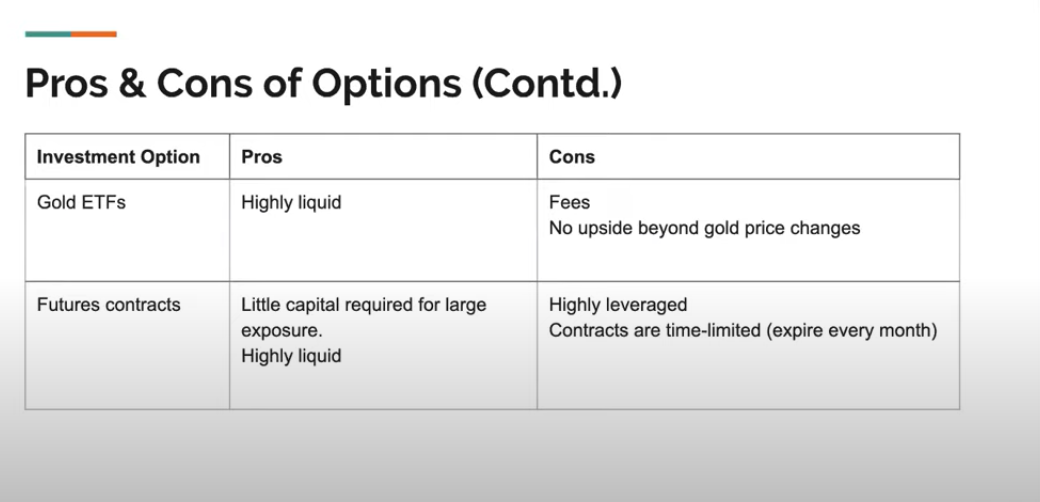

7.2 Gold ETFs

7.3 Sovereign Gold Bonds (SGB)

7.4 Bullion

7.5 Gold Futures

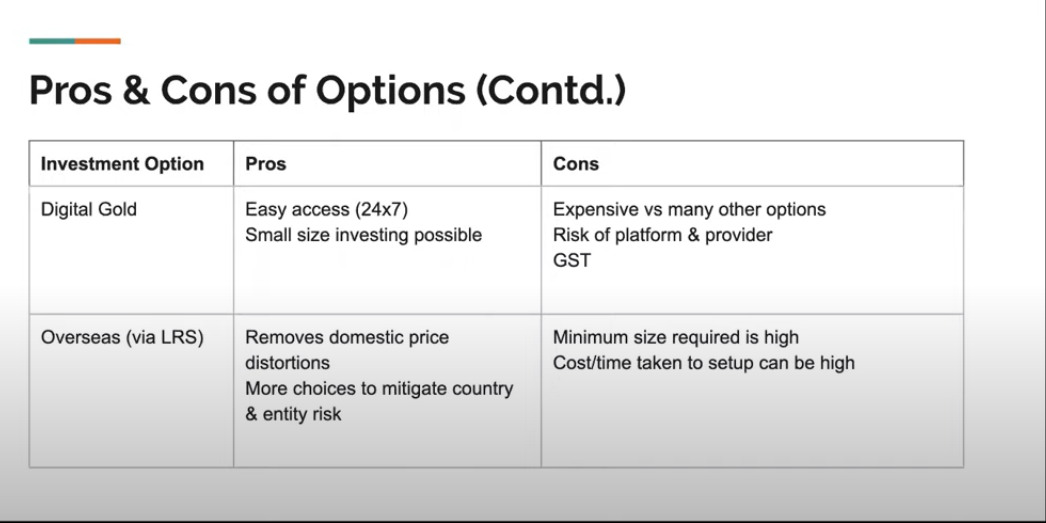

7.6 Digital Gold

7.7 Paper Gold/Cert. from Jewellers

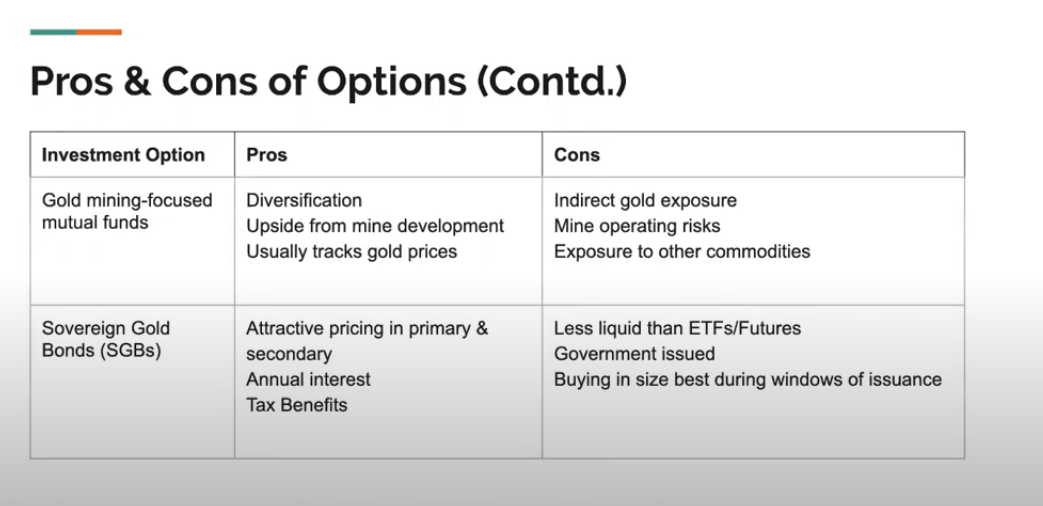

7.8 Gold Mining Fund

7.9 Overseas Options via LRS

Details below...

(9/16)

7.1 Jewellery

7.2 Gold ETFs

7.3 Sovereign Gold Bonds (SGB)

7.4 Bullion

7.5 Gold Futures

7.6 Digital Gold

7.7 Paper Gold/Cert. from Jewellers

7.8 Gold Mining Fund

7.9 Overseas Options via LRS

Details below...

(9/16)

9) SGBs is something I like and feel is probably the best instrument if you see GOLD as a long term investment.

9.1 Attractive pricing in Primary (Disc. on Digital Purchase) & Secondary Market

9.2 Annual Interest Component - 2.5% Annual Return

(11/16)

9.1 Attractive pricing in Primary (Disc. on Digital Purchase) & Secondary Market

9.2 Annual Interest Component - 2.5% Annual Return

(11/16)

9.3 Tax Benefits - Tax Free after holding period of 8 Years!

9.4 Liquidity - Less liquid compared to Gold ETFs, hence only good for Long Term Gold buying!

9.5 Govt. Issued and Backing

9.6 Fine Print behind SGBs - 10K Cr. of Govt. Borrowings through SGBs - money used...

(12/16)

9.4 Liquidity - Less liquid compared to Gold ETFs, hence only good for Long Term Gold buying!

9.5 Govt. Issued and Backing

9.6 Fine Print behind SGBs - 10K Cr. of Govt. Borrowings through SGBs - money used...

(12/16)

in funding Govt. deficit! Govt. is not buying Gold for SGB, at the end its a promissory note based on gold prices. Metal lease rates are b/w 1.5-2.5%, so interest offered is based on that! Hence very different from buying Gold Bars.

Instrument not well discovered...

(13/16)

Instrument not well discovered...

(13/16)

... and hence Liquidity in the secondary market is poor. Not being marketed as nicely as MFs, overtime market will deepen over time!

10) Digital Gold - By Digital Gold anytime and anywhere at the same price across the country - Tier 2 & 3 cities have...

(14/16)

10) Digital Gold - By Digital Gold anytime and anywhere at the same price across the country - Tier 2 & 3 cities have...

(14/16)

physical gold prices which are higher than Tier 1 cities - Digital Gold is uniform, Main Purpose-Democratise investment in Gold - low ticket investments as well. Total Cost of buying & selling is 6-7% because of GST & Markup! Risk of platform and digital gold provider!

(15/16)

(15/16)

11) Discussed SGBs & Digital Gold coz of the easier purchase model but below is rating for various options of all gold buying modes according to six criteria!

This was a really insightful talk & I definitely know more now! Thank you @PositiveGamma for this! (16/16)

Fin.

This was a really insightful talk & I definitely know more now! Thank you @PositiveGamma for this! (16/16)

Fin.

Sorry for the Typos

Another Great article I read last week on this topic! https://www.google.com/amp/s/ofdollarsanddata.com/why-is-gold-valuable/amp/

Read on Twitter

Read on Twitter