Thread on the ponzinomics of $YFI, what drives it's fundamental intrinsic value and why YFI is a superior product with superior token economics compared to other DeFi tokens.

0

0

At the moment, if you're providing liquidity to mine $YFI, DAI pool definitely superior returns on both Trade Volume/Liquidity and YFI rewards.

But if you're looking to purchase YFI, better to purchase off yCRV pool. There'll be less slippage.

1

But if you're looking to purchase YFI, better to purchase off yCRV pool. There'll be less slippage.

1

Perhaps the reason why there's such a stark difference is inconvenience/incompetence of swapping stablecoins to yCRV, then proceeding to @Balance_io to purchase YFI.

Another reason could be better composability and network effects of $DAI across other DEXs.

2

Another reason could be better composability and network effects of $DAI across other DEXs.

2

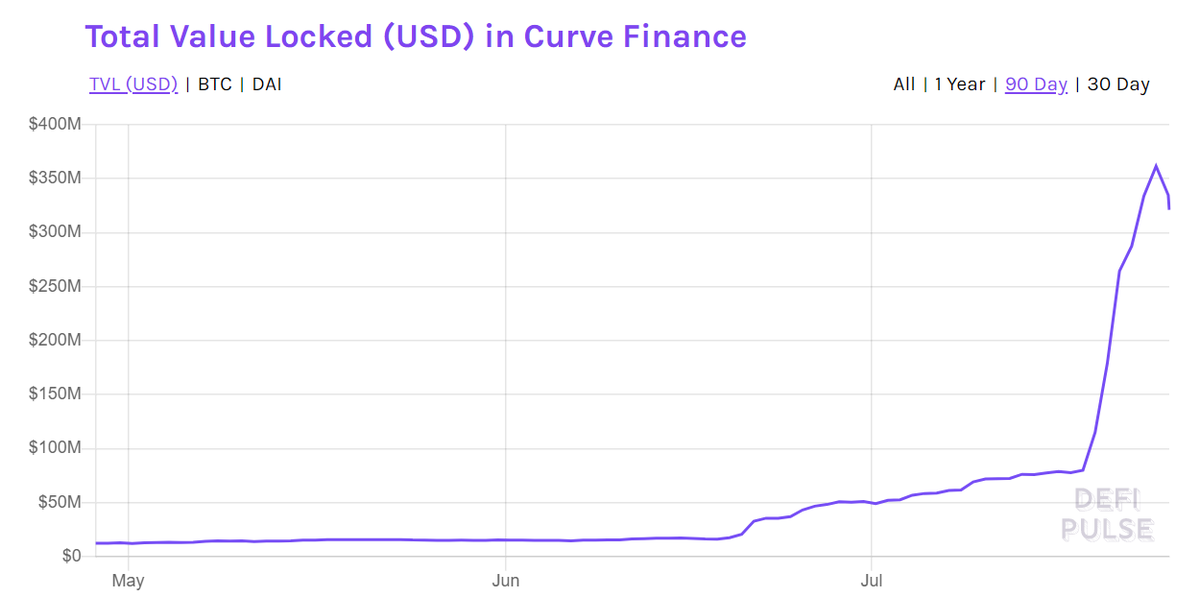

This is just the beginning for yCRV which is the fundamental value driver for YFI.

yCRV has the potential to expand it's network effects across the DeFi space in lending/borrowing markets, decentralized exchanges and derivatives amongst others.

3

yCRV has the potential to expand it's network effects across the DeFi space in lending/borrowing markets, decentralized exchanges and derivatives amongst others.

3

Think of it this way, why use USDT when you can have interest bearing USDT like aUSDT or cUSDT?

Exchanges like @FTX_Official have already started accepting using @compoundfinance's cUSDT which allows you to earn interest on your margin while you trade.

4

Exchanges like @FTX_Official have already started accepting using @compoundfinance's cUSDT which allows you to earn interest on your margin while you trade.

4

Then again, why use cUSDT when you can use yUSDT which is an interest bearing stablecoin that searchest for the highest yield by bouncing between @AaveAave @compoundfinance and @ddexio2018

5

5

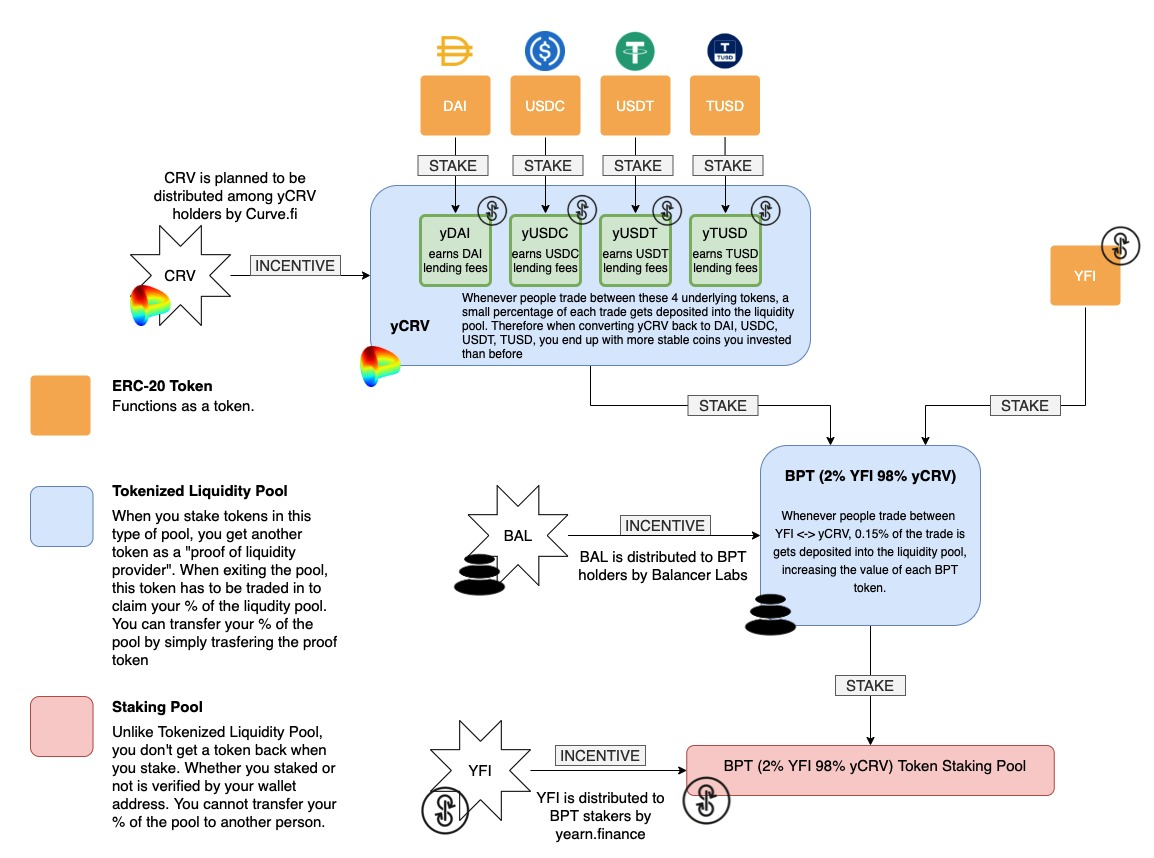

If we go one level deeper, why not use basket of interest bearing stablecoins? This is where yCRV comes in, which represents a basket of yDAI yUSDT yUSDC & yTUSD.

All interest bearing, while you earn trading fees at the same time.

Read more here:

https://medium.com/iearn/meta-stablecoins-available-today-bd9b5a77e49

6

All interest bearing, while you earn trading fees at the same time.

Read more here:

https://medium.com/iearn/meta-stablecoins-available-today-bd9b5a77e49

6

Looking at the stats on https://www.curve.fi/iearn/stats , There's an obvious clear product market fit for such a product with recent APYs of 10%.

Most people are worried that once inflation drops, there'll be a price dump which may not happen. This is due to..

7

Most people are worried that once inflation drops, there'll be a price dump which may not happen. This is due to..

7

..how the uneven 98/2 yCRV/YFI pool work.

If price dumps, you end up with alot more YFI than for the stablecoins lost, which is great for accumulation.

@Weeb_Mcgee

https://twitter.com/Weeb_Mcgee/status/1284961356039372800

I believe most users have likely been selling YFI into pool#3 thinking it's better..

8

If price dumps, you end up with alot more YFI than for the stablecoins lost, which is great for accumulation.

@Weeb_Mcgee

https://twitter.com/Weeb_Mcgee/status/1284961356039372800

I believe most users have likely been selling YFI into pool#3 thinking it's better..

8

..to compound their mining returns. But this is where it gets interesting.

If price pump, suddenly the YFI that you had in the pool originally gets drained fast.

And the amount of yCRV u get for the lost YFI is little.

9

If price pump, suddenly the YFI that you had in the pool originally gets drained fast.

And the amount of yCRV u get for the lost YFI is little.

9

This means that it's unlikely that farmers will be able to sell their YFIs at high prices because they've already lost it all.

Moreover, farmers will have to pull liquidity from balancer when they leave the network. This makes YFI even more scarce as markets become illiquid.

10

Moreover, farmers will have to pull liquidity from balancer when they leave the network. This makes YFI even more scarce as markets become illiquid.

10

On top of that, you need to be staking YFI in order to vote & claim a portion of the rewards generated by other ecosystem rewards within (int rates, trading fees etc) and externally (COMP, BAL etc) https://medium.com/iearn/yfi-rewards-pool-810ef9256ec6

This will be the true liquidity blackhole as other ecosystem rewards are constantly sold into the YFI rewards contract.

https://twitter.com/Arthur_0x/status/1267360945963032576

11

https://twitter.com/Arthur_0x/status/1267360945963032576

11

As such, looking at massive spike of TVL of other platforms could actually be counter-intuitive as they'd be considered 'toxic' capital.

Infact, YFI could be seen as a proxy for CRV since rewards are not distributed yet.

12

Infact, YFI could be seen as a proxy for CRV since rewards are not distributed yet.

12

The OTC market for YFI has also become extremely vibrant over the week mostly with purchasers. If exchanges want a piece of the action, they need to have some on their balance sheet.

I can already see this creating a 'sell-side liquidity crisis.'

13

I can already see this creating a 'sell-side liquidity crisis.'

13

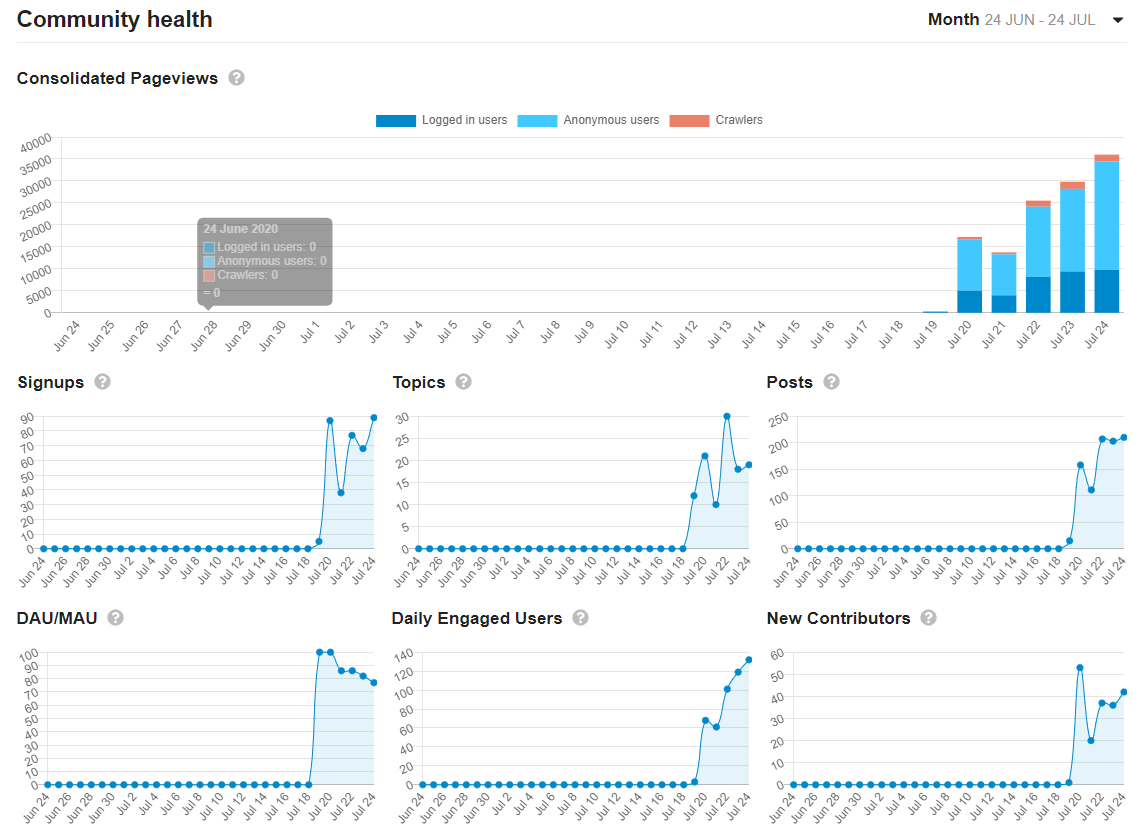

To top things off, community engagement has been nuts with several top tier firms/individuals stepping in especially with aspects of security and audit.

@samczsun @trailofbits @Quantstamp

Open sourced and transparent:

https://docs.google.com/document/d/1JFX79p37-2cMCqEjUIhyba1oZzgtPb-QJgt7a4uhbFk/edit#

@samczsun @trailofbits @Quantstamp

Open sourced and transparent:

https://docs.google.com/document/d/1JFX79p37-2cMCqEjUIhyba1oZzgtPb-QJgt7a4uhbFk/edit#

If you want to set limit orders, you can do it on YFI/DAI and YFI/ETH pairs on @dexdotblue for DEX orderbook style trading instead of market orders off AMM model.

https://dex.blue/trading/#YFI/ETH

16

https://dex.blue/trading/#YFI/ETH

16

Just going to end this off with a few references @QWQiao https://twitter.com/QWQiao/status/1286841100494344193

Forgot to mention the most important point:

When ppl yield farm, they need to buy yCRV which drives flows to the intrinsic value of YFI.

The fundamentals of YFI depend on the TVL of yCRV, while the yield farming APY depends on the price of YFI.

It's a virtuous cycle.

When ppl yield farm, they need to buy yCRV which drives flows to the intrinsic value of YFI.

The fundamentals of YFI depend on the TVL of yCRV, while the yield farming APY depends on the price of YFI.

It's a virtuous cycle.

Read on Twitter

Read on Twitter