(1/4) I hear stories like the oe below all the time. They are WRONG. Sometimes we need to go beyond the first simple reading of charts to understand what's going on.

I know this is not immediately obvious, but TIPS are NOT telling us inflation is a concern.

(thread) https://twitter.com/lisaabramowicz1/status/1286742313901985792

I know this is not immediately obvious, but TIPS are NOT telling us inflation is a concern.

(thread) https://twitter.com/lisaabramowicz1/status/1286742313901985792

(2/4) First, even though SPOT breakevens are rising, FORWARD breakevens are flat and lower than pre #COVID19. If there was an inflation scare, both would be up. Chart shows 10 yr spot (white) vs. 5yr 5yr forward (blue).

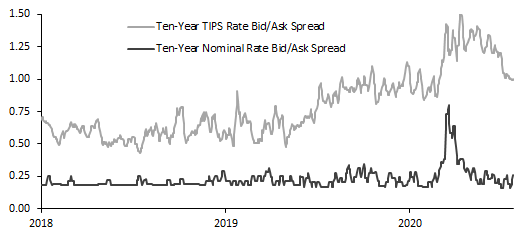

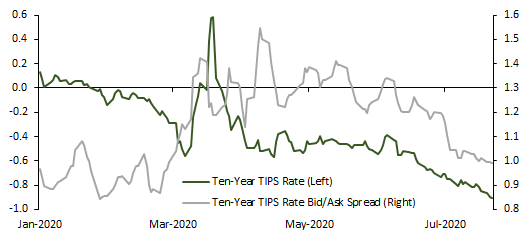

(3/4) The reason spot breakevens are going up and real rates are going down is that liquidity in the TIPS mkt is normalizing, finally. Bid/ask spreads in the TIPS mkt much slower to normalize than in the nominal market.

Read on Twitter

Read on Twitter