1/ Issue #42

Is Yield Farming bringing new users to DeFi?

by @mohamedffouda

With the rise of Yield Farming, billions of dollars flooded into various DeFi protocols. In less than two months, the total dollar value locked in DeFi tripled, going from $1B to more than $3B

Is Yield Farming bringing new users to DeFi?

by @mohamedffouda

With the rise of Yield Farming, billions of dollars flooded into various DeFi protocols. In less than two months, the total dollar value locked in DeFi tripled, going from $1B to more than $3B

2/ Is Yield Farming bringing new users to DeFi?

Are new inflows coming from new users? Or is this just a case of financial musical chairs - a reshuffling of existing crypto investors masquerading as industry growth?

Are new inflows coming from new users? Or is this just a case of financial musical chairs - a reshuffling of existing crypto investors masquerading as industry growth?

3/ Is Yield Farming bringing new users to DeFi?

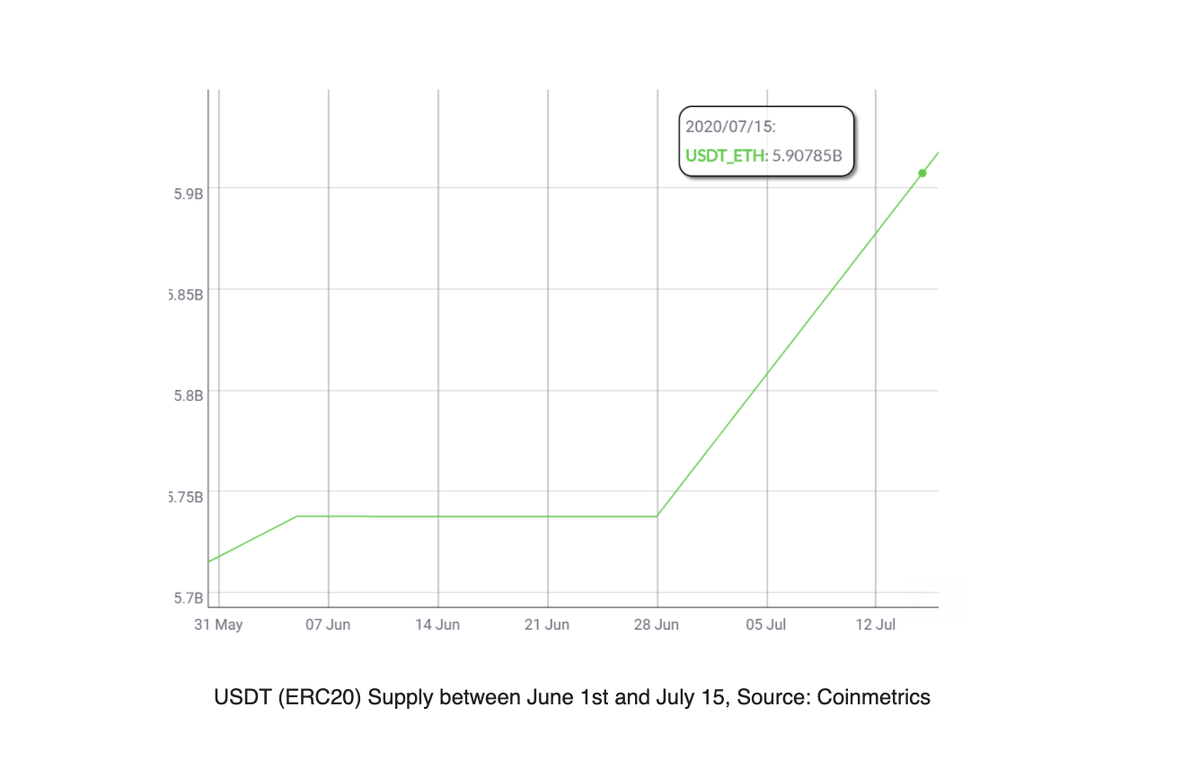

Stablecoins are some of the largest onramps to crypto. USDT & USDC are major fiat-backed stablecoins w/ integrations to popular DeFi protocols. Analyzing their supply provides some insight into the source of recent DeFi inflows

Stablecoins are some of the largest onramps to crypto. USDT & USDC are major fiat-backed stablecoins w/ integrations to popular DeFi protocols. Analyzing their supply provides some insight into the source of recent DeFi inflows

4/ Is Yield Farming bringing new users to DeFi?

The chart above shows USDT supply only grew by $200M between June 1st and July 15th. Additionally, USDC supply grew by about $380M in the same period. But the delta for DeFi total value locked (TVL) in the same timeframe is ~$2B

The chart above shows USDT supply only grew by $200M between June 1st and July 15th. Additionally, USDC supply grew by about $380M in the same period. But the delta for DeFi total value locked (TVL) in the same timeframe is ~$2B

5/ Is Yield Farming bringing new users to DeFi?

Realistically, not all new issuance flows into DeFi protocols, but even if we assume so, the total represents less than 30% of the growth of DeFi TVL.

Realistically, not all new issuance flows into DeFi protocols, but even if we assume so, the total represents less than 30% of the growth of DeFi TVL.

6/ Is Yield Farming bringing new users to DeFi?

In addition to stablecoins, we ought to analyze classic crypto onramps. Though popular crypto exchanges are important onramps, onramps/onboarding platforms that focus on direct DeFi integrations are particularly important to study.

In addition to stablecoins, we ought to analyze classic crypto onramps. Though popular crypto exchanges are important onramps, onramps/onboarding platforms that focus on direct DeFi integrations are particularly important to study.

7/ Is Yield Farming bringing new users to DeFi?

The volume facilitated by classic onramps typically isn't made public, but suffice it to say it's much smaller than the volume facilitated by stablecoin issuance for several reasons.

The volume facilitated by classic onramps typically isn't made public, but suffice it to say it's much smaller than the volume facilitated by stablecoin issuance for several reasons.

8/ Is Yield Farming bringing new users to DeFi?

The most obvious one being that classic onramps are geared towards retail investors, while stablecoins are more appropriate for trading firms and other institutional players.

The most obvious one being that classic onramps are geared towards retail investors, while stablecoins are more appropriate for trading firms and other institutional players.

9/ Is Yield Farming bringing new users to DeFi?

Since current onramp activity doesn’t show meaningful inflows from new investors into DeFi, the logical conclusion is that the current increase in DeFi TVL is mainly a recirculation of money within the current crypto market.

Since current onramp activity doesn’t show meaningful inflows from new investors into DeFi, the logical conclusion is that the current increase in DeFi TVL is mainly a recirculation of money within the current crypto market.

10/ Is Yield Farming bringing new users to DeFi?

For many existing crypto users, the yield earned from $COMP, $LEND, $BAL likely justifies the risks of moving cold-stored coins into DeFi protocols

For many existing crypto users, the yield earned from $COMP, $LEND, $BAL likely justifies the risks of moving cold-stored coins into DeFi protocols

11/ Is Yield Farming bringing new users to DeFi?

Regardless, DeFi is a promising phenomenon that has the momentum to attract mainstream users away from traditional institutions. The movement will slowly garner attention as digital assets are more widely adopted and UX improves

Regardless, DeFi is a promising phenomenon that has the momentum to attract mainstream users away from traditional institutions. The movement will slowly garner attention as digital assets are more widely adopted and UX improves

12/ Is Yield Farming bringing new users to DeFi?

The burden, however, remains on DeFi products to scale beyond the existing crypto-native user base.

The burden, however, remains on DeFi products to scale beyond the existing crypto-native user base.

13/ Is Yield Farming bringing new users to DeFi?

If you're building a DeFi product and looking to scale to users outside of the crypto space, we're now accepting applications for CDA cohort #2 https://medium.com/volt-capital/announcing-defi-alliance-cohort-2-liquidity-liquidity-liquidity-8c12bd510fba

If you're building a DeFi product and looking to scale to users outside of the crypto space, we're now accepting applications for CDA cohort #2 https://medium.com/volt-capital/announcing-defi-alliance-cohort-2-liquidity-liquidity-liquidity-8c12bd510fba

14/ Long Reads

3 Reasons I'm investing in Bitcoin by @LynAldenContact https://www.lynalden.com/invest-in-bitcoin/

3 Reasons I'm investing in Bitcoin by @LynAldenContact https://www.lynalden.com/invest-in-bitcoin/

Bitcoin Meets Banking As U.S. Bank Regulator Permits Cryptocurrency Custody by @HaileyLennonBTC https://www.forbes.com/sites/haileylennon/2020/07/22/bitcoin-meets-banking-as-us-bank-regulator-permits-cryptocurrency-custody/#6df5684a5479

Bitcoin Meets Banking As U.S. Bank Regulator Permits Cryptocurrency Custody by @HaileyLennonBTC https://www.forbes.com/sites/haileylennon/2020/07/22/bitcoin-meets-banking-as-us-bank-regulator-permits-cryptocurrency-custody/#6df5684a5479

3 Reasons I'm investing in Bitcoin by @LynAldenContact https://www.lynalden.com/invest-in-bitcoin/

3 Reasons I'm investing in Bitcoin by @LynAldenContact https://www.lynalden.com/invest-in-bitcoin/ Bitcoin Meets Banking As U.S. Bank Regulator Permits Cryptocurrency Custody by @HaileyLennonBTC https://www.forbes.com/sites/haileylennon/2020/07/22/bitcoin-meets-banking-as-us-bank-regulator-permits-cryptocurrency-custody/#6df5684a5479

Bitcoin Meets Banking As U.S. Bank Regulator Permits Cryptocurrency Custody by @HaileyLennonBTC https://www.forbes.com/sites/haileylennon/2020/07/22/bitcoin-meets-banking-as-us-bank-regulator-permits-cryptocurrency-custody/#6df5684a5479

15/ Long Reads

Ethereum 2.0 Economic Review: an analysis by @tehoban1 and @thomasborgers https://medium.com/@thomasborgers/ethereum-2-0-economic-review-1fc4a9b8c2d9

Ethereum 2.0 Economic Review: an analysis by @tehoban1 and @thomasborgers https://medium.com/@thomasborgers/ethereum-2-0-economic-review-1fc4a9b8c2d9

What explains the rise of AMMs? @hosseeb dissects the model behind automated market-making (AMM) https://medium.com/dragonfly-research/what-explains-the-rise-of-amms-7d008af1c399

What explains the rise of AMMs? @hosseeb dissects the model behind automated market-making (AMM) https://medium.com/dragonfly-research/what-explains-the-rise-of-amms-7d008af1c399

Ethereum 2.0 Economic Review: an analysis by @tehoban1 and @thomasborgers https://medium.com/@thomasborgers/ethereum-2-0-economic-review-1fc4a9b8c2d9

Ethereum 2.0 Economic Review: an analysis by @tehoban1 and @thomasborgers https://medium.com/@thomasborgers/ethereum-2-0-economic-review-1fc4a9b8c2d9 What explains the rise of AMMs? @hosseeb dissects the model behind automated market-making (AMM) https://medium.com/dragonfly-research/what-explains-the-rise-of-amms-7d008af1c399

What explains the rise of AMMs? @hosseeb dissects the model behind automated market-making (AMM) https://medium.com/dragonfly-research/what-explains-the-rise-of-amms-7d008af1c399

16/ Long Reads

The Rise of Stablecoins: A report from the @coinmetrics team https://coinmetrics.io/the-rise-of-stablecoins/

The Rise of Stablecoins: A report from the @coinmetrics team https://coinmetrics.io/the-rise-of-stablecoins/

Beijing unveils plan for blockchain-based government: A report by @egreechee https://technode.com/2020/07/16/beijing-unveils-plan-for-blockchain-based-government/

Beijing unveils plan for blockchain-based government: A report by @egreechee https://technode.com/2020/07/16/beijing-unveils-plan-for-blockchain-based-government/

The Rise of Stablecoins: A report from the @coinmetrics team https://coinmetrics.io/the-rise-of-stablecoins/

The Rise of Stablecoins: A report from the @coinmetrics team https://coinmetrics.io/the-rise-of-stablecoins/ Beijing unveils plan for blockchain-based government: A report by @egreechee https://technode.com/2020/07/16/beijing-unveils-plan-for-blockchain-based-government/

Beijing unveils plan for blockchain-based government: A report by @egreechee https://technode.com/2020/07/16/beijing-unveils-plan-for-blockchain-based-government/

Read on Twitter

Read on Twitter