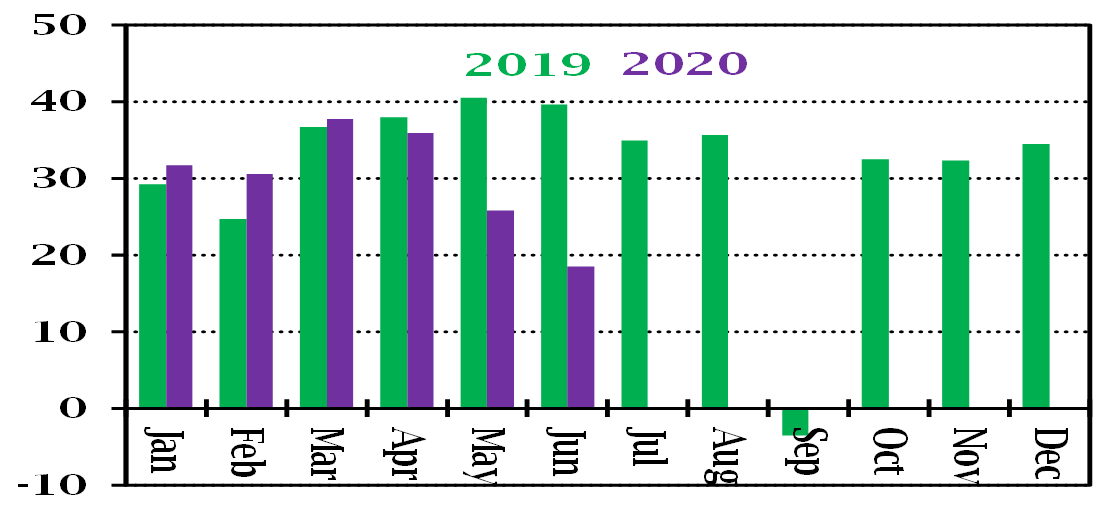

The following chart shows why we don't need to be too concerned about the recent surge in gov't debt:

Notice how net interest paid by the Treasury Dept has plummeted, despite the surge in debt. The average interest rate on Treasury debt was ~2.4% before the current crisis; it's been ~0.2% on debt issued since then (including extra debt + the rollover of old debt.

Note: the reason we had negative net interest in September 2019 is because we usually have negative net interest in September, that being the month the Treasury counts the interest the gov't earns on federal credit programs, like student loans.

Note also: this doesn't mean we shouldn't be concerned about all the extra gov't spending. My view is that it's the *spending* path that matters in the long run (more is typically bad), not as much the debt.

To be clear: the chart shows net interest paid each month by the Treasury Department, in $ billions.

Read on Twitter

Read on Twitter