Ethereum is on a rampage right now and it's mostly due to the pace of innovation, composability, and trustlessness of token models.

Decentralized derivative exchanges are gaining momentum as liquidity incentives are turbocharging TVL.

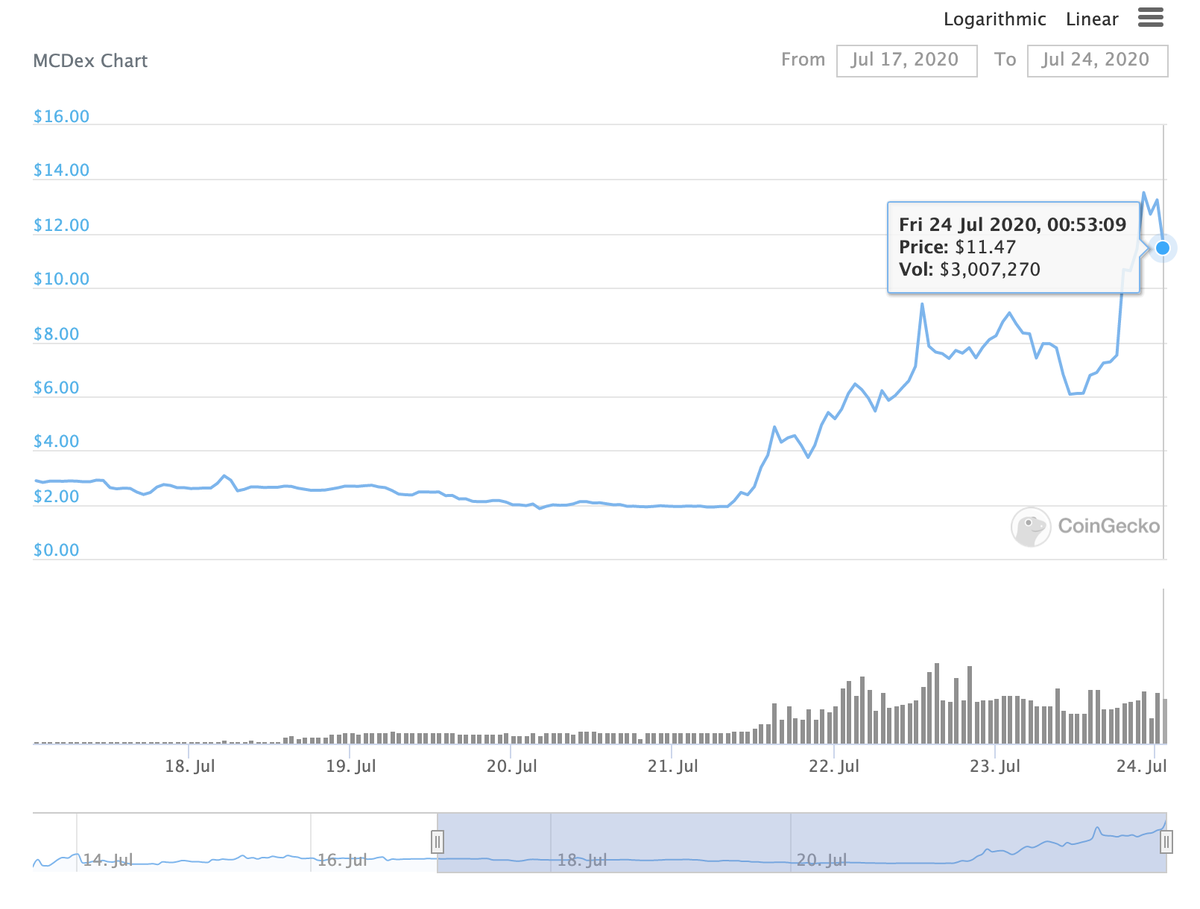

Take for example @MonteCarloDEX whose $MCB token has 5x'd over the last week.

They will soon release a synthetic dollar token that could be used as margin collateral.

Take for example @MonteCarloDEX whose $MCB token has 5x'd over the last week.

They will soon release a synthetic dollar token that could be used as margin collateral.

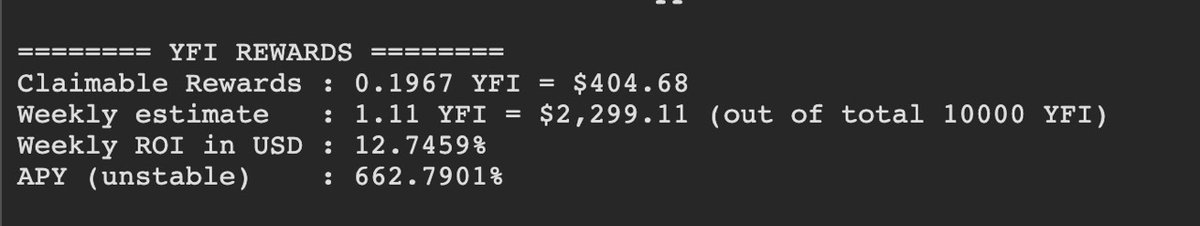

@iearnfinance's $YFI is dominating yield farming most likely because it's the most equitable token distribution since #bitcoin  .

.

Further, its composability lifts the entire ecosystem, as evident from the yCRV-YFI liquidity mining pool.

855% APY

cc @CurveFinance

.

.Further, its composability lifts the entire ecosystem, as evident from the yCRV-YFI liquidity mining pool.

855% APY

cc @CurveFinance

It's also hard to ignore that some of the most well-respected quantitative trading funds are bullish on the space, especially as value locked meteorically exceeds $450m in a matter of days https://twitter.com/Galois_Capital/status/1286029371526897664

No doubt that gas fees are high. L2 solutions are capable of alleviating the congestion, and it will be interesting to see how defi projects adopt L2 for interacting with each other.

Sooner or later there will be a bridge between L2s.

cc @zksync @loopring @abridged_io

Sooner or later there will be a bridge between L2s.

cc @zksync @loopring @abridged_io

This is not without risks. Building defi lego blocks could end up like an unstable inverted pyramid as flash f*ckers stress test the system. Long and short tail risks abound. Remember to put in capital you are willing to lose.

Read on Twitter

Read on Twitter