Something else I'm thinking about re: the Passion Economy: funding.

Not revenue from individual consumers (via merch, tips, subscriptions) but "institutional" funding from companies, syndicates, and... banks.

A few thoughts about the opportunities

/thread https://twitter.com/max_eyr/status/1283058172257861633

Not revenue from individual consumers (via merch, tips, subscriptions) but "institutional" funding from companies, syndicates, and... banks.

A few thoughts about the opportunities

/thread https://twitter.com/max_eyr/status/1283058172257861633

It's something I looked at earlier this year.

Companies like Substack, Gumroad, Podfund, Patreon are taking creator funding in their own hands through grants, rev share, and stipends https://twitter.com/max_eyr/status/1252973202948722688

Companies like Substack, Gumroad, Podfund, Patreon are taking creator funding in their own hands through grants, rev share, and stipends https://twitter.com/max_eyr/status/1252973202948722688

The idea behind this is that creators in the early days need a little help to even *start*.

Going full-time takes courage, and depending on your preferred medium, it comes with some inevitable upfront costs (a camera for video, a mic for podcasting...)

Going full-time takes courage, and depending on your preferred medium, it comes with some inevitable upfront costs (a camera for video, a mic for podcasting...)

Early funding can go towards:

* getting the set-up you need (lighting, camera, mic, tools, software, laptop, etc.)

* an emergency fund / safety net before you actually start making revenue

Both will boost your confidence as a creator

* getting the set-up you need (lighting, camera, mic, tools, software, laptop, etc.)

* an emergency fund / safety net before you actually start making revenue

Both will boost your confidence as a creator

But creators need funding later on as well. Whether that's for new gear, expanding into a new medium, paying the upfront costs of a larger project...

Like companies, creators have Free Cash Flow needs.

Like companies, creators have Free Cash Flow needs.

Tipping is great, but doesn't exactly address this.

You tip your favorite creators because you like them, not to fund their next project.

You're paying for their present work, not the future. And crowdfunding isn't feasible. What to do?

You tip your favorite creators because you like them, not to fund their next project.

You're paying for their present work, not the future. And crowdfunding isn't feasible. What to do?

There's a need for creator funding at all stages of their careers (the same way VCs invest at the Seed, or Series A/B/etc. stage)

And it's becoming especially crucial with the rise of One Person Companies (h/t @brettbivens) https://venturedesktop.com/One-Person-Companies-are-Still-Underrated-66fb1ad4d2ce49c4a77e9b99acbda3ff

And it's becoming especially crucial with the rise of One Person Companies (h/t @brettbivens) https://venturedesktop.com/One-Person-Companies-are-Still-Underrated-66fb1ad4d2ce49c4a77e9b99acbda3ff

It's not so crazy. Cash advances for example have long been a part of both the music and the publishing industries, for as long as labels and publishers have existed.

Advances are not patronage; they're, well, *advances* on future revenue you'll generate.

Advances are not patronage; they're, well, *advances* on future revenue you'll generate.

Lately more and more music companies have been iterating on the model. Some for a fee, some for free.

A few recent examples:

* stem: https://www.musicbusinessworldwide.com/stem-offers-advances-via-new-scale-funding-product-allowing-artists-to-keep-100-of-their-masters/

* UMPG: https://www.musicbusinessworldwide.com/universal-music-publishing-group-launches-new-writer-portal-that-offers-no-fee-advances/

* Amuse: https://www.musicbusinessworldwide.com/amuse-is-capable-of-offering-1m-plus-advances-whats-its-long-term-game-plan/

A few recent examples:

* stem: https://www.musicbusinessworldwide.com/stem-offers-advances-via-new-scale-funding-product-allowing-artists-to-keep-100-of-their-masters/

* UMPG: https://www.musicbusinessworldwide.com/universal-music-publishing-group-launches-new-writer-portal-that-offers-no-fee-advances/

* Amuse: https://www.musicbusinessworldwide.com/amuse-is-capable-of-offering-1m-plus-advances-whats-its-long-term-game-plan/

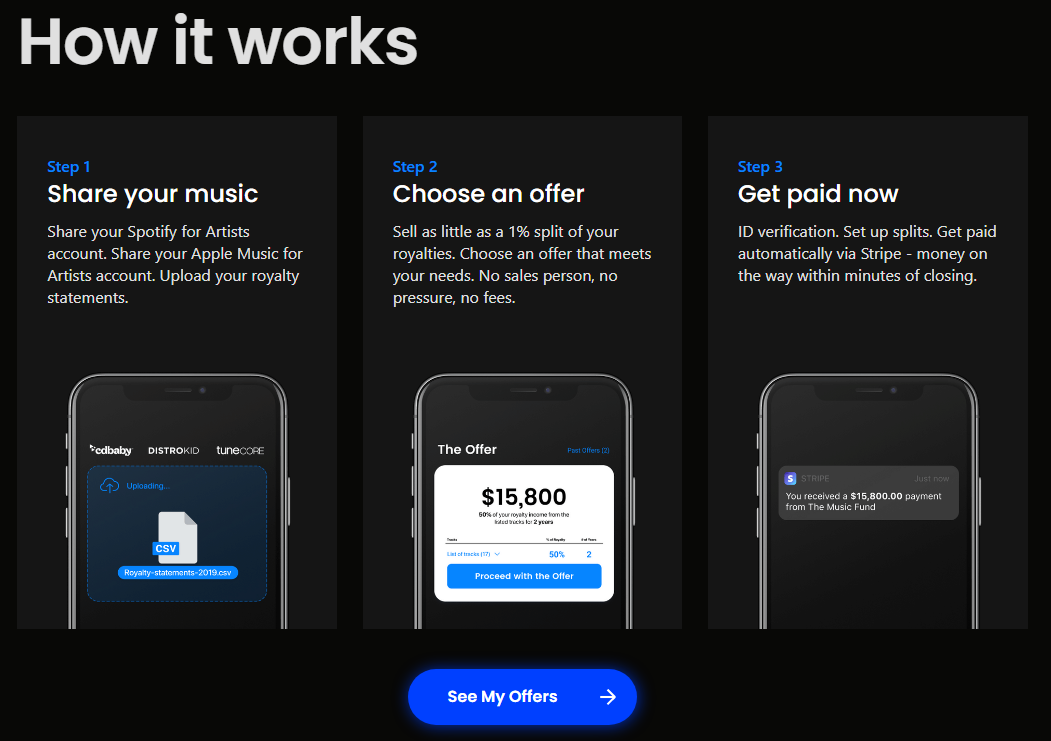

Some now focus solely on music advances.

Here are two examples (there's probably more out there)

https://themusic.fund/

https://openonsunday.com/

Must be good business!

Here are two examples (there's probably more out there)

https://themusic.fund/

https://openonsunday.com/

Must be good business!

Music is an obvious use case. With streaming now ubiquitous, companies have good enough visibility over an artist's future earnings

That's make it easy to loan against, or to price a catalogue's economic potential

The Music Fund uses artists' Spotify and Apple Music accounts

That's make it easy to loan against, or to price a catalogue's economic potential

The Music Fund uses artists' Spotify and Apple Music accounts

I think we'll see this model expand to more media very soon.

Last month, Karat launched "a credit card for online creators." Creators can use Karat for their business-related expenses and... receive advances on sponsorship payments! https://techcrunch.com/2020/06/25/karat-black-card/

Last month, Karat launched "a credit card for online creators." Creators can use Karat for their business-related expenses and... receive advances on sponsorship payments! https://techcrunch.com/2020/06/25/karat-black-card/

The underwriting model is analytics-driven and looks at the size of a creators' following, their current revenue, and what platforms they're using at the moment.

That's incredibly smart, and a foreshadowing of what's to come for creator funding in general

That's incredibly smart, and a foreshadowing of what's to come for creator funding in general

Another model I could see emerge is... syndicates. (yes, à la Angellist!)

The same way individual investors pool money into syndicates to fund startups, I think we'll see individual fans fund their favorite creator, making collective bets on high-potential individuals.

The same way individual investors pool money into syndicates to fund startups, I think we'll see individual fans fund their favorite creator, making collective bets on high-potential individuals.

This opens up a world of opportunities - and questions.

For instance:

* How do you reward the fans spotting the talent? Do they get carry, the way a syndicate lead does?

* Is it a loan? An advance? Are you buying into future revenue? https://twitter.com/thejerrylu/status/1273268723030384640

For instance:

* How do you reward the fans spotting the talent? Do they get carry, the way a syndicate lead does?

* Is it a loan? An advance? Are you buying into future revenue? https://twitter.com/thejerrylu/status/1273268723030384640

* How big can the upside be? Is it capped?

* How do you enable the best talent-spotters to become agents, managers, or business partners?

* Who can invest? Is it just accredited investors? (Then you get the investing, without the actual fandom)

* How do you enable the best talent-spotters to become agents, managers, or business partners?

* Who can invest? Is it just accredited investors? (Then you get the investing, without the actual fandom)

The Ownership Economy seems like a viable approach from here.

It turns fans into stakeholders, allows them to share in the success of the creator through "novel economic rewards, platform governance, or new forms of social capital" https://variant.fund/the-ownership-economy-crypto-and-consumer-software/

It turns fans into stakeholders, allows them to share in the success of the creator through "novel economic rewards, platform governance, or new forms of social capital" https://variant.fund/the-ownership-economy-crypto-and-consumer-software/

Read on Twitter

Read on Twitter