0/ We published our latest piece on SPAC's given the interest post the $4.0bn offering done by @BillAckman $PSTH/U yesterday. We provide some high level details on structural considerations / ideal FinTech targets https://medium.com/@John_Street_Capital/return-of-the-spac-4836b7b0e3f

1/ While SPAC's have been around for 3 decades the recent buzz has surpassed the frenetic energy around them in '06-'07. Why Now? We have improved sponsors w/ people like Bill Foley, @chamath & @BillAckman cleaning up historical economic models that had big overhangs w/ promotes

2/ The success of deals like $SPCE $DKNG $NKLA & early market receptivity to $SPAQ / $SHLL begets further interest. With strong price performance & the removal of the historical negative connotation associated with SPACs more high quality sponsors / targets are considering them

3/ The revolt from SV vs. the IPO market is palatable; look no further than @bgurley thoughts regarding $NCNO, $API, $LMND, $JAMF & the principal-agent issue that is front & center when these names are up 50%-200% on Day 1. As they look at alts SPAC's become more compelling

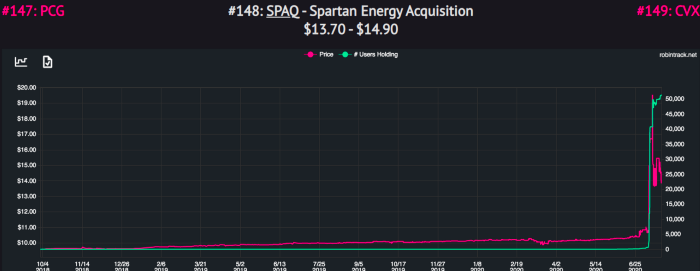

4/ Performance has been strong as the @RobinhoodApp "Mafia" are becoming liquidity providers in the "hybrid phase" that sits between arb funds and long only / long/short fundamental funds. Look no further than $SPAQ ownership

5/ If '18-'19 showed us that many late stage private companies got ahead of where they would be in public markets with $UBER $LYFT $CSPR being cut by more than half, with WeWork never getting out the door. If $NKLA could be $13bn w/ $0 sales & $DKNG at $13.5bn thats interesting

6/ In a 0% interest rate world with a lack of M&A there's plenty of IPO demand from arb funds that don't have alternative places to park capital.

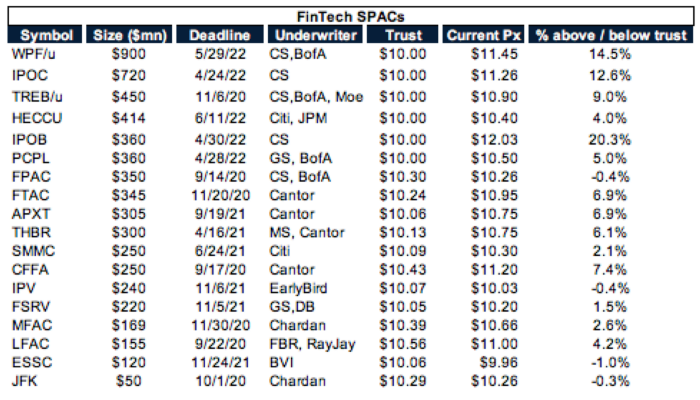

7/ With $20bn of dry powder and ~$6.0bn of FinTech SPAC mandates we went through a few deals we'd like to see happen

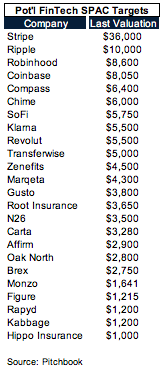

8/ The biggest meme convergence trade would be @RobinhoodApp going public via a SPAC. Given the size $WPF could do it (but not Foley's DNA), so could $PSTH (but probably too small). @chamath could surprise with a PIPE as it fits his SV network.

9/ @coinbase has discussed a "direct listing" & @brian_armstrong has talked down IPO's. Tiger led a $300mn Series E round in Oct '18 at an $8.05bn valuation. $IPOC / Chamath have familiarity w/ the business & tough to justify that valuation with "reported" metrics.

10/ @SoFi last raised at a $5.75bn valuation & acquired @Galileo_Tweets / applied for a national bank charter. With SoftBank ownership it might be tough to get. Going public can dilute their stake & $WPF / Bill Foley have had interest in that type of business in the past.

11/ Foley & @anthonynoto would be too in 1 room. Which is why $WPF should really go after @Marqeta which is in Foley's sweetspot with time at $FNF $FIS $BKFS and $FGL.

12/ One of the more colorful characters in FinTech is @mcagney. He's motivated to beat SoFi out of the gate with @Figure. While he wouldn't attract a "top quality" sponsor there's plenty of dry powder for a $1.5-$2.0bn deal for him to go public first.

13/ Finally given the size of $PSTH Ackman could make a run at @stripe which would be a fitting way to top off this SPAC mini-cycle. Given the age of the company there has to be some RSU / option issues with employees seeking liquidity. Its a classic Ackman business w/ a moat

14/ We put a longer list of potential FinTech targets together embedded below but given the dry powder on the sidelines....everyone is "in play."

15/ Whether or not you think this SPAC trend is structural or cyclical with $20.0bn of dry powder on the sidelines we can easily see $200.0bn+ of deals over the next 6-12 months. It's important to know who is sitting on what balance sheet & what their mandate it.

Read on Twitter

Read on Twitter