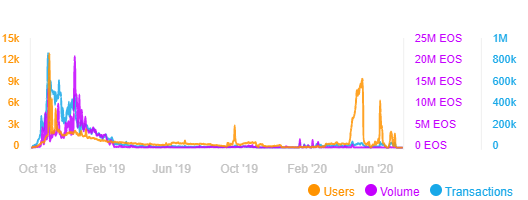

I'm surprised no one has drawn the comparison between the EOS dice craze and Defi yield farming. I suppose it would be an unfortunate comparison for insiders to make. This is a bit different as liquidity makes the protocol more valuable.

The dice apps used "mining" ie giving their own token to people who bet on their platform. This both juiced the platforms activity and the yield for current token holders who could stake in return for part of the profits made vs bettors.

Of course, this did not work out. Projects rapidly sprung up offering increased rakeback to the losers and increased yield for the stakers. Many projects had aggressive emission schedules and they would let insiders mine the first 50% of the token inside a week before...

the public launch. Shit got wild. I even found a VC that "invested" in one of the bigger scams. https://www.crunchbase.com/organization/jrr-crypto#section-investments

(FAST)

(FAST)

The end result: Many scams, many ripoff projects. The first and only real one left standing has a 3m marketcap, down roughly 95%. Absolute wild west. I caught a well known Defi guy dumping a project one day after his tweetstorm about it, never to be mentioned again...

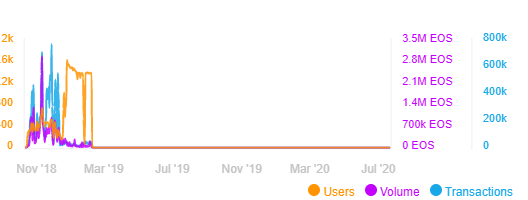

Dice is still going today by the way. 91% staked roughly 1k users every 24hrs. Probably somewhat legit volume at this point due to declining rewards. https://www.eosdividends.com/

Read on Twitter

Read on Twitter