A little bit on the geography of the profits U.S. firms earn abroad ...

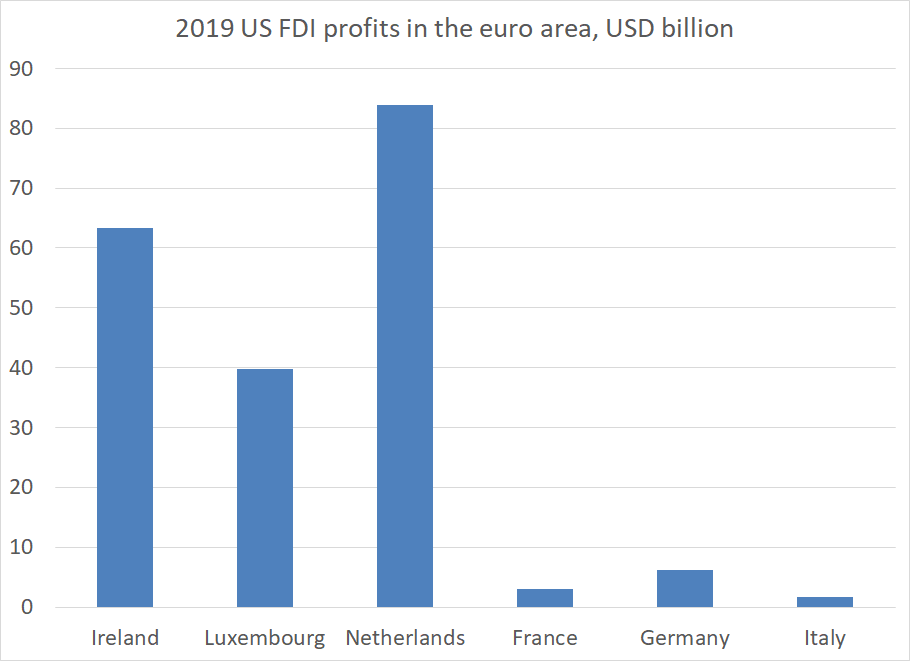

Say in the euro area.

Notice a pattern?

There is no real correlation between the size of the profits of US firms and the size of the country's economy ...

1/n

Say in the euro area.

Notice a pattern?

There is no real correlation between the size of the profits of US firms and the size of the country's economy ...

1/n

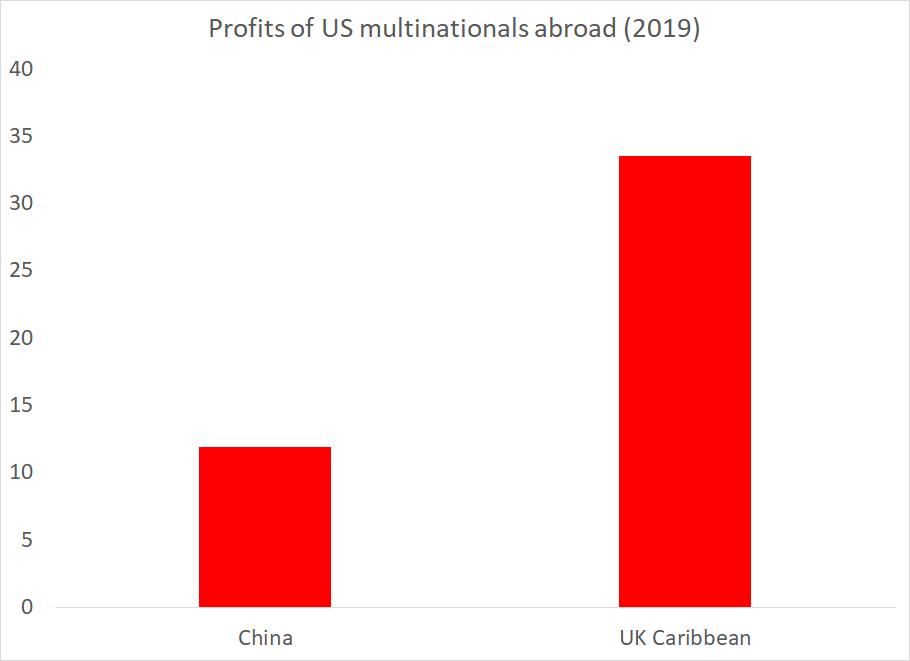

The U.S. has spent the last three years negotiating to improve the conditions facing U.S. firms in China ...

But right now, the Caymans (together with the British Virgin Islands) generate three times more profit for U.S. firms than all of China.

But right now, the Caymans (together with the British Virgin Islands) generate three times more profit for U.S. firms than all of China.

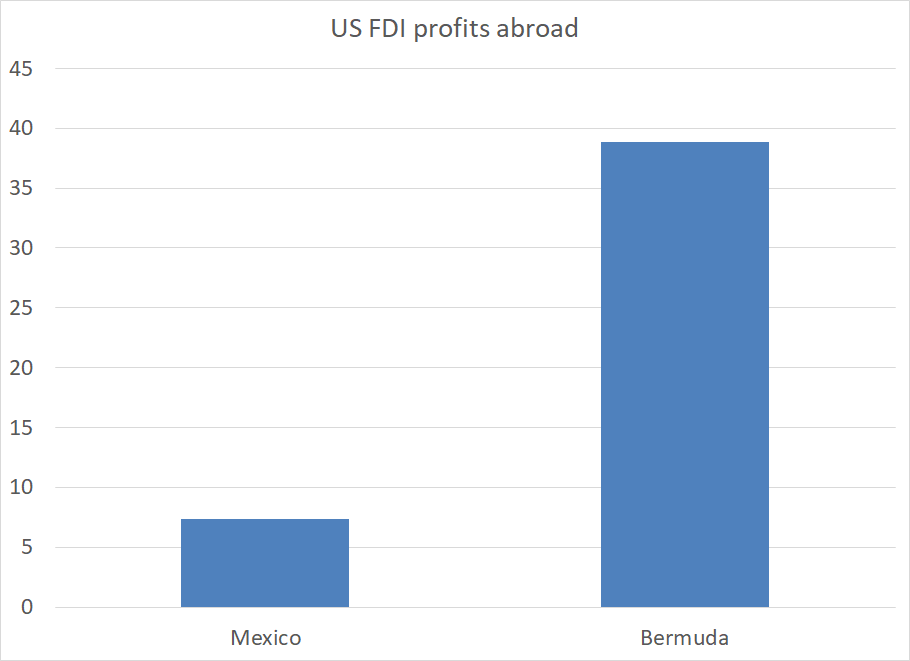

The U.S. auto industry makes a ton of cars (and now light trucks) in Mexico. Measures to limit the shift in auto production toward law wage countries were at the center of the USMCA.

But Bermuda generates five times more profits for the US than Mexico

But Bermuda generates five times more profits for the US than Mexico

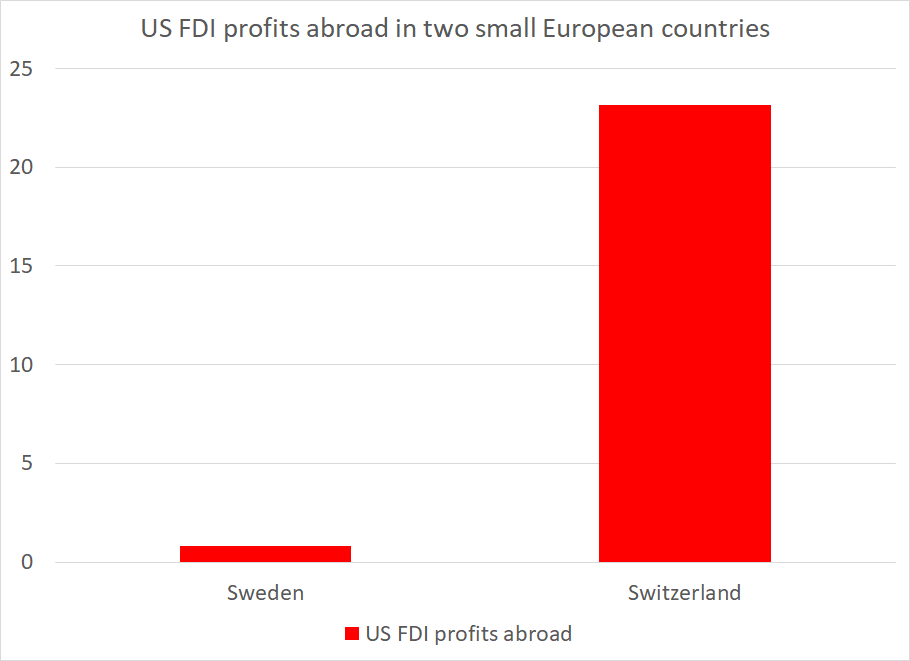

Switzerland and Sweden are both mid-sized European economies with mountains and lakes and a tradition of manufacturing excellence.

Only one though generates big profits for U.S. firms ....

Only one though generates big profits for U.S. firms ....

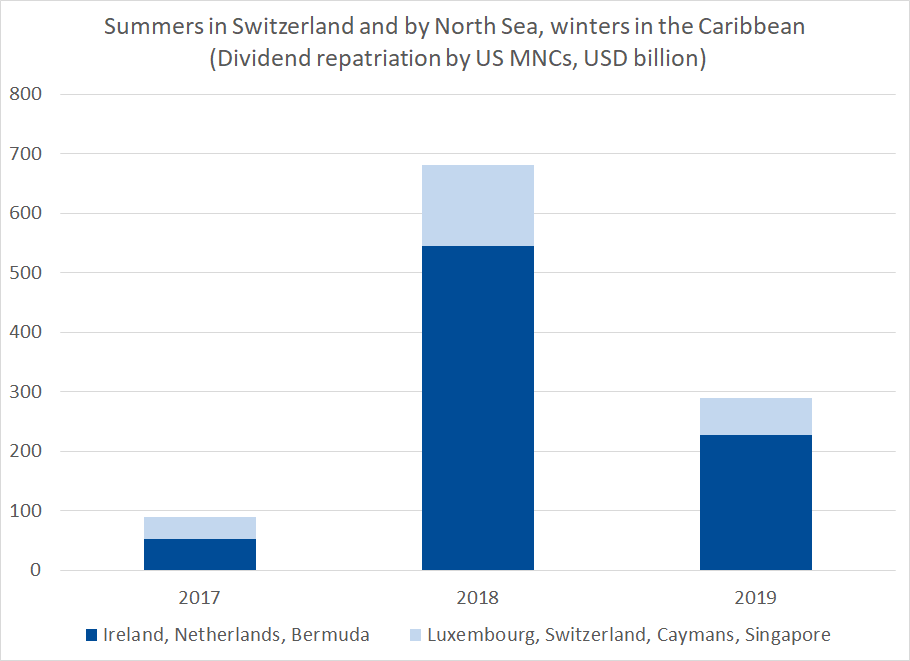

All those U.S. corporate profits that were trapped abroad?

They weren't trapped in the world's big economies. They were trapped in the world's low tax jurisdictions ...

The seven main low tax jurisdictions have returned almost a trillion to their US parents in the last 2 years

They weren't trapped in the world's big economies. They were trapped in the world's low tax jurisdictions ...

The seven main low tax jurisdictions have returned almost a trillion to their US parents in the last 2 years

with the latest BEA data, the following facts easily check out ...

50% of all US FDI abroad is in the seven main low tax jurisdictions. And those seven jurisdictions account for 60% of all profits U.S. firms earn abroad.

https://www.bea.gov/news/2020/direct-investment-country-and-industry-2019

50% of all US FDI abroad is in the seven main low tax jurisdictions. And those seven jurisdictions account for 60% of all profits U.S. firms earn abroad.

https://www.bea.gov/news/2020/direct-investment-country-and-industry-2019

Read on Twitter

Read on Twitter