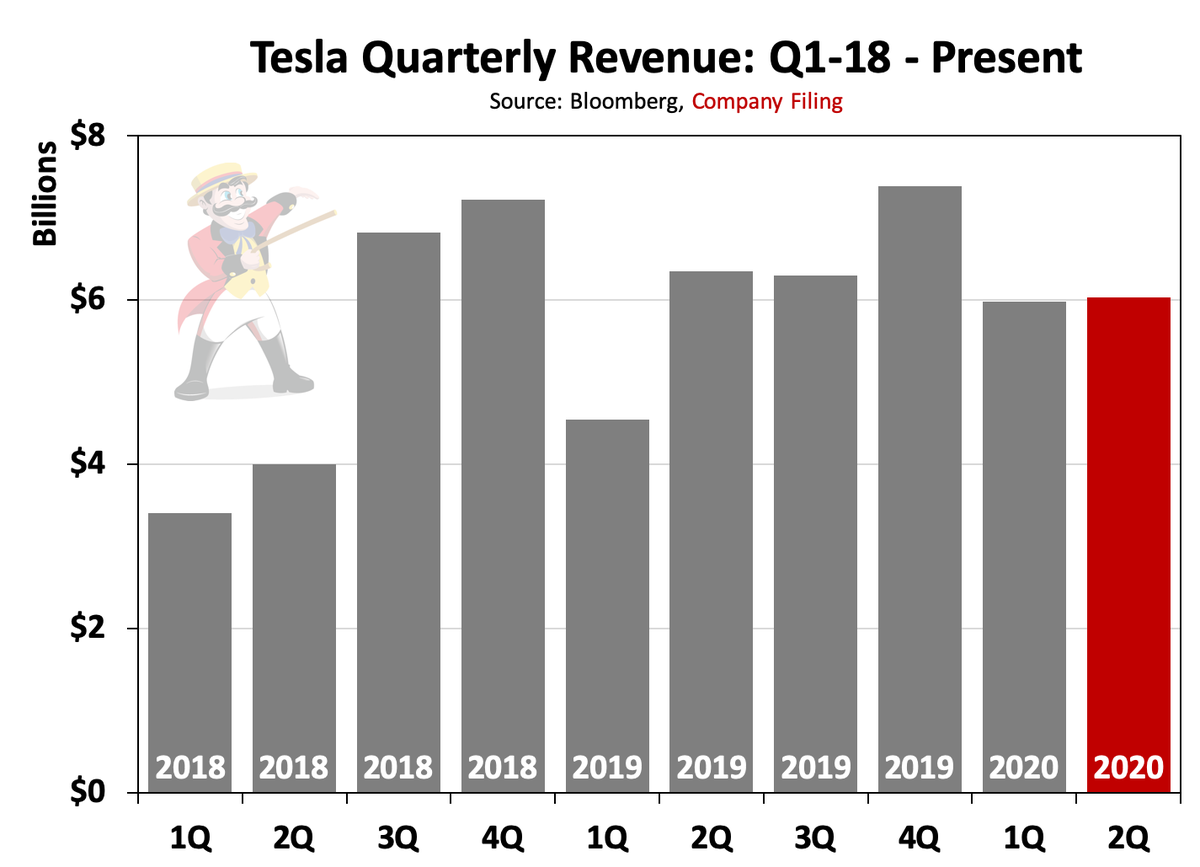

1/ A few charts on Tesla's quarter. I'll leave the obvious shenanigans around accounts receivable to others. We begin with overall revenue. In a post-truth world, this is "growth". $TSLAQ

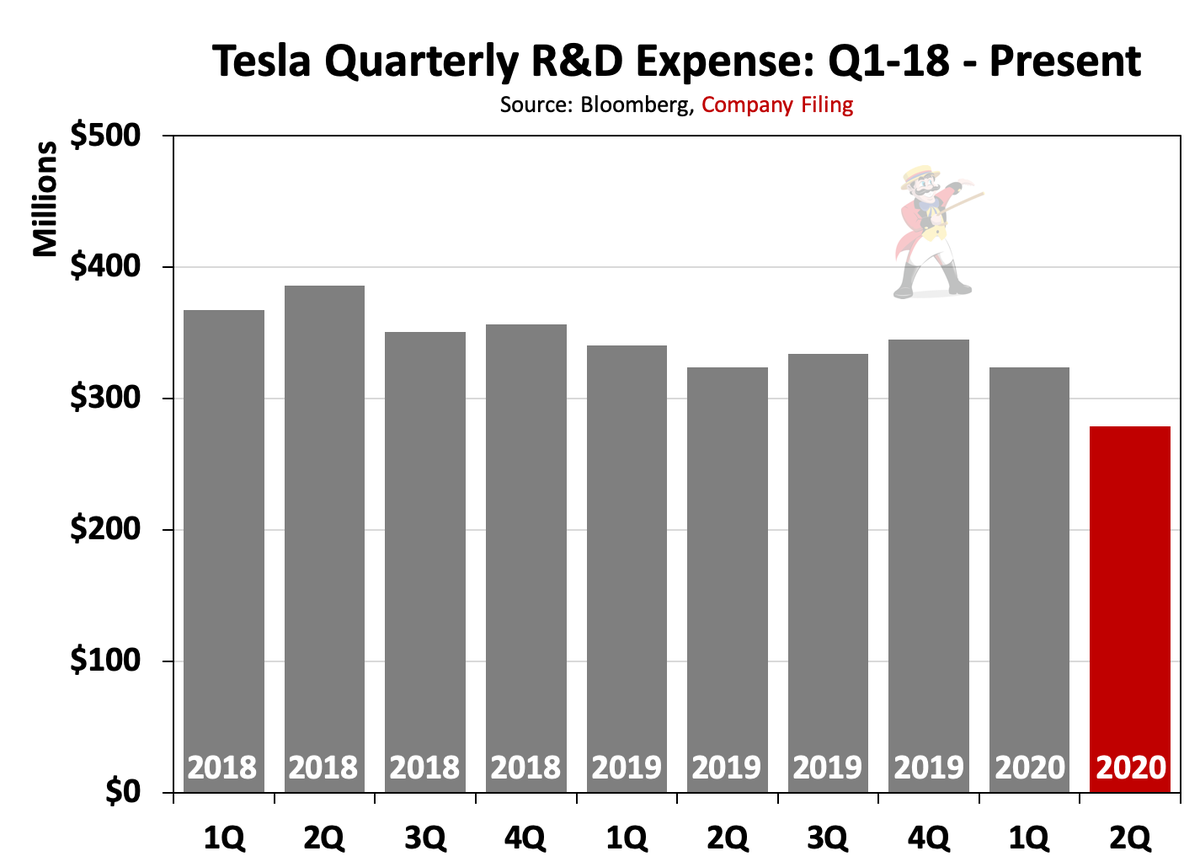

2/ Tesla is allegedly on the cusp of developing Level 5 autonomy, building a new electric semi/Roadster/Cybertruck, creating breakthrough solar technology, and developing a million mile battery. Yet, they've cut R&D to levels not seen since 2016. $TSLAQ

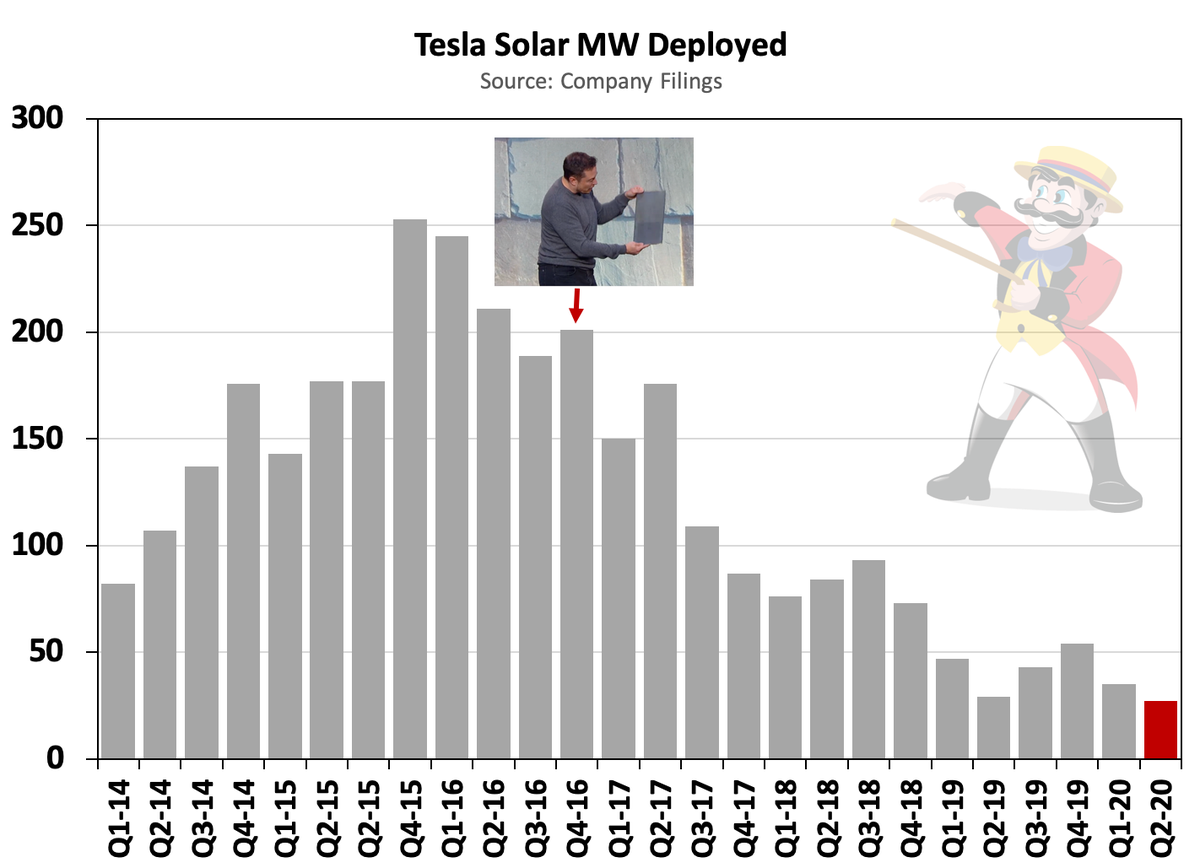

3/ Jim Cramer would have you believe that Tesla has an amazing solar business. Jim Cramer often says things that are absurd. For some reason, he goes on TV and says provably false things about Tesla with alarming regularity. $TSLAQ

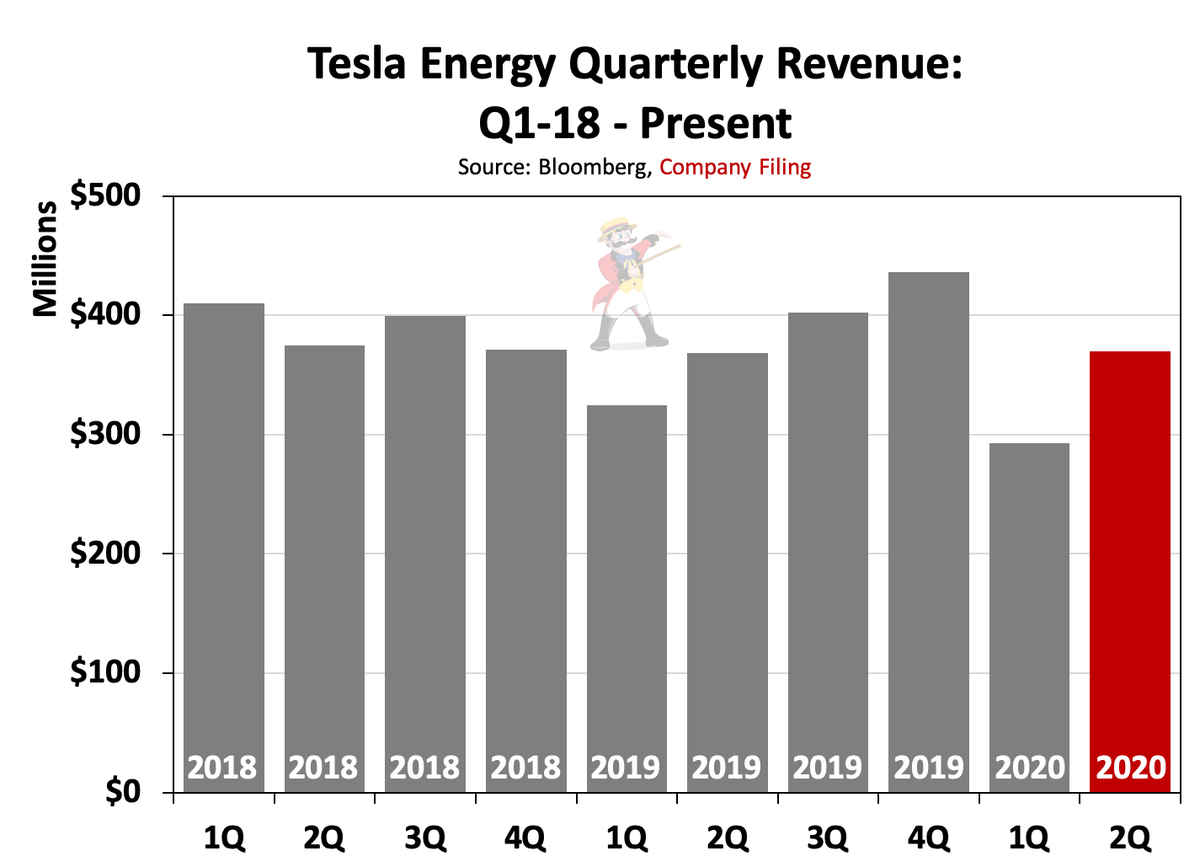

4/ Here is the wonderful Tesla Energy business revenue "growth". So far in 2020, Tesla Energy has returned only 4.8% GROSS margin. Energy generation and storage accounts for just 6% of Tesla's revenue. Tesla is a manufacturer of cars. Nothing more.

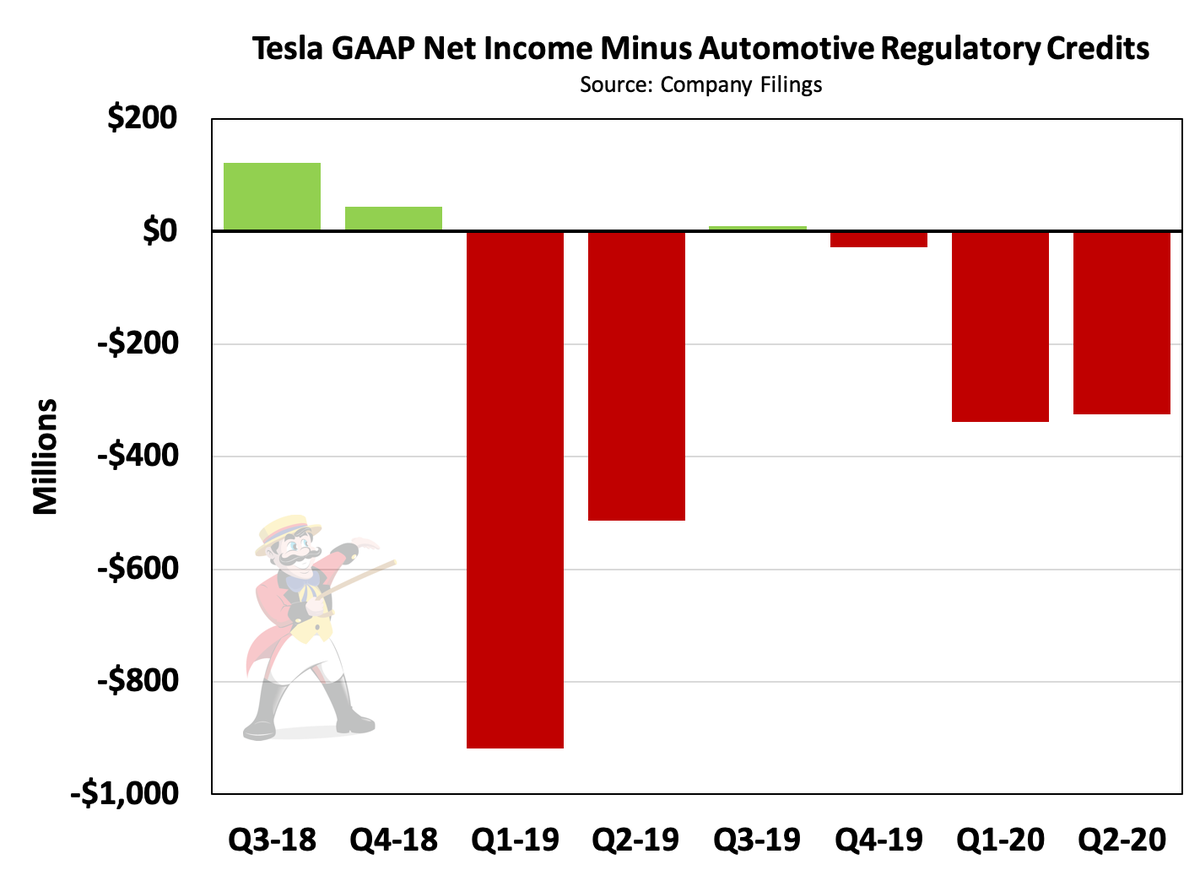

5/ Even with all the accounting games (warranty reserves, refusing to repair cars, charging customers for software they didn't buy, selling full self-driving vaporware), the underlying core of Tesla's business loses money net of regulatory credits. $TSLAQ

6/ Anybody who says Tesla is a technology leader, a growth company or a profitable business is either knowingly lying or incredibly lazy. In 2020, with information so widely and freely available, there's not much distinction between the two. $TSLAQ

Read on Twitter

Read on Twitter