1/EM Core Inflation Subdued During COVID

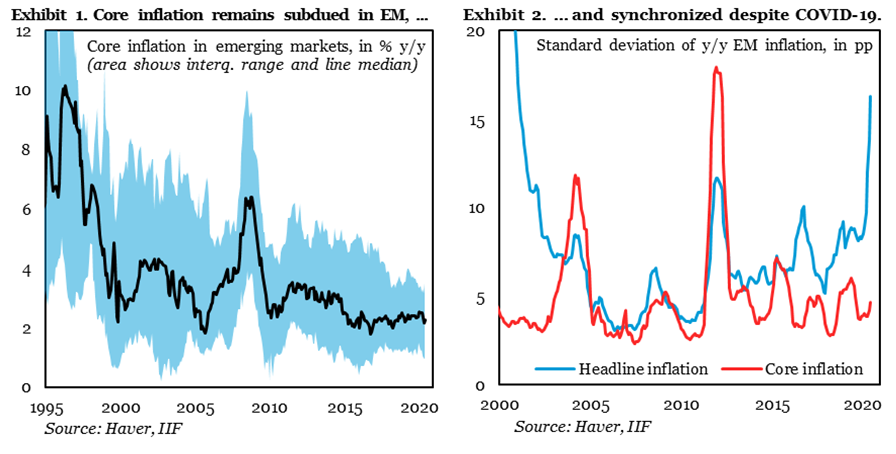

• #EmergingMarkets core inflation slowed in Q2 compared to early 2020

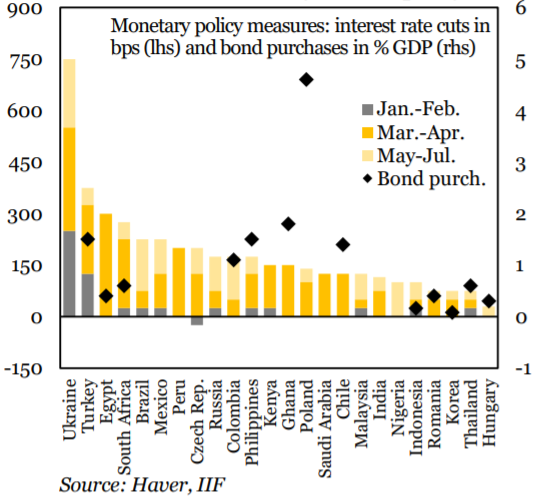

• This, together with higher credibility, allowed many central banks to ease policy

• While inflation risks appear moderate, fiscal dominance could change the picture

• #EmergingMarkets core inflation slowed in Q2 compared to early 2020

• This, together with higher credibility, allowed many central banks to ease policy

• While inflation risks appear moderate, fiscal dominance could change the picture

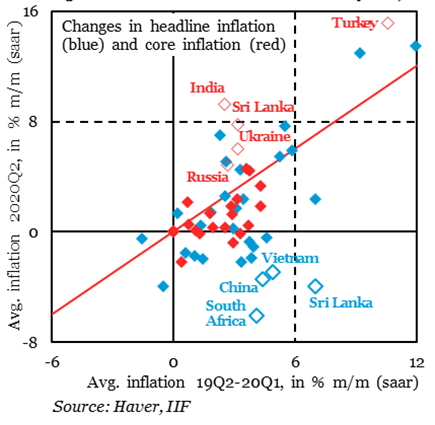

2/ For now at least #COVID has proved not inflationary for most #EmergingMarkets Comparing aver 2020Q2 and the preceding twelve months. Increasing heterogeneity of headline inflation and the relative stability of core inflation.

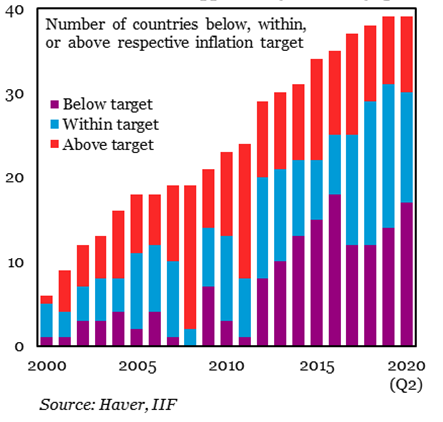

3/ Higher credibility and inflation targeting likely helped trend decline in headline (and core) inflation in #EmergingMarkets. @BHilgenstockIIF Empirical studies suggest that inflation decreases after the introduction of inflation targeting—an approach roughly 40 EM CBs.

4/ A broad-based decline in FX pass-throughs is also supporting lower inflation in many cases. While a few central banks continue to pay close attention to FX risks, this is largely due to high foreign ownership of local bonds and, in some cases, corporate FX indebtedness.

5/ Looking ahead, could a combination of increasing debt, higher neutral rates, and fiscal dominance drive inflation higher? We continue to believe that the risk is moderate for #EmergingMarkets. Important note to by @ojblanchard1 https://www.piie.com/blogs/realtime-economic-issues-watch/high-inflation-unlikely-not-impossible-advanced-economies?_cldee=ZXJpYmFrb3ZhQGlpZi5jb20=

Read on Twitter

Read on Twitter