Thread;

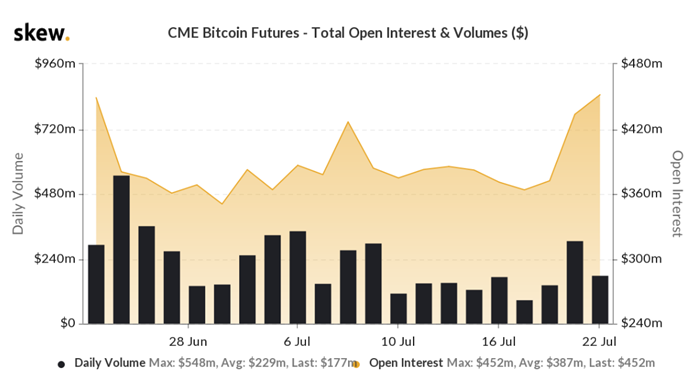

OI at the CME has increased over the last 4 weeks from $364m to $452m (24%)

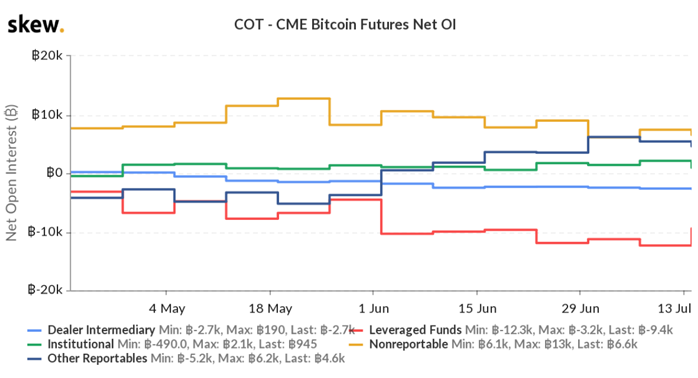

leveraged funds decreased their net short exposure by about 23% last week.

Dealer intermediary has been getting shorter over this period, representing a liquidity void on the market.

OI at the CME has increased over the last 4 weeks from $364m to $452m (24%)

leveraged funds decreased their net short exposure by about 23% last week.

Dealer intermediary has been getting shorter over this period, representing a liquidity void on the market.

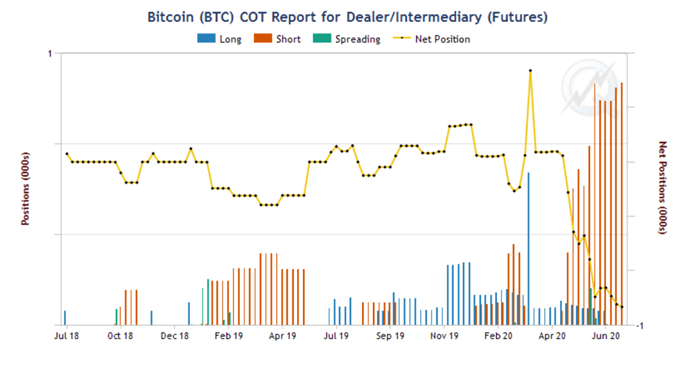

The Dealer intermediary over time can be useful to see where there is an issue between supply and demand;

Currently it is stepping in, filling short volume (i.e. there other side to the longs) on a level previously unseen in the last 2 years.

Currently it is stepping in, filling short volume (i.e. there other side to the longs) on a level previously unseen in the last 2 years.

This was similar back in Jan->April 2019 as Bitcoin broke out of the 3/4k range.

Also the largest 4 traders have generally been adding to their positions and reducing their shorts

Neither of these were true the case in the last 10k Consolidation in mid-2019.

Also the largest 4 traders have generally been adding to their positions and reducing their shorts

Neither of these were true the case in the last 10k Consolidation in mid-2019.

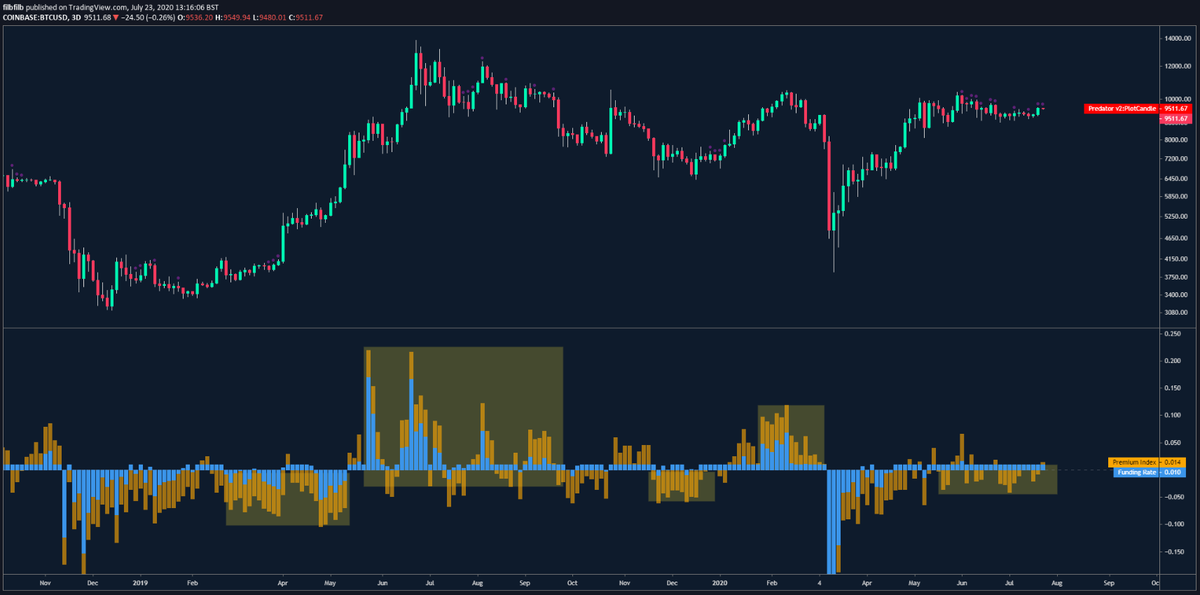

Funding Rates have also been showing more accumulation-like behaviour than that of pending imminent breakdowns.

Also, there is a big bid 8.5-9k just above the 20ma.. implying that it could be a crowded trade. - it certainly looks popular.

Also, there is a big bid 8.5-9k just above the 20ma.. implying that it could be a crowded trade. - it certainly looks popular.

So which is it going to be then?

I’d suggest that on closer inspection, the CME, although only part of the market, is more aligned to Q1 2019 than mid 2019.

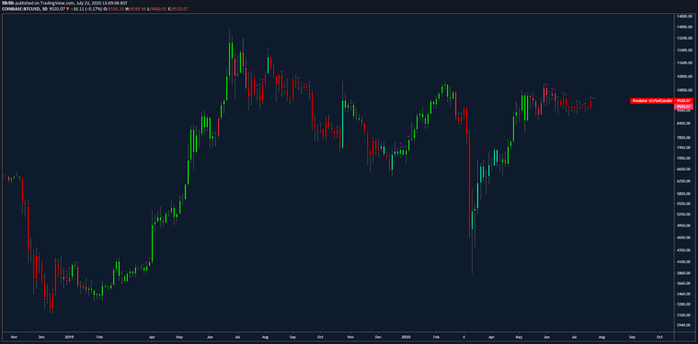

Assuming we can close here today, it’s a reclaim of the mid BBand.

I’d suggest that on closer inspection, the CME, although only part of the market, is more aligned to Q1 2019 than mid 2019.

Assuming we can close here today, it’s a reclaim of the mid BBand.

Given the print money endlessly narrative, my money is on up.

Ideally, I would like confirmation on the 3 day on the Predator indicator, we need more volume for that but I'm expecting we will see it green by the end of this month assuming no big selloff.

Ideally, I would like confirmation on the 3 day on the Predator indicator, we need more volume for that but I'm expecting we will see it green by the end of this month assuming no big selloff.

Agree with me or not.. whatever happens, when this thing goes, it's going to go big.

Read on Twitter

Read on Twitter