Inflation tail risks have risen, mostly to the downside but some also to the upside

Today's #BIS_Bulletin sorts through the cases

https://www.bis.org/publ/bisbull28.htm

Today's #BIS_Bulletin sorts through the cases

https://www.bis.org/publ/bisbull28.htm

Phillips curve reasoning carries us a long way: subdued activity increases downside tail risk to inflation; but this is not the only story on inflation

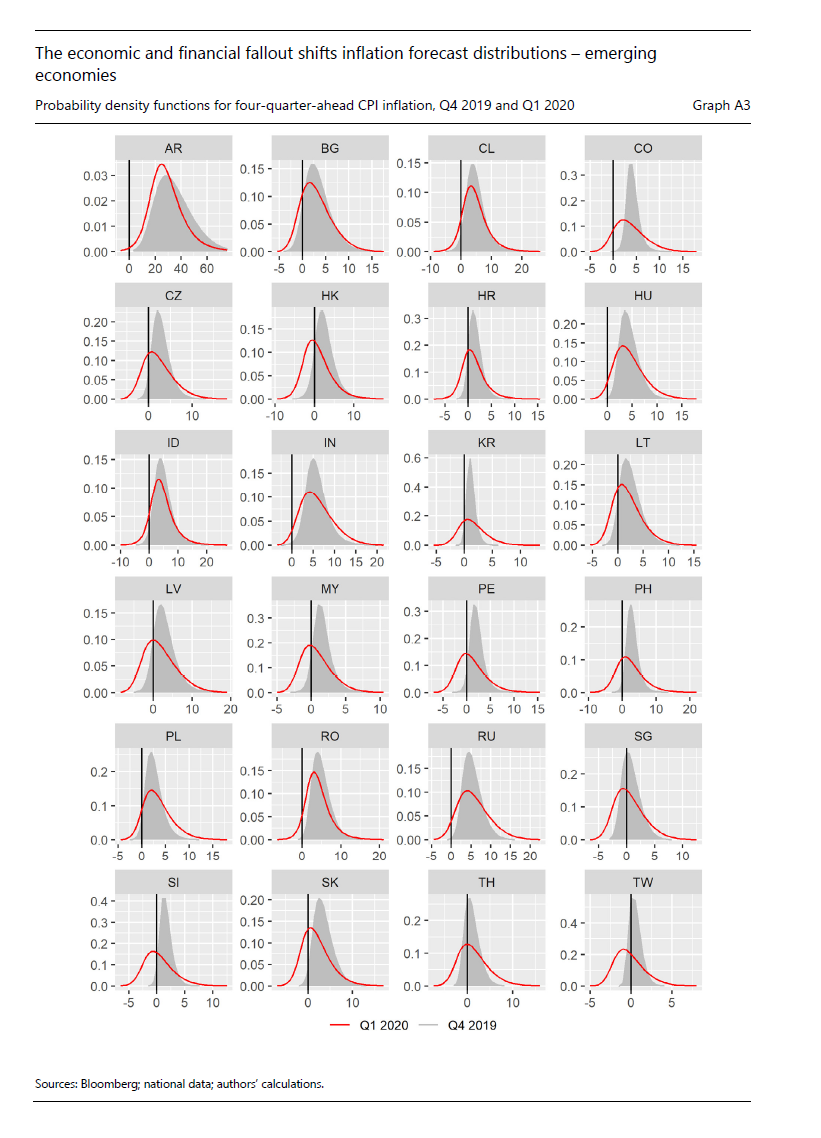

The authors get at tail risks through quantile regressions that track outliers in realised inflation; the red curves below give the densities of 4-quarter ahead probability densities for inflation

Some additional cases in the online annex here https://www.bis.org/publ/bisbull28_appendix.pdf

For most countries, downside risk to inflation has risen; this reflects the Phillips curve reasoning where slower activity due to the pandemic puts downward pressure on inflation

But upside risk to inflation is also heightened in some cases, especially in those economies that suffered financial crises during the sample period

Explanatory variables pick up what accounts for the shifts in tail risks; financial instability (picked up by equity volatility) and currency depreciation loom large

Phillips curve reasoning can break down during financial crises; depressed economies can see a surge in inflation depending on the monetary policy response

Emerging markets are familiar with these episodes

Emerging markets are familiar with these episodes

I discussed some of the mechanisms with @tracyalloway and @TheStalwart on their podcast; listen from 34'35" when Tracy asks me about MMT

(Spoiler: monetary financing by central banks don't end well in emerging markets...) https://www.bloomberg.com/news/audio/2020-07-01/what-central-banks-learned-from-the-crisis-podcast

(Spoiler: monetary financing by central banks don't end well in emerging markets...) https://www.bloomberg.com/news/audio/2020-07-01/what-central-banks-learned-from-the-crisis-podcast

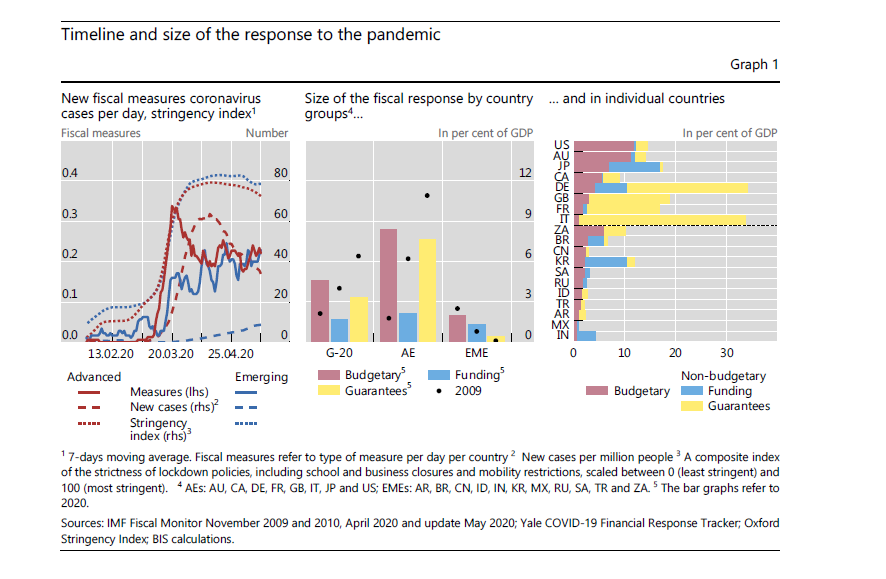

The issues in today's #BIS_Bulletin are likely to prove very important going forward; if the pandemic is protracted, fiscal space is key, but not everyone has it

See this earlier #BIS_Bulletin https://www.bis.org/publ/bisbull23.htm

See this earlier #BIS_Bulletin https://www.bis.org/publ/bisbull23.htm

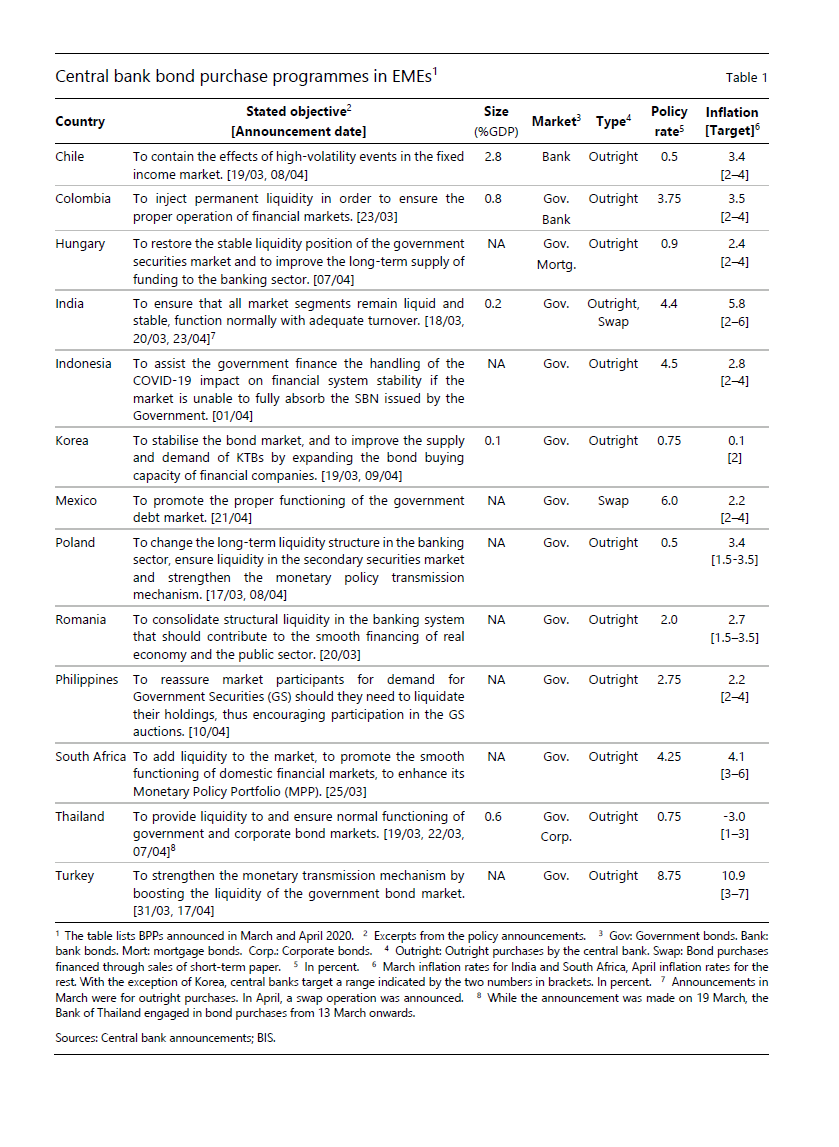

Emerging market economies have responded well, especially in local currency sovereign bond markets where direct purchases by central banks quelled the sharp (but short-lived) stress in March; but the purchases were very small, lest they test the limits https://www.bis.org/publ/bisbull20.htm

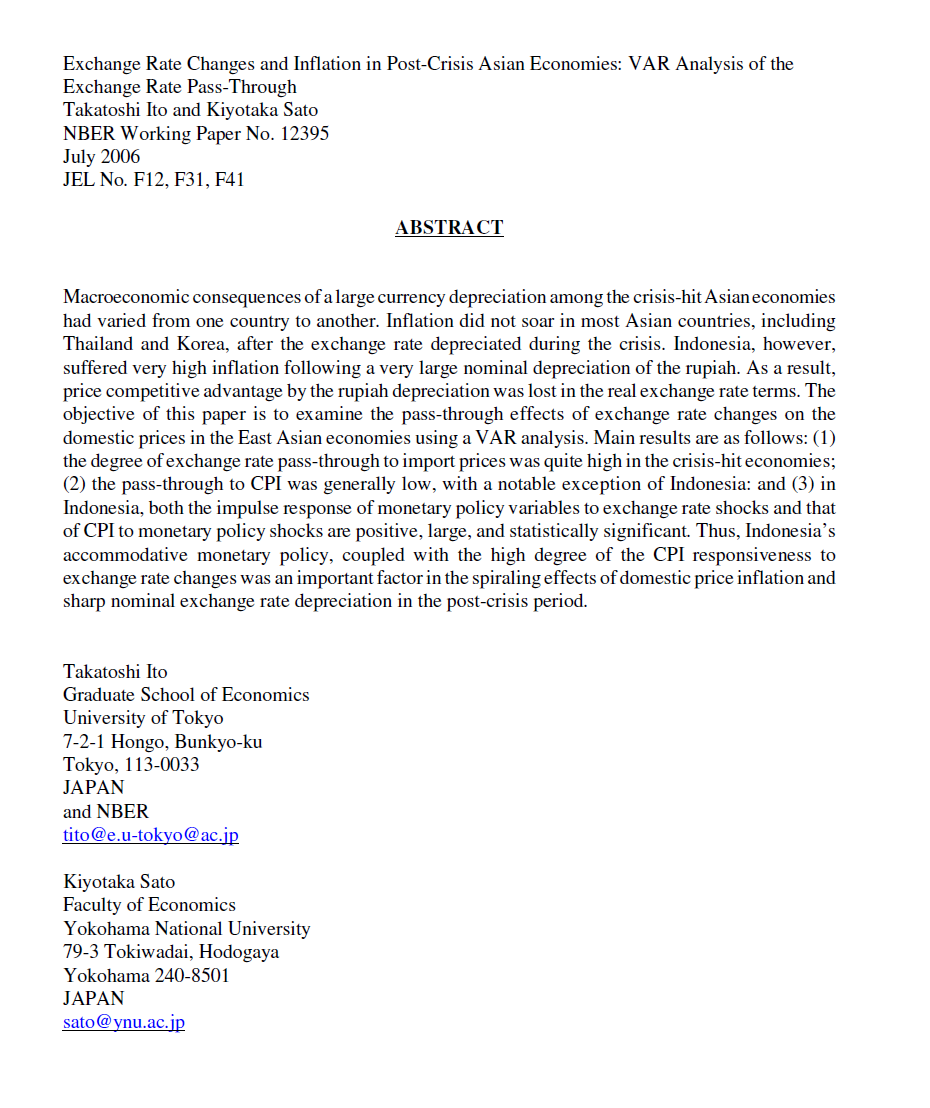

History can be revealing, especially when countries experience different outcomes to the same shock

The Asian Financial Crisis of 1997-8 is not one associated with higher inflation, but there was a diversity of outcomes depending on the monetary policy response

This classic by Ito and Sato is worth re-reading https://www.nber.org/papers/w12395.pdf

This classic by Ito and Sato is worth re-reading https://www.nber.org/papers/w12395.pdf

Read on Twitter

Read on Twitter