"The EU itself is set to become one of Europe’s largest bond issuers" write @MAmdorsky & @TomStub in today's @FT.

But what type of debt instruments will the EU (via the @EU_Commission) actually issue?

Let's take a closer look. A (longer) thread. 1/x https://www.ft.com/content/da0f71e4-e629-404d-ba65-fe1dcf3d4a14

But what type of debt instruments will the EU (via the @EU_Commission) actually issue?

Let's take a closer look. A (longer) thread. 1/x https://www.ft.com/content/da0f71e4-e629-404d-ba65-fe1dcf3d4a14

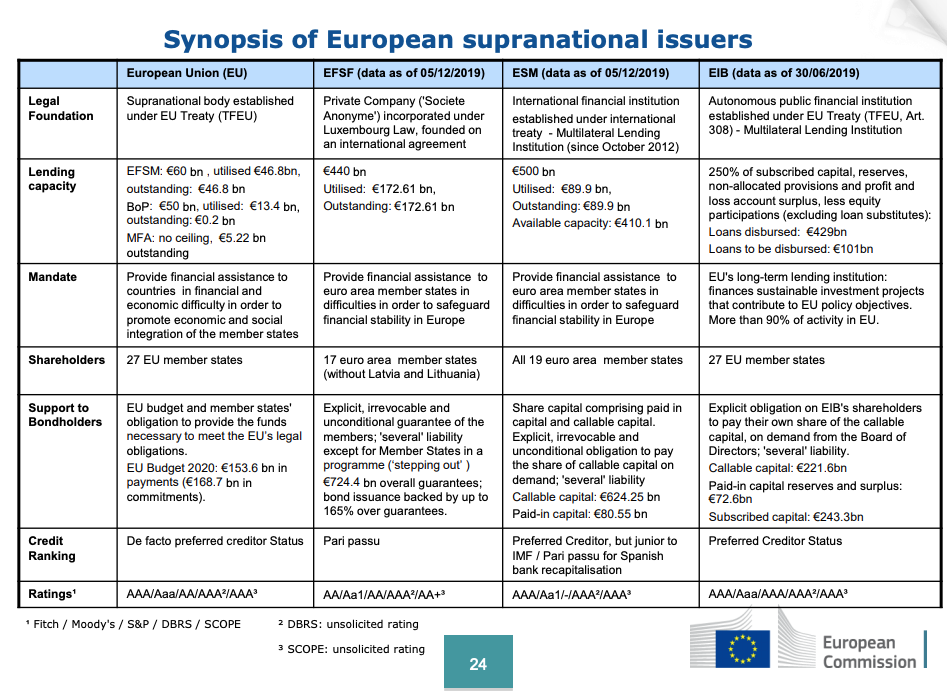

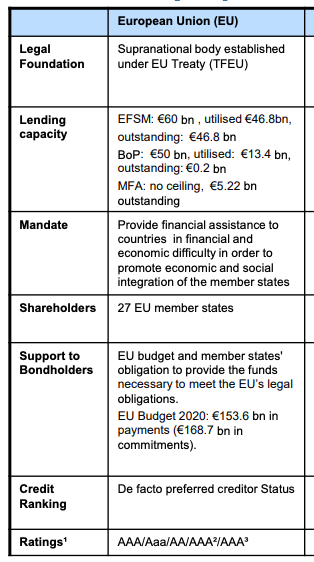

First, we should not forget that the EU (via the @EU_Commission) has been in the markets for quite some time. As this July '20 Investor Presentation ( https://ec.europa.eu/info/sites/info/files/economy-finance/eu_investor_presentation_en.pdf) shows, the EU currently operates 3 funding programs: the EFSM, the BoP program & MFA. 2/x

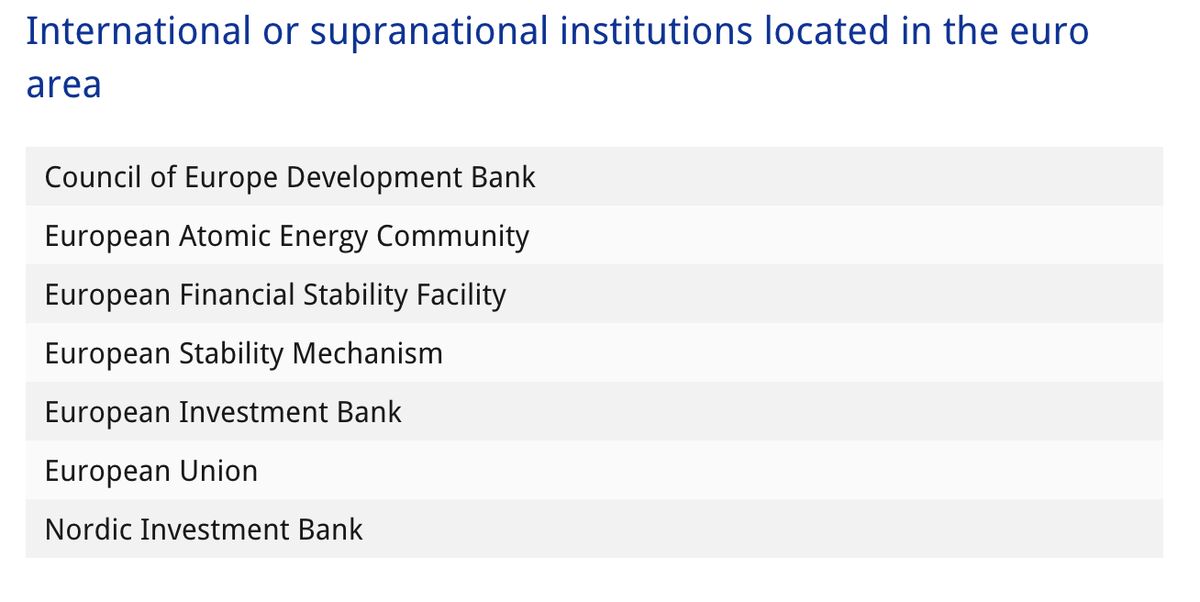

Also, it should be noted that several "supranational" issuers exists, e.g. Euroatom, @EIB , @ESM_Press (& @ecb can purchase their bonds through PSPP & the PEPP). I will focus here on the EU/ @EU_Commission, which has its own legal personality and is distinct from other issuers.3/x

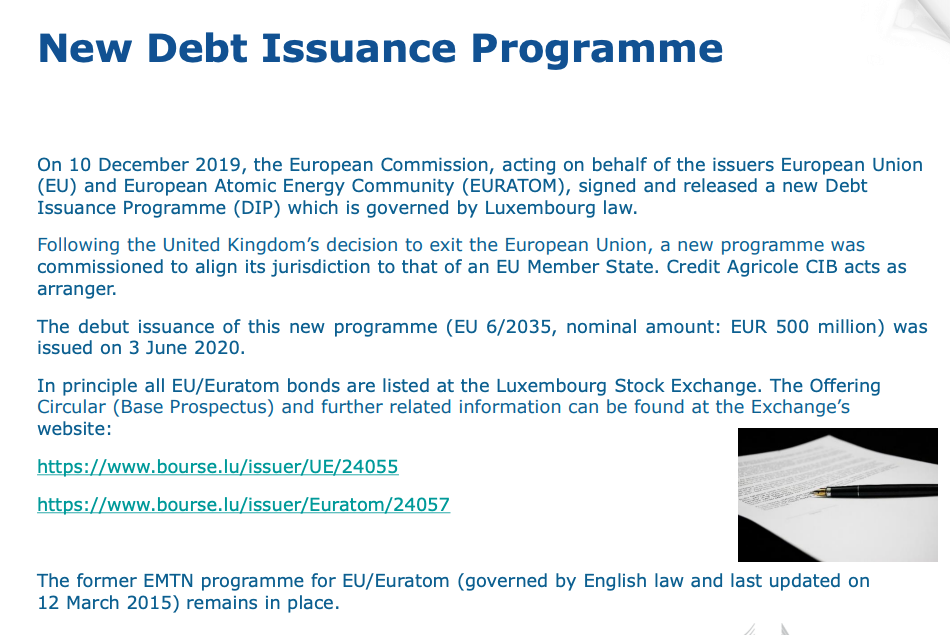

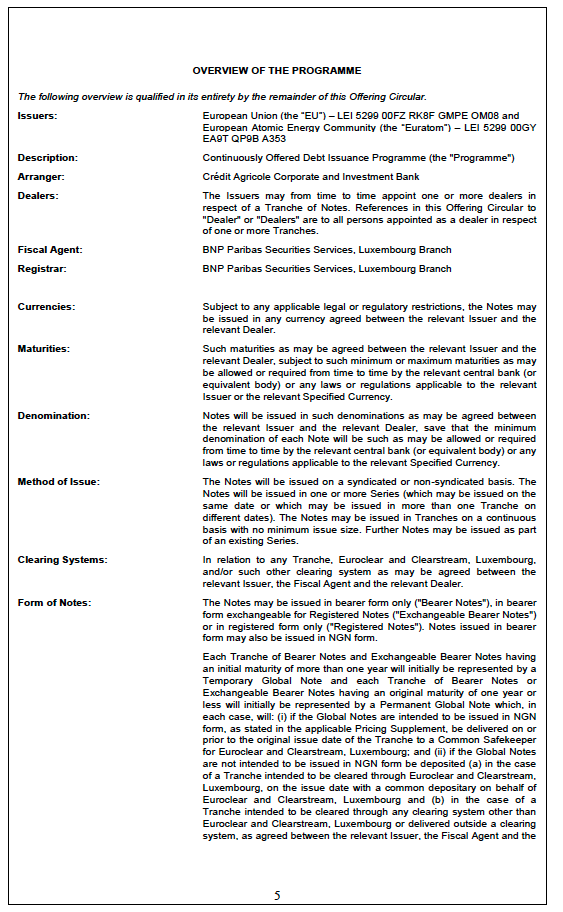

The EU has currently listed 37 debt securities @LuxembourgSE, all of which are issued under the (old) EUR80bn Medium-Term Note Programme (MTN). https://www.bourse.lu/issuer/UE/24055 . But in Dec. '19, a new program was announced. 4/x

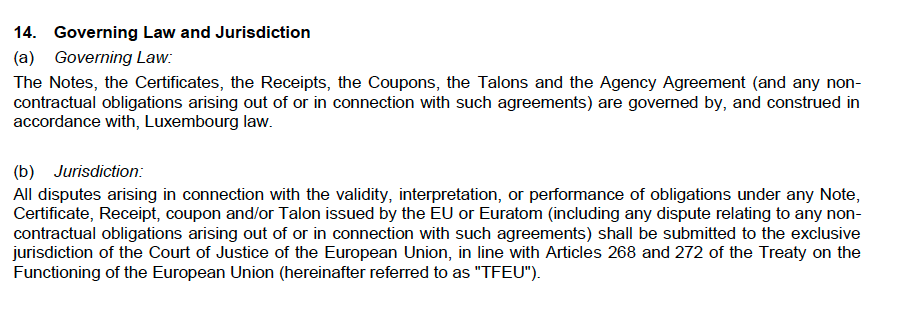

The new Debt Issuance Program (DIP) shifts the bonds' governing law shifting from ENG to LUX law. The @EUCourtPress retains jurisdiction over disputes. Like the @ESM_Press & @EIB, the EU shifted to LUX law in response to Brexit. 5/x

One may now ask, why LUX? Let's say listing requirements in Luxembourg are lax, there is a lot of experience with using LUX law (see EFSF, ESM, etc.), and LUX has one of the most liquid securities markets - it has indeed become the prime location for int'l sovereign bonds. 6/x

My hunch is that the '19 EU Debt Issuance Program is likely to be the basis for the EUR750bn Recovery Instrument issuances, so let's take a closer look at the legal fine print (here: https://www.bourse.lu/programme/Programme-UE/14608). Ofc, changes will need to be made, but the DIP is a good benchmark. 7/x

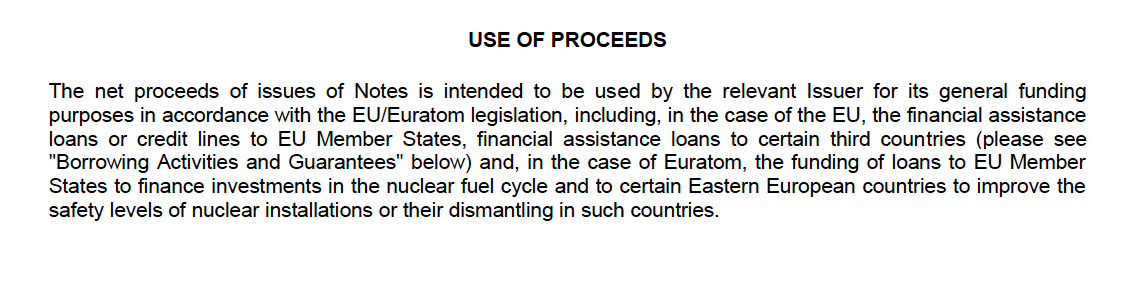

E.g., the current EU DIP limits the "use of proceeds" to EFSM, BoP, MFA activities - for the Recovery Instrument, the prospectus needs to reflect that proceeds will be used for grants to MS (EUR390bn). But I doubt that investor protection clauses will change a lot. 8/x

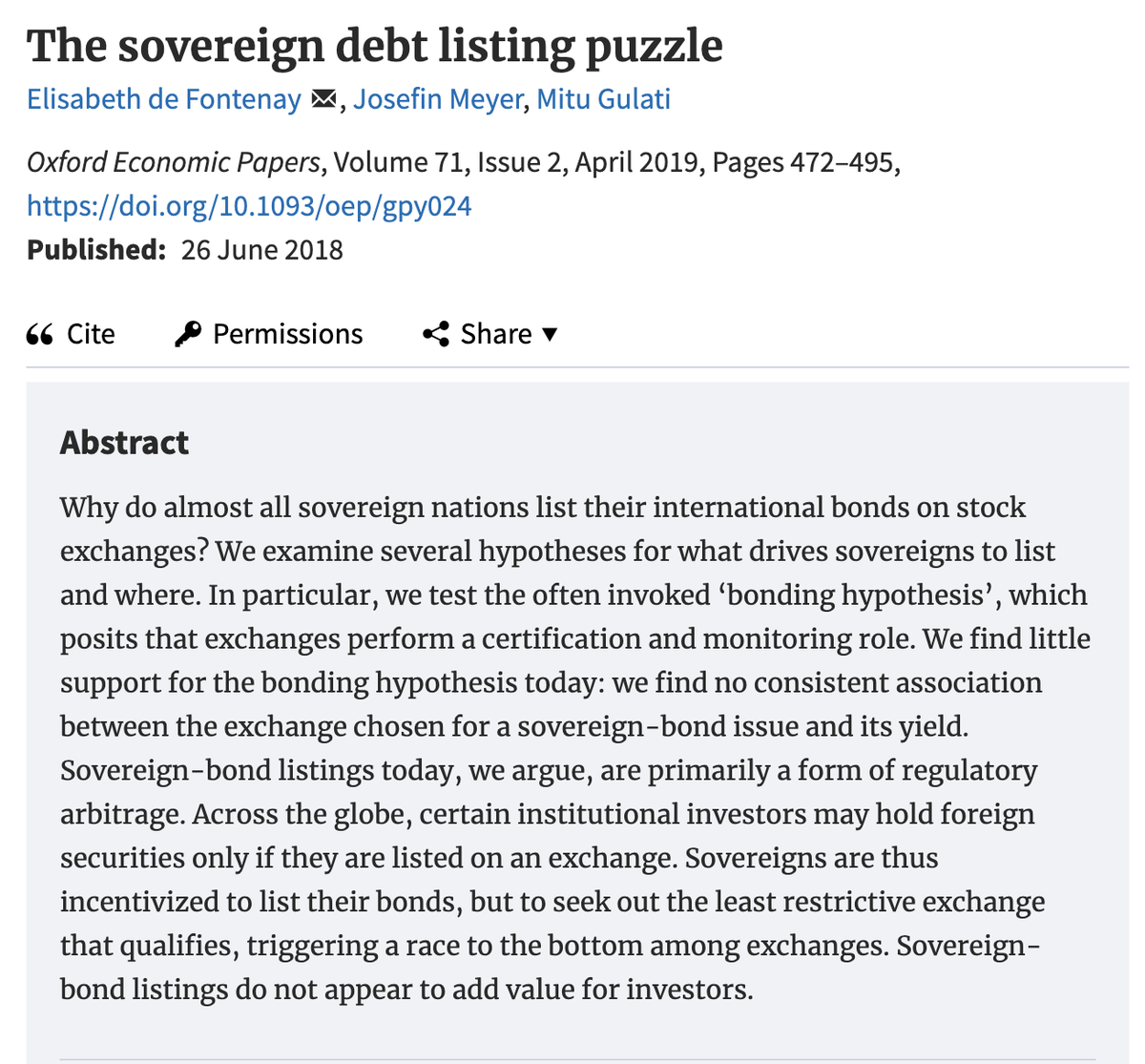

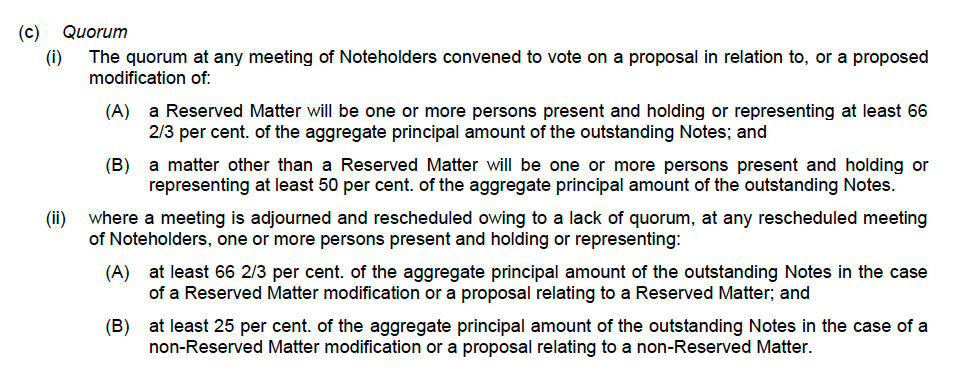

As stated above, governing law is likely to be LUX, @EUCourtPress the competent forum. The EU bonds will include Collective Action Clauses (CACs), albeit probably the old double-limb model, which is not exactly up to speed, as we discuss here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3318570. 9/x

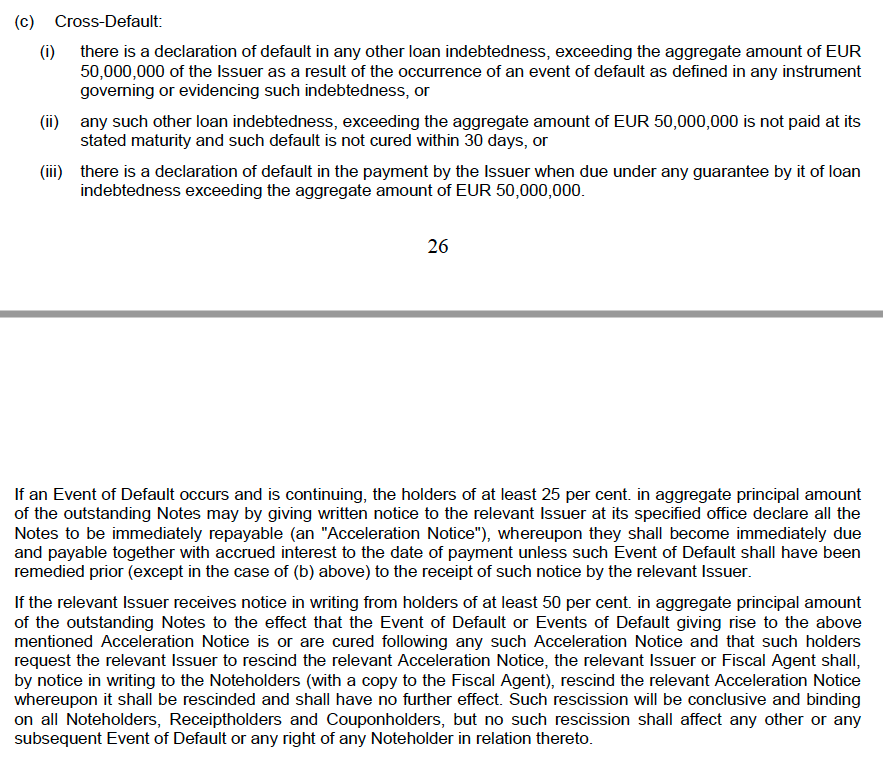

As the @FT article from today indicates, the cross-default clauses in the EU bonds are currently limited to loans by the EU. In other words, if the EU defaults, investors cannot declare a cross-default event with regard to Member States' debt (limiting mutualisation). 10/x

This said, the EU DIP prospectus also recalls that "In the unlikely event of non-payment by a loan beneficiary, the EU budget guarantees that the EU timely honours its debt repayment obligations". This includes drawing additional resources from Member States. 11/x

Whether this provision will be adapted for issuances related to the Recovery Instrument is to be seen (irrelevant for grants ofc). But, since the Own Resource ceiling will be increased, the question is imo less relevant than before: https://www.consilium.europa.eu/media/45109/210720-euco-final-conclusions-en.pdf. 12/x

As @lucasguttenberg, @COdendahl & myself argued a while ago, the EU is perfectly capable of issuing debt - the legal & financial basis is sound: https://voxeu.org/article/pandemic-solidarity-instrument-eu. Moreover, given that the @ecb can purchase EU debt in the PEPP/PSPP, l am not so concerned re liquidity. 13/x

The fact that @ecb may buy EU debt is also relevant for the rating (& concerns abt it, @MoritzKraemerDr). Ofc, joint & several guarantees would be safer. But I think that combination of increased ORs, de-facto preferred creditor states & @ecb backstop will do the trick. 14/x

Much of the European safe asset debate became so complicated BECAUSE leaders never pushed for a strong common issuer - (see here in my draft paper, forthcoming in @JFinReg: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3455792). COVID-19 has changed that. We are closer to Hamilton than Jefferson now. 15/end

Read on Twitter

Read on Twitter