With apologies for the length of this tweet stream.

When economists talk about elasticity is typically with respect to supply and demand and how both change based on price.

When economists talk about elasticity is typically with respect to supply and demand and how both change based on price.

I think a far better way to look elasticity is with respect to confidence and how quantities demanded or supplied change as confidence rises and falls.

And today offers a great example of why confidence elasticity matters so much.

And today offers a great example of why confidence elasticity matters so much.

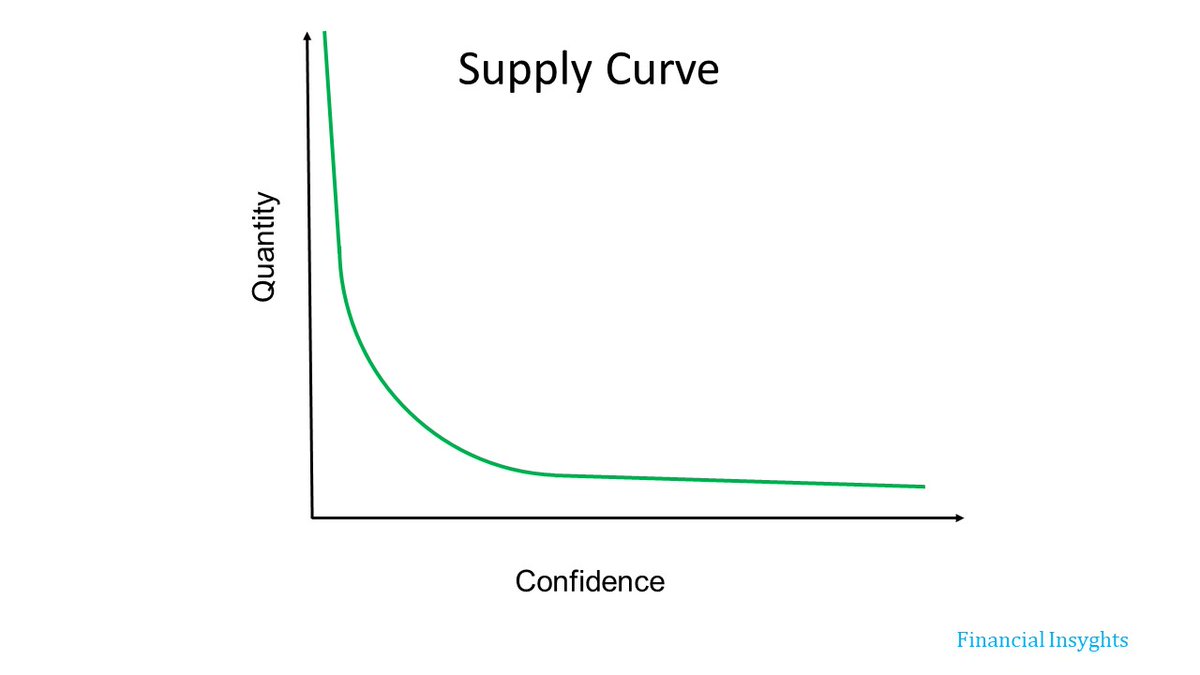

When it comes to extraordinary fiscal assistance, I'd offer that the supply curve for today's policymakers looks something like this.

Confidence must collapse before policymakers act. And once confidence begins to recover, policymakers' appetite to provide more assistance quickly drops.

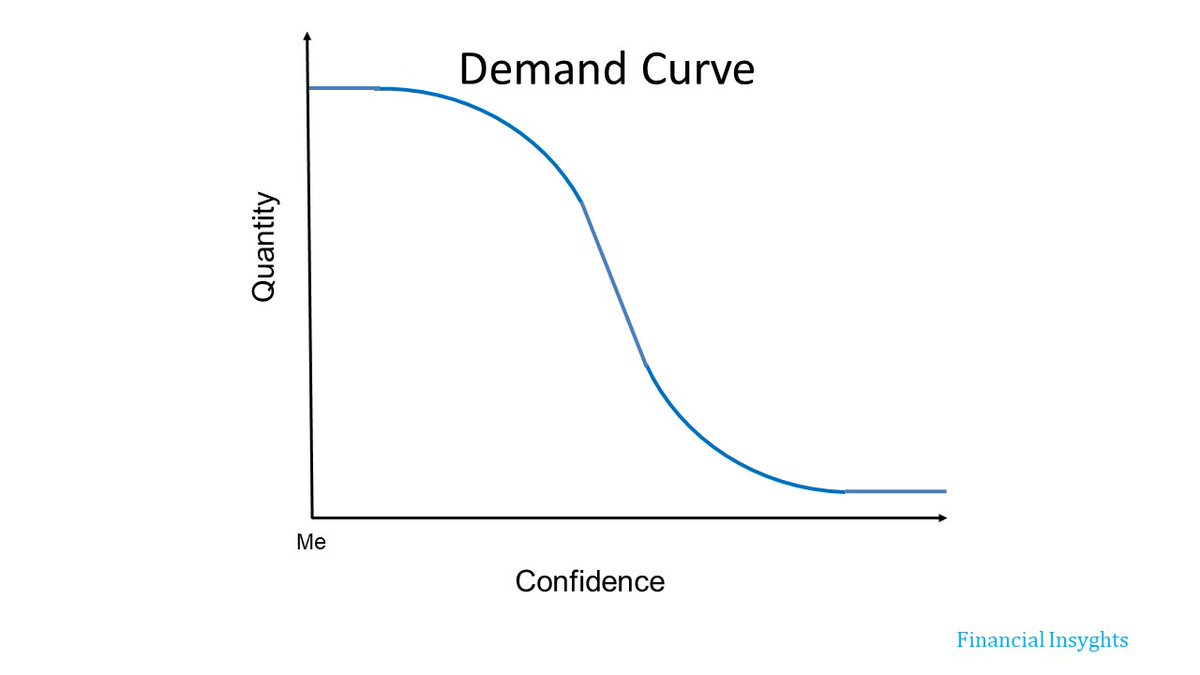

For low wage earners and people who are most economically vulnerable, I'd offer that the demand curve for Federal assistance looks more like this.

When confidence falls demand for aid rises faster, and, after significant economic turmoil, as confidence rises anew, people are very tentative and cautious. It takes a long time for confidence to recover.

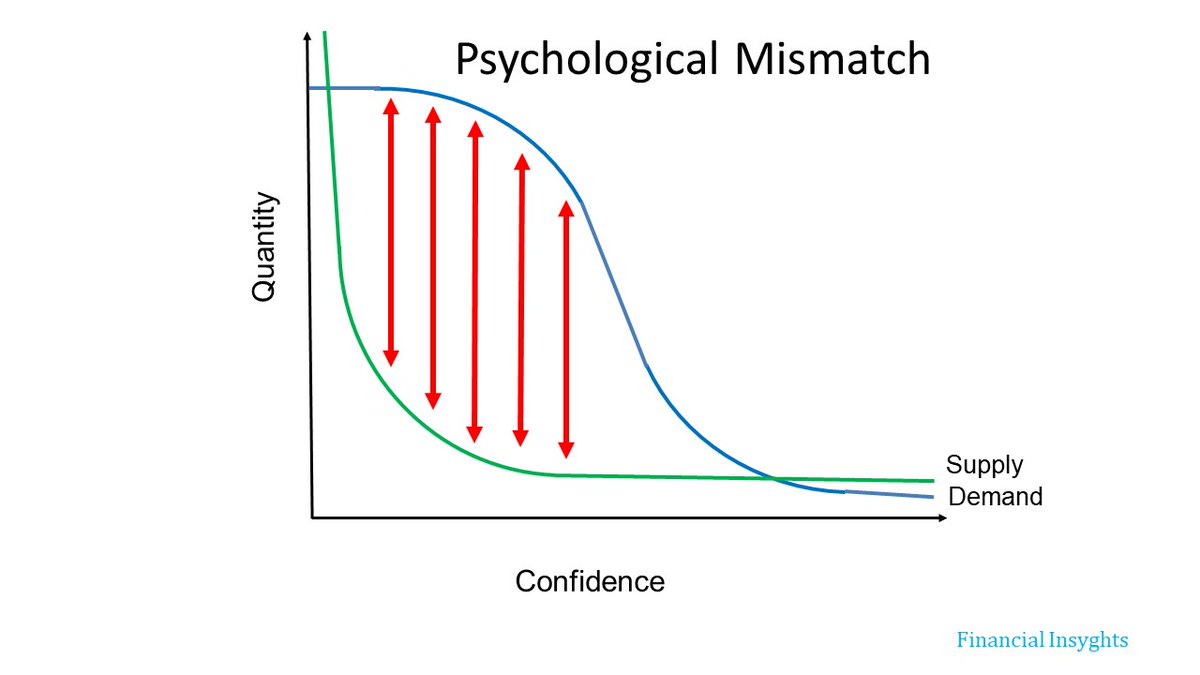

The result is that even in the best case scenario, there is a significant mismatch between the supply and demand for aid at all points except at the two extremes. The demand from those needing/wanting aid is much greater than what Congress is willing to supply.

That naturally creates tension between Main Street and Washington.

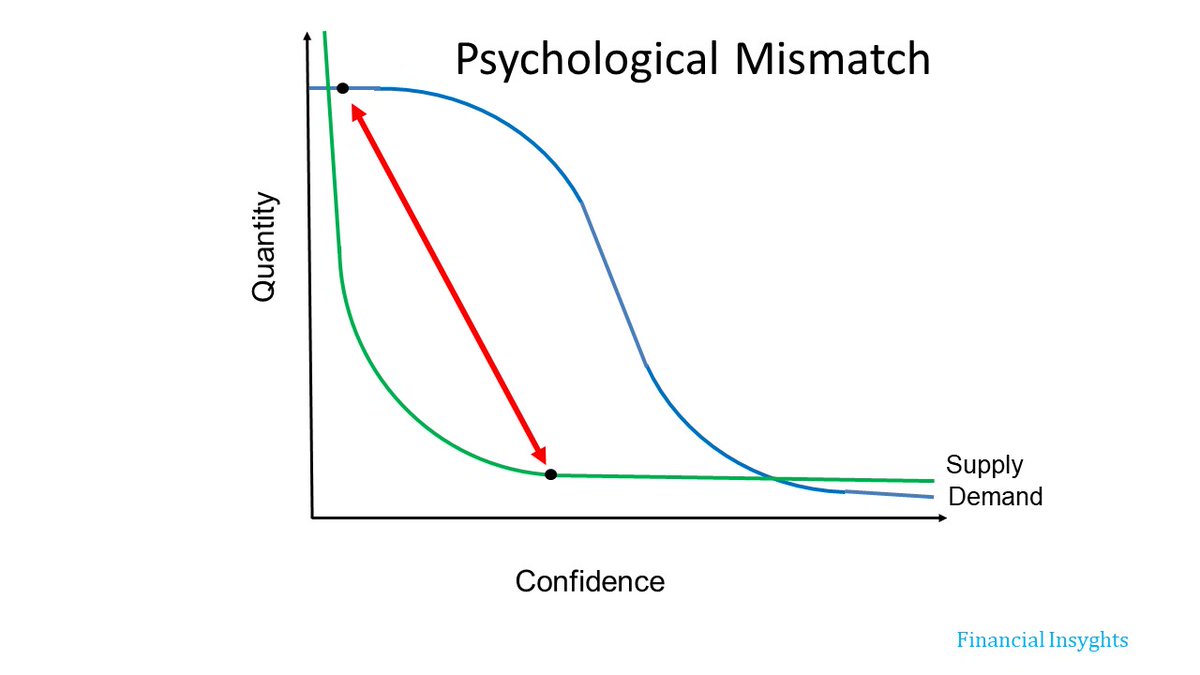

In the case of this recovery, though, I'd offer that it's K-shape has compounded the psychological mismatch.

In the case of this recovery, though, I'd offer that it's K-shape has compounded the psychological mismatch.

Confidence for many on Main Street has barely budged since March, while I suspect for members of Congress it is substantially higher given members' significantly greater wealth and the rebound in the financial markets.

That same confidence-divide can also be seen in the relative sense of urgency for additional assistance, too.

With July end rapidly approaching, and many consumers becoming more and more anxious, it will be interesting to see how the consequences of the substantial confidence divide above play out.

Read on Twitter

Read on Twitter