THREAD

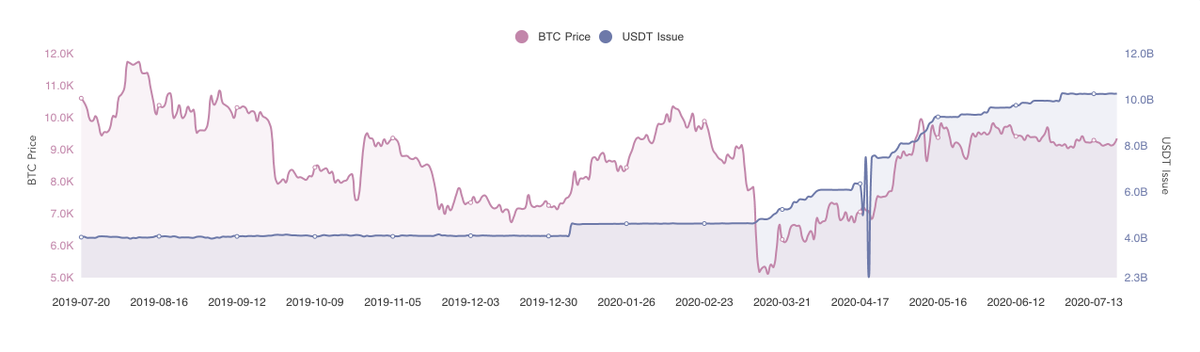

1/ Following the March crash on both traditional and cryptocurrency markets, we've seen a surge in stablecoin issuance. Take a look at USDT in circulation during the past year (src: LongHash).

1/ Following the March crash on both traditional and cryptocurrency markets, we've seen a surge in stablecoin issuance. Take a look at USDT in circulation during the past year (src: LongHash).

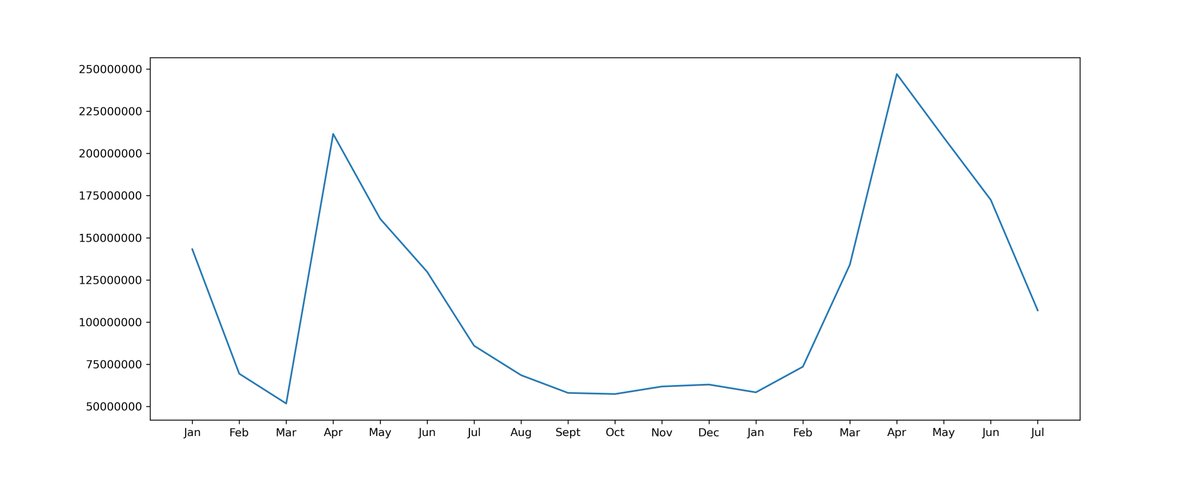

2/ Here is USDT/USD (and vice-versa) trading volumes aggregated from the top spot markets throughout 2019-2020 (src:Coinapi). The volumes roughly reach $250 million. Now let's recall how many USDT were printed lately.

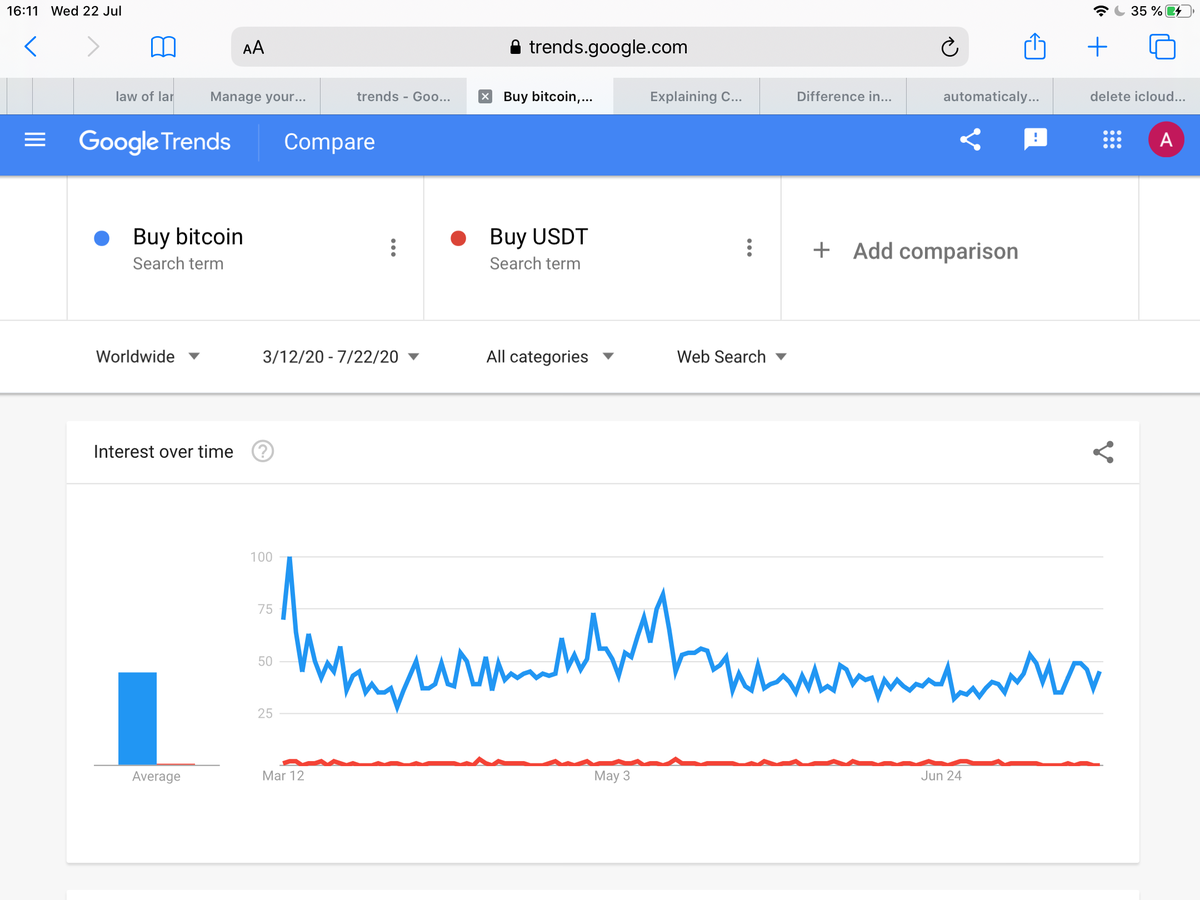

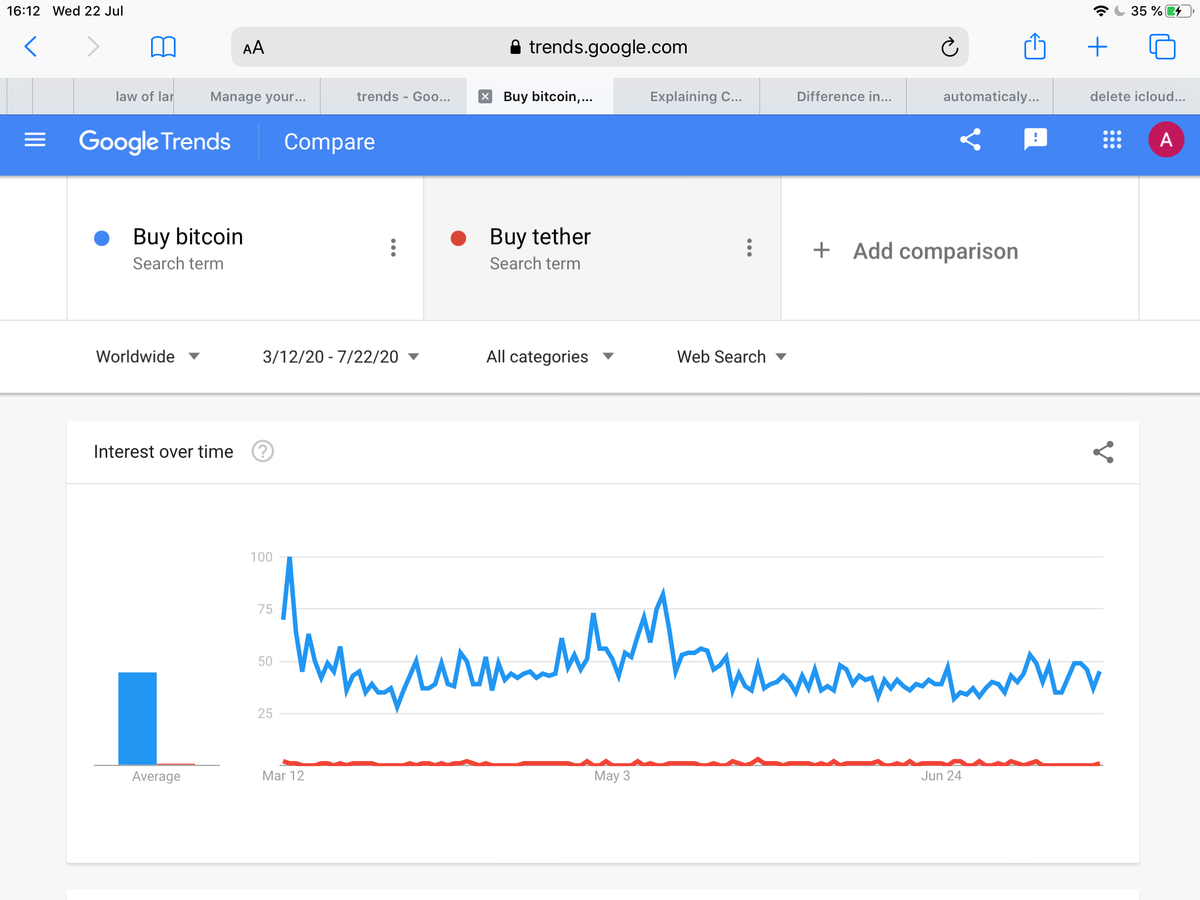

3/ Now let's look at how many people wanted to buy USDT vs how many wanted to buy BTC in Google Trends.

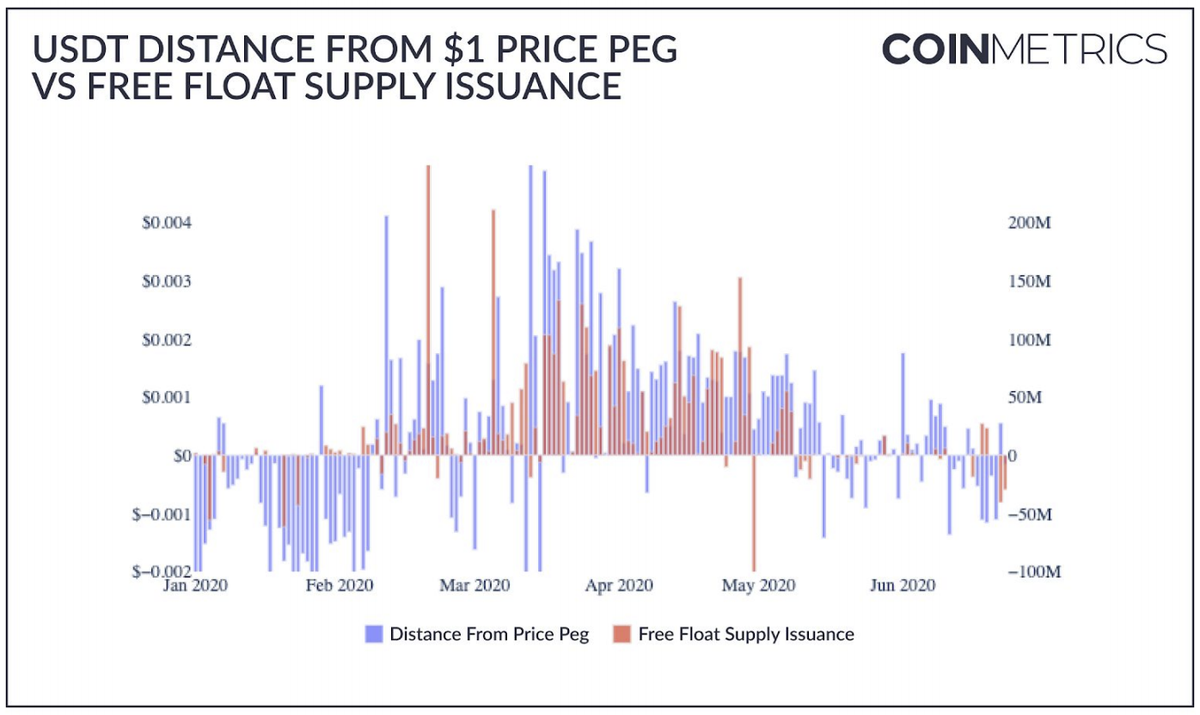

4/ The recent report from Bitstamp & CoinMetrics hit the nail on the head by highlighting stablecoins' premium during the crash. In short, it made sense to print stablecoins in large volumes and sell them at a premium to get USD profits (img: Bitstamp).

5/ On the other hand, we have DAI-like coins that depend on collateral. I think their issuance is primarily triggered by the DeFi uprise, which is partially explained by their high velocity.

6/ You collateralize your alts, take out DAI, move it around various smart-contracts to farm yields. But it only makes sense as long as yields are attractive, which in turn depends on the price of governance tokens.

7/ You can find more on governance tokens being traded with substantial premiums in Ashwath's article here: https://bit.ly/cb_defi_premium

/8 This leaves us in a pretty closed-off ecosystem where the real value of BTC (and alts) is pretty distorted by issuing stablecoins without retail demand. Now we have a bunch of idle stablecoins and a DeFi craze that sucks them in.

/9 If DeFi fails for some reason, this leaves the market with a bunch of idle stablecoins that need to go somewhere. My best guess is another BTC pump, despite its questionable performance as a macroeconomic hedge.

10/ What do you think? Please share your thoughts on the current state of the market and where do you think I'm wrong.

Read on Twitter

Read on Twitter