Everyone has heard of Income sharing agreements, yes? Rightly so, for it's the (un)promised land for India's underserved yet aware and aspiring young populace.

How exactly does it work though? Let's pick up the thread

1/n

How exactly does it work though? Let's pick up the thread

1/n

For beginners — in a typical ISA model, a student pays to the education provider only when they achieve a minimum threshold of the income or outcome. The amount is then recovered as a percentage of future monthly income over a period of 4-5 years.

2/n

2/n

Given the large student debt in countries like the US, an ISA is an innovation that shifts the burden from students to the education provider. Students who don't find employment don't have to pay ANYTHING. Sounds too good to be true? Read on

3/n

3/n

In India, where student loans are still inaccessible to the people who need them the most, this model opens up the opportunity for deserving students to access high-quality education without creating a burden on their parents.

4/n

4/n

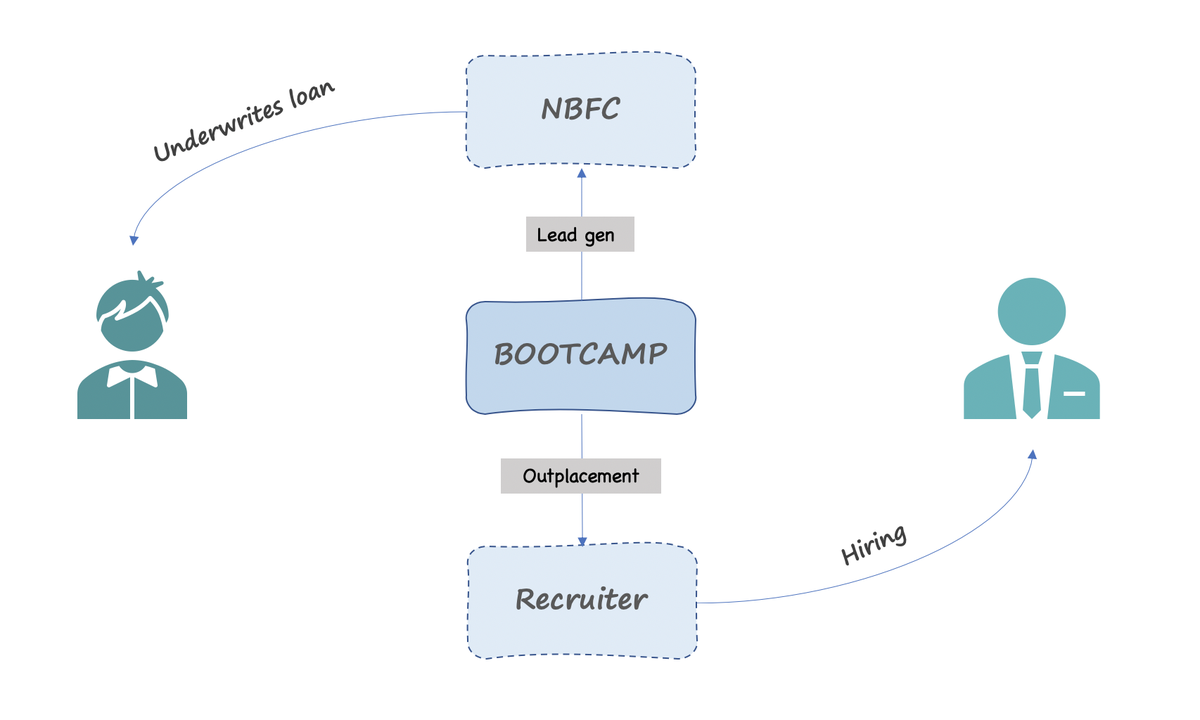

"Who assumes the risk?" you ask. In India, coding boot camps sign an upfront agreement with students and later partner with NBFCs, who underwrite the student loan. The income to NBFCs comes from the subsidy (25–35%) they charge the training provider

5/n

5/n

Pros: The boot camp will use all their resources to get you the best education and opportunities, focus on your skills, help you connect to the network, and help you land good opportunities. The student's success is now inevitably in the vested interest of the provider.

6/n

6/n

Cons:

- the amount you'll pay back over 3-4 years is arguably very high as compared to other alternatives.

- We do not have a way to track what a guy earns and that puts the boot camps in a spot – what if one fine day, the student decides to jump the boat and stop paying?

7/n

- the amount you'll pay back over 3-4 years is arguably very high as compared to other alternatives.

- We do not have a way to track what a guy earns and that puts the boot camps in a spot – what if one fine day, the student decides to jump the boat and stop paying?

7/n

Let's face it. There are only as many jobs available in the market. It eventually boils down to the number of placed students from every batch. Given the current doomed scenario due to COVID, jobs are few and far between. Sooner than later, the companies will hit the wall.

8/n

8/n

Though it’s being touted as an affordable, smart alternative to student loans, if you have to “borrow” money from anyone, by definition, you’re in debt and that’s a financial liability. Once the default rate for loans begins to surge, so will the attached interest rates

9/n

9/n

For a zero-sum game, if someone were to pay for it -- it would eventually be VCs -- to prop up for a high CAC, low LTV, high NPA, supply-constrained business.

10/n

10/n

Then again, with ~10mn students graduating every year, and only 14% of them being employed in white-collar jobs, the skill gap is increasingly alarming. Given the limited number of high caliber tech jobs, identifying and investing in "cream of the crop" could make it work

11/n

11/n

All said and done, it's still early days for ISAs in India and I believe a lot of innovation is yet to come out of companies like @PestoTech @interview_bit and @attain_u

Excited to see how things unfold

n/n

Excited to see how things unfold

n/n

Read on Twitter

Read on Twitter