DER SPIEGEL’S PERSPECTIVE

VW, BWM, Daimler Are In A Race to Try And Catch Tesla

Government subsidies promoting the purchase of electric cars in Germany are causing demand to skyrocket

VW, BMW and Daimler are all overwhelmed by the sudden boom https://www.spiegel.de/international/europe/vw-bwm-daimler-the-race-to-beat-tesla-at-its-own-game-a-58ddb443-29be-4764-9f5c-3d1140e0519f

VW, BWM, Daimler Are In A Race to Try And Catch Tesla

Government subsidies promoting the purchase of electric cars in Germany are causing demand to skyrocket

VW, BMW and Daimler are all overwhelmed by the sudden boom https://www.spiegel.de/international/europe/vw-bwm-daimler-the-race-to-beat-tesla-at-its-own-game-a-58ddb443-29be-4764-9f5c-3d1140e0519f

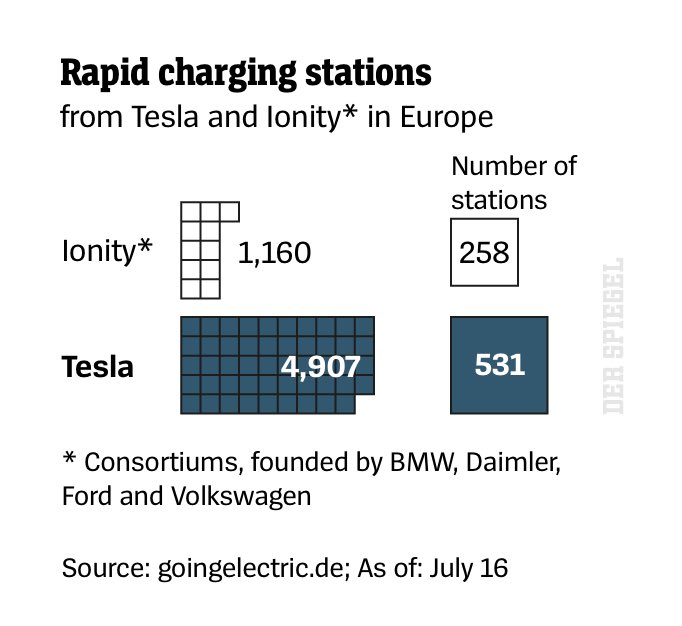

Not only are there too few vehicles coming off the assembly lines, but there aren't enough charging stations around Europe

The companies are now going on the offensive to catch up with Tesla

The companies are now going on the offensive to catch up with Tesla

Right before Markus Duesmann began his new and difficult mission he fulfilled one of his life's dreams

Duesmann, the designated head of the German automaker Audi, hopped on a motorcycle and spent several months cruising around Europe, from Gibraltar to the Black Sea, from the North Cape to the British Isles

In all, he put more than 28,000 kilometers on the odometer

In all, he put more than 28,000 kilometers on the odometer

That journey Duesmann would later tell his confidants helped him gain perspective

Indeed, there are many things he sees more clearly now :

His respect for Europe, its size and its cultural diversity had grown, he said

Indeed, there are many things he sees more clearly now :

His respect for Europe, its size and its cultural diversity had grown, he said

So had his respect for Audi's biggest competitor in the field of electric mobility - Tesla

In the fall of 2019, Duesmann was sitting on his bike when he received a message from Berlin

The e-car pioneer Tesla was planning on opening a car factory just outside the capital

In the fall of 2019, Duesmann was sitting on his bike when he received a message from Berlin

The e-car pioneer Tesla was planning on opening a car factory just outside the capital

Duesmann laughed out loud

He was impressed by the Californians' audacity

“At first, none of us took Tesla seriously," the Audi CEO would later say

“Then we were puzzled - and then we were shocked by what they were capable of”

He was impressed by the Californians' audacity

“At first, none of us took Tesla seriously," the Audi CEO would later say

“Then we were puzzled - and then we were shocked by what they were capable of”

Tesla's Model 3 is one of the best-selling electric cars in Europe, way ahead of its German competition

The only carmaker that has recently outperformed Tesla is Renault with its tiny e-car Zoe

The only carmaker that has recently outperformed Tesla is Renault with its tiny e-car Zoe

The Californians are also ahead of the pack with their charging stations

The company has installed almost 5,000 of its "Superchargers" in 24 European countries

The company has installed almost 5,000 of its "Superchargers" in 24 European countries

By comparison Ionity, the charging station consortium of BMW, Daimler, VW and Ford, has so far only managed to install 1,160 electric charging columns

The Germans Can't Keep Up

The Germans Can't Keep Up

The German government's subsidy to encourage the purchase of electric cars was recently increased to €9,000

This is putting more pressure on automakers with demand booming

This is putting more pressure on automakers with demand booming

In June alone, while the car market slumped overall, more than 8,000 e-cars were registered in Germany, a solid +40% more than in the previous year

Other European countries like Austria, France, Spain and Britain are also spurring demand with their own subsidy programs

Other European countries like Austria, France, Spain and Britain are also spurring demand with their own subsidy programs

Yet German manufacturers are ill-equipped for the surge in demand

Most new electric models won't hit the market for the next 6 to 18 months

And their ability to manufacture more of the existing models can't just be ramped up overnight

Most new electric models won't hit the market for the next 6 to 18 months

And their ability to manufacture more of the existing models can't just be ramped up overnight

“The car companies are suffering from bottlenecks," says Roman Zitzelsberger, head of the IG Metall union in the German state of Baden-Württemberg and a member of Daimler's supervisory board

“Especially with regard to battery cells”

“Especially with regard to battery cells”

Anyone who orders an electric car now will have to wait up to a year to get it

For some models German companies have even placed a freeze on new orders

For some models German companies have even placed a freeze on new orders

In the middle of the coronavirus pandemic BMW, Daimler and Volkswagen must now increase production, deliver more e-cars and close the massive gaps in their charging networks

Otherwise, the billions of euros they poured into their e-car offensives will have been for naught

Otherwise, the billions of euros they poured into their e-car offensives will have been for naught

The Artemis Project

Duesmann has been at his post since April and has hardly had any time to get used to the job

He's been tasked with turning the ailing premium brand back into an innovation leader, while at the same time accelerating the turnaround of Audi's parent company VW

Duesmann has been at his post since April and has hardly had any time to get used to the job

He's been tasked with turning the ailing premium brand back into an innovation leader, while at the same time accelerating the turnaround of Audi's parent company VW

Duesmann is also the head of research and development at VW

Just two months after he started his new job, he spearheaded a project aimed at putting Audi and VW on equal footing with Tesla

The project is called Artemis after the Greek goddess of the hunt

Just two months after he started his new job, he spearheaded a project aimed at putting Audi and VW on equal footing with Tesla

The project is called Artemis after the Greek goddess of the hunt

Duesmann has put together a largely independent team of experts from across the VW Group

They will be working in a startup-like atmosphere developing new technologies and eliminating previous deficits particularly in software and networking

They will be working in a startup-like atmosphere developing new technologies and eliminating previous deficits particularly in software and networking

The goal is "to accelerate the development of additional car models," according to the Audi CEO

Duesmann has experience with such tasks

As a former executive at BMW he was jointly responsible for the famous "Project i” which the company ultimately spun off

Duesmann has experience with such tasks

As a former executive at BMW he was jointly responsible for the famous "Project i” which the company ultimately spun off

Thanks to the e-cars developed there BMW was able to become a frontrunner in the field for a while

However the i3 and i8 models caused such severe losses that the Munich-based automaker lost its nerve

BMW's next generation of electric cars won't come onto the market until 2021

However the i3 and i8 models caused such severe losses that the Munich-based automaker lost its nerve

BMW's next generation of electric cars won't come onto the market until 2021

Project i was integrated back into the BMW Group essentially phasing it out

It's now up to Audi to do it better

The Artemis project managers want to be in close contact with the group's developers from the very beginning

It's now up to Audi to do it better

The Artemis project managers want to be in close contact with the group's developers from the very beginning

Duesmann has been admonishing his colleagues that the company must be constantly developing new cars, "otherwise we won't manage to establish a new technology”

By 2024 e-vehicles with completely new designs are set to be created, serving as blueprints for the entire VW Group

By 2024 e-vehicles with completely new designs are set to be created, serving as blueprints for the entire VW Group

A Dearth of Charging Stations

At the company's headquarters in Wolfsburg there is a fear that any new models, however innovative, wouldn't be very popular since potential customers will not have enough places to charge them

At the company's headquarters in Wolfsburg there is a fear that any new models, however innovative, wouldn't be very popular since potential customers will not have enough places to charge them

“The infrastructure is a huge challenge," VW's works council chairman, Bernd Osterloh, recently told investors, "especially in Southern and Eastern Europe”

There is still a long way to go, he said, "to push ahead with e-mobility in these countries”

There is still a long way to go, he said, "to push ahead with e-mobility in these countries”

According to Osterloh, CO2 reductions demanded by the European Union cannot be achieved if electric cars are only widely adopted in Scandinavia or the Netherlands, which have extensive networks of charging stations

So preparations are already underway within the Artemis project to create a separate charging network for the whole of Europe

Artemis' role model is Electrify America, a VW subsidiary that has set up thousands of charging points in the U.S.

Artemis' role model is Electrify America, a VW subsidiary that has set up thousands of charging points in the U.S.

The expansion of the charging network with its price tag in the billions was part of the settlement with the U.S. authorities for Volkswagen's diesel scandal but it they think it can become a strategic advantage for VW in the world's third-largest car market

Managers at the company recently presented the project to their German colleagues and made a big impression

Also having its own network in Europe could prove to be a major selling point for the company

Also having its own network in Europe could prove to be a major selling point for the company

The Artemis team's plans foresee Audi customers initially getting exclusive access, after which Porsche drivers would also be allowed to charge their vehicles at the stations

It's still unclear whether other VW Group brands or even competitors will also be given access

It's still unclear whether other VW Group brands or even competitors will also be given access

The first step therefore would be a closed network similar to Tesla's

Premium customers could reserve a charging port in advance to avoid waiting times

Premium customers could reserve a charging port in advance to avoid waiting times

Other offerings are in the works too with services that could make waiting times while charging more pleasant for customers - and that would ideally get them to spend more money

One idea is to cooperate with retailers who could open pop-up stores near the stations

One idea is to cooperate with retailers who could open pop-up stores near the stations

The project is still in its infancy

Issues are still being discussed like whether the charging stations should be installed primarily along major traffic arteries or also in cities

The plans are expected to further coalesce this fall

Issues are still being discussed like whether the charging stations should be installed primarily along major traffic arteries or also in cities

The plans are expected to further coalesce this fall

Other manufacturers doubt that shortfalls in charging infrastructures can be closed if everyone goes it alone

Markus Schäfer, a member of Daimler's management board whose portfolio includes group research, has called for "a coordinated approach between car companies, power utilities and politicians”

Schäfer says the German government would be well advised to use its current presidency of the European Council "to make a functional charging infrastructure throughout Europe possible”

This would also include creating standards for a uniform payment system

This would also include creating standards for a uniform payment system

Automakers, the Daimler manager adds, should concentrate on improving battery technology so that e-cars don't have to recharge as often

In the medium term Mercedes is looking to increase the range of its electric vehicles to 700 kms and reduce charging times to around 15 minutes

In the medium term Mercedes is looking to increase the range of its electric vehicles to 700 kms and reduce charging times to around 15 minutes

If electric cars no longer need to block charging stations for 30 minutes to an hour, "then gas station operators will also discover this business for themselves and set up their own charging points”

However in order to increase the range of their e-vehicles the companies are dependent on help from the Far East

The heart of the electric car is its battery and the corresponding software

This is what companies like CATL, Panasonic or LG Chem - high-tech companies from China, Japan and Korea – are best at

This is what companies like CATL, Panasonic or LG Chem - high-tech companies from China, Japan and Korea – are best at

German suppliers like Bosch or Continental have decided against producing their own battery cells

They view the Asian companies as being simply too far ahead

But German car companies are no longer willing to acquiesce to such dominance

They view the Asian companies as being simply too far ahead

But German car companies are no longer willing to acquiesce to such dominance

Schäfer says Daimler is now building a "global network of battery factories, from Europe and Asia to the USA”

The Stuttgart-based company got out of industrial mass production of battery cells in 2015

The Stuttgart-based company got out of industrial mass production of battery cells in 2015

Instead in early July the group acquired a stake in the Chinese battery manufacturer Farasis

The plan is to build a cell factory in Bitterfeld in eastern Germany, with Farasis as the producer and Daimler as the major customer

Another partnership will soon follow

The plan is to build a cell factory in Bitterfeld in eastern Germany, with Farasis as the producer and Daimler as the major customer

Another partnership will soon follow

This is how the automaker hopes to lock down the long-term supply of battery cells and gain insights into the future market

Daimler will also get to send Schäfer as its representative on the Farasis supervisory board

Daimler will also get to send Schäfer as its representative on the Farasis supervisory board

This kind of cooperation shows how much technological change is shifting the balance of power in the automotive industry

“The lever has been flipped toward electrification," says Andreas Wolf, head of the Continental powertrain division, Vitesco Technologies

“The lever has been flipped toward electrification," says Andreas Wolf, head of the Continental powertrain division, Vitesco Technologies

“There will be no renaissance of the combustion engine”

This means new players have a good shot at cornering the market

This means new players have a good shot at cornering the market

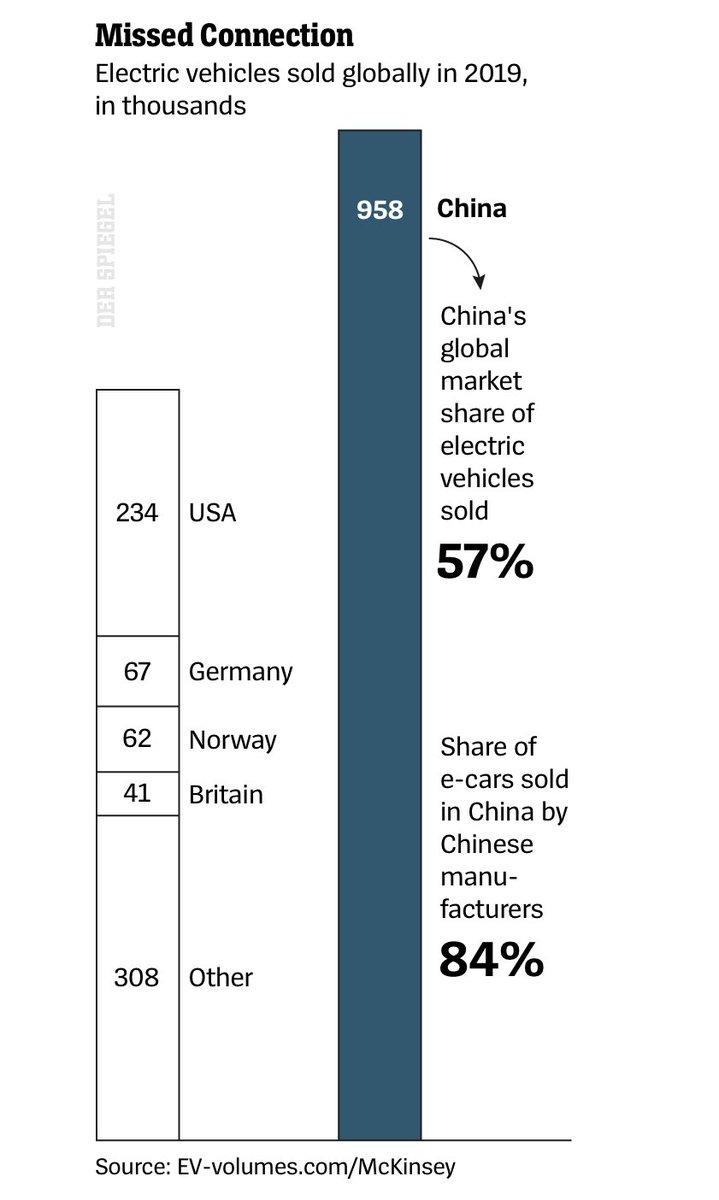

Experts from the management consultancy McKinsey wanted to know whether Asian car manufacturers could keep up with their Western competitors

To find out, they dismantled the 10 best-selling Chinese e-vehicles

They published the results of their study in June

To find out, they dismantled the 10 best-selling Chinese e-vehicles

They published the results of their study in June

They found that on average electric vehicles from Asia offer "a price-to-range ratio that is twice as good as that of their international competitors”

Many e-car makers who are still making losses today would turn a profit "as soon as they fully exploit their production volume”

Many e-car makers who are still making losses today would turn a profit "as soon as they fully exploit their production volume”

International manufacturers must hurry, the McKinsey authors added, "in order to participate in the market growth”

Whereas in the past it was mostly Chinese manufacturers who were keen to skim know-how from Western companies, these days it's often the other way around

Whereas in the past it was mostly Chinese manufacturers who were keen to skim know-how from Western companies, these days it's often the other way around

Chinese corporations possess competencies that are valuable for their German partners

In turn, they are seeking access to the European market

This is provided to them by well-known Western brands

In turn, they are seeking access to the European market

This is provided to them by well-known Western brands

That's why Daimler cooperates not only with Farasis but also has a major Chinese shareholder

Since 2018 the businessman Li Shufu has held a 10% stake in Daimler

He wants to turn Geely, the Chinese car maker he owns, into a global automobile conglomerate

Since 2018 the businessman Li Shufu has held a 10% stake in Daimler

He wants to turn Geely, the Chinese car maker he owns, into a global automobile conglomerate

A central role in its e-car offensive is played by Sweden's Volvo, a subsidiary of Geely

As early as 2017 Volvo announced that it would be equipping its entire fleet with electric motors

With Geely's help Volvo is trying to come up with a Scandinavian answer to Tesla

As early as 2017 Volvo announced that it would be equipping its entire fleet with electric motors

With Geely's help Volvo is trying to come up with a Scandinavian answer to Tesla

The executive in charge, Thomas Ingenlath, was formerly a designer at VW

He remembers well the time when German auto executives laughed at all-electric manufacturers like Tesla

He remembers well the time when German auto executives laughed at all-electric manufacturers like Tesla

But then the California-based company developed two vehicles that revolutionized the market - the Model S and the Model 3

“It's unusual for the top dogs to be down 2-0," Ingenlath says

But maybe that's what was needed for the Germans to start seriously rethinking things

“It's unusual for the top dogs to be down 2-0," Ingenlath says

But maybe that's what was needed for the Germans to start seriously rethinking things

As far as e-mobility is concerned, Ingenlath hasn't written off the Germans yet

But he does want to make life difficult for them

The first model, Polestar 1, is more of a collector's item with only 500 cars manufactured a year

But he does want to make life difficult for them

The first model, Polestar 1, is more of a collector's item with only 500 cars manufactured a year

Meanwhile Ingenlath plans to sell several tens of thousands of the Polestar 2, which was launched in Europe in July

Polestar hopes to go from being an elite niche brand to a premium e-car manufacturer

Production will take place in China

Polestar hopes to go from being an elite niche brand to a premium e-car manufacturer

Production will take place in China

The world's No. 1 market for e-mobility, China offers the best starting conditions

The government there recently extended subsidies it grants for the purchase of electric vehicles

They apply to e-vehicles offering long ranges at low prices

The government there recently extended subsidies it grants for the purchase of electric vehicles

They apply to e-vehicles offering long ranges at low prices

And customers' fears of not being able to charge their vehicles aren't really an issue in China, which has an extensive network of charging stations

Even the entry into established car markets like Germany or France seems to be easier than ever

Newcomers no longer have to build up their own dealership networks to succeed - Tesla proved as much

Newcomers no longer have to build up their own dealership networks to succeed - Tesla proved as much

Polestar is selling its new model mostly online

It plans to open showrooms in seven major German cities and will otherwise rely on Volvo dealerships

It plans to open showrooms in seven major German cities and will otherwise rely on Volvo dealerships

There's another way in which Polestar is fundamentally different than the Germans' e-cars

Whereas VW, Daimler and BMW are each developing their own IT operating systems, Polestar is partnering with Google

The Polestar 2 relies on Google Maps and Google Assistant for navigation

Whereas VW, Daimler and BMW are each developing their own IT operating systems, Polestar is partnering with Google

The Polestar 2 relies on Google Maps and Google Assistant for navigation

Ingenlath sees no point in wasting time and money on developing an inferior product than what Google has to offer

The German automakers are struggling to network their cars

The best example is VW

The German automakers are struggling to network their cars

The best example is VW

Its new e-car, the ID.3, was supposed to be a computer on wheels, but at the time of its launch in September the smartphone connection App-Connect won't be working yet

In order to fix the problem the car will have to be brought to a repair garage

In order to fix the problem the car will have to be brought to a repair garage

Unlike Teslas, whose software can be updated remotely

To prevent this from happening again in the future, Duesmann, VW's chief developer, is working on completely new software

He has around 5,000 employees at his disposal to help him

The whole thing will take years to finish

To prevent this from happening again in the future, Duesmann, VW's chief developer, is working on completely new software

He has around 5,000 employees at his disposal to help him

The whole thing will take years to finish

But already the endeavor is wearing down top personnel

The VW Group's head of software, Christian Senger, had to step down just two weeks after the project officially began

Now Duesmann wants to pick up the pace

He has plenty of respect for the job and for Tesla

The VW Group's head of software, Christian Senger, had to step down just two weeks after the project officially began

Now Duesmann wants to pick up the pace

He has plenty of respect for the job and for Tesla

“As far as networking and on-board networking go," he said recently, "we are not yet on equal footing”

Read on Twitter

Read on Twitter