Latest AEMO quarterly update reports electricity prices plunge to lowest levels in 5 years

https://www.aemo.com.au/news/qed-q2

The AEMO presser fingers COVID-19, but really it is

really a text-book example of market power (ie monopolistic pricing).

see also @AFR https://www.afr.com/companies/energy/electricity-prices-plunge-to-lowest-in-five-years-20200721-p55e47

https://www.aemo.com.au/news/qed-q2

The AEMO presser fingers COVID-19, but really it is

really a text-book example of market power (ie monopolistic pricing).

see also @AFR https://www.afr.com/companies/energy/electricity-prices-plunge-to-lowest-in-five-years-20200721-p55e47

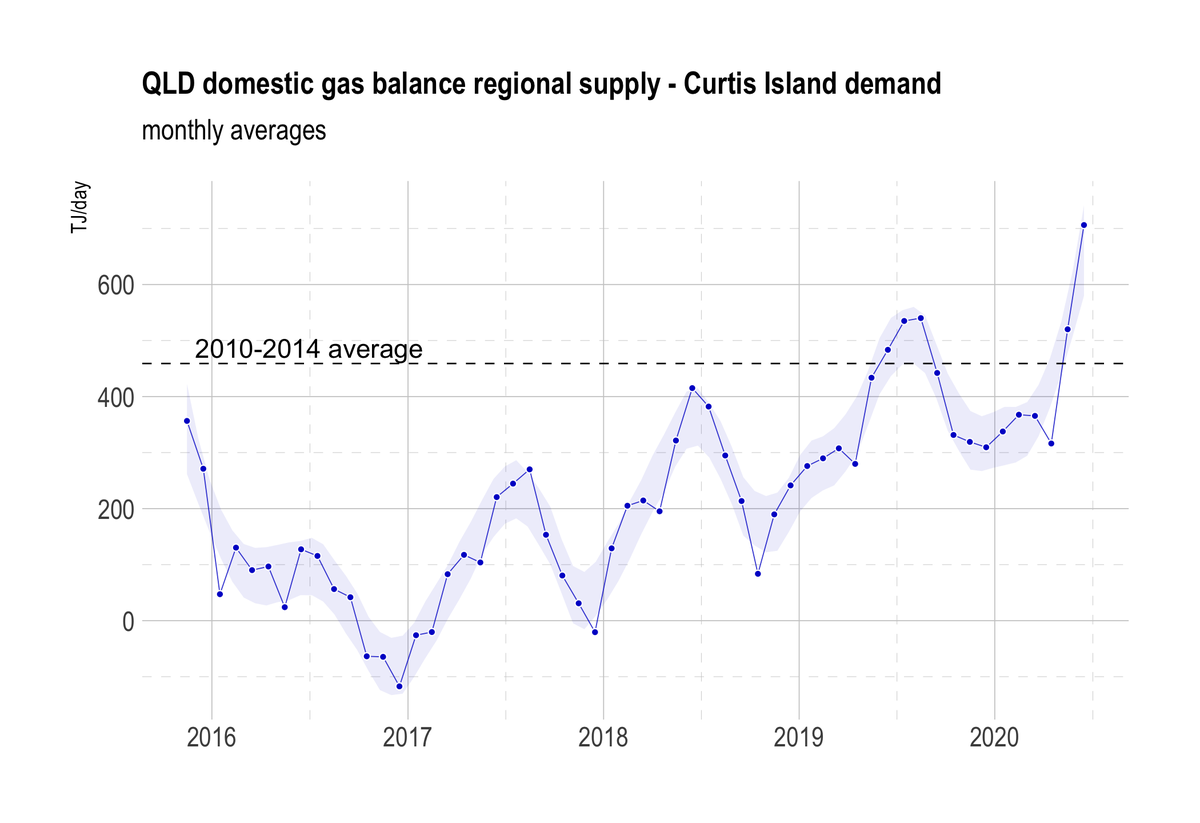

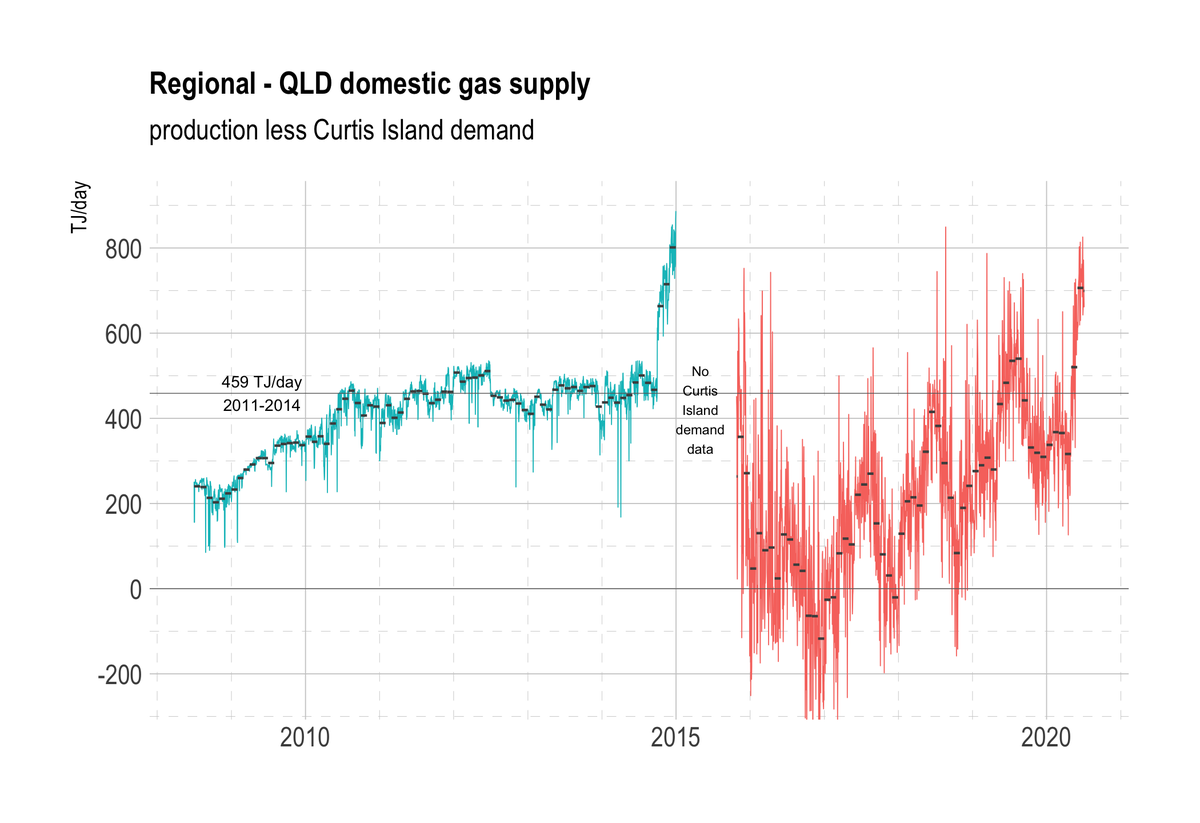

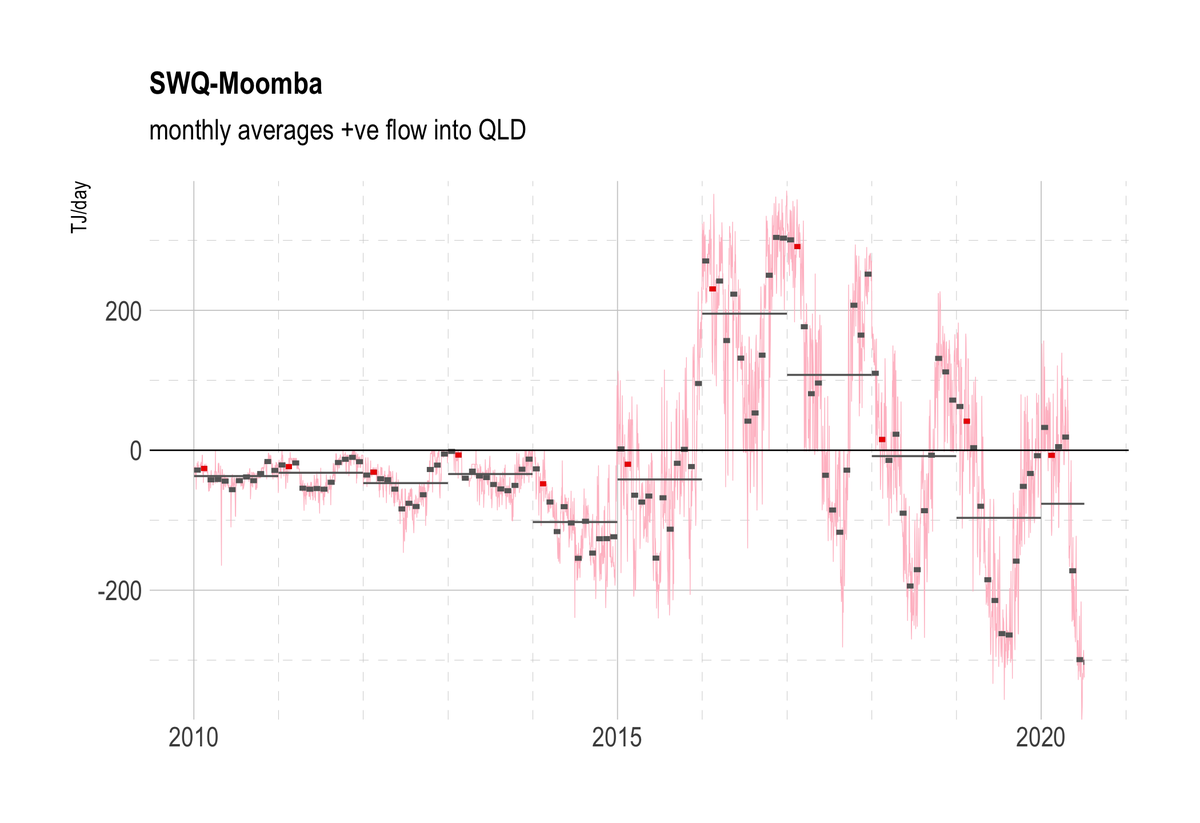

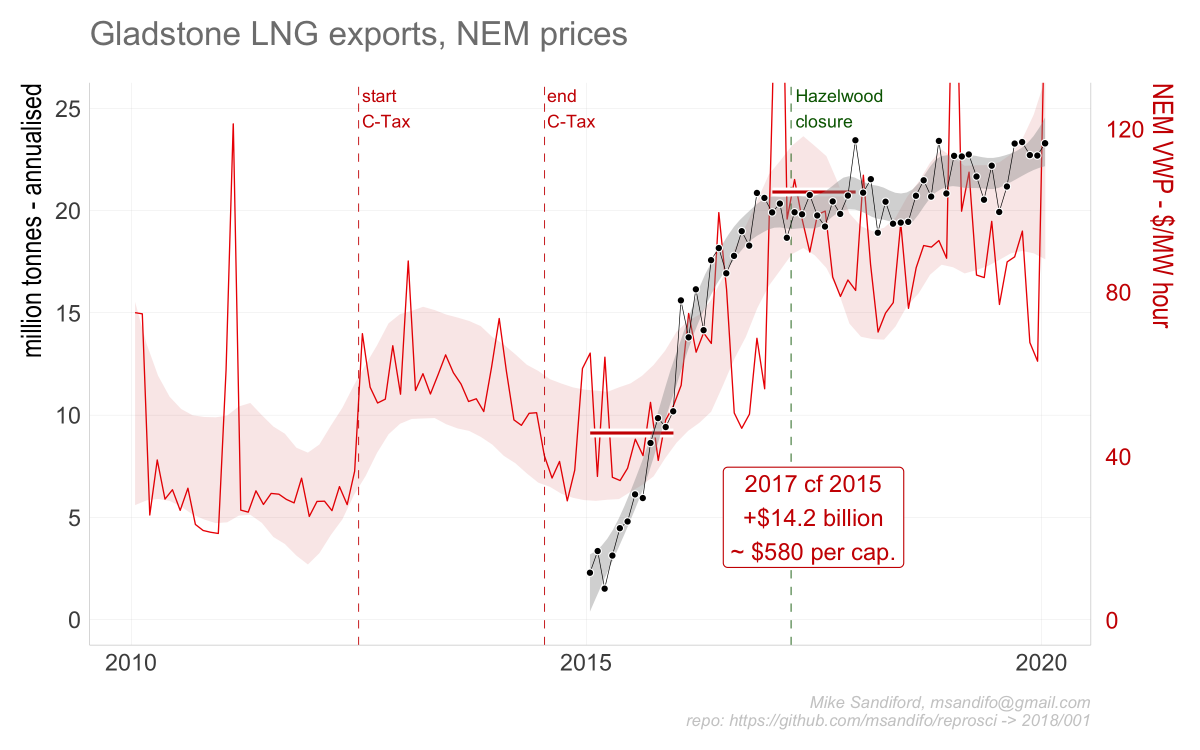

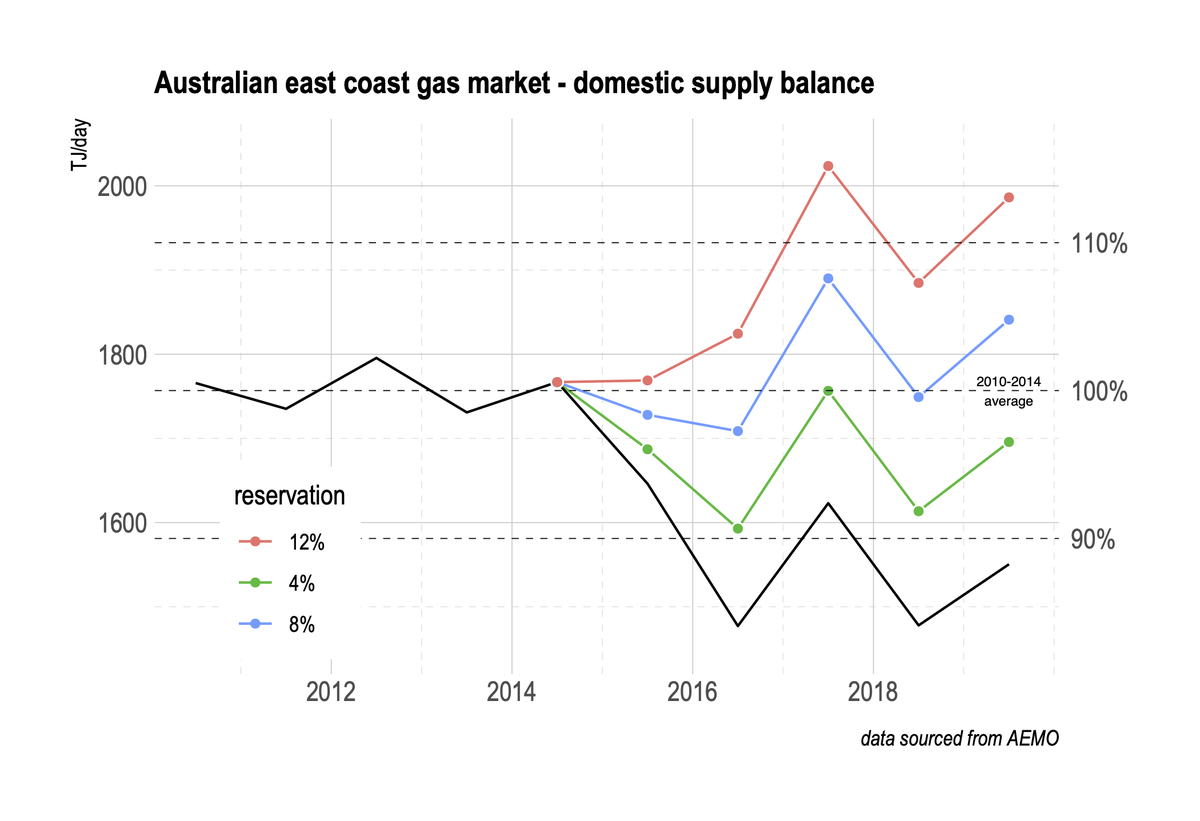

2. So instead of southern gas flowing north to help fill LNG cargoes (at 300 TJ/day across 2016), northern gas is now flowing south again (at an average rate of 100 TJ/day across 2019), as it was prior to LNG exports starting in 2015.

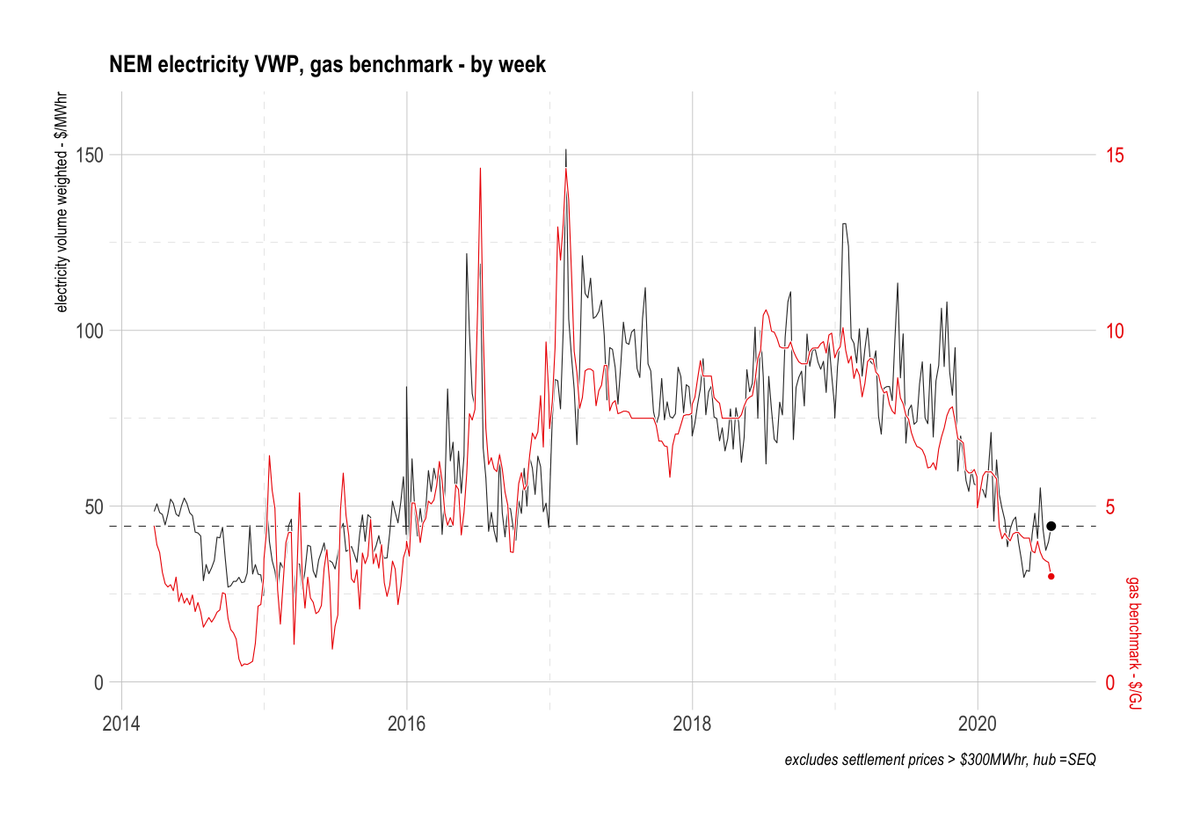

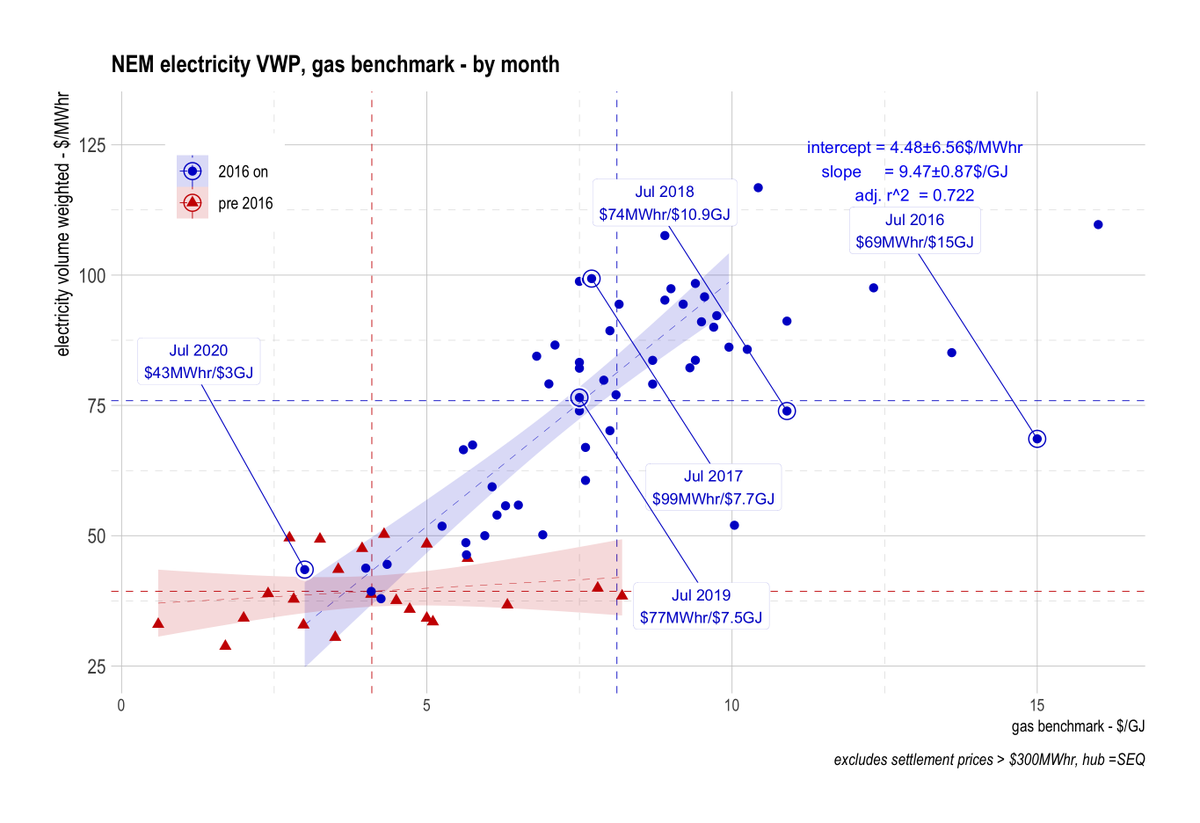

4. So gas hub prices are collapsing back to pre LNG prices of $3-5 /GJ, from highs of $7-10/GJ across 2016-2018.

5. with the electricity price following the gas price, electricity prices have also plummeted, back to pre LNG levels

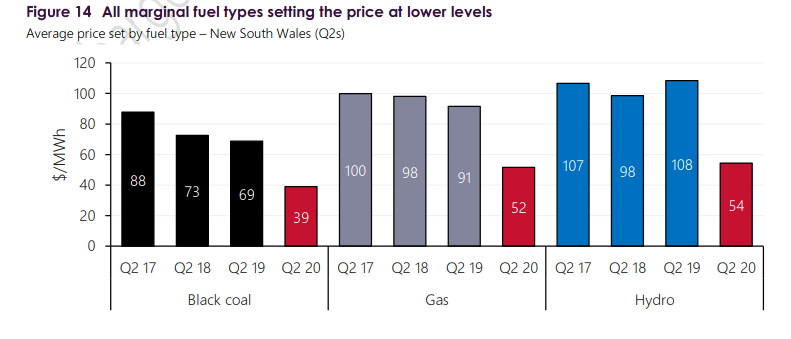

6. Analysis in the new AEMO report makes clear why. Even though gas does not set the price very much of the time (10-20%), black coal generators have been setting high prices by "shadowing" the gas price.

7. "Price shadowing" is an expression of monopolistic behaviour. It was allowed because 1) the extraordinary tightening in the gas markets due to the impact of LNG exports. 2) in our extremely concentrated electricity markets, we do not have adequate competition.

8. The "price shadowing" has been a major reason for the increase in the value of wholesale electricity markets by $14 billion in 2017 cf 2015, or $580 for every Australia. That is a heavy price to pay for the privilege if exporting our gas.

9. And how could have it been averted? All that was needed to maintain balance in the domestic gas supply at pre LNG levels was a temporary reservation of coal seam gas production by as little as 6% (with a cap of total domestic supply of 1750 TJ/day.)

Read on Twitter

Read on Twitter