While the purchase of @Nblenergy

makes @Chevron a dominant Permian player, its international component is also a big development in East Med gas markets, and potentially a turning point for Israel's threatened #natgas market. Lets dive in (Thread) #lng #energy #oott #energy

makes @Chevron a dominant Permian player, its international component is also a big development in East Med gas markets, and potentially a turning point for Israel's threatened #natgas market. Lets dive in (Thread) #lng #energy #oott #energy

Noble operates the two largest #natgas fields in Israel, Leviathan and Tamar, which hold a combined capacity of 2.4 Bcfd—well above Israeli’s domestic demand. ~70% of this production is locked into long-term sales deals, with an average sale price of $5.50/MMbtu

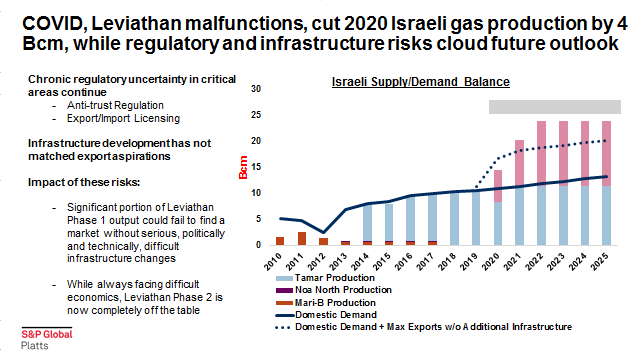

It has not been smooth sailing though. Noble and Delek have been hit hard by COVID, both selling assets & cutting capex to meet financial obligations. Further, production from Leviathan/Tamar has been capped at 50% cap in 2020 due to demand destruction & infrastructure issues

This is a foreshadowing of future challenges. ~25% of Leviathan’s output currently doesn't have a locked-in buyer or realistic spot market option w/o significant infrastructure buildout, meaning upstream prod caps could be here to stay and the threat of stranded assets is real

Indeed, looking at Leviathan, given current sales contracts, over a project lifespan of 30 years, the field would see the total output of below 60% of its estimated reserves!

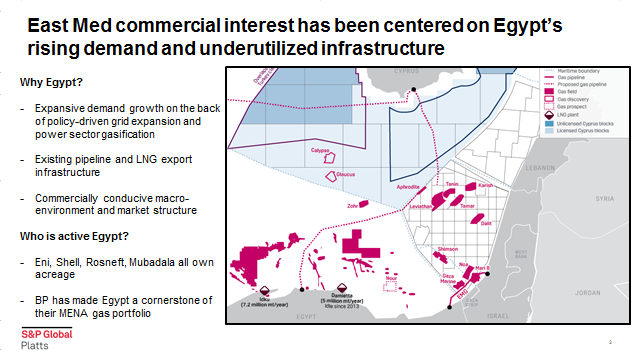

Making matters worse, flagship deal w/Egypt, which Platts Analytics has always been bearish on, will see limited flows until 2022 as the contract allows 50% down-nom when oil prices are <$50/bbl. Beyond this infra issues could mean this cap is here to stay https://twitter.com/Samermosis/status/1145700871344402433

One potential solution has been building an LNG export facility—but this would be difficult. Israeli regulation requires exports to be priced at least as high as domestic prices (presently ~$5), meaning LNG exports would be at least $5/MMBtu FOB, not a very competitive level...

With this in mind, Noble and Delek's stretched balance sheets put big questions around how Leviathan would be fully monetized. Now, Chevron's balance sheet, regional presence, and global downstream portfolio make creative export solutions more feasible.

What is most likely is Chevron will fully finance, debottleneck and overhaul the export of Israel's threatened gas assets to Egypt, a strategy its already employing with assets in Cyprus. Egypt will then act as a jumping-off point to global markets

Read on Twitter

Read on Twitter