1/ The #StockMarket keeps going up and everbody is getting insanely rich thats how the story goes right now.

I believe this is a false assumption.

Lets have a closer look why most gains in the stockmarket are an illusion.

Thread

#Bitcoin #Gold #Silver

#Gold #Silver

I believe this is a false assumption.

Lets have a closer look why most gains in the stockmarket are an illusion.

Thread

#Bitcoin

#Gold #Silver

#Gold #Silver

2/ Gains in the stock market are measured in fiatcurrency which makes little sense to me.

Lets think about it:

1kg will be 1kg hundred years from now.

100cm will be 100cm hundred years from now.

Those scales will not change in the future no matter what.

Lets think about it:

1kg will be 1kg hundred years from now.

100cm will be 100cm hundred years from now.

Those scales will not change in the future no matter what.

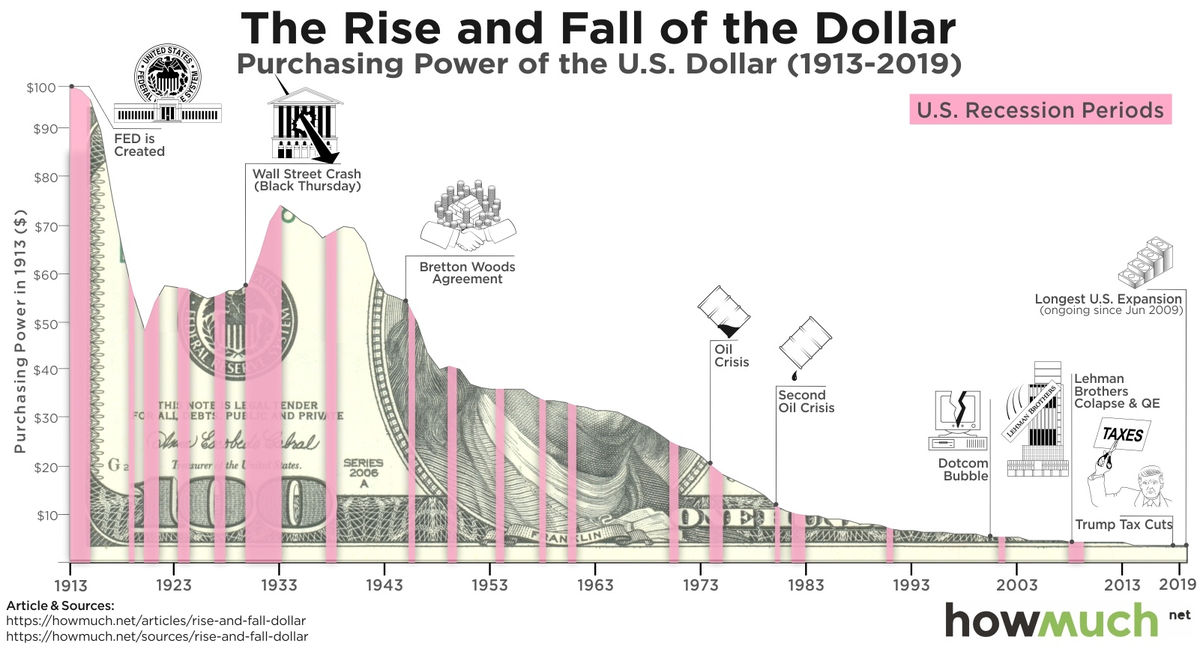

3/ What about money though?

Does the same apply to the US Dollar or the Euro?

Unfortunately not.

Every fiat currency is constantly losing its value therefore an $ or € from one year ago has a different value than todays $ or €.

The $ lost close to 99% over the past century

Does the same apply to the US Dollar or the Euro?

Unfortunately not.

Every fiat currency is constantly losing its value therefore an $ or € from one year ago has a different value than todays $ or €.

The $ lost close to 99% over the past century

4/ I can not stress enough how imporant it is to understand that concept.

By printing money, our currency gets devalued day by day.

It is like using a pocket rule which shrinks every day.

Would you use for measuring anything?

Nope it would not make any sense at all!

By printing money, our currency gets devalued day by day.

It is like using a pocket rule which shrinks every day.

Would you use for measuring anything?

Nope it would not make any sense at all!

5/That raises the question why everbody is using a currency that constantly gets debased as a measurement for financial gains.

It does not make any sense whatsoever.Gains measured in fiat currency are an illusion.

This concept truly changed the way I look at markets/investments

It does not make any sense whatsoever.Gains measured in fiat currency are an illusion.

This concept truly changed the way I look at markets/investments

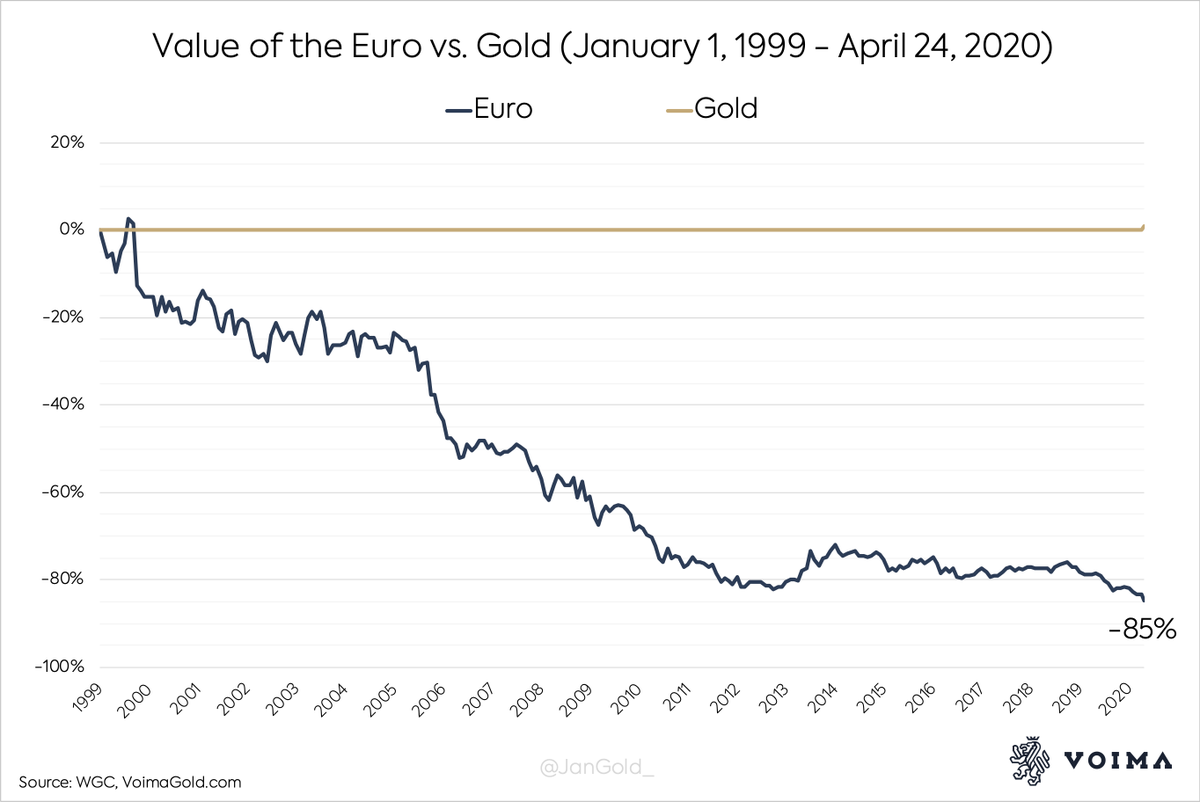

6/ So what could we use instead?

Well lets try something with less inflation and debasement.

What if we would measure the stockmarket in #Gold or #Bitcoin ?

?

Gold and Bitcoin are curshing fiat currencies as a store of value.

Well lets try something with less inflation and debasement.

What if we would measure the stockmarket in #Gold or #Bitcoin

?

?Gold and Bitcoin are curshing fiat currencies as a store of value.

7/ When looking at the SP500 over the past 60 years it sure does look like a good investment.

But not so fast....

$SPX

But not so fast....

$SPX

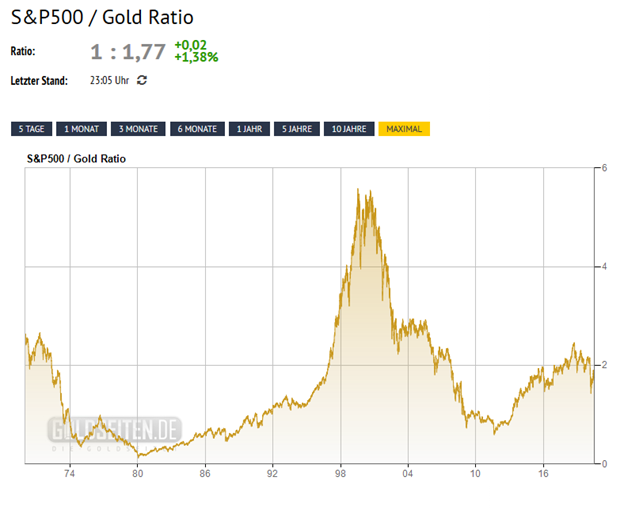

8/ Lets have a look at #Gold vs $SPX

The S&P500 measured in Gold saw its all time high around the early 2000s and lost more than 60% since then.

It basically did not go up since 1996. Crazy when you think about it.

The S&P500 measured in Gold saw its all time high around the early 2000s and lost more than 60% since then.

It basically did not go up since 1996. Crazy when you think about it.

9/ Same goes for the SP500 vs #Silver Ratio.

Note how low it went during the 70ies and 80ies.

I expect something similar during this decade.

Note how low it went during the 70ies and 80ies.

I expect something similar during this decade.

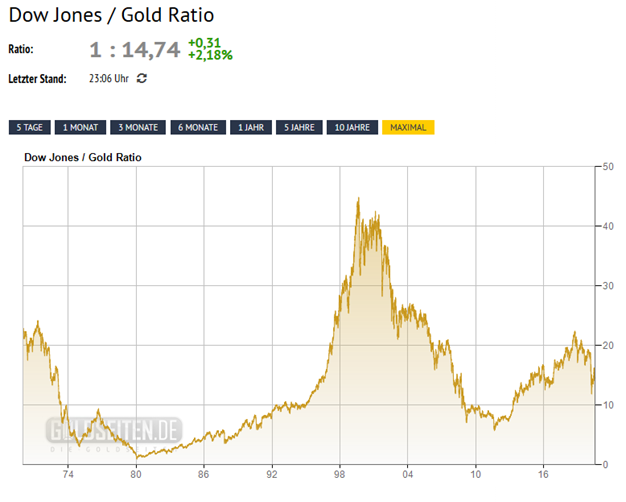

12/ Lets have a look at the #DowJones.

Once again as an stock investor you feeling great by looking at this 90 year chart.

It is only going up you may think. I am getting rich!

Once again as an stock investor you feeling great by looking at this 90 year chart.

It is only going up you may think. I am getting rich!

15/ You know the drill...

16/ What about the #NASDAQ100.

Surely Technology is outperforming #Gold?!

Again it peaked in 2000 but at least it is close to break even vs #Gold, at least for now.

But think about it, the $NDXX is in the biggest tech bull market of all time and still not crushing Gold.

Surely Technology is outperforming #Gold?!

Again it peaked in 2000 but at least it is close to break even vs #Gold, at least for now.

But think about it, the $NDXX is in the biggest tech bull market of all time and still not crushing Gold.

18/ If you got to this point as an stock investor, unfortunately the bad news just keep coming.

You might say I can not compare Bitcoin vs some indicies so lets compare #Bitcoin vs the best performer of the recent past.

vs the best performer of the recent past.

#Google, #Tesla and #Amazon

You might say I can not compare Bitcoin vs some indicies so lets compare #Bitcoin

vs the best performer of the recent past.

vs the best performer of the recent past.#Google, #Tesla and #Amazon

19/ $TSLA #Tesla vs #Bitcoin

Again down 99% even so we are seeing a dead cat bounce right now.

Just to put things into perspective I put the "real" chart next to it. All those gains are an illusion.

Again down 99% even so we are seeing a dead cat bounce right now.

Just to put things into perspective I put the "real" chart next to it. All those gains are an illusion.

21/ $GOOGL vs #Bitcoin

More of the same.

Some of the best performing stocks of all time getting smoked by Bitcoin.

Let that sink in.

More of the same.

Some of the best performing stocks of all time getting smoked by Bitcoin.

Let that sink in.

22/ Conclusion:

I hope that threads helps you think about investing differently or at least open up an alternative perspective.

I expect all those ratios at all time lows before the end of the decade, maybe even before 2025.

IMO it is obvious where to put your money.

I hope that threads helps you think about investing differently or at least open up an alternative perspective.

I expect all those ratios at all time lows before the end of the decade, maybe even before 2025.

IMO it is obvious where to put your money.

Read on Twitter

Read on Twitter