1/ I am pretty freaking excited about what is happening in crypto right now.

After being an on-again off-again cynic, I think big things are finally starting to happen including DeFi, ownership tokens, vertically-focused 'niche' products, capital efficiency

After being an on-again off-again cynic, I think big things are finally starting to happen including DeFi, ownership tokens, vertically-focused 'niche' products, capital efficiency

2/ Let's start 2.5 years ago when I started working at CoinList. Things were crazy - $ was sloshing around and everything moved stupid fast. Coinbase became the top app in the app store. I remember an ex-girlfriend's mom asking me at 2017 xmas dinner which cryptos she should buy

3/ I remember feeling intimidated because guys 23 year old guys would speak about things like DAG's with the confidence of a college professor. It wasn't until a few years later that it became obvious that they were full of shit. But that's a digression

4/ Great parties often cause hangovers and that's what 2018/19 felt like. There were a ton of teams still clinging onto the dream that they could raise $50M in an ICO with smoke and mirrors.

Things at CoinList were slow too - tokens were about as fashionable as cargo shorts

Things at CoinList were slow too - tokens were about as fashionable as cargo shorts

5/ I became disillusioned with the space - it genuinely felt like there were very few teams focused on building things people wanted. It just was not clear that anyone in the space was building with the idea that people would actually use these products.

6/ I was a grumpy old man and would frequently complain to people like @MikeZajko , @ZhuoxunYin , @crabbylions over lunch

needless to say i was shit company

needless to say i was shit company

7/ This February - around @gocryptopeaks, I started to get more optimistic. A couple of things happened:

8/ @CoinList integrated USDC and I saw firsthand how much better Ethereum rails are relative to the US banking system

It is really a 100x improvement. I am not surprised that stablecoin growth has gone parabolic

It is really a 100x improvement. I am not surprised that stablecoin growth has gone parabolic

9/ I finally got smart enough to pay attention to what was happening in DeFi. I spent more time digging into things like @SetProtocol and got excited about how powerful this stuff is - democratizing asset management (and alpha) is really fucking powerful

10/ I finally saw teams like Valiu and @simonvaliu solving real problems for real people.

Read Valiu's reviews in the play store - they are leveraging BTC rails to deliver lower costs remittances - and its working https://play.google.com/store/apps/details?id=com.valiu.app&hl=en_US

Read Valiu's reviews in the play store - they are leveraging BTC rails to deliver lower costs remittances - and its working https://play.google.com/store/apps/details?id=com.valiu.app&hl=en_US

10/ And then just like Avicii in 2011 (RIP), $COMP changed everything - a company created a novel token distribution mechanism that helped w/ user acquisition and generated protocol activity.

Really really impressive

Really really impressive

11/ But people should be cautious - this shit is early

Beware of DeFi Chad bragging about his $LINK bags. By the time the music stops he is going to be in the suite next to Charlie Lee at the Maui Four Seasons and you will be left holding his bags

Beware of DeFi Chad bragging about his $LINK bags. By the time the music stops he is going to be in the suite next to Charlie Lee at the Maui Four Seasons and you will be left holding his bags

12/ I am long $LINK but they have a truly Herculean task of growing into their valuation

13/ But back to what is exciting:

DEX's are finally having their day in the sun. Automated market makers are a 0 to 1 improvement. DEX's are beating centralized exchanges in terms of the pace of innovation. Volume here is going through the roof and I am super bullish

DEX's are finally having their day in the sun. Automated market makers are a 0 to 1 improvement. DEX's are beating centralized exchanges in terms of the pace of innovation. Volume here is going through the roof and I am super bullish

14/ Token models have evolved a ton - teams like @KyberNetwork have learned from people's mistakes and are leveraging their network tokens to create really innovative network engagement and shared upside

15/ Digital ownership/NFT's are back - @ourZORA and @withFND are doing really really interesting things around bringing art/culture online

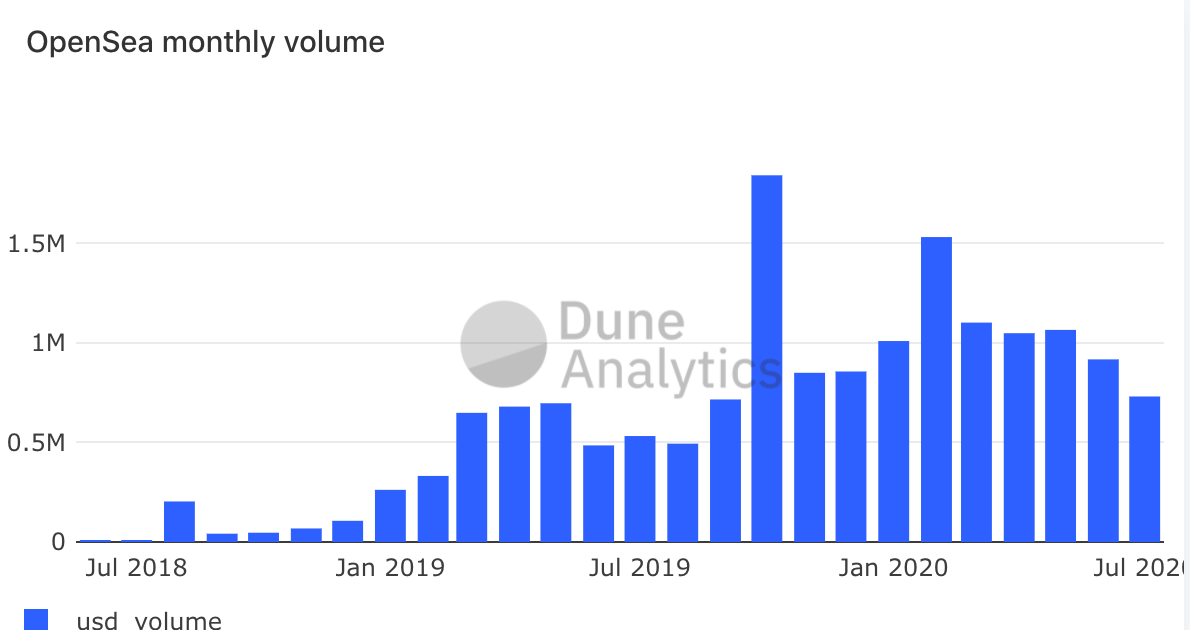

16/ Meanwhile the @opensea team has spent the last three years cranking and they are doing serious volume GMV wise

17/ I am far from an expert on these projects but it *seems* like Helium and Livepeer are some of the earliest Web3 products starting to find some semblance of product-market fit

18/ @Filecoin will be launching mainnet imminently and i have spent a lot of time with their team - they are brilliant and their launch will be massive for Web3

19/ Meanwhile teams are getting more capital efficient - @Instadapp has processed $100M+ through their platform while raising just a seed round.

They had processed almost $50M before they raised anything.

This is the inverse of what was happening in 2017

They had processed almost $50M before they raised anything.

This is the inverse of what was happening in 2017

20/ I am bullish BTC but am not smart enough to know where macro trends are headed.

That said it has been refreshing to watch every 23 yo DeFi Chad re-open their Econ 101 textbook. Glad we have our best people on the case...

That said it has been refreshing to watch every 23 yo DeFi Chad re-open their Econ 101 textbook. Glad we have our best people on the case...

21/ ...but actually governments printing a fuck ton of money is scary and i do think the macro *narrative* is primetime for BTC.

If it does not break out in a meaningful way 2020 I will be worried, although I think Ethereum is somewhat insulated from BTC these days

If it does not break out in a meaningful way 2020 I will be worried, although I think Ethereum is somewhat insulated from BTC these days

22/ I'm also excited by the smart people that have become friends are still working in the space, despite how fucking hard it is to run a company in it - I'm bullish on patience above everything else

23/ Meanwhile capital is maturing. A bunch of 2017 and 2018 funds had the same thesis - spray and pray across smart contract platforms, speak at 25 conferences a year, and collect your 2% tax

24/ Funds like Parafi, @1kx and @hiFramework are smaller, more nimble, and have all been making big money moves this year

25/ Meanwhile more operators in the space are starting to deploy advice/capital at the earlier stages.

This is healthy - these folks have 100x more credibility to invest in the space than people that made some cash flipping shitcoins in 2017

This is healthy - these folks have 100x more credibility to invest in the space than people that made some cash flipping shitcoins in 2017

26/ I'm working on something to help operators deploy more capital - smart people with experience in the space helping out the next generation of entrepreneurs is good for everyone

Read on Twitter

Read on Twitter